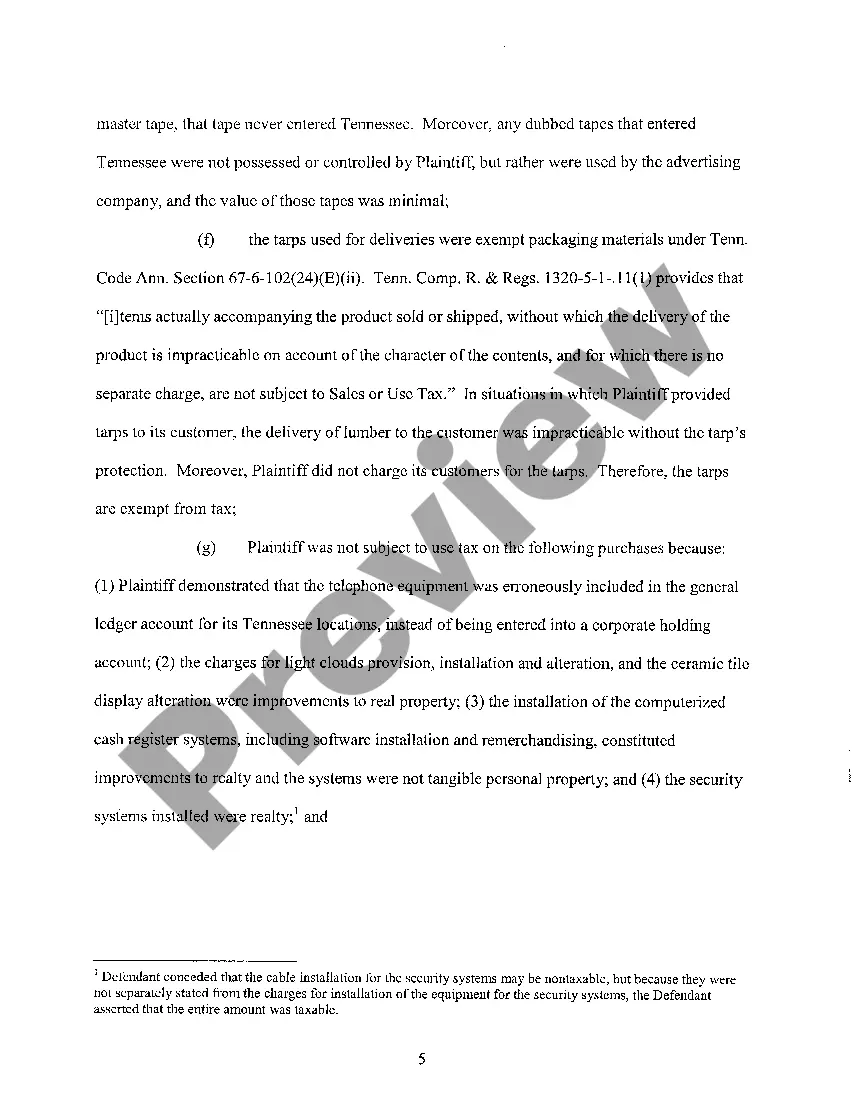

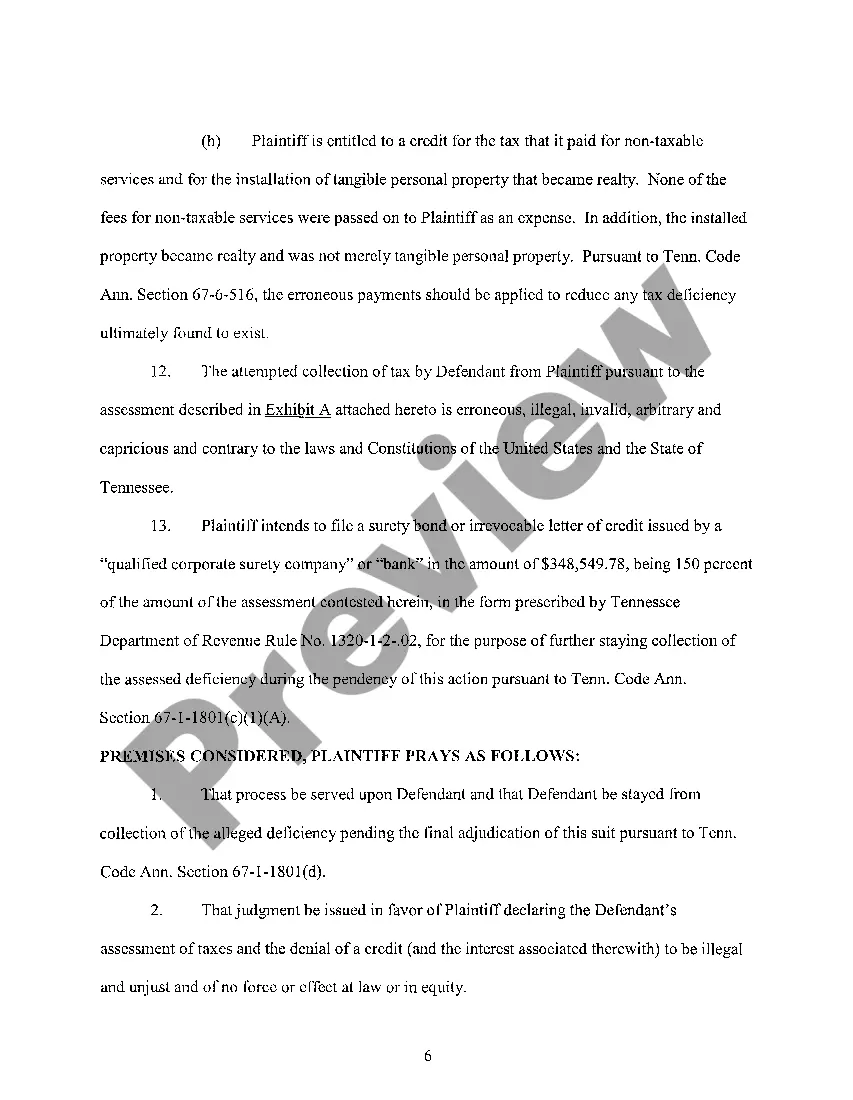

Tennessee Complaint regarding assessment of sales, use taxes

Description

How to fill out Tennessee Complaint Regarding Assessment Of Sales, Use Taxes?

Get access to quality Tennessee Complaint regarding assessment of sales, use taxes samples online with US Legal Forms. Avoid days of misused time looking the internet and dropped money on documents that aren’t updated. US Legal Forms gives you a solution to exactly that. Find more than 85,000 state-specific authorized and tax templates you can save and submit in clicks in the Forms library.

To find the sample, log in to your account and click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Tennessee Complaint regarding assessment of sales, use taxes you’re looking at is appropriate for your state.

- Look at the sample making use of the Preview option and read its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by card or PayPal to finish creating an account.

- Pick a preferred file format to save the document (.pdf or .docx).

You can now open the Tennessee Complaint regarding assessment of sales, use taxes example and fill it out online or print it out and get it done by hand. Consider mailing the document to your legal counsel to make sure everything is filled out appropriately. If you make a error, print and complete sample again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and get more samples.

Form popularity

FAQ

Overview. Use Tax is the counterpart to the sales tax. All individuals, as well as businesses operating in the state, must pay use tax when goods are purchased from outside the state of Tennessee and brought or shipped into the state and the seller did not collect sales tax on the purchase.

Goods that are subject to sales tax in Tennessee include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine and gasoline are both tax-exempt. Some services in Tennessee are subject to sales tax.

A copy of the Tennessee Department of Revenue Agricultural Sales and Use Tax Certificate of Exemption. A copy of the wallet-sized exemption card also provided by the Department of Revenue, or.

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states.

A sales tax exemption releases a business or organization from having to pay state or local sales tax on at least some of the items that it purchases.A tax-exempt organization, such as an elementary or high school, makes a purchase for items needed for the school.

Yes you can claim a TN sales tax deduction on your federal income tax return if you are itemizing your deductions. No you cannot claim a loss related to a personal use capital asset (your personal use car) on your income tax return.Choose - continue to sales tax and choose "Easy Guide"

Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.

Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies, certain groceries and food items, and items which are used in the process of packaging. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Use Tax is the counterpart to the sales tax.Use tax does not apply to the purchase of services. The purpose of the use tax is not only to raise revenue, but also to protect local merchants, who must collect the sales tax, from unfair competition from out-of-state sellers who do not collect Tennessee's sales tax.