This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Mortgage Securing Guaranty of Performance of Lease

Description

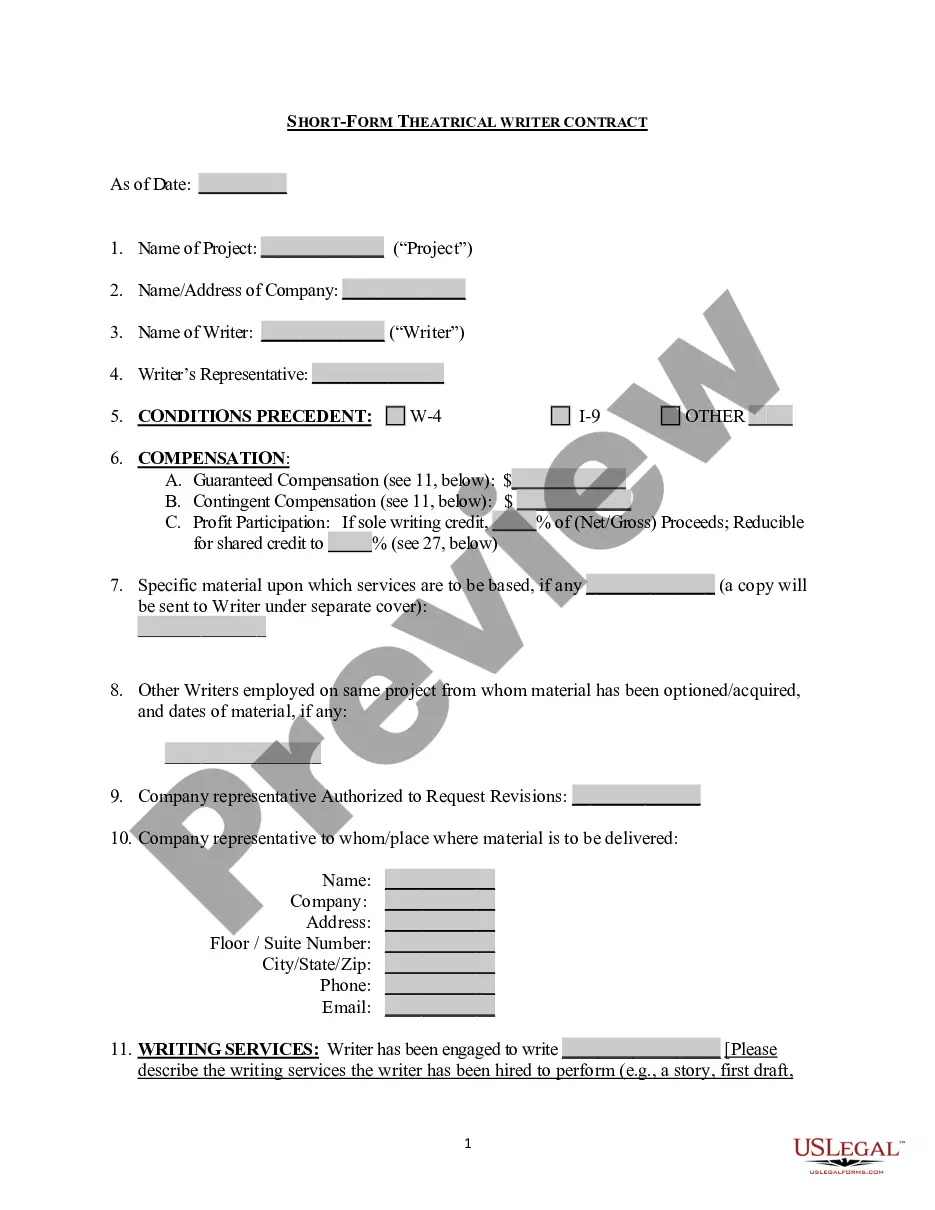

How to fill out Mortgage Securing Guaranty Of Performance Of Lease?

If you want to comprehensive, acquire, or produce legitimate file web templates, use US Legal Forms, the most important variety of legitimate forms, that can be found on the Internet. Make use of the site`s simple and easy practical lookup to find the papers you require. Various web templates for enterprise and person functions are sorted by classes and claims, or key phrases. Use US Legal Forms to find the Tennessee Mortgage Securing Guaranty of Performance of Lease with a couple of clicks.

When you are already a US Legal Forms consumer, log in in your bank account and click on the Obtain key to find the Tennessee Mortgage Securing Guaranty of Performance of Lease. You can also gain access to forms you earlier acquired in the My Forms tab of your own bank account.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for the right city/nation.

- Step 2. Use the Review choice to look over the form`s articles. Do not forget to see the information.

- Step 3. When you are not happy together with the form, use the Research field at the top of the screen to get other versions of your legitimate form format.

- Step 4. Once you have located the form you require, select the Acquire now key. Opt for the prices plan you prefer and put your references to sign up to have an bank account.

- Step 5. Process the deal. You should use your credit card or PayPal bank account to finish the deal.

- Step 6. Find the file format of your legitimate form and acquire it on your gadget.

- Step 7. Total, modify and produce or indicator the Tennessee Mortgage Securing Guaranty of Performance of Lease.

Every legitimate file format you get is your own forever. You have acces to each form you acquired in your acccount. Select the My Forms segment and pick a form to produce or acquire yet again.

Contend and acquire, and produce the Tennessee Mortgage Securing Guaranty of Performance of Lease with US Legal Forms. There are thousands of expert and condition-certain forms you may use for your personal enterprise or person needs.

Form popularity

FAQ

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the ...

A signature guarantee is a form of authentication, issued by a bank or other financial institution, which verifies the legitimacy of a signature and the signatory's overall request. This type of guarantee is often used in situations where financial instruments, such as securities, are being transferred.

A guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

A commercial lease guaranty is an agreement signed by the landlord, tenant, and a third party who meets the landlord's standards of financial trustworthiness. In the leasing context, this is usually the corporation(s) that owns or controls the tenant's business, but it can also be a bank or an individual.

If this happens and additional funds are advanced or re-advanced, the guarantee secures the additional funds up to the fixed amount. When a mortgage secures a guarantee, it secures the guarantor's obligation to repay the funds advanced related to the other party's debt, up to the guarantee amount.

A guarantor is a financial term describing an individual who promises to pay a borrower's debt if the borrower defaults on their loan obligation. Guarantors pledge their own assets as collateral against the loans.

Answer and Explanation: A guarantor's signature may refer to the actual signature of the guarantor whom the principal party or debtor may have acquired to secure his or her obligations.

What does being a guarantor mean? Being a guarantor involves helping someone else get credit, such as a loan or mortgage. Acting as a guarantor, you ?guarantee? someone else's loan or mortgage by promising to repay the debt if they can't afford to. It's wise to only agree to being a guarantor for someone you know well.