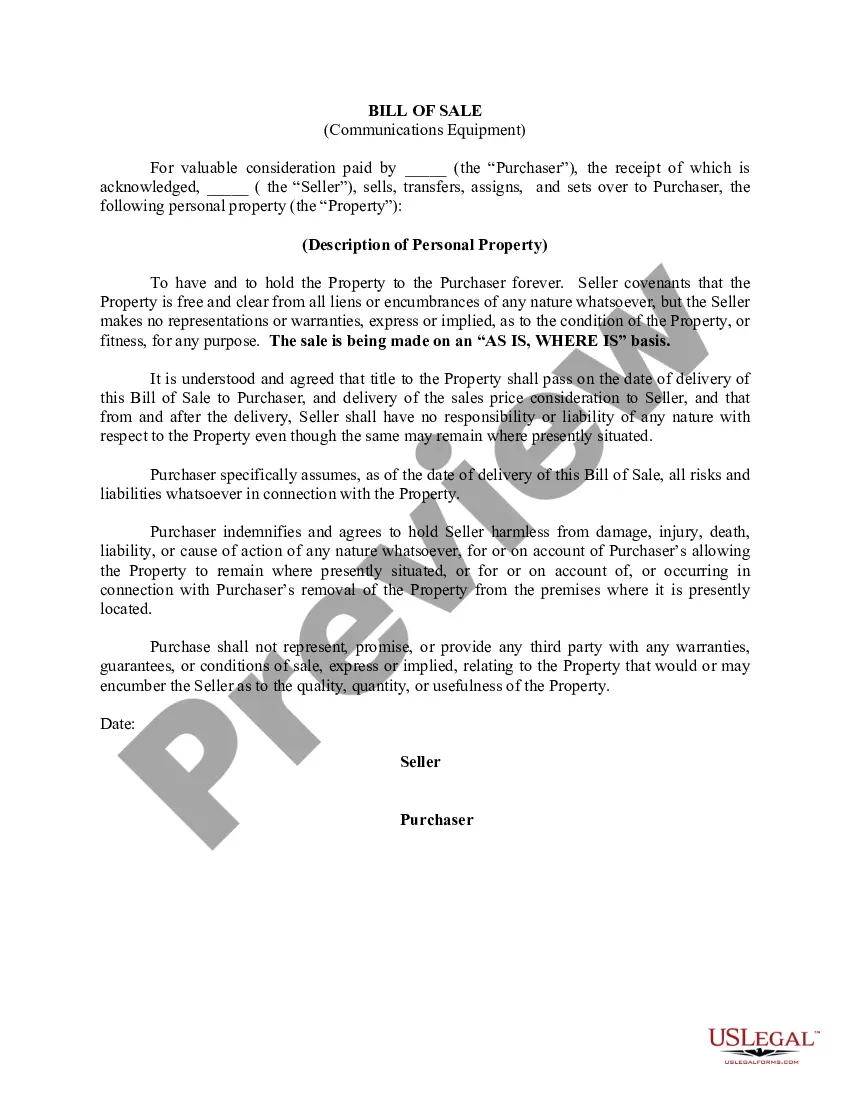

South Dakota Bill of Sale (Communications Equipment)

Description

How to fill out Bill Of Sale (Communications Equipment)?

Are you in the place in which you need to have papers for either organization or specific reasons nearly every working day? There are a lot of legal record layouts accessible on the Internet, but finding versions you can depend on is not simple. US Legal Forms gives thousands of develop layouts, much like the South Dakota Bill of Sale (Communications Equipment), that happen to be created to satisfy federal and state requirements.

Should you be already knowledgeable about US Legal Forms site and possess your account, merely log in. After that, you may download the South Dakota Bill of Sale (Communications Equipment) format.

Should you not have an accounts and want to begin to use US Legal Forms, adopt these measures:

- Get the develop you require and make sure it is to the right metropolis/region.

- Make use of the Review button to analyze the form.

- Read the outline to actually have chosen the right develop.

- When the develop is not what you`re trying to find, make use of the Look for field to get the develop that meets your needs and requirements.

- Once you obtain the right develop, click Get now.

- Select the rates prepare you want, submit the required details to make your account, and pay money for your order using your PayPal or bank card.

- Choose a handy data file formatting and download your backup.

Discover each of the record layouts you might have bought in the My Forms food selection. You may get a additional backup of South Dakota Bill of Sale (Communications Equipment) anytime, if necessary. Just click on the essential develop to download or printing the record format.

Use US Legal Forms, one of the most extensive assortment of legal forms, to save time and steer clear of faults. The support gives professionally made legal record layouts which you can use for a variety of reasons. Generate your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Sales of tangible personal property and items used for preparing advertisements are subject to South Dakota's 4% sales tax, plus applicable municipal sales tax. If an agency prepares and places the advertisement in the media, the service fee is not subject to sales tax.

Ag Excise Tax ? Applies to all sales or purchases of farm machinery, attachment units or irrigation equipment used exclusively for agricultural purposes. Purchasers are responsible for the ag excise tax if the retailer does not charge the tax.

If you have any questions, please contact the South Dakota Department of Revenue. Machinery, tools, bolts, and other equipment sold to a manufacturer or producer are subject to sales tax.

.taxes.state.mn.us Businesses must pay tax on administrative supplies, most machinery, accessories, furniture, fixtures, and other items used to produce a product. However, ma- terials used or consumed to produce products for sale are exempt from sales tax.

The gross receipts for architect, engineering, and surveying services are subject to state sales tax plus applicable municipal sales tax. Architect, engineering, or surveying services provided for projects located entirely outside of South Dakota are not subject to South Dakota sales tax.

Unlike general sales taxes, excise taxes are usually applied on a per-unit basis instead of as a percentage of the purchase price. For instance, cigarette excise taxes are calculated in cents per pack. And most gasoline excise taxes are imposed in cents per gallon.

Some goods are exempt from sales tax under South Dakota law. Examples include gasoline, purchases made with food stamps, and prescription drugs.