Tennessee Accounts Receivable - Assignment

Description

How to fill out Accounts Receivable - Assignment?

Are you currently in a situation where you frequently require documents for organizational or specific purposes? There are numerous legal document templates available online, but locating reliable ones isn't easy.

US Legal Forms provides thousands of form templates, such as the Tennessee Accounts Receivable - Assignment, which can be tailored to fulfill state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Tennessee Accounts Receivable - Assignment template.

Choose a convenient file format and download your version.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Tennessee Accounts Receivable - Assignment at any time if necessary. Click on the desired form to download or print the template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is applicable to the correct region/area.

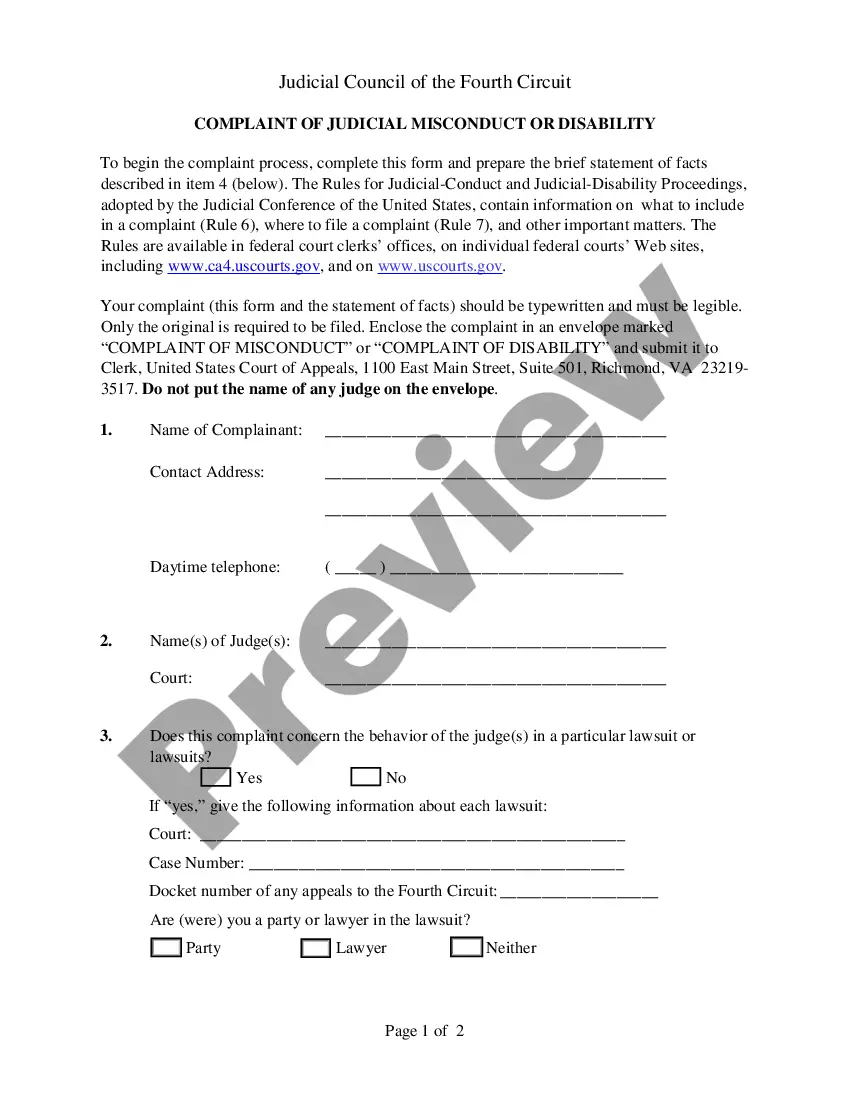

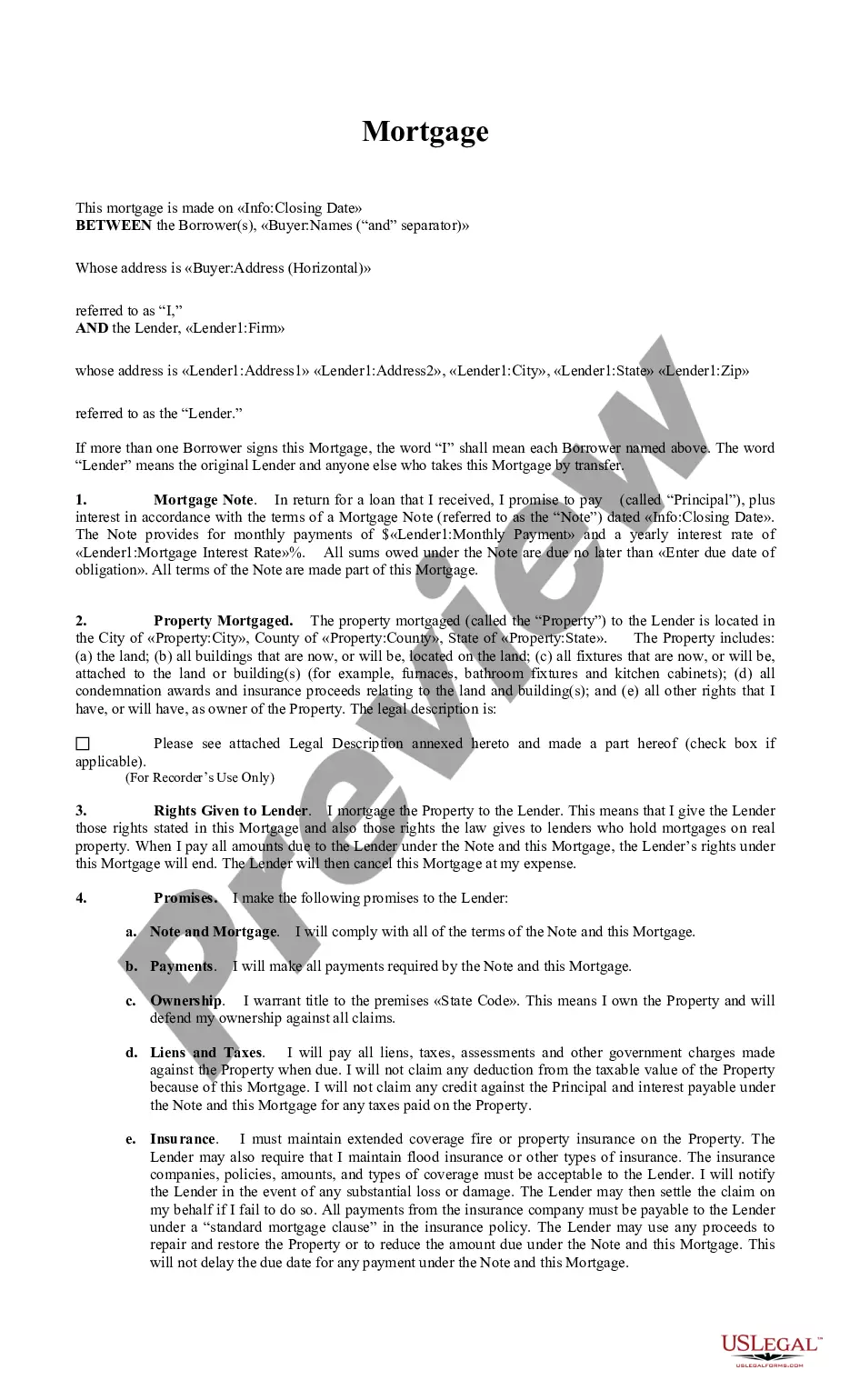

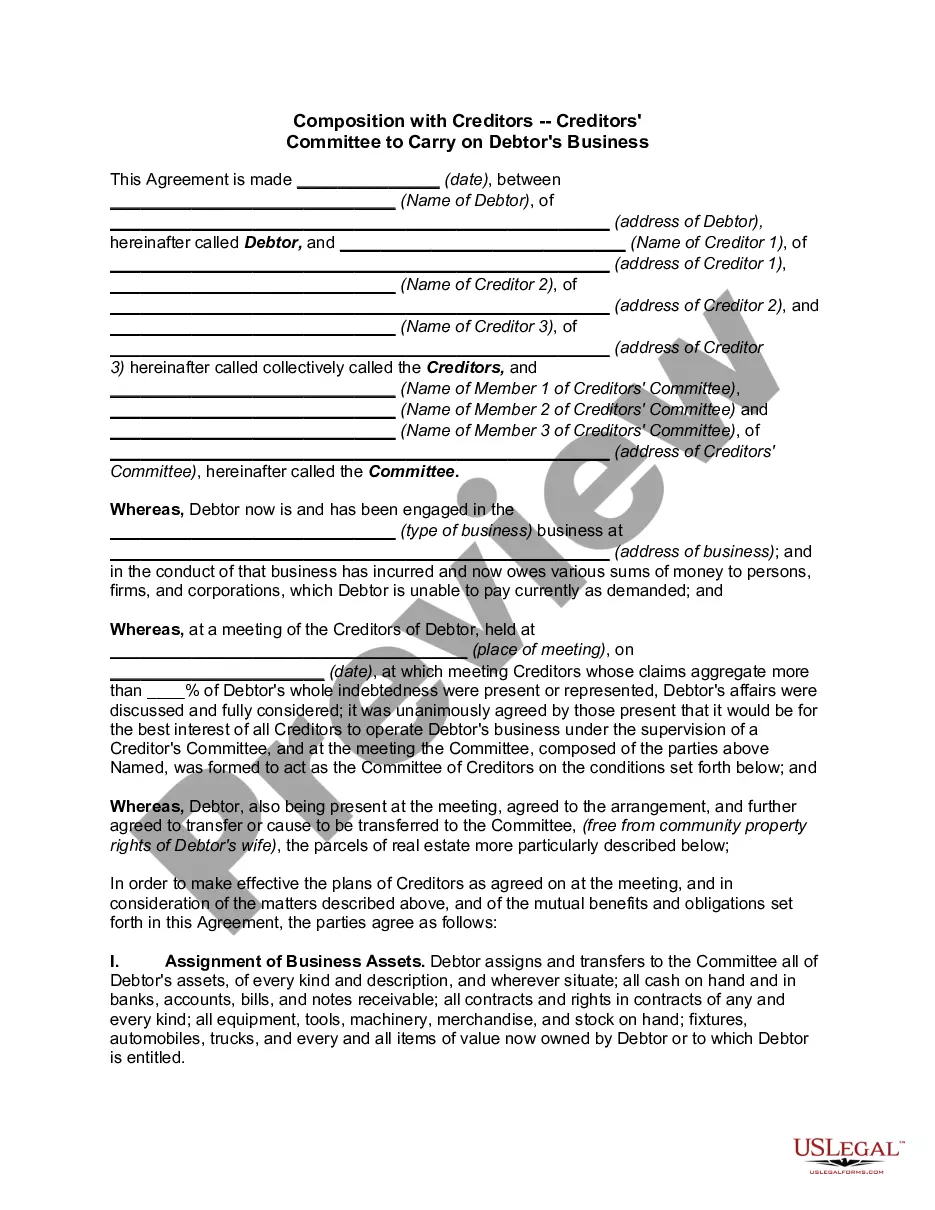

- Use the Preview button to review the form.

- Read the information to confirm that you have selected the correct form.

- If the form isn't what you are looking for, utilize the Search area to find the form that fits your requirements.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you prefer, fill in the required information to create your account, and complete the order with your PayPal or credit card.

Form popularity

FAQ

The general assignment of accounts receivable refers to the broad transfer of all or a portion of a company's receivables to a creditor or third party. This assignment can help businesses secure financing or settle debts, improving their liquidity. For those navigating Tennessee Accounts Receivable - Assignment, understanding the nuances of general assignments can enhance financial strategies and business operations.

Assignment and factoring are methods to generate cash from accounts receivable (B). Assigning accounts receivable allows a company to get a loan and use the accounts receivable as collateral. Once they receive the cash receipts from customers they must pay their loan off.

For the journal entry, you can document the total amount due from the invoice as a debit in the accounts receivable account. You also list the total amount due from the invoice as a credit in the sales account. Because of this, these entries are beneficial in a double-entry accounting system.

Example of the Assignment of Accounts Receivable ABC Corp. approaches XYZ Bank to obtain financing using its accounts receivable as collateral. XYZ Bank agrees to provide a loan of 85% of the total accounts receivable value, which amounts to $170,000 (85% of $200,000).

Firstly, factoring is a financial service of selling and purchasing, which implies consideration, unlike assignment, which may take place either with or without consideration. In addition, non-matured or future accounts receivable can be subject to factoring.

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.