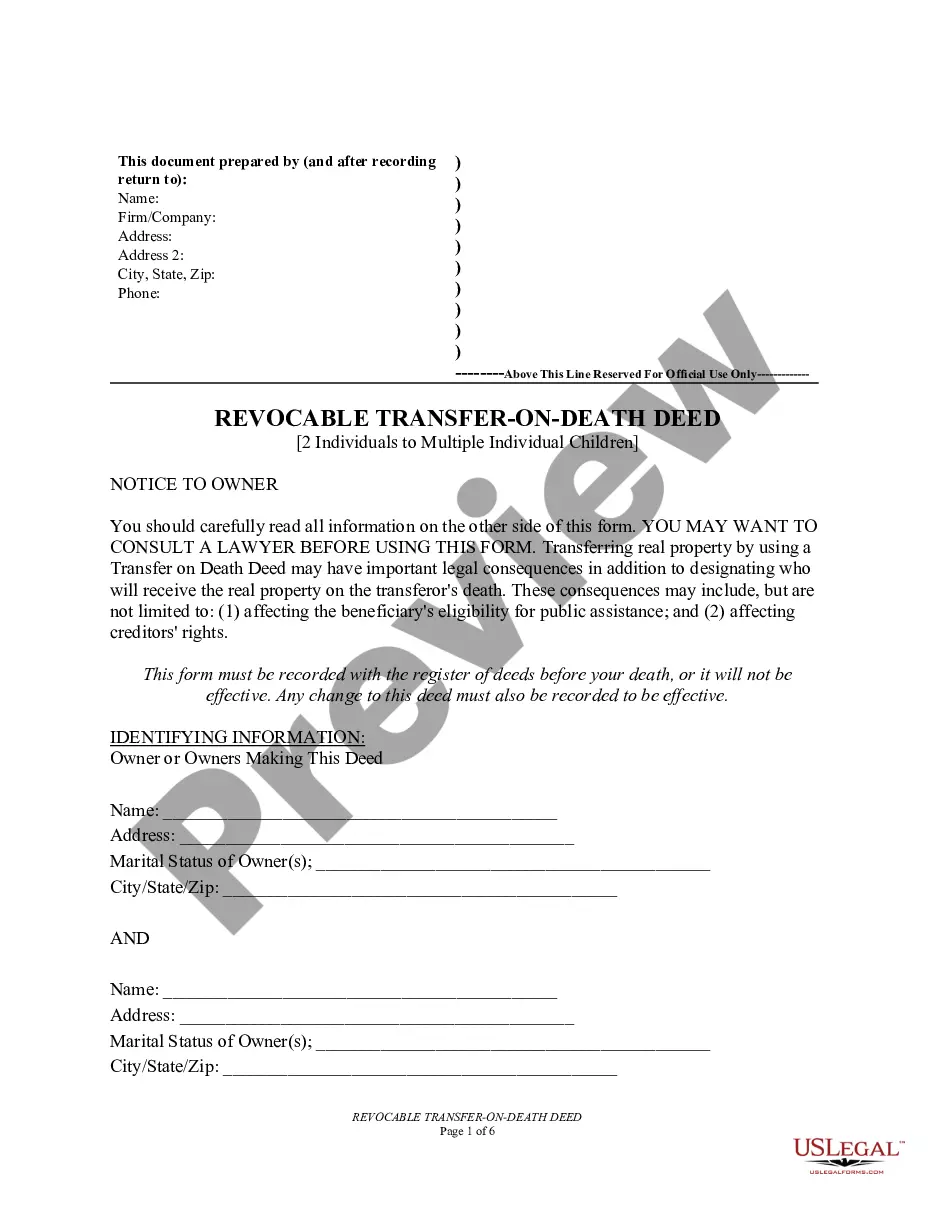

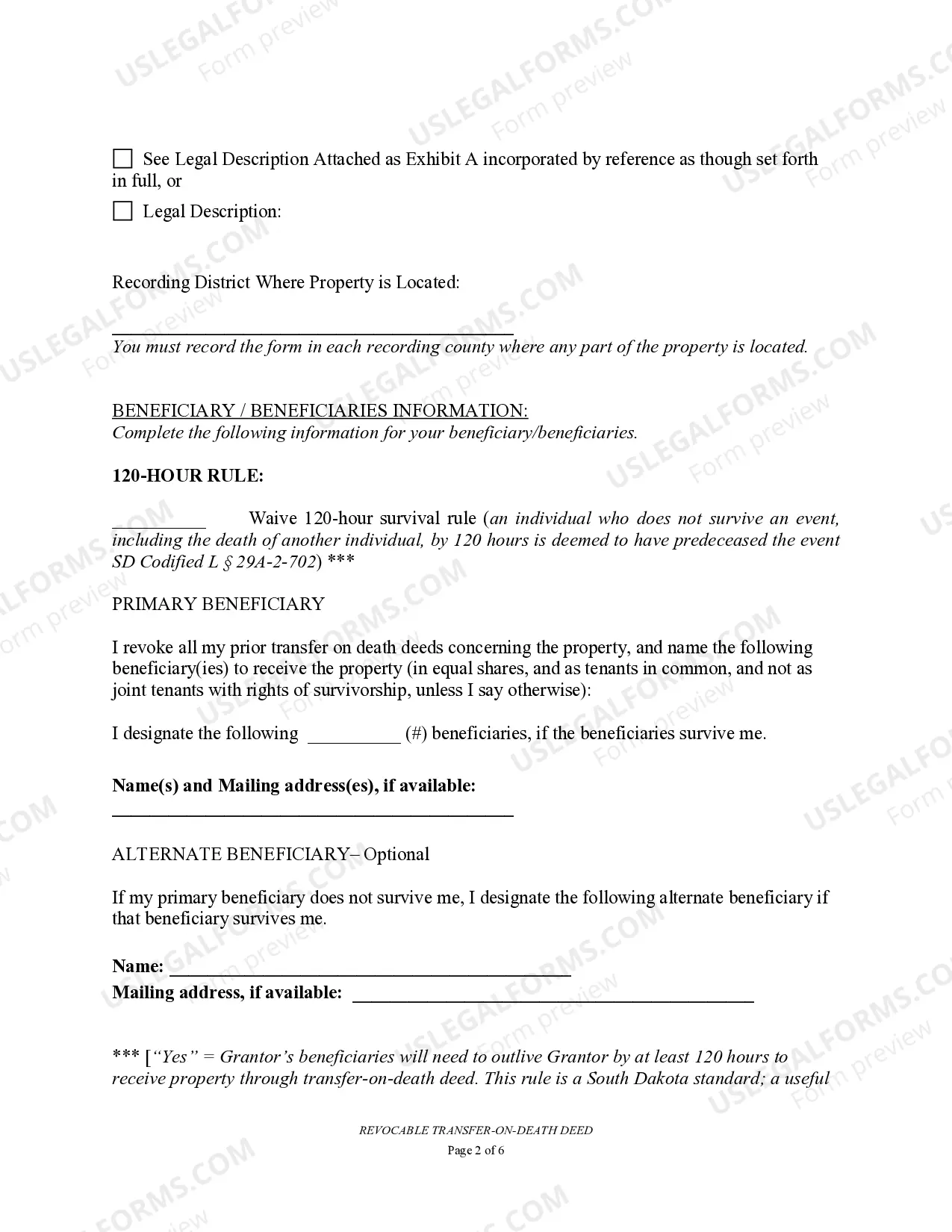

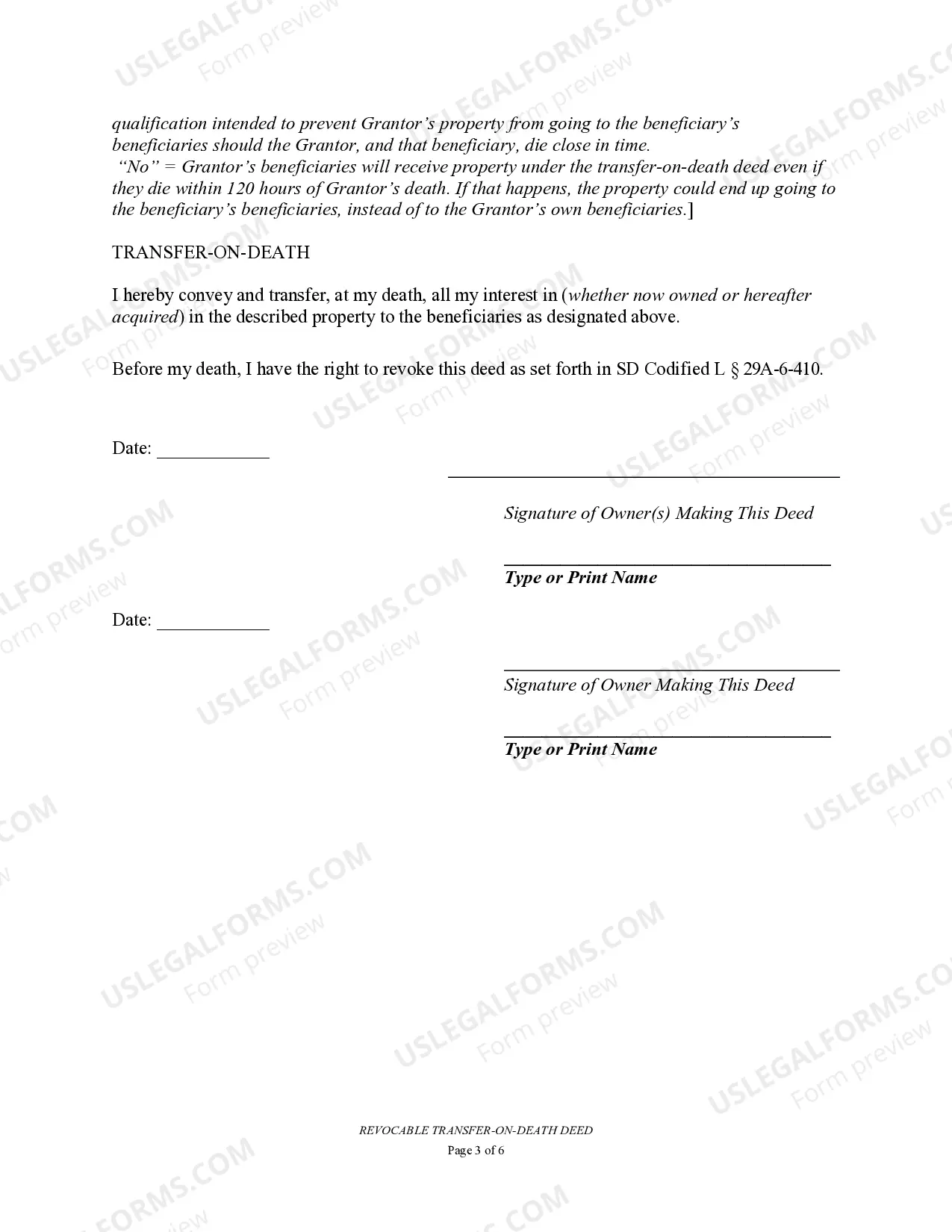

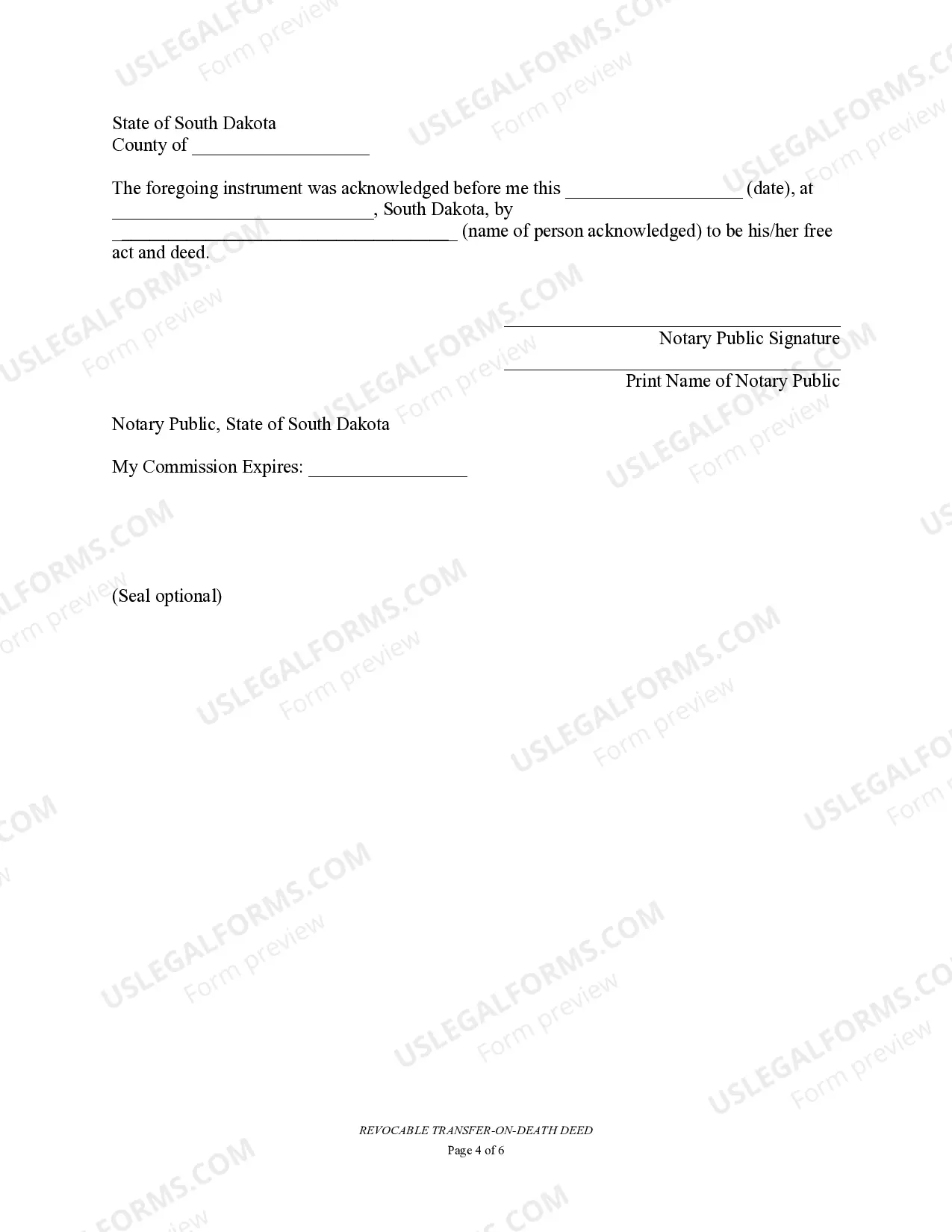

South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals

Description

How to fill out South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Multiple Individuals?

Use US Legal Forms to obtain a printable South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the internet and provides cost-effective and accurate samples for customers and attorneys, and SMBs. The documents are grouped into state-based categories and many of them might be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals:

- Check to make sure you get the proper form in relation to the state it’s needed in.

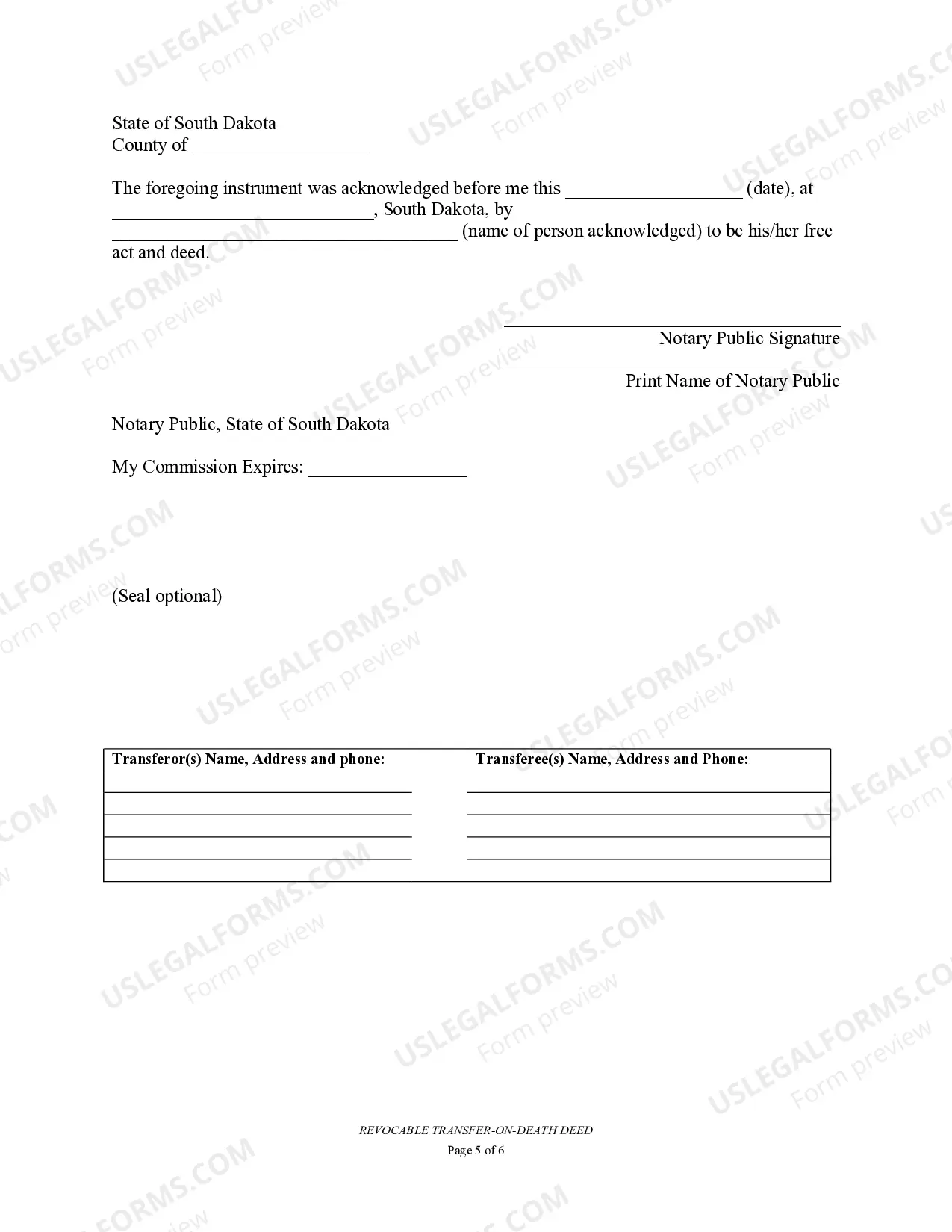

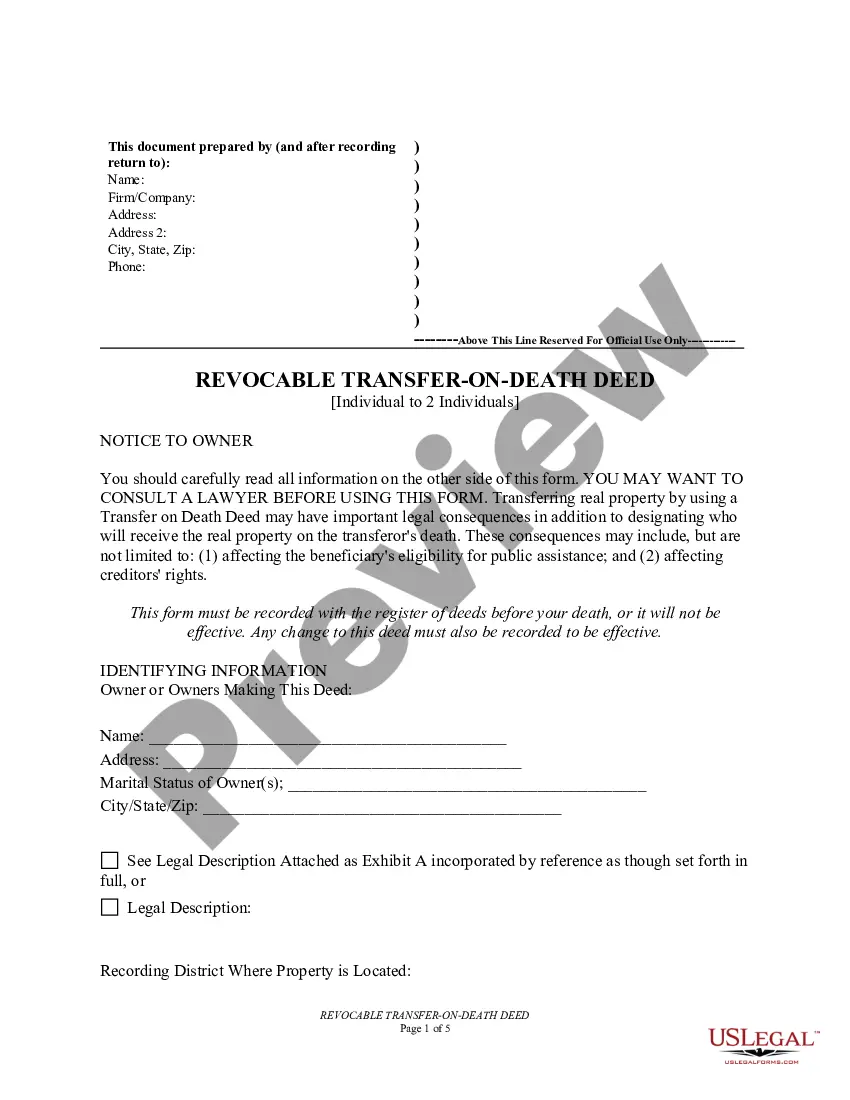

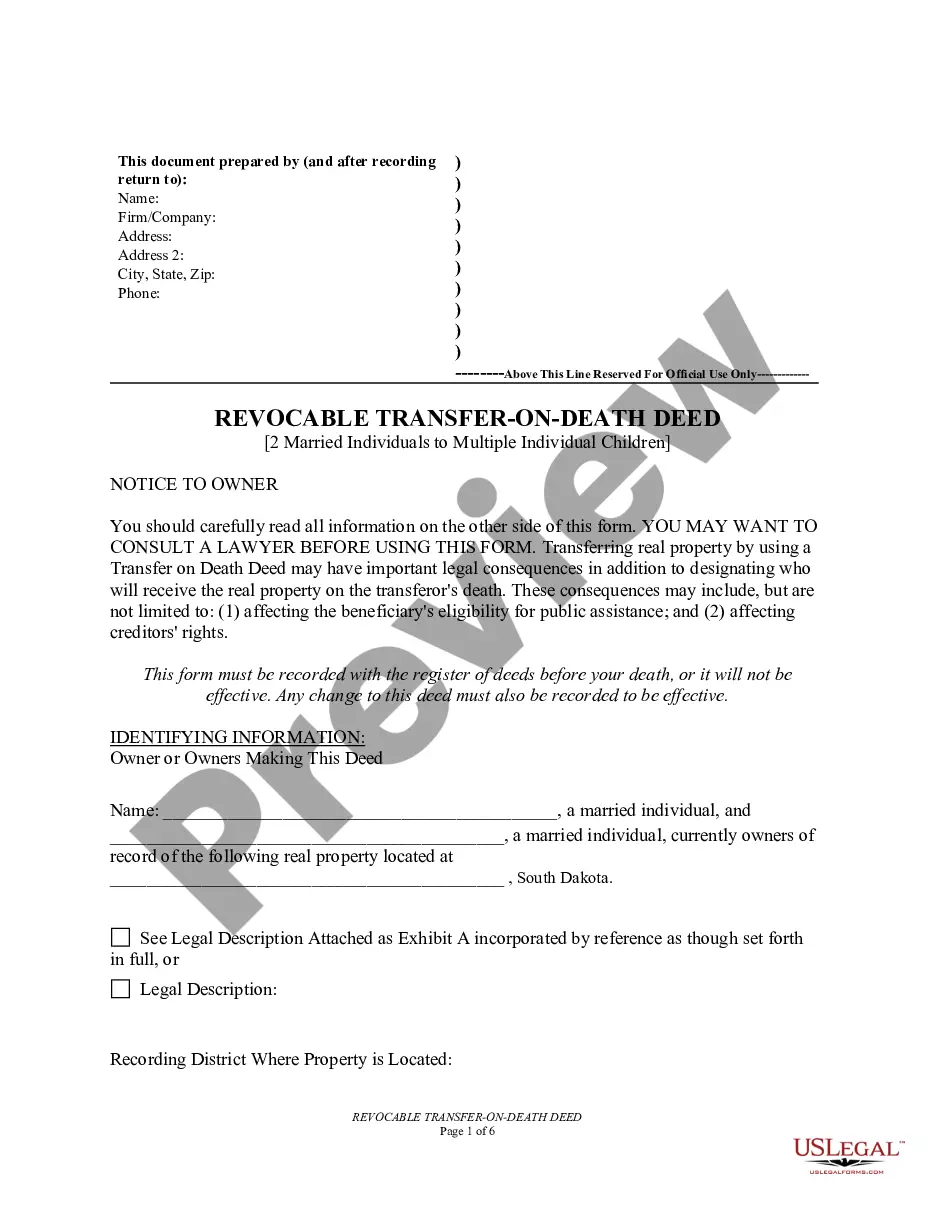

- Review the document by looking through the description and by using the Preview feature.

- Hit Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search field if you need to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals. More than three million users already have utilized our platform successfully. Select your subscription plan and have high-quality forms in just a few clicks.