Tennessee Revocable Trust Agreement - Grantor as Beneficiary

Description

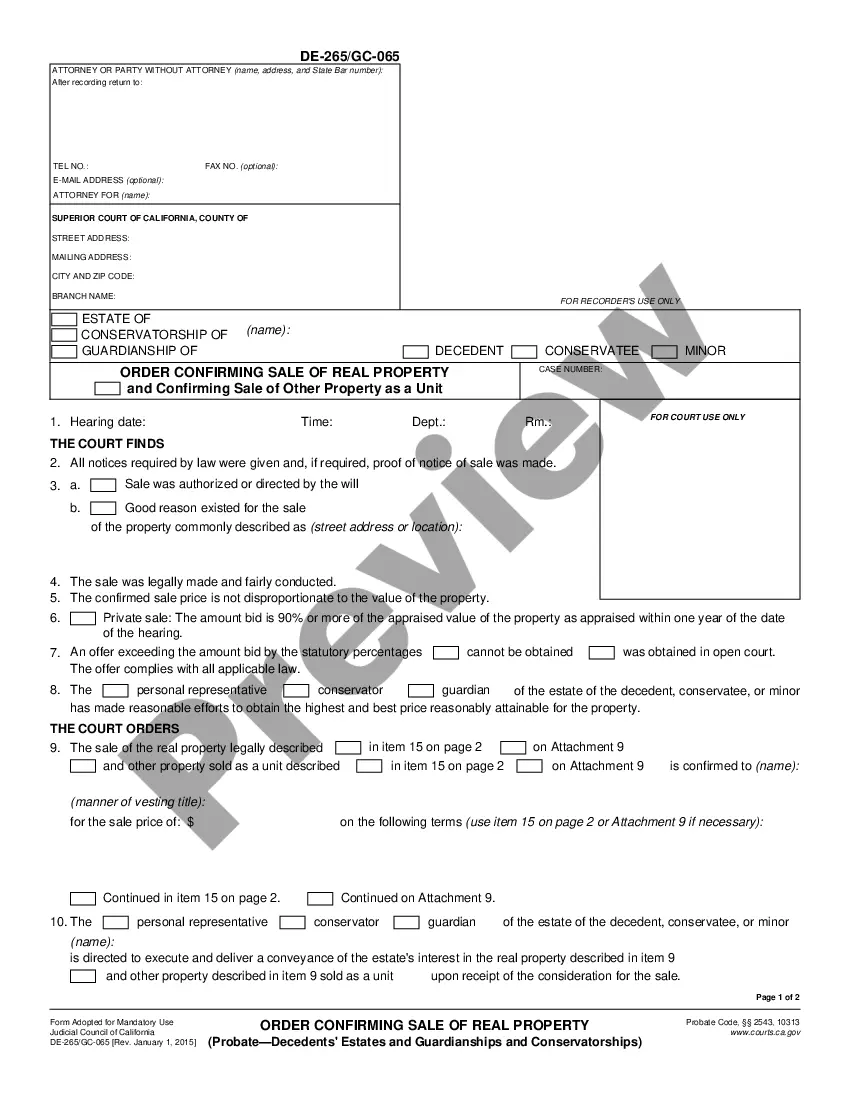

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

If you desire to be thorough, download, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms, which can be accessed online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and jurisdictions, or by keywords.

Every legal document template you purchase is yours indefinitely. You will have access to every form you have acquired within your account. Click on the My documents section and select a form to print or download again.

Act promptly and download, and print the Tennessee Revocable Trust Agreement - Grantor as Beneficiary using US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Tennessee Revocable Trust Agreement - Grantor as Beneficiary with just a few clicks.

- In case you are already a US Legal Forms user, Log In to your account and click the Download button to find the Tennessee Revocable Trust Agreement - Grantor as Beneficiary.

- You can also access templates you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the explanation.

- Step 3. If you are not satisfied with the document, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. After you have located the form you need, click the Purchase now button. Choose the subscription plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Tennessee Revocable Trust Agreement - Grantor as Beneficiary.

Form popularity

FAQ

You can write your own trust in Tennessee, as long as it meets legal standards. A Tennessee Revocable Trust Agreement - Grantor as Beneficiary should include clear terms regarding the trust's management and distribution. However, writing a trust document can be complex, so utilizing tools and templates from US Legal Forms can ensure your trust is valid and properly structured.

Yes, in a Tennessee Revocable Trust Agreement - Grantor as Beneficiary, a beneficiary can also serve as a grantor. This arrangement allows individuals to retain control over the trust assets during their lifetime. However, it is essential to understand the implications of this decision, particularly how it affects estate planning and taxes. Working with a knowledgeable attorney can help clarify these matters.

Tennessee law provides specific guidelines for creating and managing trusts. A Tennessee Revocable Trust Agreement - Grantor as Beneficiary must clearly define the grantor, beneficiaries, and trustee roles. Additionally, the trust should comply with state regulations regarding asset management and distribution. Consulting with platforms like US Legal Forms can help ensure compliance with these legal requirements.

Choosing between a will and a trust in Tennessee often depends on your circumstances. A Tennessee Revocable Trust Agreement - Grantor as Beneficiary offers advantages like avoiding probate and providing more control over asset distribution. Conversely, a will is typically easier and less expensive to set up. It is essential to evaluate your specific needs to make an informed decision.

To register a trust in Tennessee, you must first create a Tennessee Revocable Trust Agreement - Grantor as Beneficiary. This document outlines the terms of the trust and designates assets and beneficiaries. Once finalized, you may need to file it in the county probate court if it holds real estate. Using US Legal Forms can simplify this process, providing you with templates that meet Tennessee laws.

It's entirely possible to add beneficiaries after creating your trust using a formal amendment. You can specify new beneficiaries and outline their share of the assets in the trust. A Tennessee Revocable Trust Agreement - Grantor as Beneficiary empowers you to make such changes with ease, ensuring your estate plan reflects your current intentions.

To add a beneficiary to a revocable trust, you typically create an amendment to the original trust document. Ensure that the amendment clearly outlines the new beneficiary's details. Utilizing a Tennessee Revocable Trust Agreement - Grantor as Beneficiary makes this process straightforward, giving you the control you need over your assets.

While the process may vary by state, generally, you'd review the trust document and follow its amendment procedures. You might need to draft a formal amendment document and have it signed according to the terms set out in the trust. For specific guidance, consider resources from platforms like uslegalforms, which can provide templates and support for managing your trust effectively.

Yes, you can name yourself as a beneficiary in your revocable living trust. In fact, many individuals choose this option to maintain control over their assets during their lifetime. This approach is commonly seen in a Tennessee Revocable Trust Agreement - Grantor as Beneficiary, allowing for seamless asset management.

Yes, you can add a beneficiary to a revocable trust at any time before your death. This flexibility is one of the key benefits of a Tennessee Revocable Trust Agreement - Grantor as Beneficiary. To make changes, you typically need to amend the trust document and follow the procedures set out in the agreement.