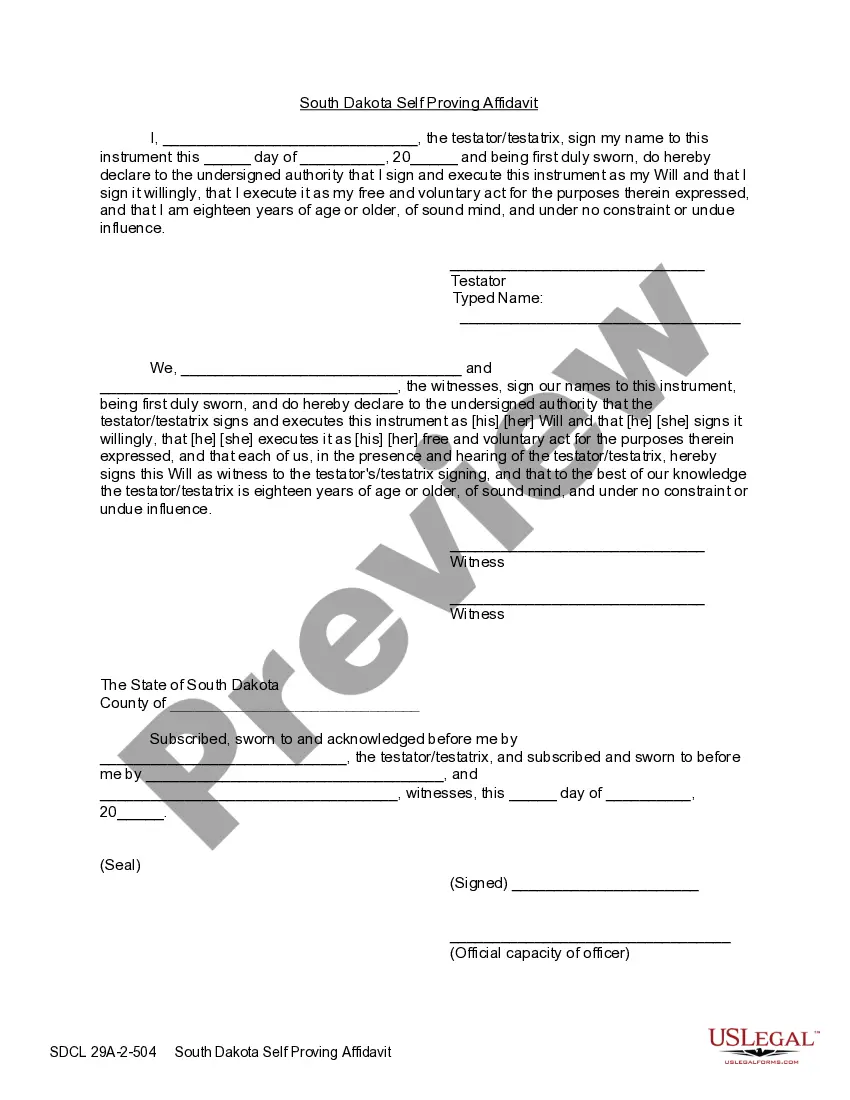

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

South Dakota Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out South Dakota Last Will And Testament With All Property To Trust Called A Pour Over Will?

Access to top quality South Dakota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will templates online with US Legal Forms. Avoid days of wasted time browsing the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find over 85,000 state-specific legal and tax samples you can download and submit in clicks in the Forms library.

To find the example, log in to your account and click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- Verify that the South Dakota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will you’re looking at is suitable for your state.

- Look at the form making use of the Preview option and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by card or PayPal to complete creating an account.

- Choose a preferred file format to save the file (.pdf or .docx).

Now you can open up the South Dakota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will sample and fill it out online or print it and get it done by hand. Consider giving the file to your legal counsel to make sure everything is filled in appropriately. If you make a error, print and fill sample once again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and get access to far more samples.

Form popularity

FAQ

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

Deciding between a will or a trust is a personal choice, and some experts recommend having both. A will is typically less expensive and easier to set up than a trust, an expensive and often complex legal document.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

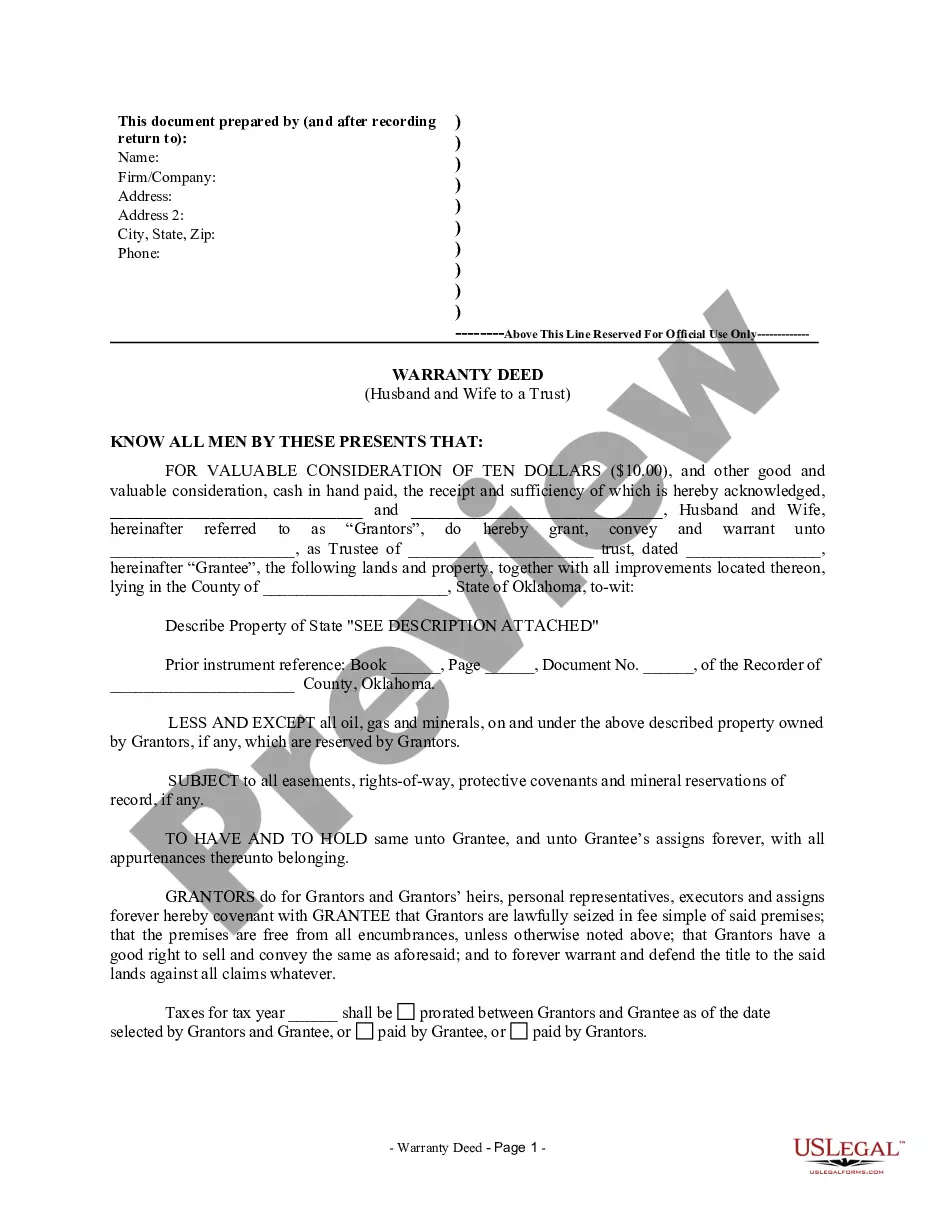

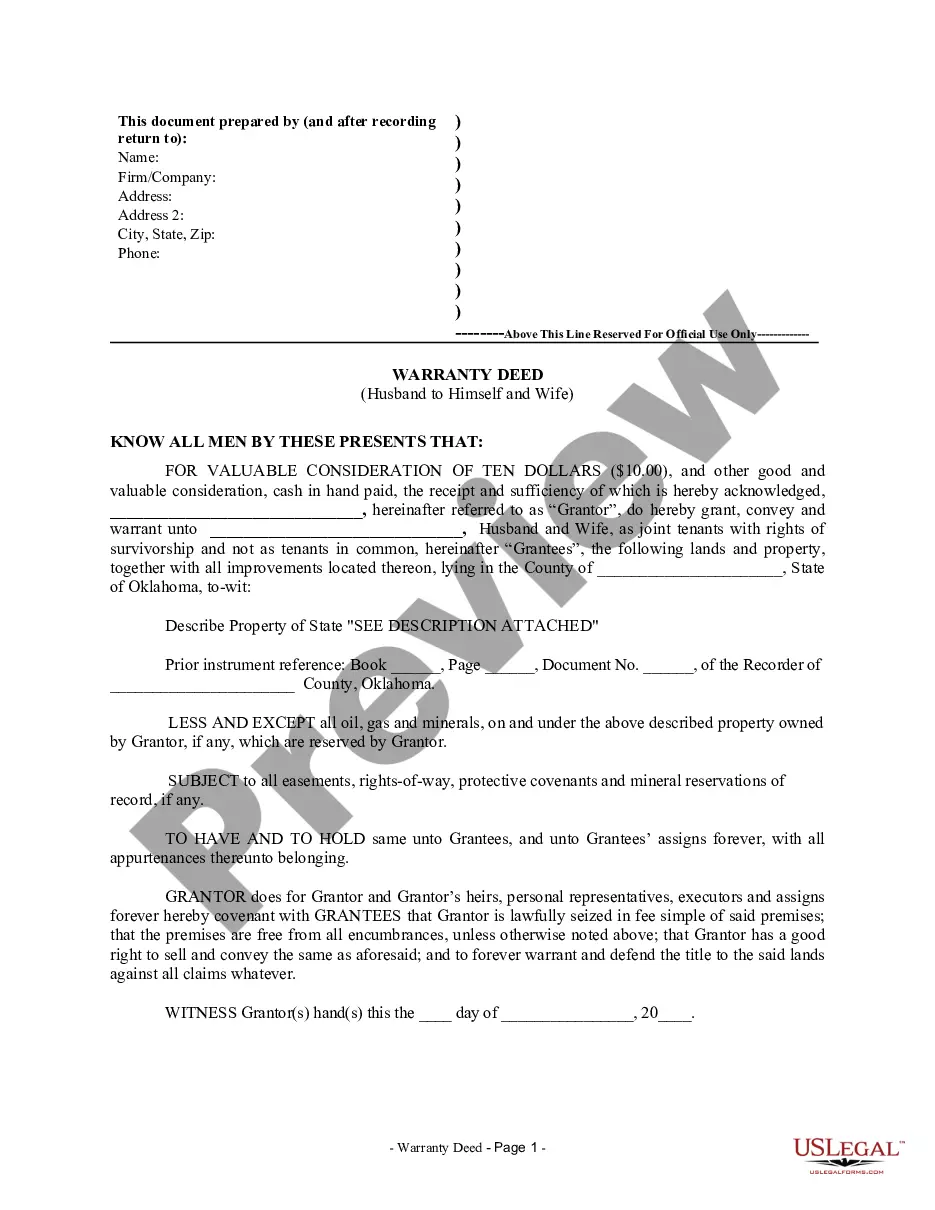

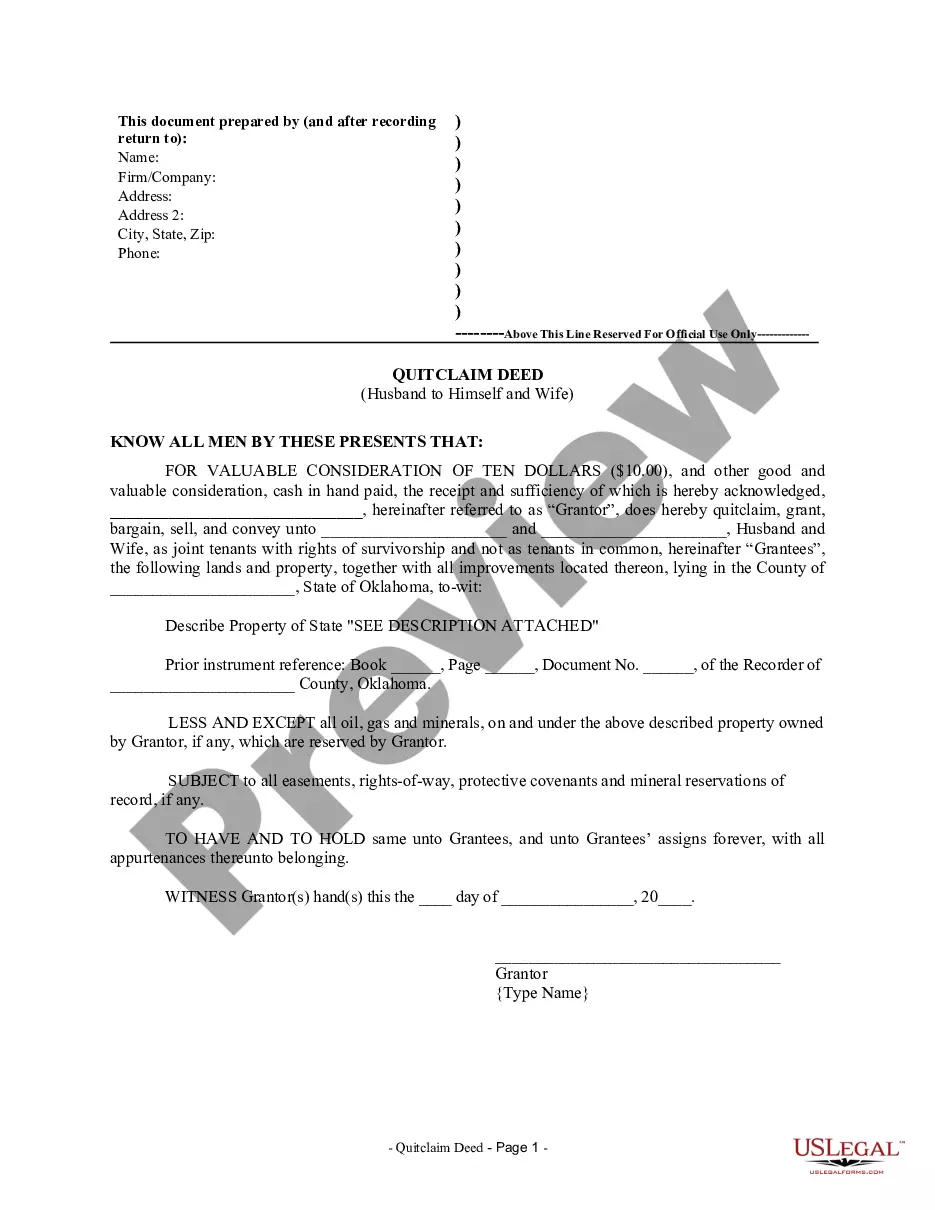

This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust. Having this information available will make it easier to prepare your trust distribution provisions.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

No. You can make your own will in South Dakota, using Nolo's do-it-yourself will software or online will programs. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.This is true whether you are preparing a revocable living trust, corporate bylaws, LLC documents, or any other legal documents.

2. Organize your paperwork. Gather together documentation pertaining to your assets. This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust.

A Living Trust is a document that allows individual(s), or 'Grantor', to place their assets to the benefit of someone else at their death or incapacitation. Unlike a Will, a Trust does not go through the probate process with the court.