This form is used when the Assignor wishes to convey, assign and sell to the Assignee an undivided working interest in an oil and gas lease but reserves an overriding royalty interest payable on all oil, gas, and associated hydrocarbons produced, saved and sold from the Lands.

South Dakota Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease

Description

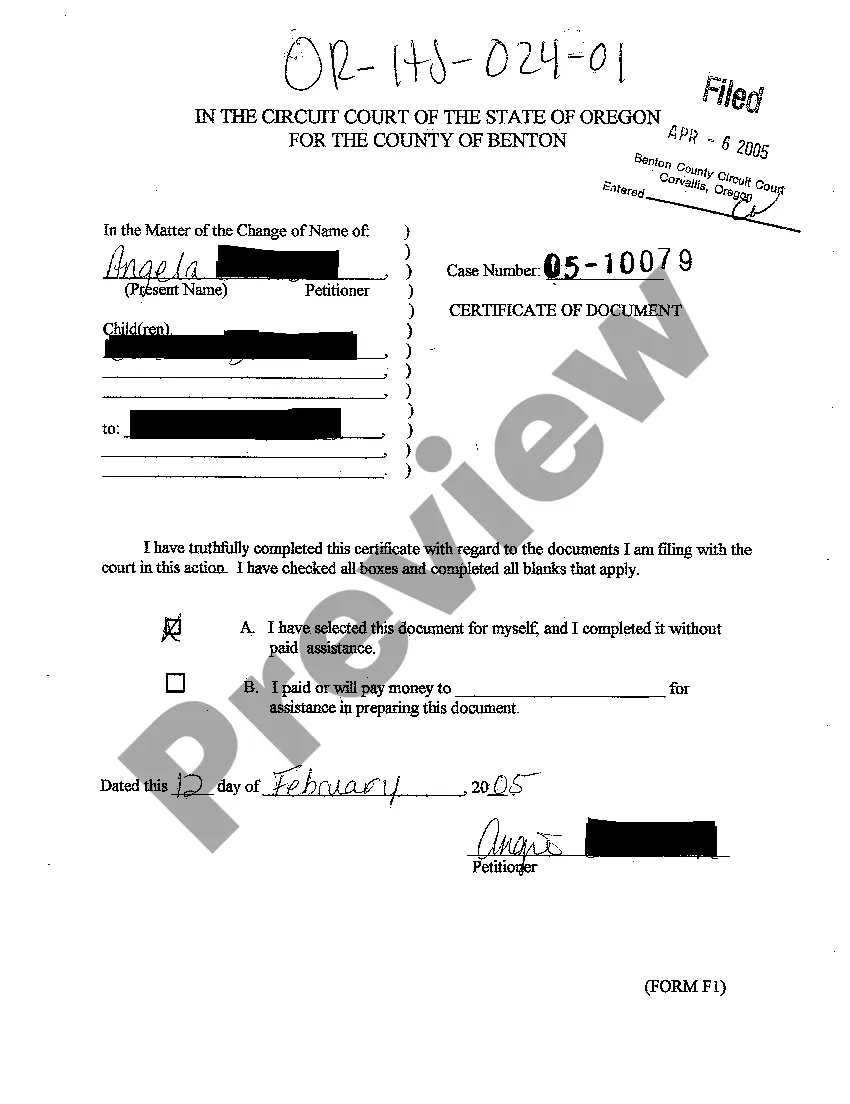

How to fill out Partial Assignment Of Oil And Gas Lease For Part Of Lands Subject To Nonproducing Lease?

Choosing the right lawful file template can be quite a struggle. Naturally, there are a lot of templates available online, but how do you discover the lawful type you will need? Use the US Legal Forms website. The support offers a huge number of templates, including the South Dakota Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease, that you can use for company and personal needs. Each of the types are inspected by pros and meet state and federal requirements.

In case you are already listed, log in to your account and then click the Down load button to have the South Dakota Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease. Make use of your account to check from the lawful types you possess purchased previously. Go to the My Forms tab of your account and get yet another duplicate from the file you will need.

In case you are a brand new consumer of US Legal Forms, listed here are basic instructions so that you can stick to:

- Initially, ensure you have chosen the proper type for your area/region. You are able to look through the form while using Preview button and browse the form information to make certain it will be the right one for you.

- In the event the type will not meet your expectations, utilize the Seach industry to find the proper type.

- Once you are positive that the form is acceptable, go through the Purchase now button to have the type.

- Pick the rates prepare you would like and type in the necessary information and facts. Build your account and buy an order with your PayPal account or bank card.

- Pick the document format and acquire the lawful file template to your product.

- Full, revise and produce and indicator the received South Dakota Partial Assignment of Oil and Gas Lease for Part of Lands Subject to Nonproducing Lease.

US Legal Forms may be the biggest catalogue of lawful types where you can find numerous file templates. Use the service to acquire expertly-produced files that stick to express requirements.

Form popularity

FAQ

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

Partial Assignments: When an assignor conveys 100% record title interest in a portion of the lands in a lease, it creates a partial assignment. Partial assignments segregate the lease into two separate leases. Normally we assign a new lease number to the conveyed portion of the lease.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.