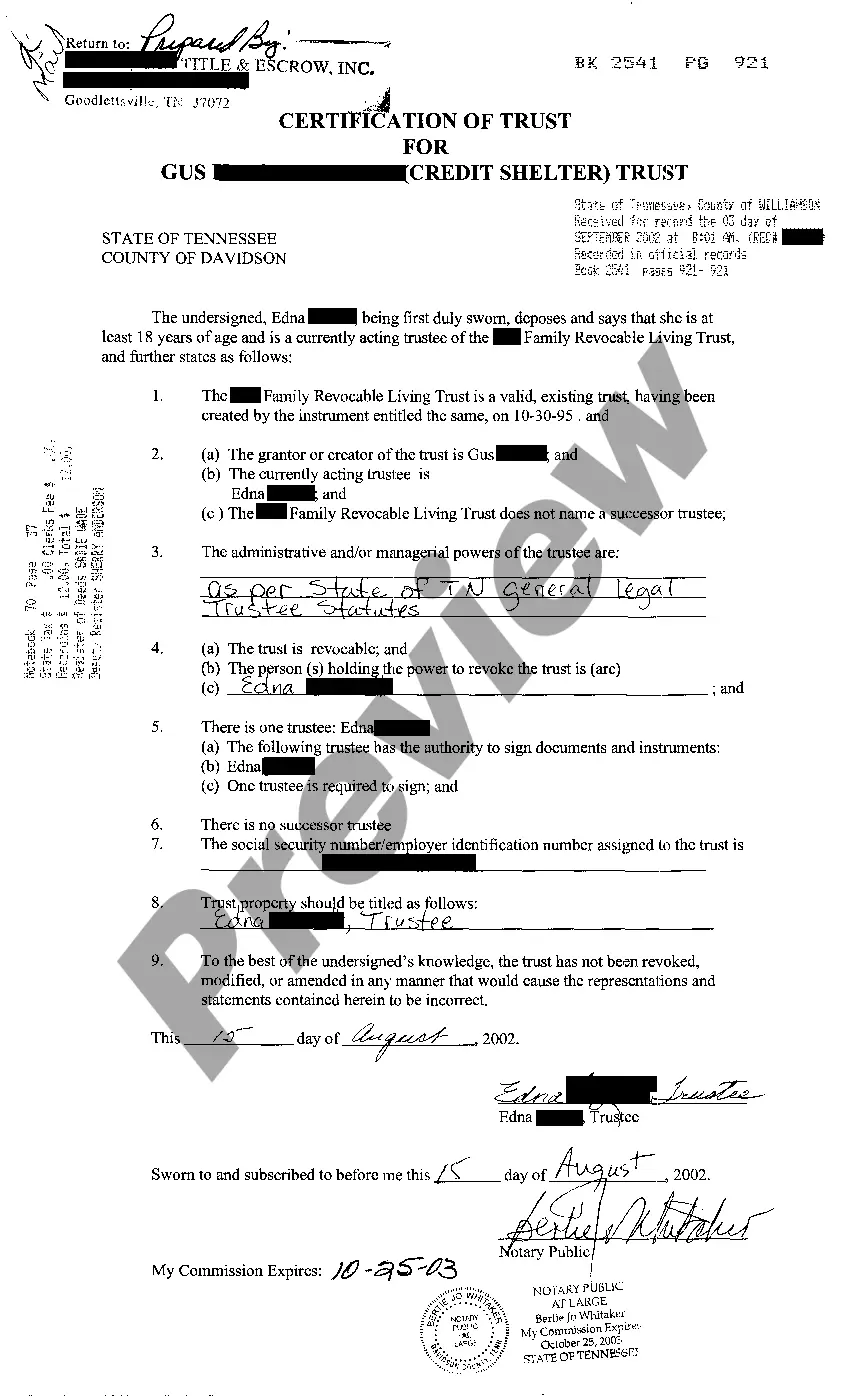

Tennessee Credit Shelter Marital Trust

Description

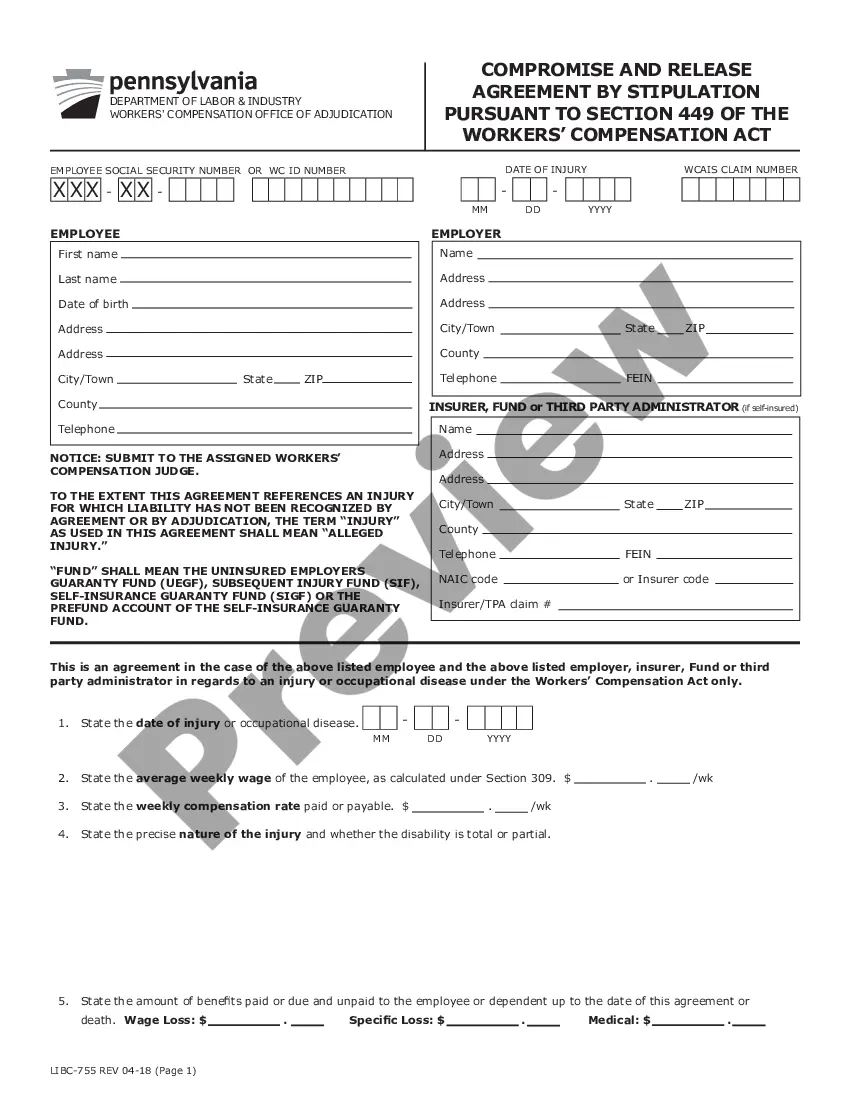

How to fill out Tennessee Credit Shelter Marital Trust?

Get access to quality Tennessee Credit Shelter Marital Trust forms online with US Legal Forms. Avoid days of wasted time browsing the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Get around 85,000 state-specific authorized and tax samples that you can save and submit in clicks in the Forms library.

To get the sample, log in to your account and then click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Tennessee Credit Shelter Marital Trust you’re considering is suitable for your state.

- View the form using the Preview option and read its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Pick a preferred format to save the document (.pdf or .docx).

Now you can open the Tennessee Credit Shelter Marital Trust template and fill it out online or print it and get it done yourself. Take into account sending the file to your legal counsel to ensure things are completed correctly. If you make a error, print and complete sample once again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

An exemption trust is a trust designed to drastically reduce or eliminate federal estate taxes for a married couple's estate.An exemption trust does not pass the assets along to the surviving spouse.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax free. It can also shield the estate of the surviving spouse before the remaining assets pass on to your children.

The "A Trust" is also commonly referred to as the "Marital Trust," "QTIP Trust," or "Marital Deduction Trust." The "B Trust" is also commonly referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust."

While a QTIP does offer more overall direction of the funds, a marital gift trust has the flexibility of not mandating that the surviving spouse take annual allotments. Instead, they are able to leave principal in the trust if so desired, which may continue to increase the total assets through interest over time.

For a trust to qualify for the marital deduction, the surviving spouse: Must be the only beneficiary of the trust during her lifetime, that is, he or she is the only person who receives any money or property from the trust for as long as he or she lives, and.This is the most commonly used marital trust.

The effect of the marital deduction trust is that it shields both spouse's assets and estates from federal estate taxes because when the first spouse dies, the assets indicated by the settlor (the spouse who created the trust) pass to the marital trust free and clear of any and all federal estate taxes.

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

An estate trust is a type of marital deduction trust requiring that when the surviving spouse dies, all remaining trust principal must go into his/her estate. This means the surviving spouse gets to choose the final beneficiaries, by will or within a living trust.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.