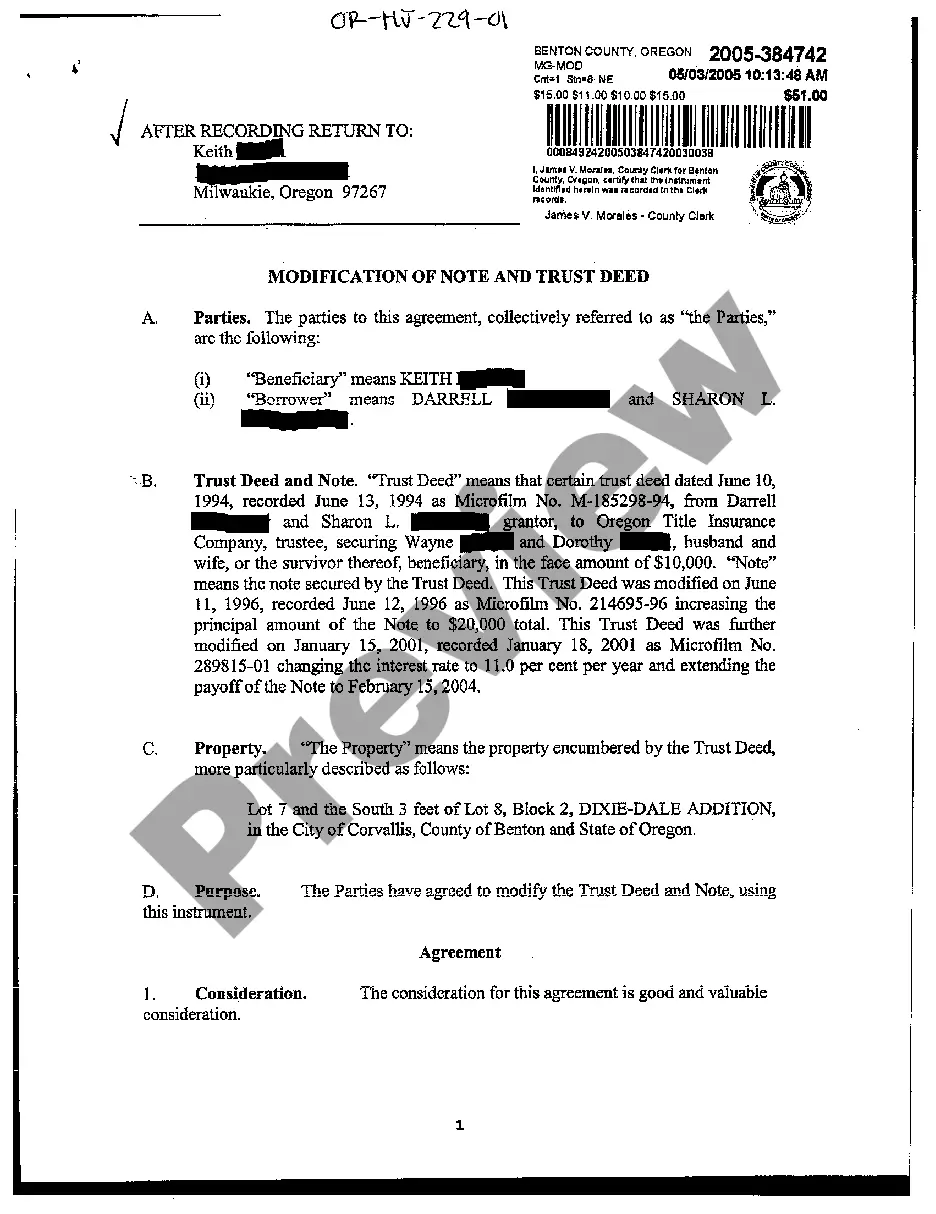

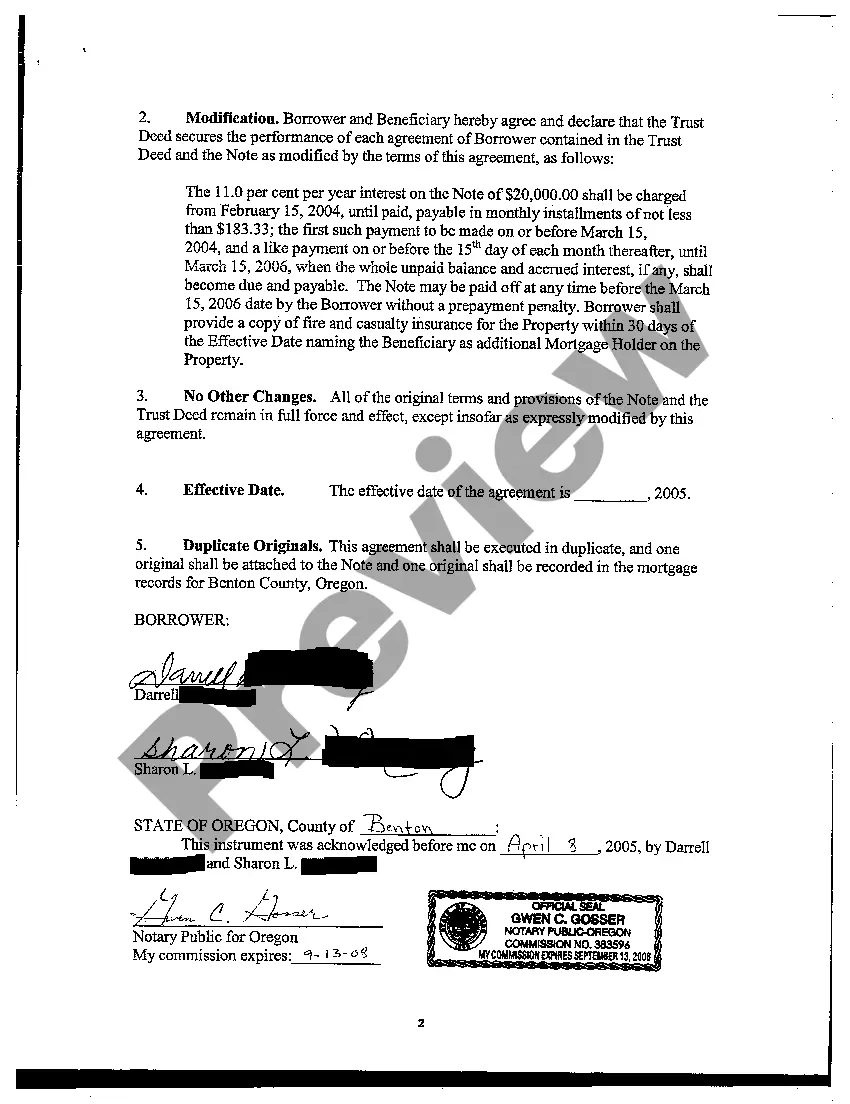

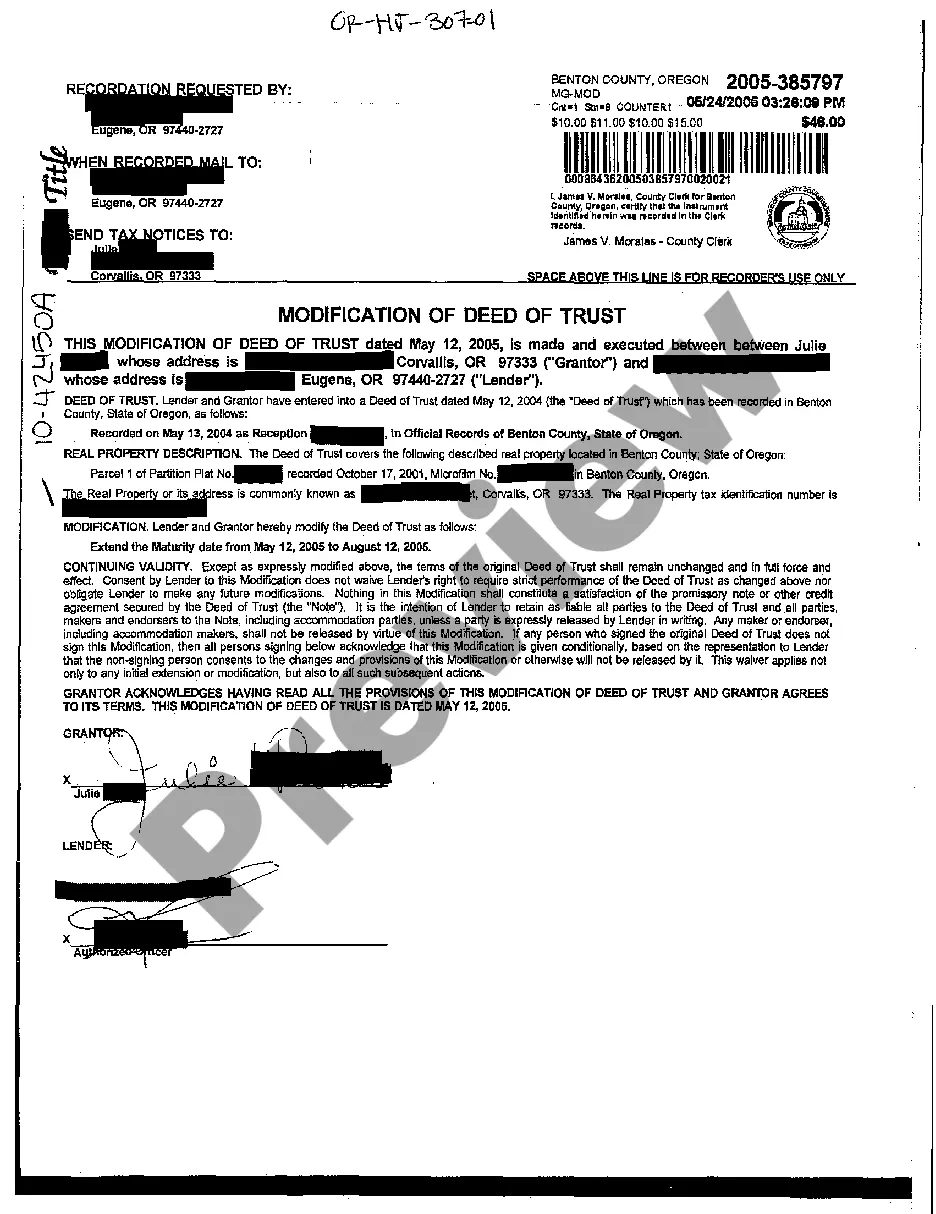

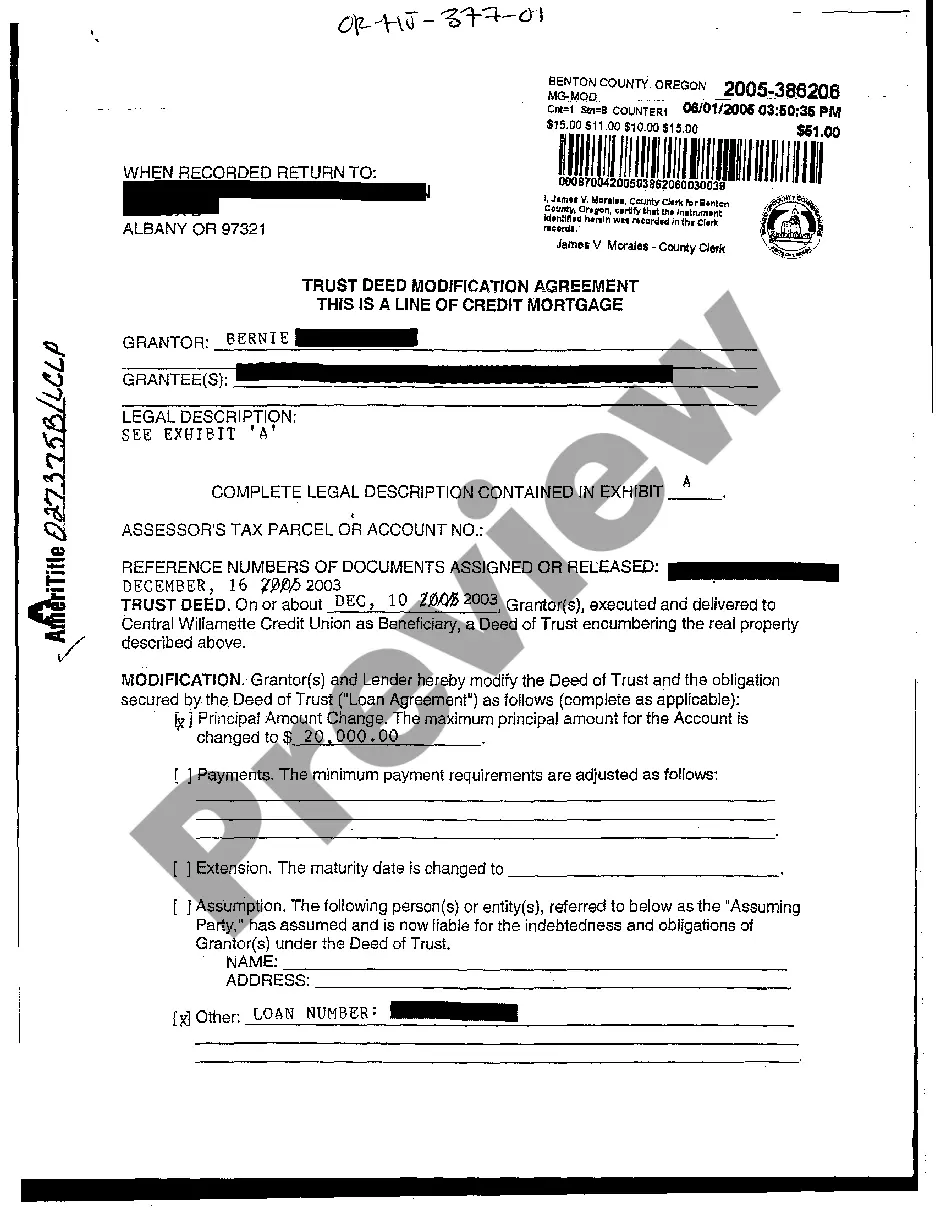

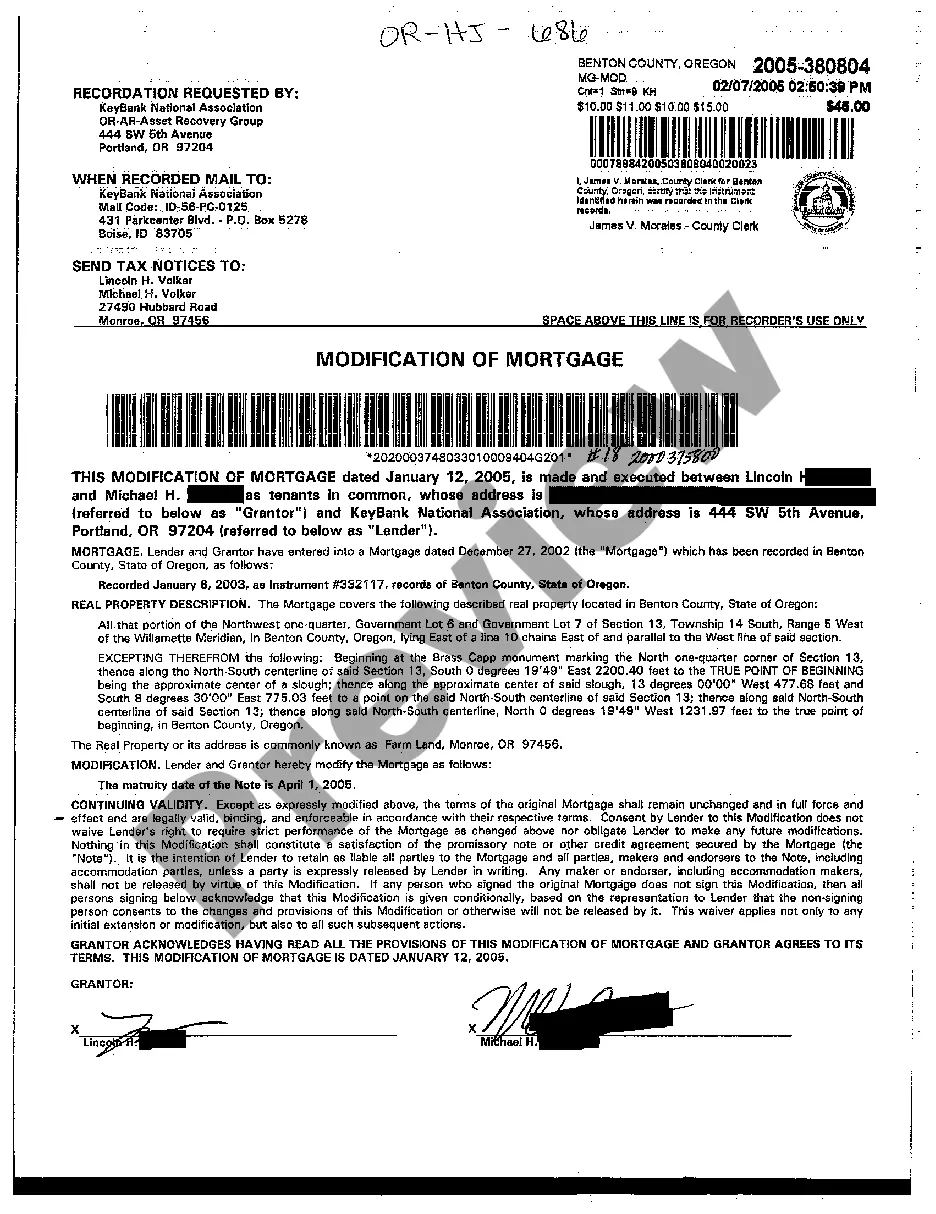

Oregon Change or Modification of Note and Trust Deed

Description

How to fill out Oregon Change Or Modification Of Note And Trust Deed?

The work with documents isn't the most uncomplicated task, especially for people who rarely deal with legal papers. That's why we recommend utilizing accurate Oregon Change or Modification of Note and Trust Deed templates made by professional lawyers. It allows you to eliminate difficulties when in court or handling official institutions. Find the templates you want on our site for top-quality forms and correct descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the file webpage. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can quickly get an account. Look at this simple step-by-step help guide to get the Oregon Change or Modification of Note and Trust Deed:

- Make certain that the form you found is eligible for use in the state it is necessary in.

- Verify the document. Use the Preview option or read its description (if offered).

- Click Buy Now if this file is the thing you need or return to the Search field to get a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these straightforward steps, you are able to complete the sample in your favorite editor. Check the completed data and consider requesting an attorney to review your Oregon Change or Modification of Note and Trust Deed for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

A trust deedalso known as a deed of trustis a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

Trust deeds can be a valuable aid to financial stability, but they are not right for everybody. They are best suited to people who have a regular income and can commit to regular payments. You can owe any amount to set up a trust deed but the typical minimum is about £7,000 or A£8,000.