Tennessee Appointment of Successor Trustee

Description

Key Concepts & Definitions

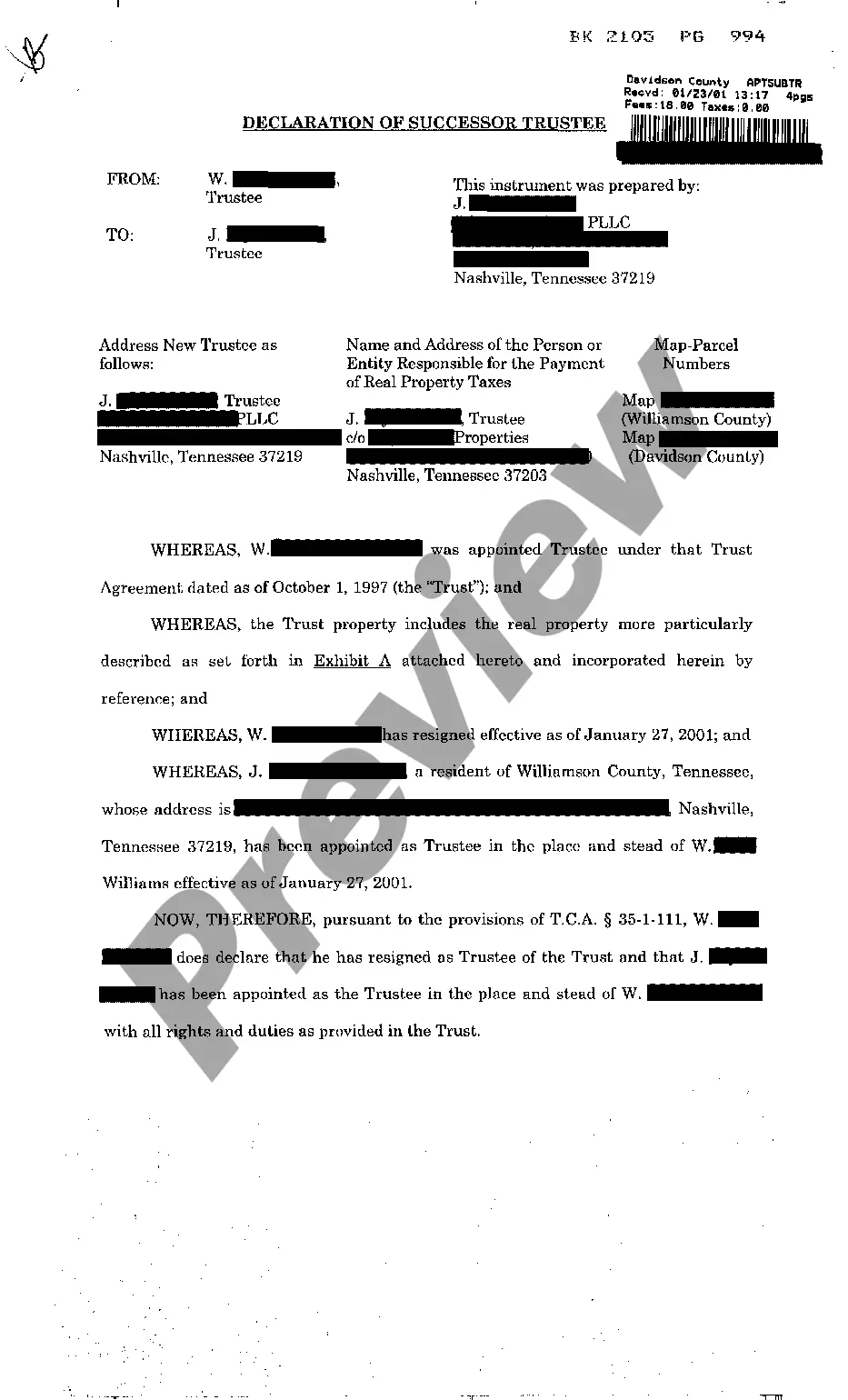

Appointment of Successor Trustee refers to the process where a new trustee is designated to take over trust management duties following the resignation, death, or incapacitation of the previous trustee. This role is crucial for ensuring the continued effective management and administration of the trust in accordance with the trust agreement and relevant legal provisions.

Step-by-Step Guide on Appointing a Successor Trustee

- Review the Trust Document: Identify the provisions for succession and any specific qualifications for the successor trustee.

- Select the Successor Trustee: Choose an individual or institution that meets the trust's requirements and is willing to take on the responsibilities.

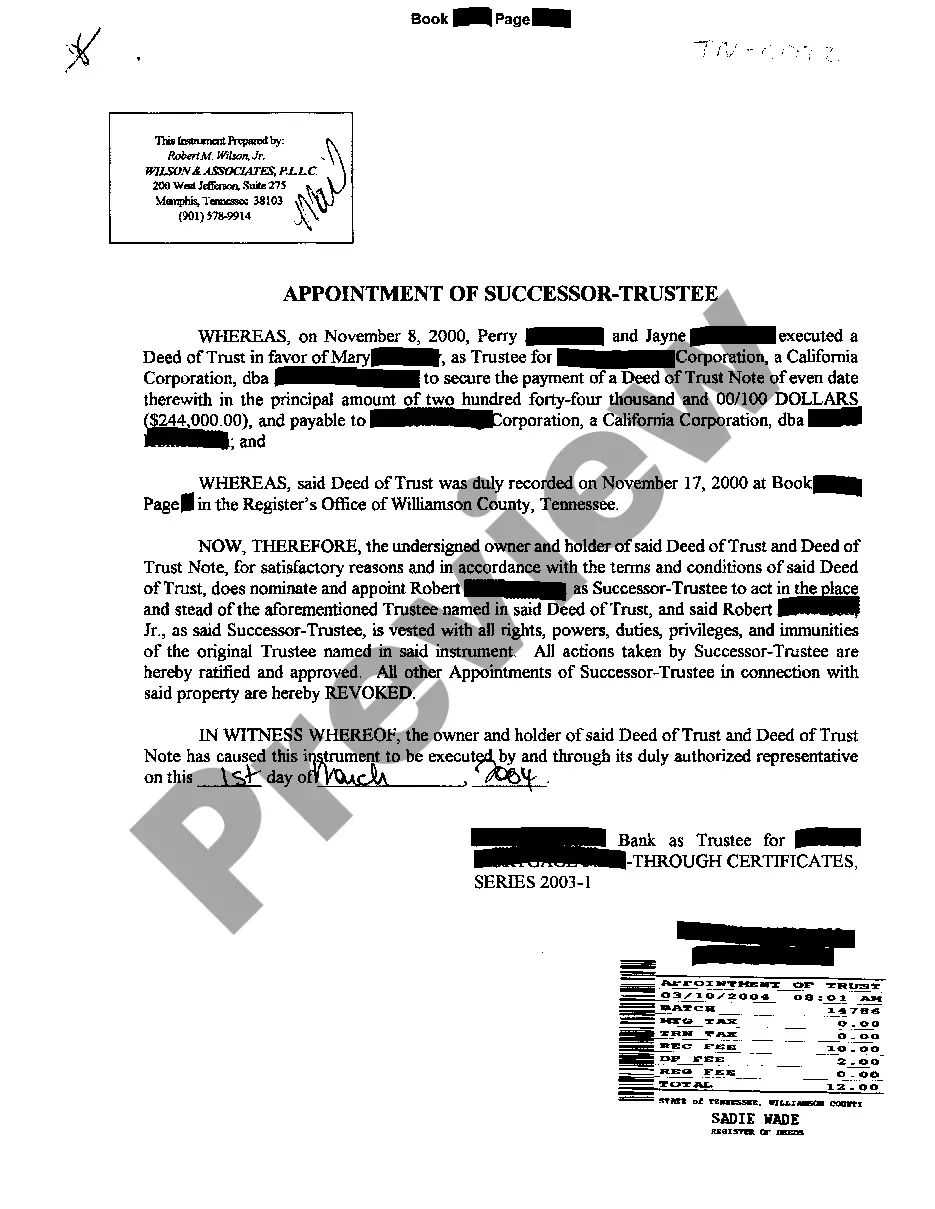

- Execute a Successor Trustee Appointment Document: Formally document the appointment as per trust guidelines or state laws.

- Notify Relevant Parties: Inform beneficiaries, co-trustees, and financial institutions of the change in trusteeship.

- Transfer Authority: Ensure all legal and financial documents are updated to reflect the change in trustee.

Risk Analysis in the Appointment of Successor Trustee

- Improper Selection Risks: Choosing a successor trustee who lacks the competence, integrity, or neutrality to manage trust assets effectively can lead to mismanagement or conflict.

- Legal Non-Compliance: Failure to adhere to the legal standards and processes for appointing a successor can result in legal challenges or invalidation of the appointment.

- Transition Risks: Poorly managed transitions can lead to operational disruptions or delays in trust administration.

Common Mistakes & How to Avoid Them

- Ignoring Trust Documents: Always consult the trust agreement first; disregarding its terms can lead to legal issues.

- Neglecting to Consider a Successors Willingness or Ability: Confirm that the successor is willing and able to serve before making the appointment.

- Delaying the Appointment Process: Avoid delays in appointing a successor to prevent gaps in trust management.

How to fill out Tennessee Appointment Of Successor Trustee?

Access to high quality Tennessee Appointment of Successor Trustee samples online with US Legal Forms. Steer clear of hours of lost time seeking the internet and lost money on documents that aren’t updated. US Legal Forms gives you a solution to just that. Find above 85,000 state-specific legal and tax forms that you can download and complete in clicks within the Forms library.

To get the example, log in to your account and click on Download button. The document is going to be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Find out if the Tennessee Appointment of Successor Trustee you’re considering is suitable for your state.

- View the form utilizing the Preview function and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by credit card or PayPal to finish making an account.

- Select a favored format to save the file (.pdf or .docx).

You can now open up the Tennessee Appointment of Successor Trustee sample and fill it out online or print it out and get it done by hand. Take into account mailing the papers to your legal counsel to be certain things are filled in properly. If you make a mistake, print out and complete sample again (once you’ve made an account all documents you save is reusable). Make your US Legal Forms account now and get far more samples.

Form popularity

FAQ

Once you follow that directive, the Trustee must step down and a successor Trustee can be appointed.Once a Trustee resigns, then either the next person named would act, or maybe you can appoint someone new if the Trust terms allow you to do that. Either way, a new Trustee will be in office when a Trustee resigns.

Some states have laws governing who may or may not serve as a trustee in a deed of trust. Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee.

When the grantor dies, the trust becomes irrevocable and management or distribution of the assets passes to a successor trustee. Most trusts name the successor trustee when the trust is established; however, if you need to change or add a successor trustee, you can do so by amending the document.

Can the Successor Trustee Be a Beneficiary of the Trust? It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common.

Tennessee is a deed of trust state. However, a mortgage is enforceable. The trustee must be a resident of Tennessee or a corporation domiciled in Tennessee. There is a reciprocal agreement in which a trustee can serve in Tennessee if the trustee's home state allows a Tennessee trustee to serve.

A trustee is any type of person or organization that holds the legal title of an asset or group of assets for another person, referred to as the beneficiary. A trustee is granted this type of legal title through a trust, which is an agreement between two consenting parties.

Successor trustees are appointed in the trust document itself. The trustor will specify who they want to take over management of the trust if and when they can't do it themselves.

Successor trustees have to willingly accept their role usually by signing a consent to serve or affidavit of appointment. If an existing trustee wishes to change their successor trustee, they must make an actual amendment to the trust. Most courts won't accept informal, self-made changes.

The lender is the person or legal entity providing the loan to the borrower. The trustee is a neutral third-party who holds the legal title to a property until the borrower pays off the loan in full. They're called a trustee because they hold the property in trust for the lender.