Tennessee Notice of Assignment to Living Trust

What this document covers

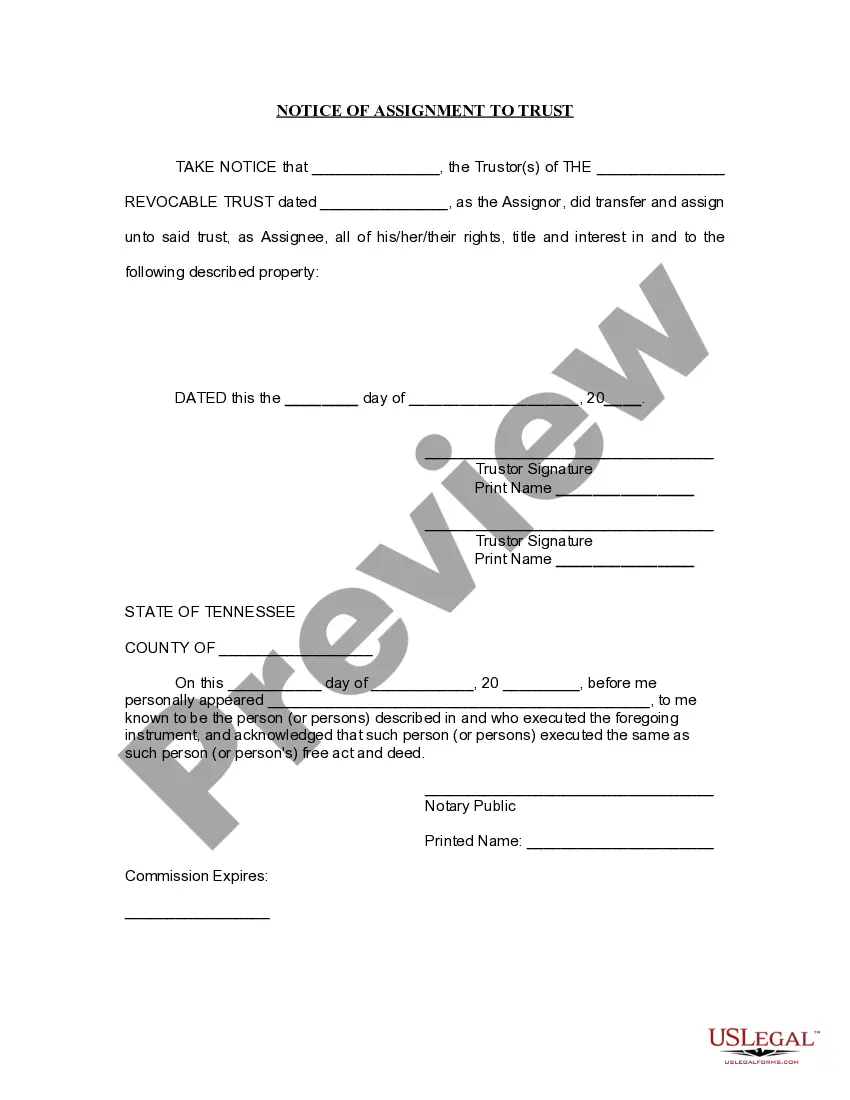

The Notice of Assignment to Living Trust is a legal document that notifies relevant parties that a trustor has transferred their rights and interests in specified property to a living trust. Unlike other estate planning documents, this form specifically acknowledges the transfer of ownership into a revocable trust, ensuring that the trustor's intentions are clearly documented for future reference, particularly in matters of estate and asset management.

Key components of this form

- Identification of the trustor(s) and the living trust involved.

- A detailed description of the property being assigned to the trust.

- Signature of the trustor(s) confirming the transfer of assets.

- Notary acknowledgment to verify the identity and intent of the signers.

Situations where this form applies

You should use the Notice of Assignment to Living Trust when you want to formally transfer ownership of personal or real property into a living trust. This is particularly important when establishing a revocable trust as part of your estate planning strategy, ensuring that your assets are appropriately managed and distributed according to your wishes after your passing.

Who can use this document

- Individuals creating a revocable living trust to manage their assets.

- Trustors wishing to clarify the transfer of property into a trust.

- Those involved in estate planning and asset management.

- People looking to formalize property assignments for estate purposes.

Completing this form step by step

- Identify the trustor(s) by filling in their full name.

- Specify the name and date of the revocable trust.

- List the property being assigned to the trust, ensuring accurate descriptions.

- Obtain the signature of the trustor(s) to formalize the transfer.

- Complete the notary section, including date and notary information.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes to avoid

- Failing to accurately describe the property being transferred.

- Not obtaining the necessary signatures from all trustors.

- Overlooking the notarization requirement, which could render the form invalid.

Why complete this form online

- Convenience of filling out the form from home at your own pace.

- Easy editing and customization to fit your specific needs.

- Access to reliable legal templates drafted by licensed attorneys.

Legal use & context

- The form provides a legal basis for asset ownership within the living trust.

- Properly executed, it helps avoid disputes regarding asset distribution after the trustor's passing.

- Can be used as evidence in court to prove the trustor's intent in estate planning.

Summary of main points

- The Notice of Assignment to Living Trust is essential for transferring assets into a living trust.

- It must include clear property descriptions, trustor signatures, and notarization.

- This form aids in estate planning and can help minimize conflicts during the distribution of assets.

Form popularity

FAQ

While many people can make a living trust without the help of an attorney, there are some situations require individualized legal advice. For example, don't try to make your own living trust if: You don't have anyone to name as trustee.See a lawyer for advice.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

The trust in no way protects your assets, so that reasoning is simply false. You should put your vehicles into your trust in order to avoid probate. Only those assets held by the trust will avoid probate.

Identify what should go into the trust. Choose the appropriate type of living trust. Next, choose your trustee, who will manage the trust. Now create a trust agreement. Then sign the trust document in front of a notary public. Finally, transfer your property into the trust.