Tennessee Sample Letter for Preferred Customer Sale

Description

How to fill out Sample Letter For Preferred Customer Sale?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal needs, sorted by categories, states, or keywords.

You can find the latest versions of forms such as the Tennessee Sample Letter for Preferred Customer Sale within moments.

If you have an account, Log In and download Tennessee Sample Letter for Preferred Customer Sale from the US Legal Forms repository. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finish the purchase.

Choose the format and download the form onto your device. Edit. Fill out, modify, and print and sign the downloaded Tennessee Sample Letter for Preferred Customer Sale. Each template you add to your account does not expire and is yours permanently. So, if you need to download or print another copy, just go to the My documents section and click on the form you desire. Access the Tennessee Sample Letter for Preferred Customer Sale with US Legal Forms, the most comprehensive repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- If you are new to US Legal Forms, here are simple steps to get started.

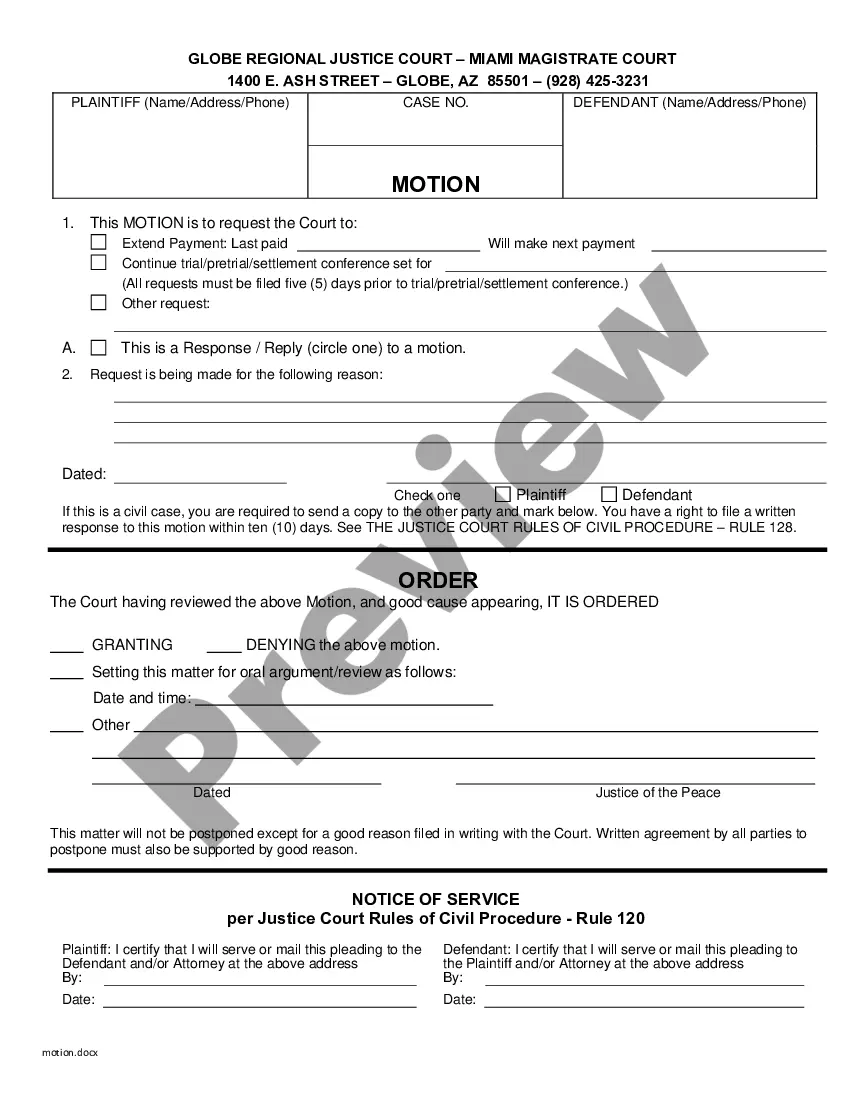

- Make sure you have selected the appropriate form for your city/county. Click on the Preview button to review the form's contents.

- Check the form summary to ensure you have chosen the right one.

- If the form doesn’t fit your requirements, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Verifying a Tennessee resale certificate involves checking the certificate details against the records maintained by the Tennessee Department of Revenue. This can be done by contacting the department directly or reviewing online resources they provide. Knowing how to verify a certificate is crucial to ensure compliance and avoid tax issues. Maintaining a Tennessee Sample Letter for Preferred Customer Sale can help clarify the verification process with your suppliers, creating transparency in your transactions.

To obtain a Tennessee resale certificate, you need to complete the appropriate form, which is readily accessible on the state's Department of Revenue website. Ensure you meet eligibility criteria, as this document is primarily for businesses purchasing goods for resale. Once you fill out the form, keep a copy for your records and present it to your suppliers when making purchases. Additionally, using a Tennessee Sample Letter for Preferred Customer Sale can streamline communication and respect supplier requirements.

The sales tax on furniture in Tennessee typically falls under the standard sales tax rate of 9.75%. This rate applies to most retail purchases, including furniture, unless an exemption applies. Being aware of this tax is necessary for both buyers and sellers. When discussing sales with preferred customers, a Tennessee Sample Letter for Preferred Customer Sale can help explain the tax implications succinctly.

Tennessee boasts one of the highest sales tax rates in the nation primarily due to its reliance on sales tax for state revenue. The state has limited funding from other sources, such as income tax, making sales tax essential for public services. Understanding these dynamics is important for businesses and consumers alike. Consider referencing a Tennessee Sample Letter for Preferred Customer Sale to ensure transparency regarding sales tax to your customers.

In Tennessee, specific items are exempt from sales tax, including certain food items, prescription medicine, and some medical devices. Additionally, products purchased for resale are usually exempt as well. Knowing these exemptions is essential for both consumers and retailers. For businesses, implementing a Tennessee Sample Letter for Preferred Customer Sale can help communicate any tax exemptions effectively.

The 9.75% tax rate in Tennessee refers to the state sales tax that applies to most retail purchases. This rate includes the state tax and local taxes, which can vary by county and city. Understanding this tax rate is crucial for businesses operating in Tennessee, especially when making sales to preferred customers. You might want to use a Tennessee Sample Letter for Preferred Customer Sale to clarify tax implications to your clients.

To obtain a sales tax number in Tennessee, you need to register with the Department of Revenue. This can be done online through the Tennessee Taxpayer Access Point (TNTAP) or by submitting a paper application. Once registered, you will receive a unique sales tax identification number, which is essential for collecting sales tax on preferred customer sales. Consider using a Tennessee Sample Letter for Preferred Customer Sale to inform your customers about your tax registration.

To obtain a US reseller certificate, you typically need to complete a resale certificate application specific to your state. Most states offer online applications or downloadable forms. Once you have your certificate, you can use it to make tax-exempt purchases for resale. Additionally, utilizing a Tennessee Sample Letter for Preferred Customer Sale can help clarify your reseller status to potential partners.

Tennessee operates on a destination-based sales tax system. This means that the tax rate is based on the location where the buyer takes possession of the item. Understanding this system is essential for accurate tax reporting and compliance. When drafting your agreements with clients, a Tennessee Sample Letter for Preferred Customer Sale can assist in specifying terms related to sales tax.

You can verify your sales and use tax certificate in Tennessee by accessing the Tennessee Department of Revenue's online verification tool. This tool allows you to check the status of your certificate quickly. Keeping your certificate verified ensures compliance and prevents potential difficulties with state regulations. Referencing a Tennessee Sample Letter for Preferred Customer Sale may help maintain clear communication with your clients.