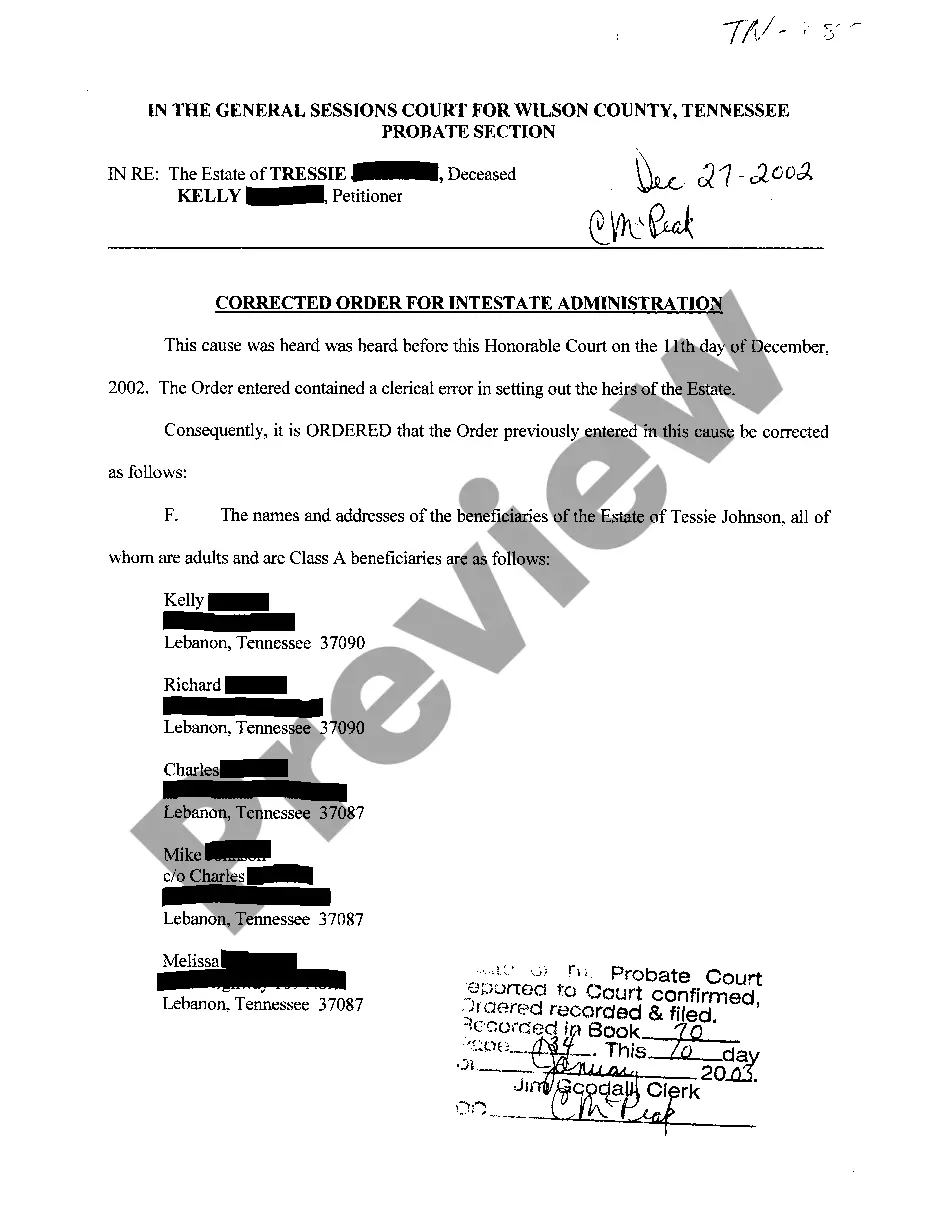

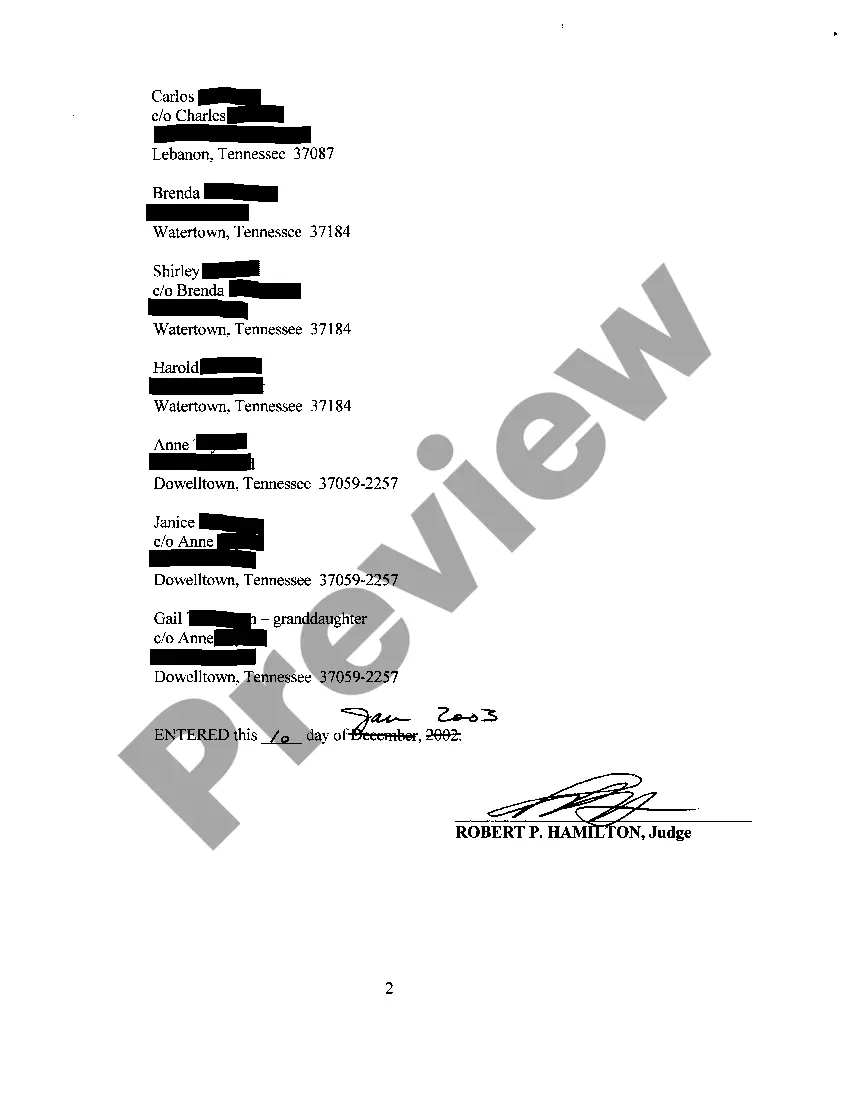

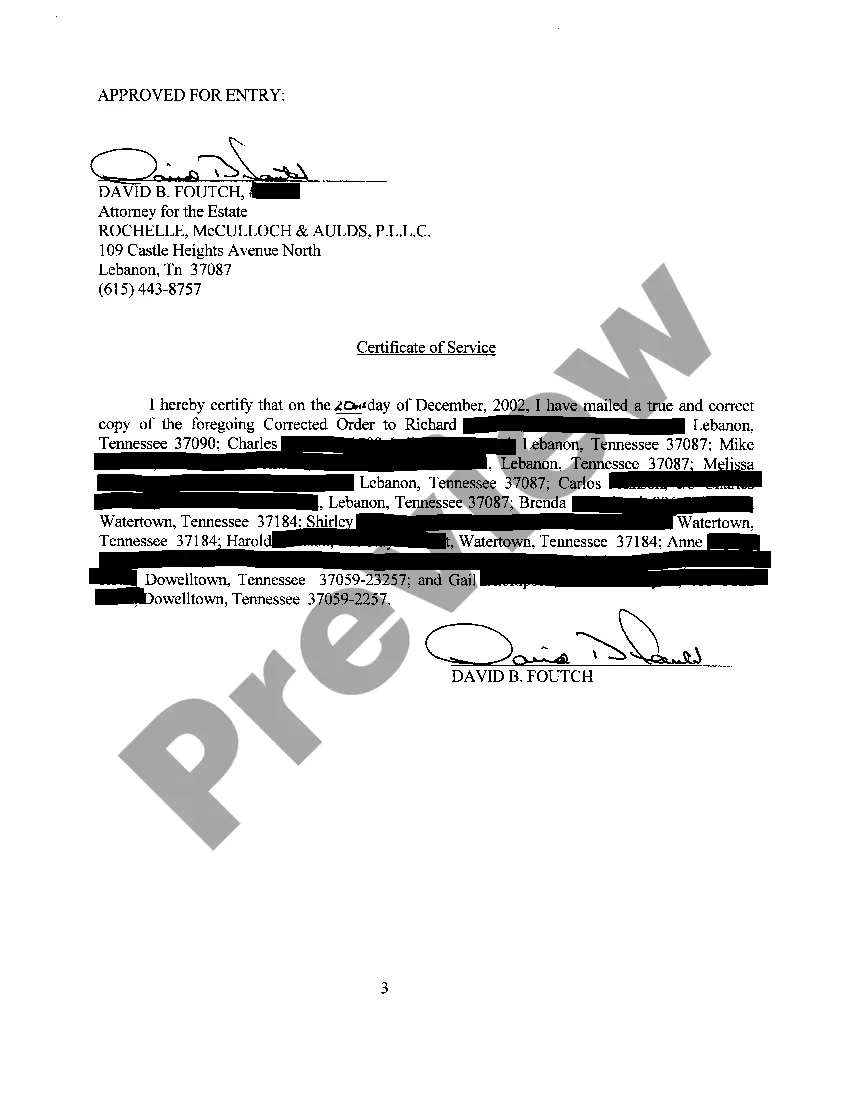

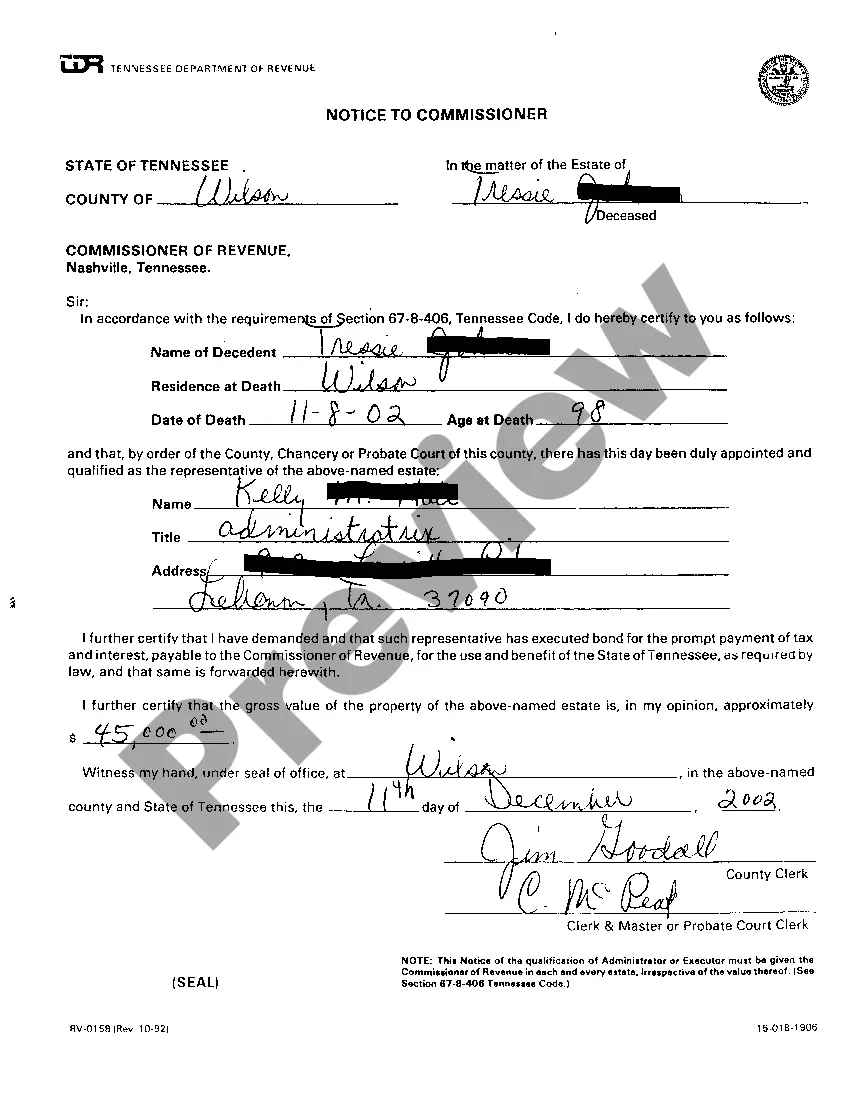

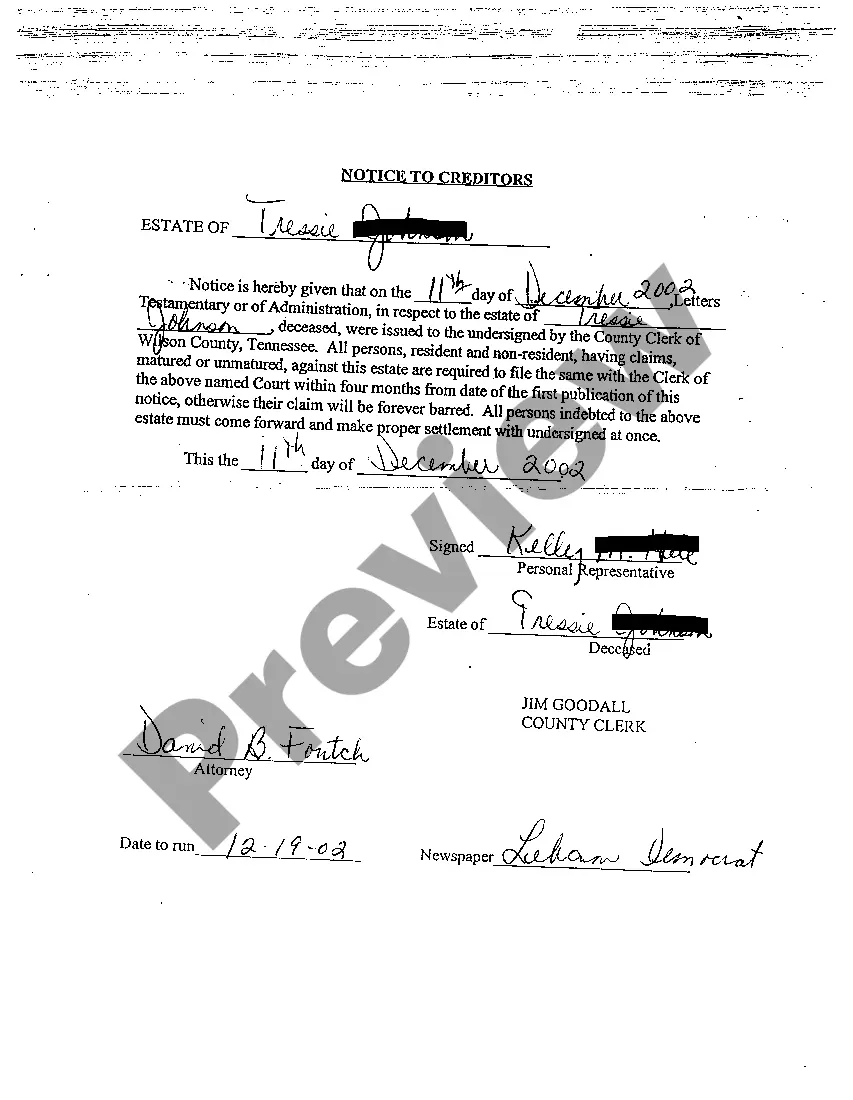

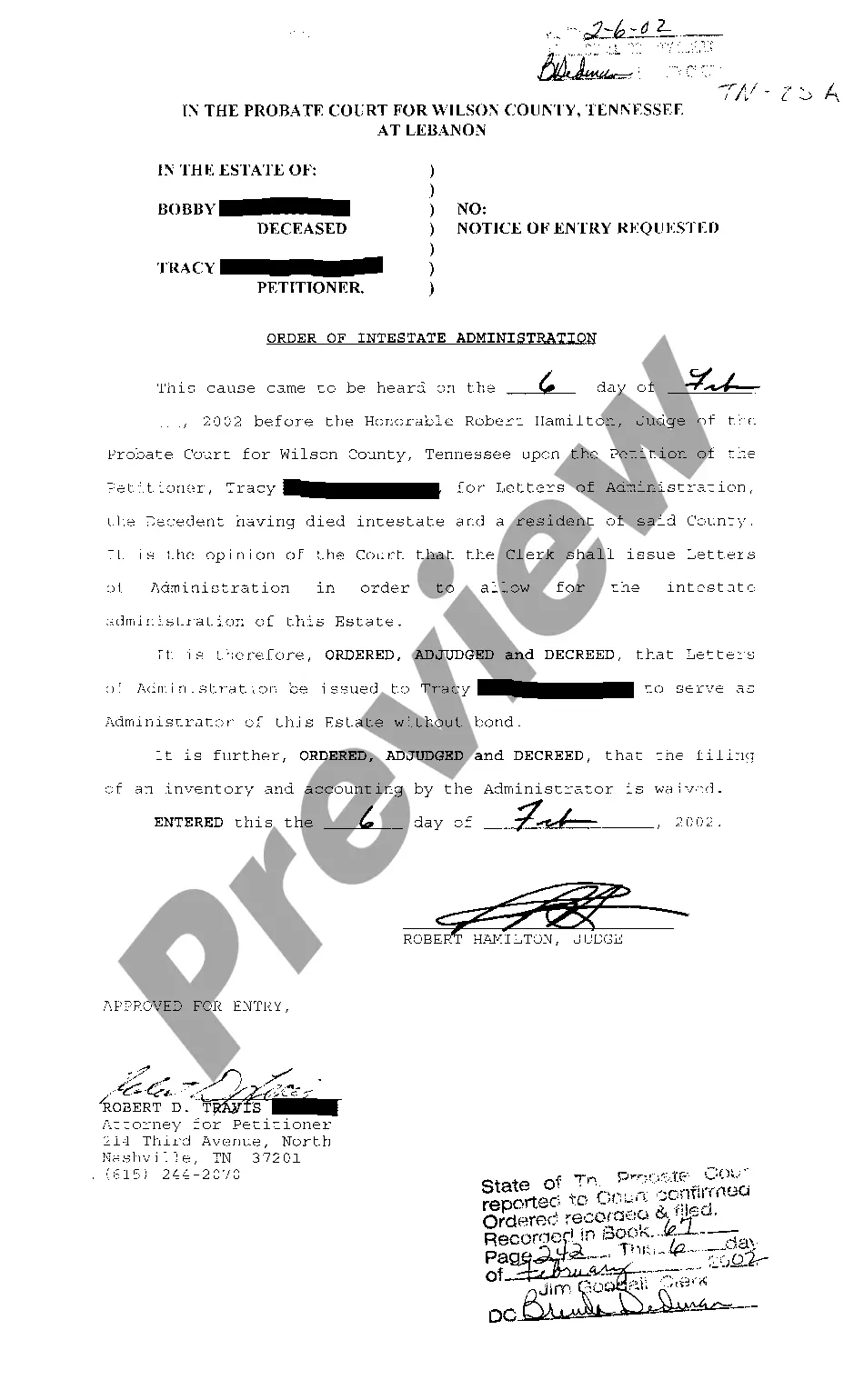

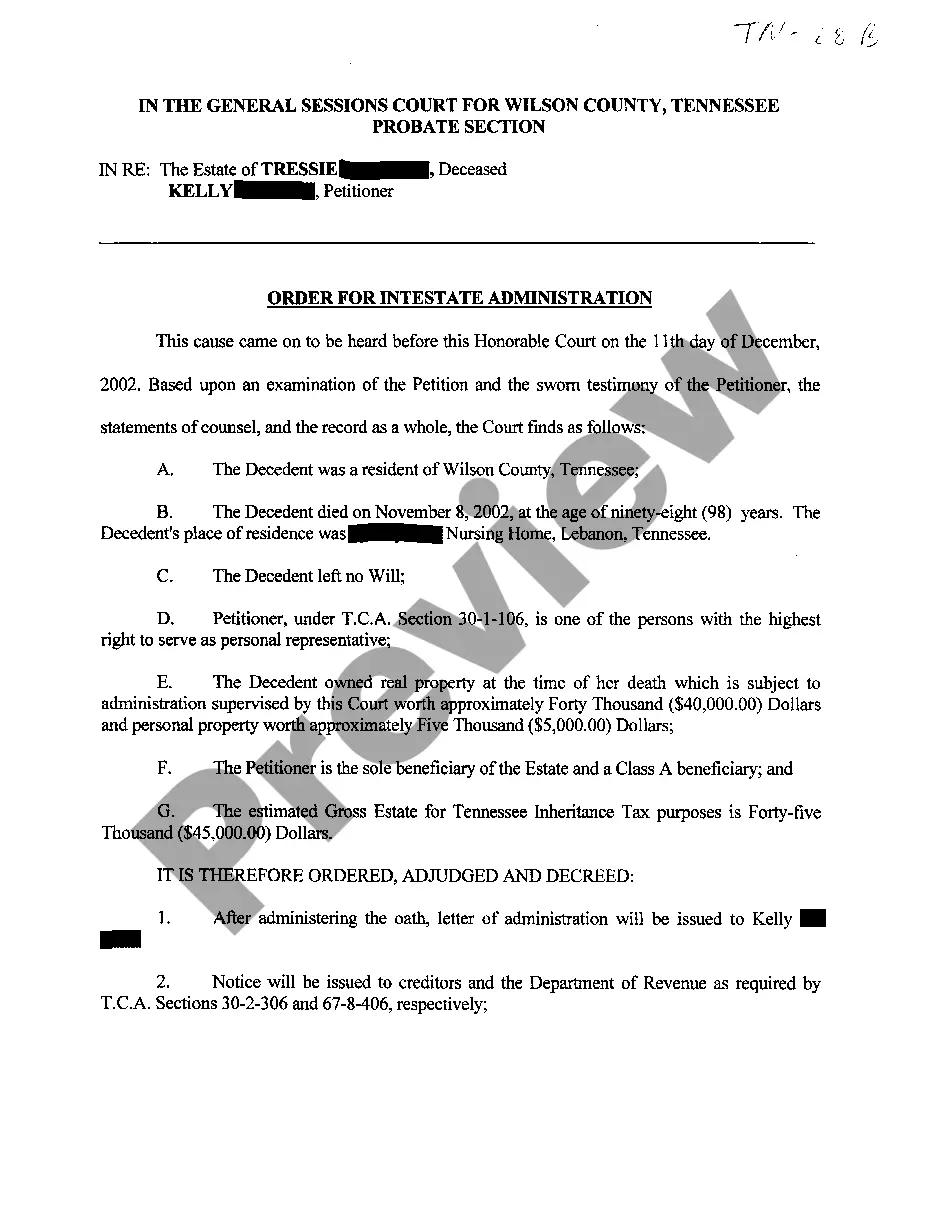

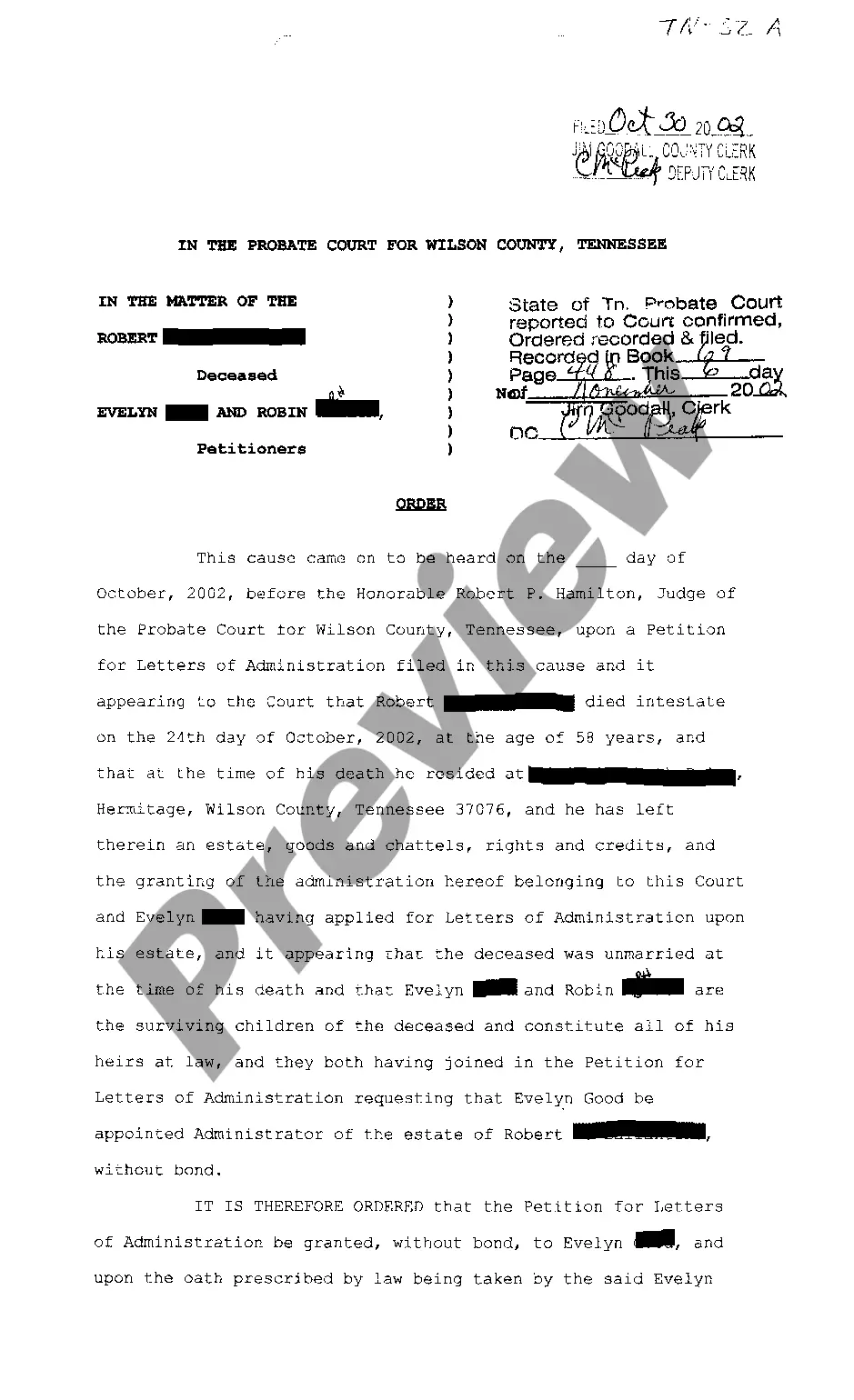

Tennessee Corrected Order For Intestate Administration

Description

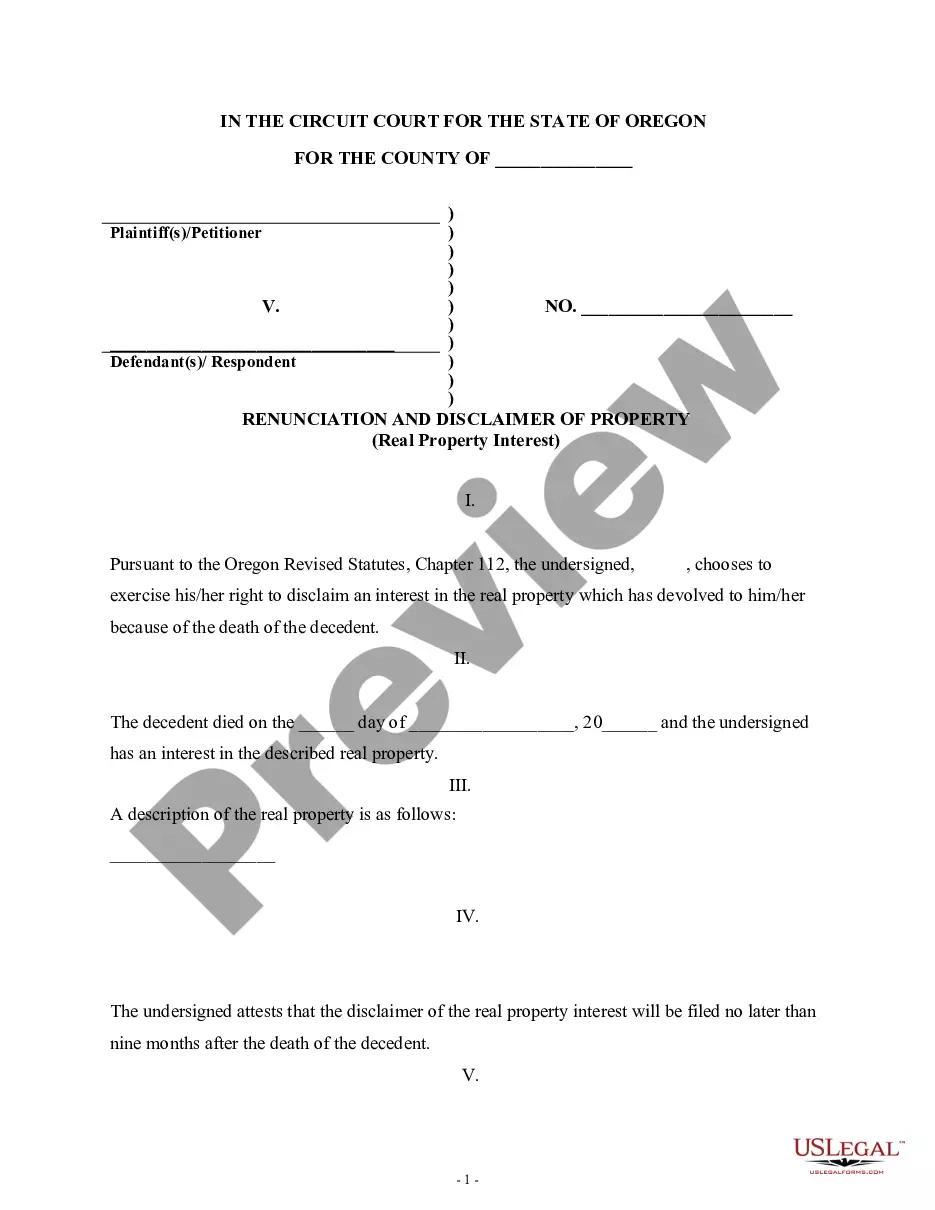

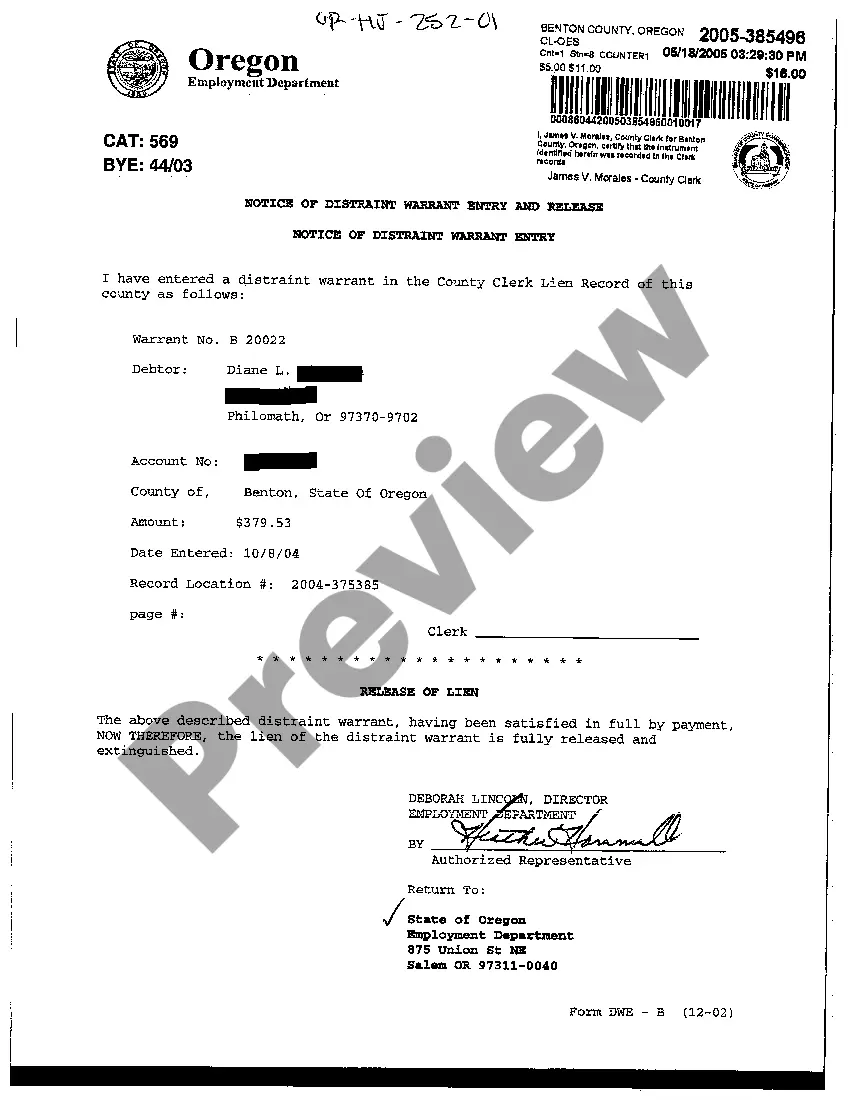

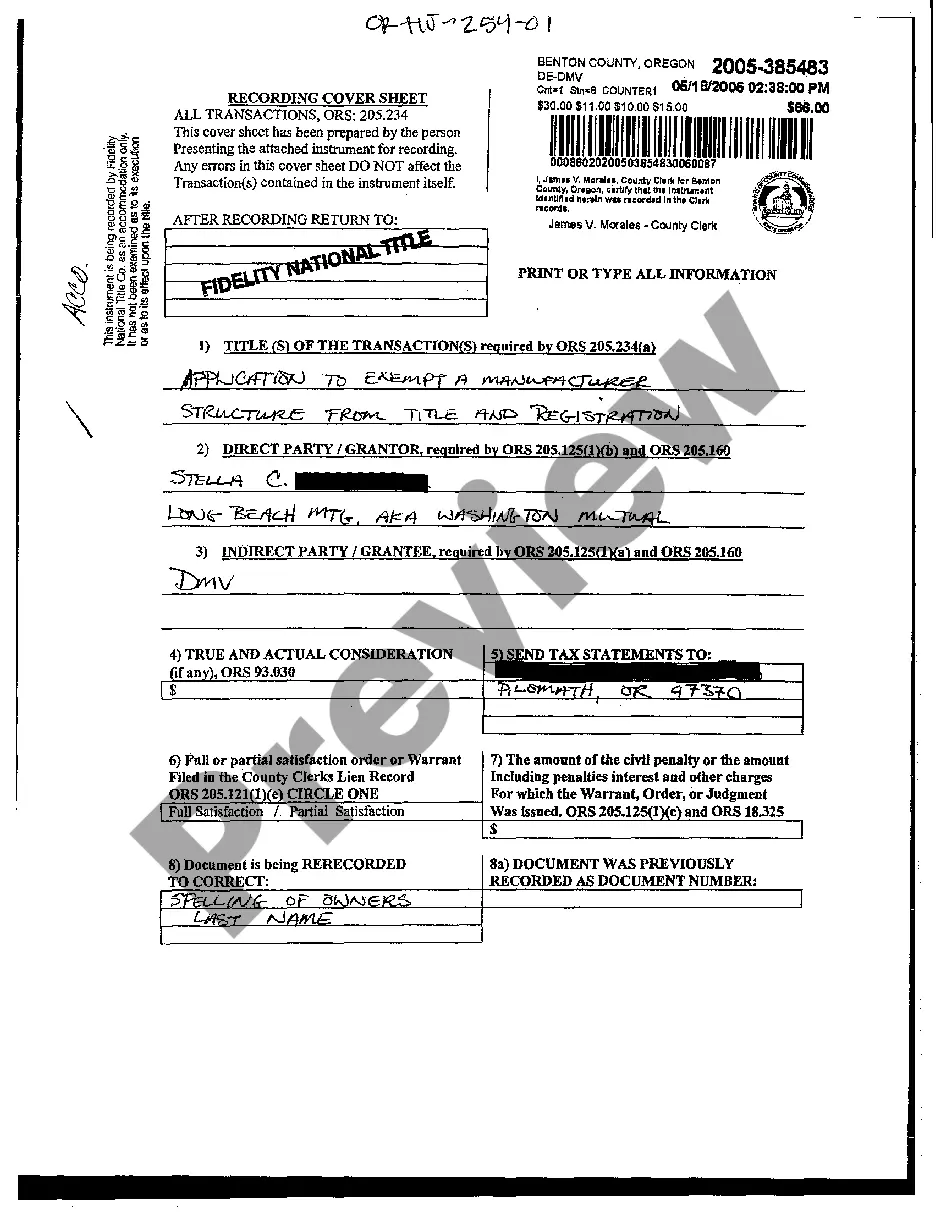

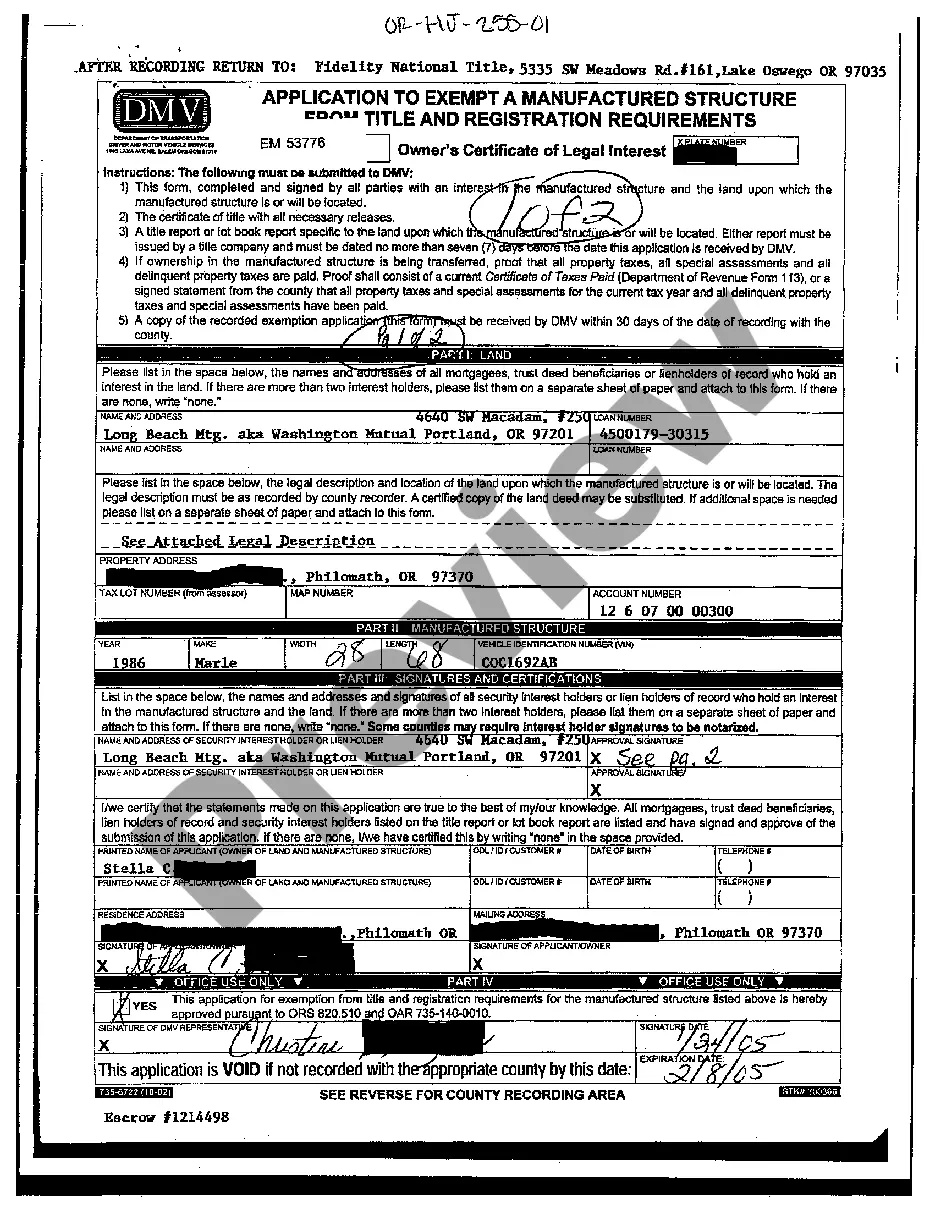

How to fill out Tennessee Corrected Order For Intestate Administration?

Access to top quality Tennessee Corrected Order For Intestate Administration templates online with US Legal Forms. Avoid hours of lost time searching the internet and dropped money on forms that aren’t updated. US Legal Forms gives you a solution to just that. Get above 85,000 state-specific authorized and tax forms that you could download and fill out in clicks within the Forms library.

To receive the sample, log in to your account and click Download. The document will be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Tennessee Corrected Order For Intestate Administration you’re looking at is appropriate for your state.

- Look at the sample utilizing the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by card or PayPal to complete creating an account.

- Pick a favored file format to download the document (.pdf or .docx).

You can now open the Tennessee Corrected Order For Intestate Administration template and fill it out online or print it and get it done yourself. Consider sending the document to your legal counsel to make sure everything is filled in properly. If you make a error, print out and complete sample again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

If there's no will or if the executor doesn't act, someone else, such as a family member, or the Office of the Public Guardian and Trustee (OPGT) may go to court for authorization to settle the estate.

The executor is the person who is going to have to go to probate court and file the paperwork to get the probate process started.If you do not choose an executor for your will, the court is going to have to appoint someone to fulfill this role.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.

One can refuse to be an Executor and the Court will then have to appoint a different person. Most persons nominated, however, do accept the obligation imposed, usually because the testator was a friend or relative who relied upon them to carry out their wishes.

Friction between Co-Executors. Failure to Comply with Will's Terms. Non-Cooperation with a Vital Party or a Beneficiary. Neglecting or Mismanaging Estate Assets. Misconduct. Self-Dealing. Abuse of Discretion. Misappropriation of Funds.

If no one moves to open or settle an estate, all assets in the estate could be lost, instead of being distributed to loved ones or other beneficiaries. Probate is not an automatic process. When a loved one dies, a family member or other interested party must petition the probate court to open an estate.

A court can always remove an executor who is dishonest or seriously incompetent. By Mary Randolph, J.D. It doesn't happen often, but beneficiaries who object to how an executor or administrator is handling an estate can ask the probate court to remove the personal representative and appoint someone else.

If no backup executor was selected by the deceased person, the court will appoint someone who is appropriate. Usually, this is another close relative of the individual who has passed away. The appointed person will be called a personal administrator or an estate administrator in these situations.

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.