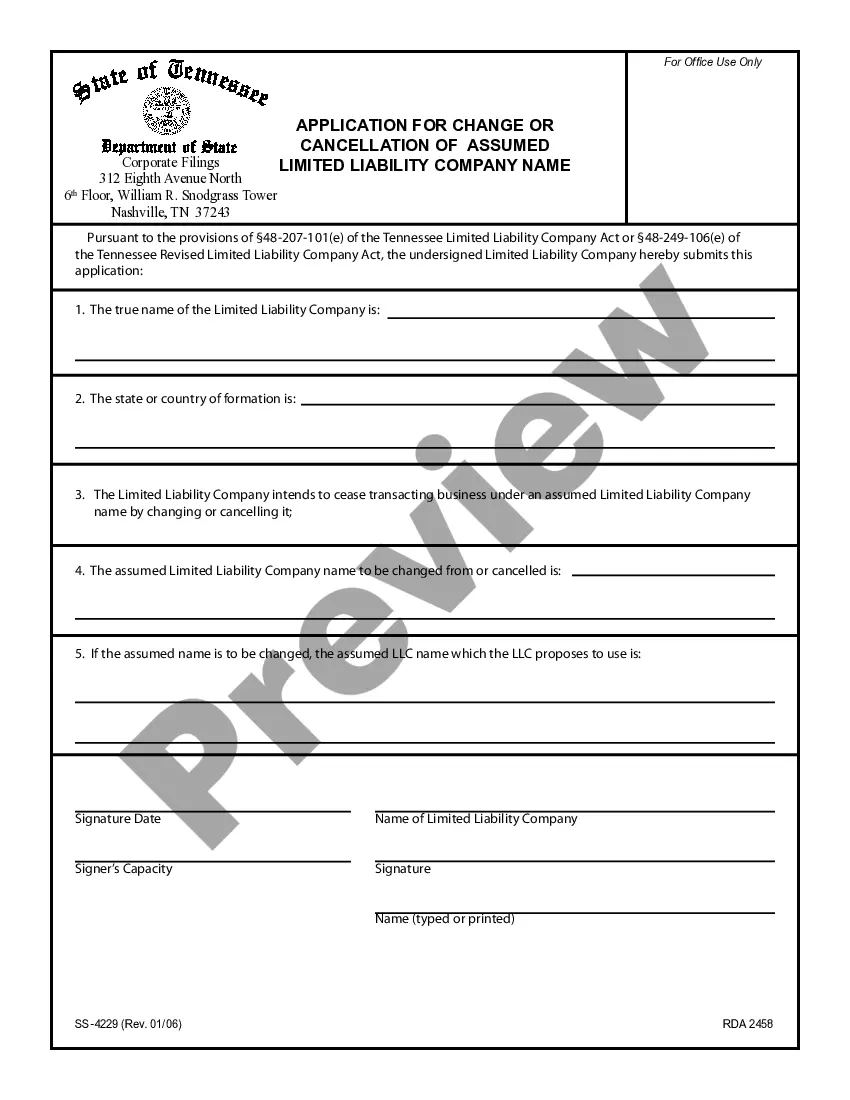

Tennessee Application for Change or Cancellation of Assumed Name

Description

How to fill out Tennessee Application For Change Or Cancellation Of Assumed Name?

US Legal Forms is the most straightforward and cost-effective way to locate appropriate legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Tennessee Application for Change or Cancellation of Assumed Name.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Tennessee Application for Change or Cancellation of Assumed Name if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Tennessee Application for Change or Cancellation of Assumed Name and save it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your reliable assistant in obtaining the required formal paperwork. Try it out!

Form popularity

FAQ

There is a $20 filing fee to amend your Tennessee LLCs Articles of Organization.

File your Tennessee amendment. You can file your Articles of Amendment by delivering them to the Business Services Division of the Tennessee Secretary of State. You can also file your Articles of Amendment online, using the Secretary of State's online portal. But you don't have to handle this process on your own.

Filing dissolution documents is the first step and requires the business to wind-up its business and affairs. Once that is complete and the entity has obtained a Certificate of Tax Clearance for Termination/Withdrawal from the Tennessee Department of Revenue, the business entity may file termination documents.

Tennessee LLCs have to file a completed Articles of Amendment to Articles of Organization (LLC) with the Division of Business Services of the Department of State. You can download the form from their website. You can also draft your articles if you do not want to use the form. Filing comes with a $20 fee.

The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000. The franchise tax is due the 15th day of the fourth month following the close of your fiscal year. It is calculated based on the LLC's net worth or real and tangible property in Tennessee. The minimum tax is $100.

File your Tennessee amendment. You can file your Articles of Amendment by delivering them to the Business Services Division of the Tennessee Secretary of State. You can also file your Articles of Amendment online, using the Secretary of State's online portal. But you don't have to handle this process on your own.

The correct fee is not paid. The annual report fee for a corporation is $20, and an additional $20 is required if any change is made concerning the registered agent/registered office. The annual report fee for LLCs is $300 minimum up to a maximum of $3000.

Submit a written Consent to Dissolution to the Tennessee Secretary of State. Submit any required annual reports to the Tennessee Secretary of State. Pay off any outstanding business debts. Pay any outstanding taxes and administrative fees.