Tennessee Sample Letter for New Discount

Description

How to fill out Sample Letter For New Discount?

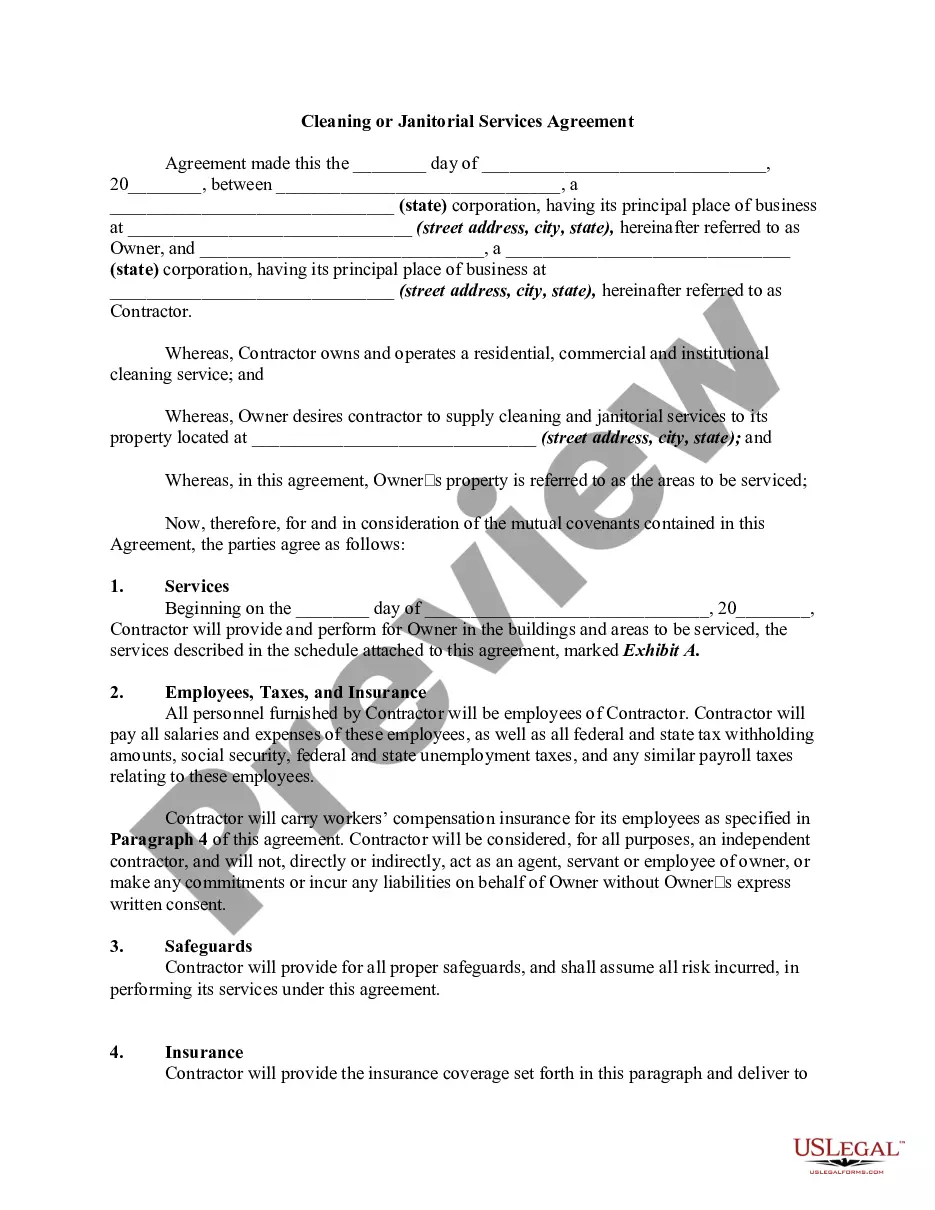

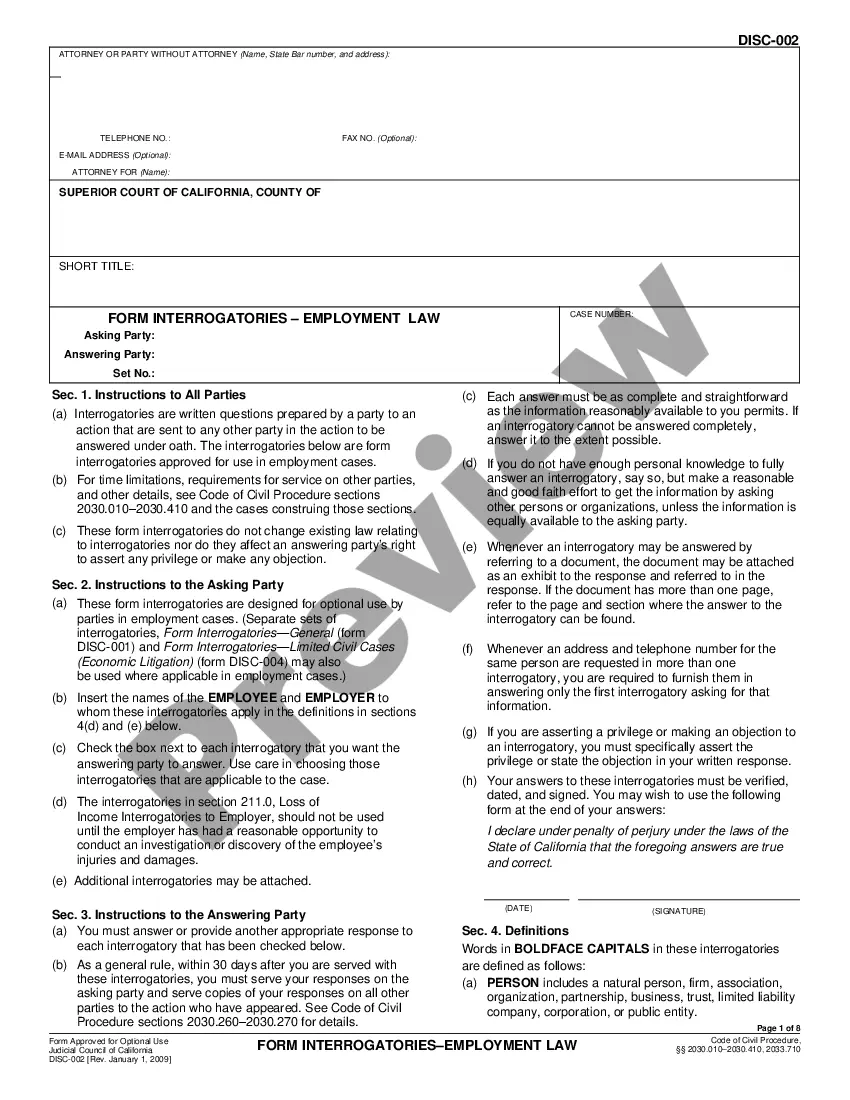

It is feasible to spend hours online searching for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

You can easily download or print the Tennessee Sample Letter for New Discount from the service.

To find another version of the form, use the Search box to locate the template that fits your needs and specifications.

- If you currently possess a US Legal Forms account, you may sign in and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Tennessee Sample Letter for New Discount.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area you have chosen.

- Check the form details to confirm you have selected the correct document. If available, use the Review option to preview the document template as well.

Form popularity

FAQ

You can obtain a copy of your Tennessee resale certificate by requesting it from the Department of Revenue if you have lost your original. If necessary, provide your business details to verify your identity. Create a Tennessee Sample Letter for New Discount to formally request this document, simplifying your inquiry and ensuring a smooth process.

To achieve tax-exempt status in Tennessee, you must first complete an exemption application and supply relevant information regarding your organization or business. The application can be found on the Tennessee Department of Revenue’s website. A Tennessee Sample Letter for New Discount can also assist in your application process by formally outlining your tax-exempt needs.

Renewing your TN sales tax exemption requires you to fill out a renewal application and provide supporting documents to verify eligibility. This process may differ slightly based on the type of exemption. Using a Tennessee Sample Letter for New Discount can clarify your request and expedite your renewal with the state authorities.

To renew your sales tax exemption in Tennessee, submit a renewal application form to the Department of Revenue. Ensure that you include a copy of your current exemption certificate along with any supporting documentation. Utilizing a Tennessee Sample Letter for New Discount can enhance your application and highlight your ongoing need for the exemption.

To obtain a sales tax number in Tennessee, you must complete the online application through the Department of Revenue. Provide all necessary business details, including your federal employer identification number. After your application is processed, you will receive a sales tax number, which allows you to issue a Tennessee Sample Letter for New Discount when applying for exemptions.

Renewing your Tennessee farm tax exemption involves completing the necessary forms and submitting them to the appropriate state office. Make sure to include any required documentation that proves your farm's operational status. It's also helpful to draft a Tennessee Sample Letter for New Discount to accompany your renewal application. This will ensure clarity and assist in processing your request.

Yes, a Tennessee sales tax exemption certificate can expire. Typically, these certificates remain valid for three years from the date of issuance. To continue benefiting from exemptions, it is vital to renew your certificate before its expiration. You may use a Tennessee Sample Letter for New Discount as a part of your renewal process.

Tennessee sales tax is classified as an origin-based tax. This means that the tax rate is determined by the seller's location rather than the buyer's shipping address. Using a Tennessee Sample Letter for New Discount can help clarify these tax responsibilities for businesses. For comprehensive support, US Legal Forms has resources to assist you in understanding your obligations.

As of now, the base sales tax rate in Tennessee is 7%. Certain local jurisdictions may impose additional local taxes, leading to combined rates that can be higher. Consider using a Tennessee Sample Letter for New Discount to stay updated with any changes affecting tax obligations. The US Legal Forms website offers tools to manage tax documents efficiently.

Tennessee employs an origin-based sales tax system. This means that sales tax is based on the location where the sale is made, rather than where the product is delivered. A Tennessee Sample Letter for New Discount can provide necessary guidelines to ensure compliance during transactions. For expert assistance, you can explore US Legal Forms to find valuable templates and resources.