Tennessee Corporate Resolution for EIDL Loan

Description

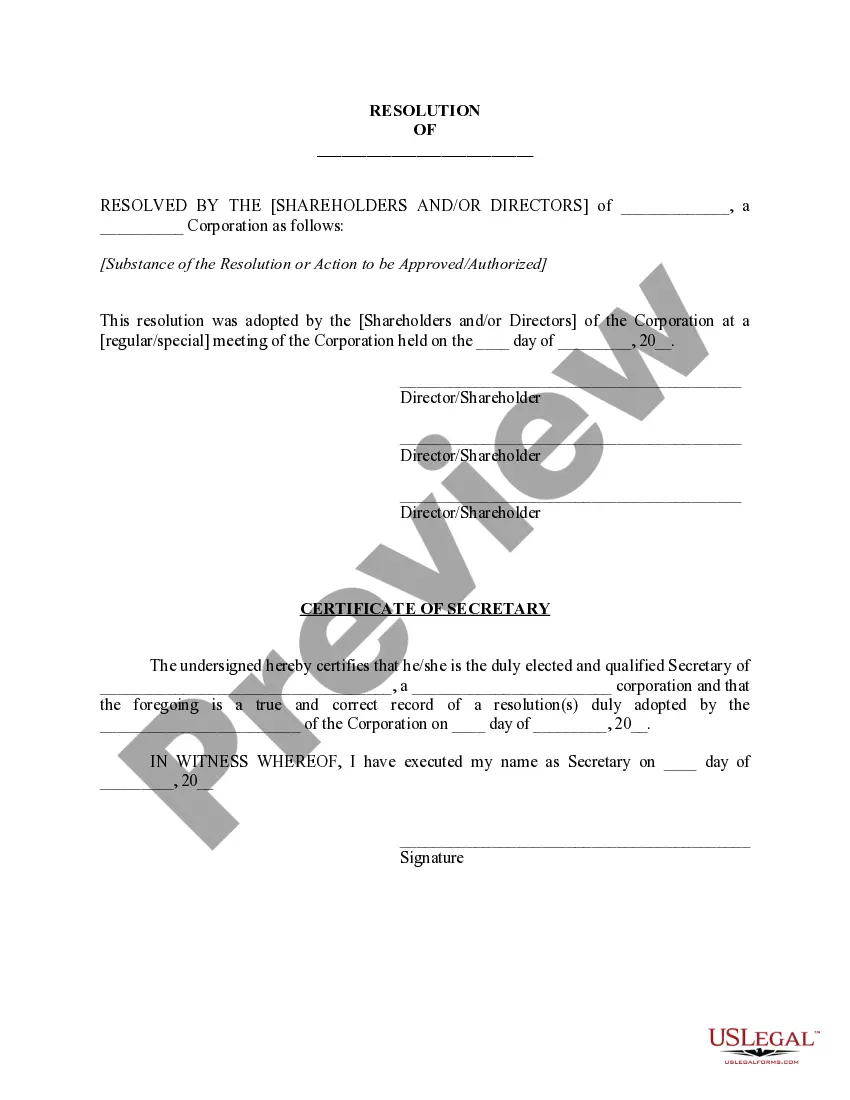

How to fill out Corporate Resolution For EIDL Loan?

You have the capacity to spend hours online searching for the legal document template that fulfills the state and federal requirements you desire.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can download or print the Tennessee Corporate Resolution for EIDL Loan from their service.

If available, use the Review button to preview the document template as well. To find another version of your form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you want, click Get now to proceed. Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction using your credit card or PayPal account to pay for the legal form. Select the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, alter, sign, and print the Tennessee Corporate Resolution for EIDL Loan. Acquire and print numerous document templates using the US Legal Forms website, which boasts the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Tennessee Corporate Resolution for EIDL Loan.

- Each legal document template you receive is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your preferred area.

- Review the form outline to confirm you have chosen the right form.

Form popularity

FAQ

The EIDL documents require a Board Resolution to be submitted within 6 months of loan disbursement. Proof of Hazard insurance is due within 1 year of loan disbursement.

When applying for an EIDL loan, don't forget to apply for the advance up to $10,000 which is a grant, by checking the box. The loan advance will not have to be repaid.

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business Expansion loans - including Direct, Guaranteed, or Participation loans.

For those loans where SBA remitted a forgiveness payment to a PPP lender that was reduced by an EIDL Advance, SBA will automatically remit a reconciliation payment to the PPP lender for the previously-deducted EIDL Advance amount, plus interest through the remittance date.

EIDL Filing RequirementsElectronic Loan Application (SBA Form 5C) Sole Proprietorship Only 3. Tax Authorization (IRS Form 4506-T) 20% Owners/GP/50% Affiliate 4. Most recent 3 Years of Business Tax Return(s) 5. Personal Financial Statement (SBA Form 413) 20% Owners/GP 6.

The Small Business Administration will determine whether you qualify for forgiveness for some or all your EIDL Advance (up to $15,000 across both Advances). Those deemed potentially eligible will receive an email from the SBA with instructions to apply for forgiveness of the Advance(s).

EIDL Filing RequirementsElectronic Loan Application (SBA Form 5C) Sole Proprietorship Only 3. Tax Authorization (IRS Form 4506-T) 20% Owners/GP/50% Affiliate 4. Most recent 3 Years of Business Tax Return(s) 5. Personal Financial Statement (SBA Form 413) 20% Owners/GP 6.

Use this form to designate additional authorized individuals to act on behalf of the Licensee.

The Small Business Administration certification is part of a contracting program that helps small companies compete for federal contracts. The government sets aside some of its contracts (both competitive set-aside and sole-source set-aside contracts) for small businesses each year to limit competition.

Remember, EIDL loans cannot for forgiven. EIDL grants are automatically forgiven, provided you use the funds on approved expenses.