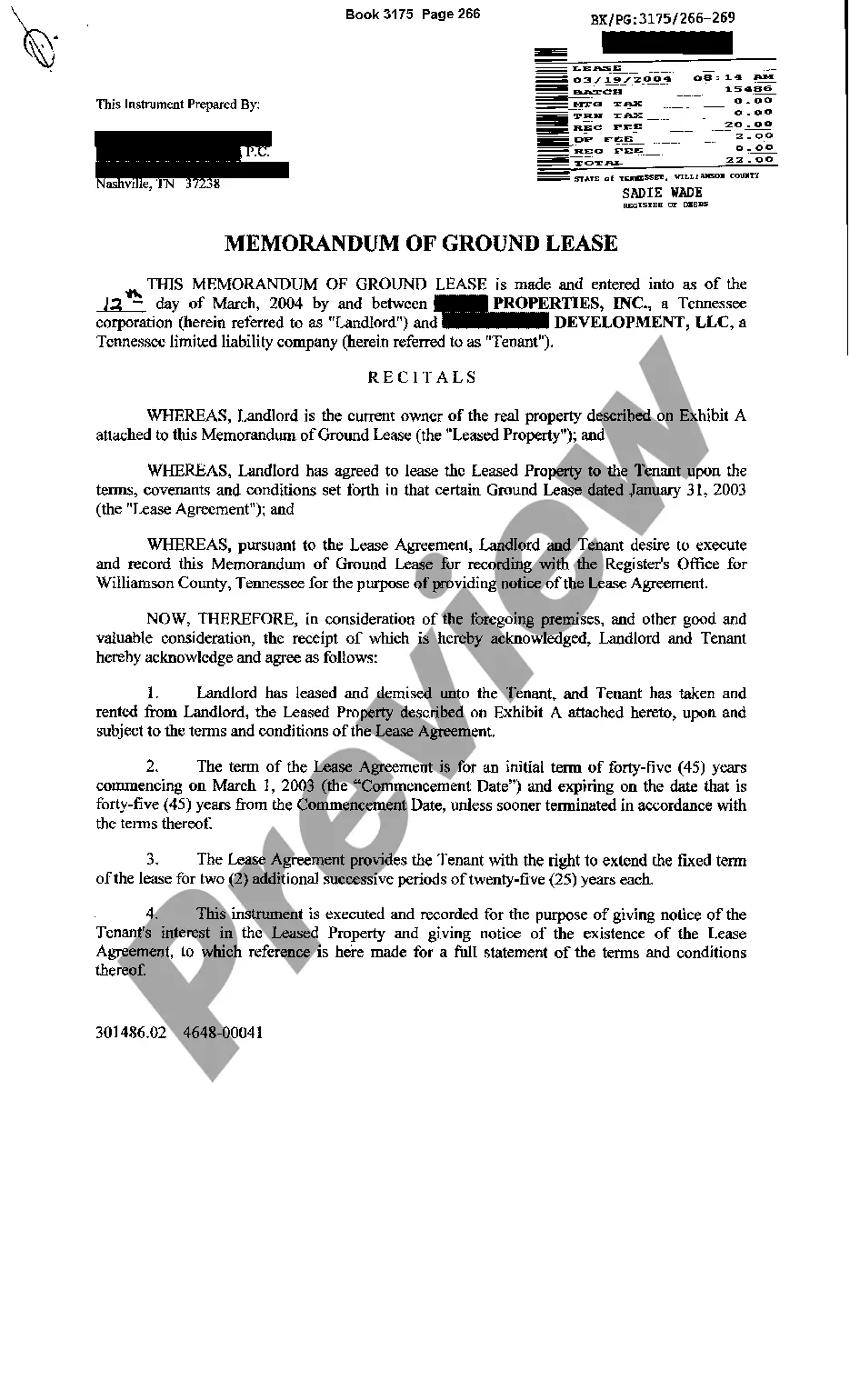

Tennessee Memorandum of Ground Lease

Description

How to fill out Tennessee Memorandum Of Ground Lease?

Get access to high quality Tennessee Memorandum of Ground Lease samples online with US Legal Forms. Prevent days of wasted time searching the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get above 85,000 state-specific authorized and tax forms that you can save and fill out in clicks within the Forms library.

To receive the example, log in to your account and click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Check if the Tennessee Memorandum of Ground Lease you’re looking at is suitable for your state.

- Look at the sample using the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay out by credit card or PayPal to finish creating an account.

- Choose a favored file format to save the file (.pdf or .docx).

You can now open up the Tennessee Memorandum of Ground Lease template and fill it out online or print it and do it yourself. Think about sending the papers to your legal counsel to ensure things are filled in appropriately. If you make a error, print out and fill sample once again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get access to much more forms.

Form popularity

FAQ

A ground lease is an agreement in which a tenant can develop property during the lease period, after which it is turned over to the property owner. Ground leases commonly take place between commercial landlords, who typically lease land for 50 to 99 years to tenants who construct buildings on the property.

Ground Lease PV Valuation To calculate the value of the ground lease, we take the present value of all ground lease payments plus the reversion value of the ground lease at maturity. Discount Rate The discount rate at which to calculate the present value of the ground lease cash flows.

A ground lease is a long-term agreement between a landlord and a tenant in which the tenant is allowed to develop the leased property. At the end of the lease term, the landlord retains ownership of the improvements made by the tenant.

Ground Lease PV Valuation To calculate the value of the ground lease, we take the present value of all ground lease payments plus the reversion value of the ground lease at maturity. Discount Rate The discount rate at which to calculate the present value of the ground lease cash flows.

So, unfortunately, if you purchase a property that's ground leased to a tenant, you won't be able to depreciate the land for taxes. However, if you own the property itself, you will be able to depreciate the property instead of the land. Such depreciation can include all changes and improvements made over time.

To be financeable, the ground lease should include the right of the ground lessee to mortgage the leasehold without obtaining the ground lessor's consent, coupled with the right of the lender to enforce its rights under the leasehold mortgage against the ground lease as its collateral, including the acquisition of the

Ground leases can provide great investment opportunities for people who want to deploy capital in real estate while never having to think about property management. The investor becomes the landlord under a long-term lease, often lasting 99 years.Landlords under old ground leases rarely want to sell.

Ground Lease Estoppel means that certain estoppel certificate and agreement given by Fee Owner for the benefit of Lender and containing certain statements and agreements relating to the Ground Lease.

Multiply the set amount per square foot times your square footage to calculate the ground rent. For instance, if the lot is 15,000 square feet and your set amount is 1 cent per square foot, multiply 0.01 by 15,000 to get a yearly ground rent of $150.