Nebraska Auto Expense Travel Report

Description

How to fill out Auto Expense Travel Report?

You can spend time online looking for the permitted template that complies with the federal and state requirements you require.

US Legal Forms offers a vast array of legal documents that have been vetted by professionals.

You have the option to download or print the Nebraska Auto Expense Travel Report from our service.

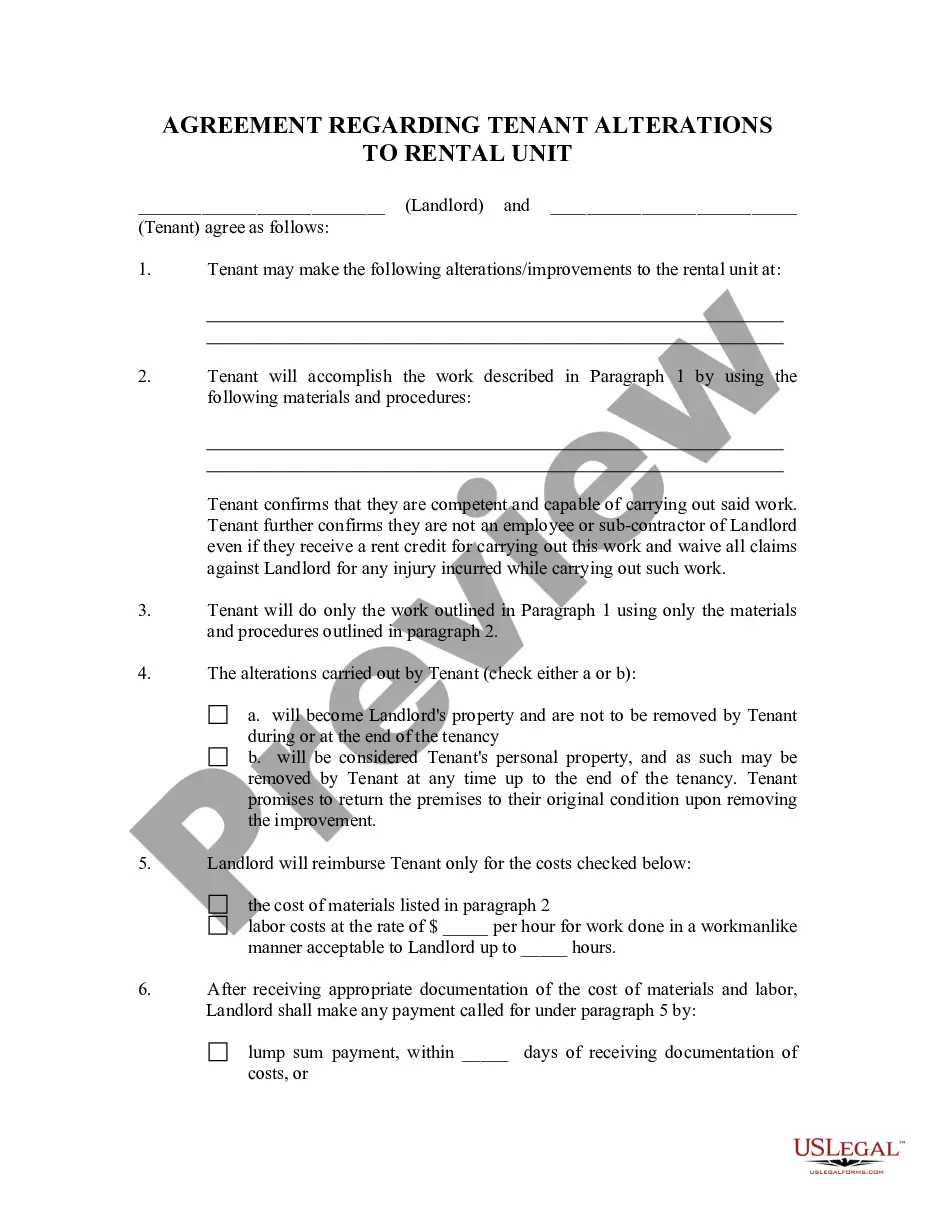

If available, use the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you may Log In and select the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Nebraska Auto Expense Travel Report.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents section and select the appropriate option.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward steps below.

- First, ensure you have chosen the correct document template for your jurisdiction/region.

- Review the form description to confirm you have selected the accurate template.

Form popularity

FAQ

Yes, SAP Concur can track mileage effectively, making your Nebraska Auto Expense Travel Report process smoother. The platform allows you to log trips through GPS tracking or manual entry, capturing necessary trip details effortlessly. This feature helps ensure that you maximize your reimbursements and maintain compliance with travel policies.

Adding mileage for reimbursement requires precise tracking of your travel. Document each trip, noting the date, destination, and miles driven. When you complete your Nebraska Auto Expense Travel Report, enter this information in your expense management system, ensuring you follow your organization's guidelines and reimbursement policy.

To add mileage to your Concur expense report for a Nebraska Auto Expense Travel Report, log into your account and select the option to create or edit an expense report. From there, choose the mileage entry option, where you can input your trip details. Be sure to check the total distance and select the correct reimbursement rates to ensure an accurate report.

Statute 81-1174 in Nebraska pertains to the reimbursement of state employees for travel expenses incurred while conducting state business, including mileage. This law outlines the calculation methods and defines acceptable expenses for reporting travel costs. Understanding this statute is crucial when preparing your Nebraska Auto Expense Travel Report, as it ensures compliance with legal standards.

Entering mileage into Concur for your Nebraska Auto Expense Travel Report is straightforward. First, log into your Concur account and navigate to the expense section. You can add a new mileage entry by selecting the relevant trip details, including the distance traveled and the purpose of the trip. Always ensure that your entry is accurate to facilitate a smooth reimbursement process.

To record mileage expenses for your Nebraska Auto Expense Travel Report, start by documenting each trip's date, purpose, and distance traveled. It's essential to keep consistent records to ensure accuracy when filing your report later. Utilizing a mobile app or online tool can streamline this process, saving you time and effort. Consider using platforms like USLegalForms to help simplify your mileage tracking.

Filling out an expense form is straightforward. Start by entering your personal details, then list each expense associated with your travel using the Nebraska Auto Expense Travel Report format. Make sure to include dates, amounts, and any necessary receipts. Finally, review your entries for accuracy before submitting the form to streamline the reimbursement process.

To reimburse travel expenses, you first need to gather all related receipts and documentation. Next, fill out a Nebraska Auto Expense Travel Report accurately detailing each expense. Once complete, submit the report to your finance department for review and approval. It’s crucial to follow your company’s guidelines to ensure timely reimbursement.

When filling in an expense report, gather all receipts and categorize your expenses. Use a Nebraska Auto Expense Travel Report to log each expense, specifying amounts and nature of costs. This organized approach not only eases the reimbursement process but also keeps your financial records accurate.

To fill out a trip report, start with an overview of your trip, including dates and destinations. Next, provide a summary of activities and any relevant outcomes. Using a Nebraska Auto Expense Travel Report, you can incorporate your expenses seamlessly, allowing for a comprehensive review of your travel experience.