Tennessee Transfer of Registration of Foreign Limited Partnership

Description

How to fill out Tennessee Transfer Of Registration Of Foreign Limited Partnership?

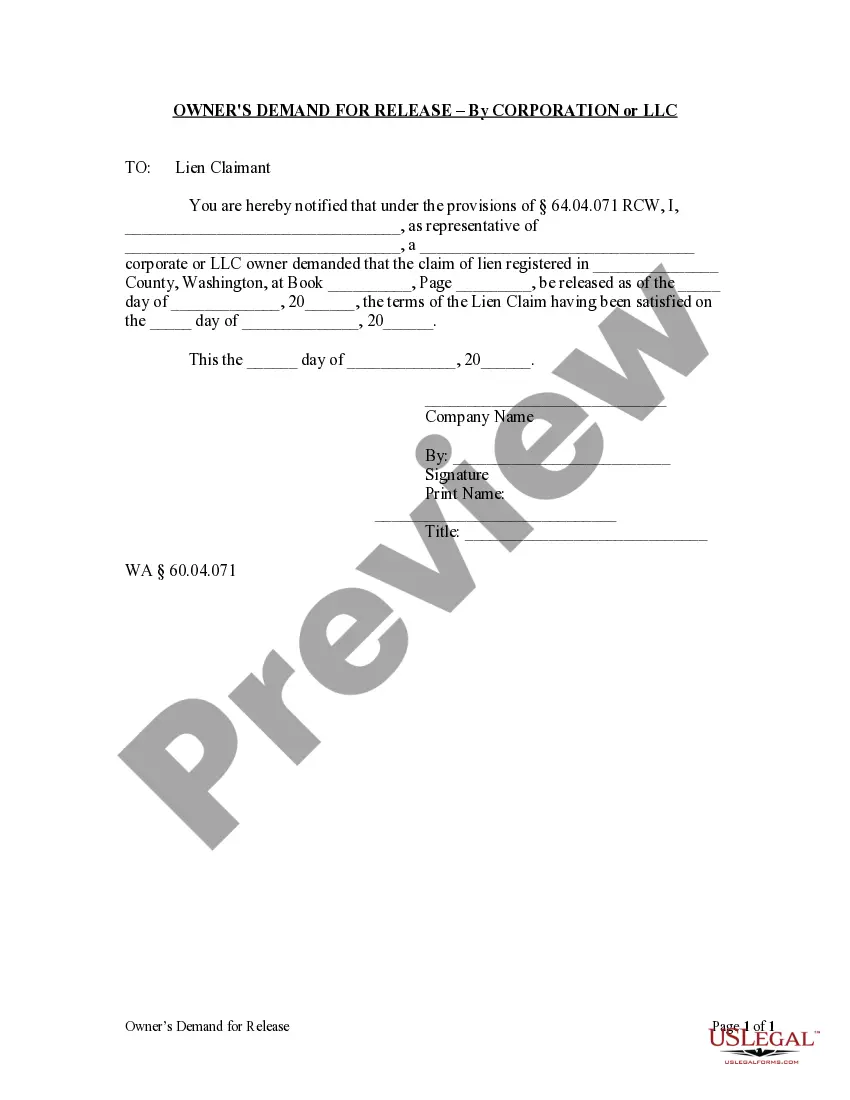

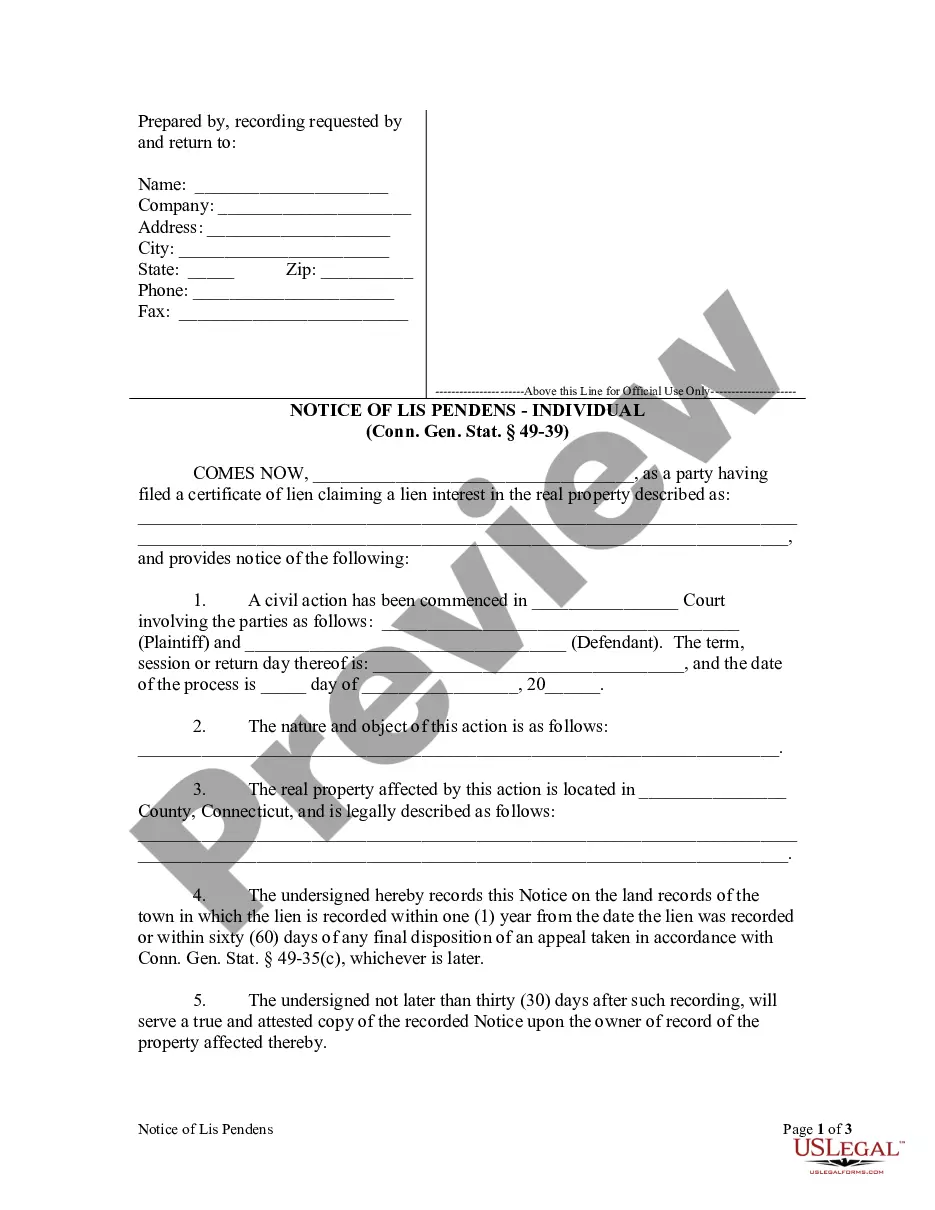

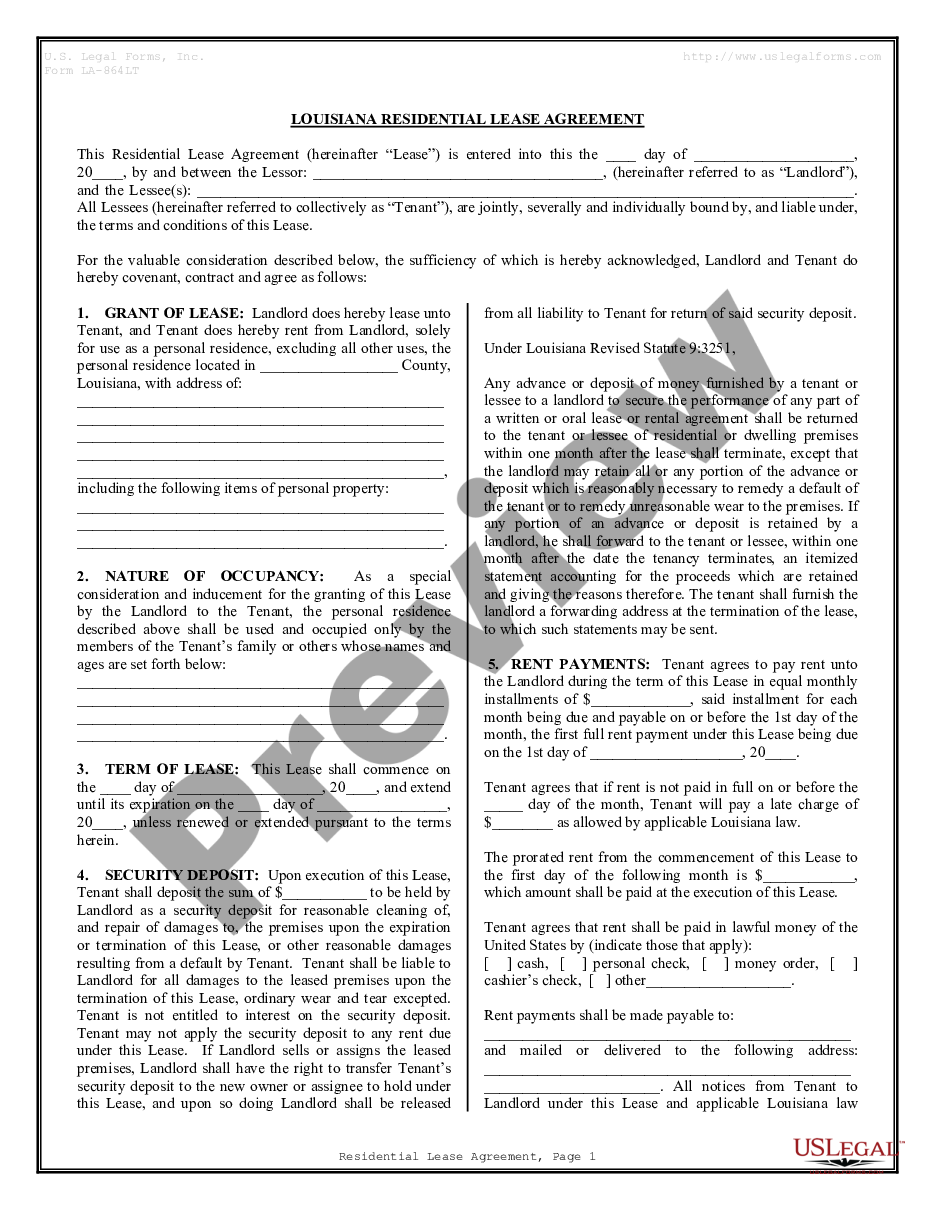

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are examined by our experts. So if you need to prepare Tennessee Transfer of Registration of Foreign Limited Partnership, our service is the perfect place to download it.

Obtaining your Tennessee Transfer of Registration of Foreign Limited Partnership from our catalog is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they locate the correct template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it suits your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Tennessee Transfer of Registration of Foreign Limited Partnership and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Any corporation, limited partnership, limited liability company or business trust chartered/organized in Tennessee or doing business in this state must register with the secretary of state and file annual reports. Click here for more information.

To register a foreign corporation in Tennessee, you must file a Tennessee Application for Certificate of Authority with the Tennessee Department of State, Corporate Filings. You can submit this document by mail or in person. The Certificate of Authority for a foreign Tennessee corporation costs $600 to file.

Tennessee doesn't require you to file your Partnership Agreement with the state. Partnership Agreements are valid and binding when all the partners sign it.

Tennessee law has no provisions for entity domestication. If you plan to move your company to Tennessee your can choose between qualifying your existing company as Tennessee Foreign Entity, or dissolving it in the original state of registration and forming a new company in Tennessee.

Limited partnerships (LP): In Tennessee, a LP must file a Certificate of Limited Partnership with the Secretary of State. Limited liability partnerships (LLP): A Registration Statement with the Secretary of State is required in order to form an LLP in Tennessee.

Fiduciary Duty of Loyalty ? The Tennessee partnership statute allows partnership agreements to eliminate the fiduciary duty of noncompetition because of the wide use of partnerships in real estate investment (a business sector in which partners typically invest in multiple properties that may be in direct competition).

To cancel your foreign LLC in Tennessee, you submit form SS-4241, Application for Cancellation of Certificate of Authority and the filing fee, to the Tennessee Department of State, Division of Business Services (DBS).

Steps to Create a Tennessee General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Tennessee state tax identification numbers.