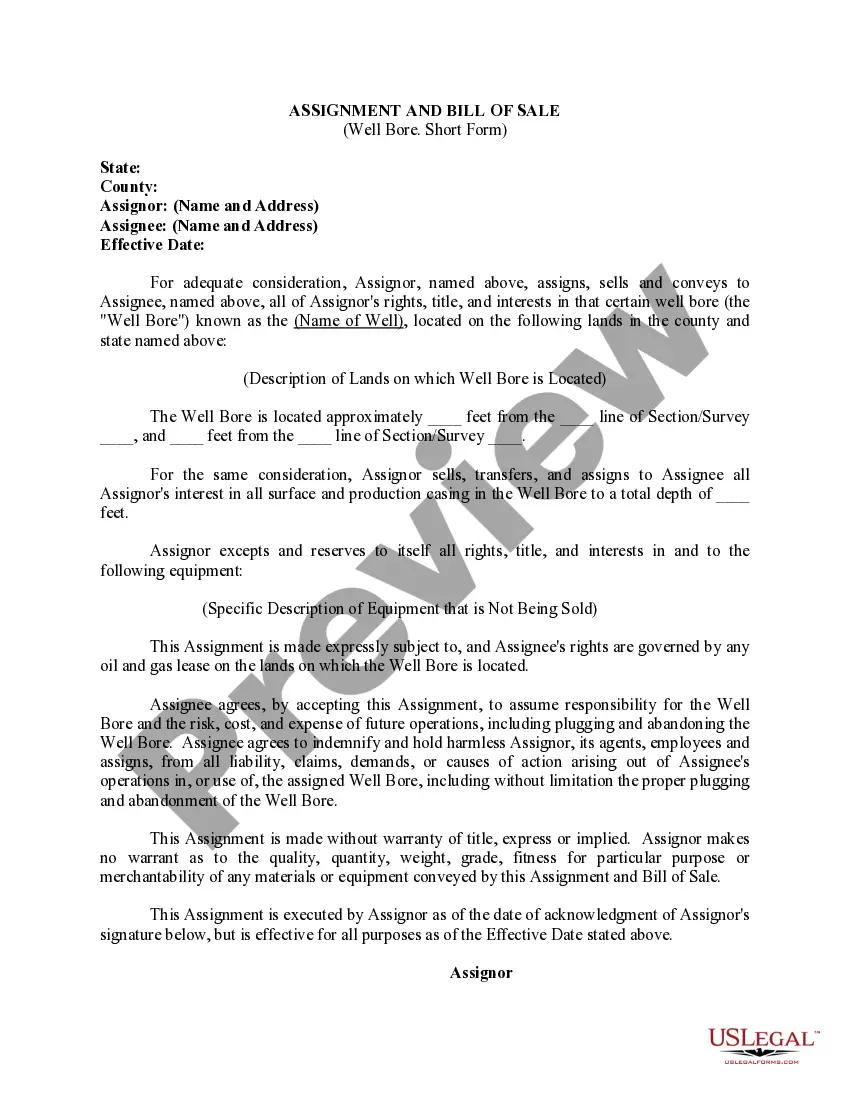

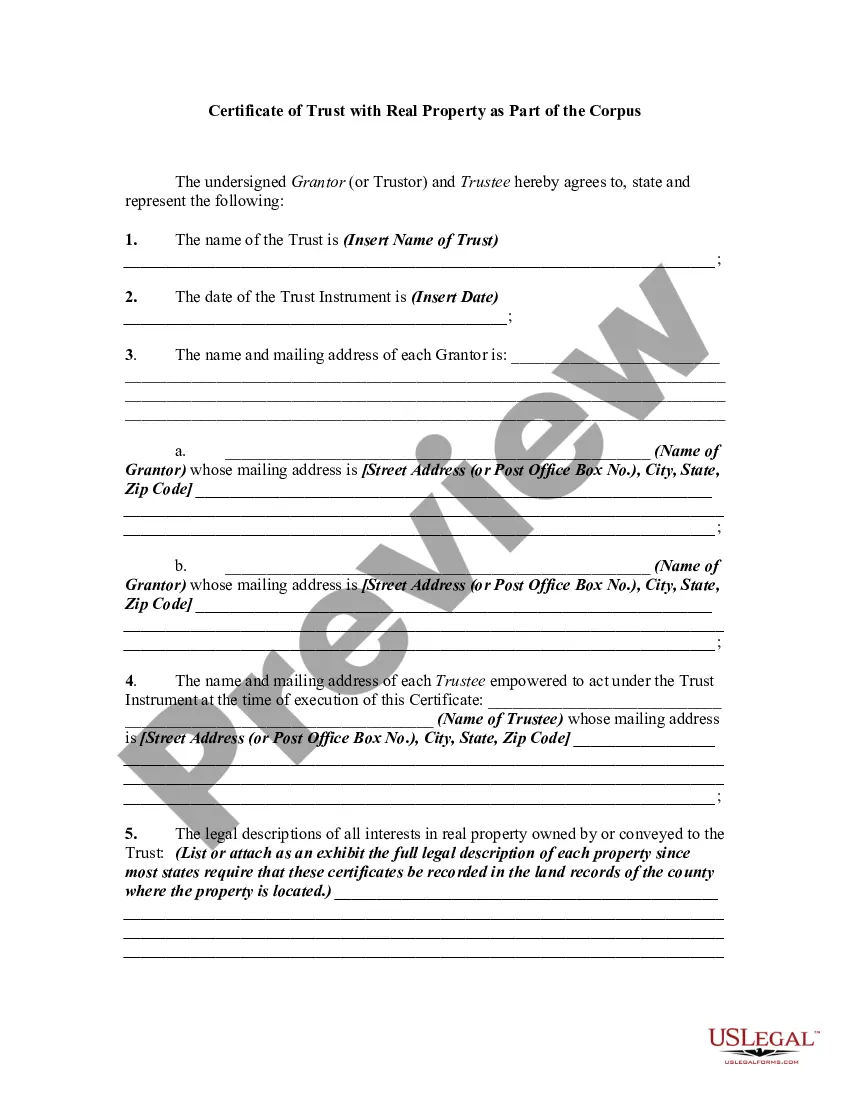

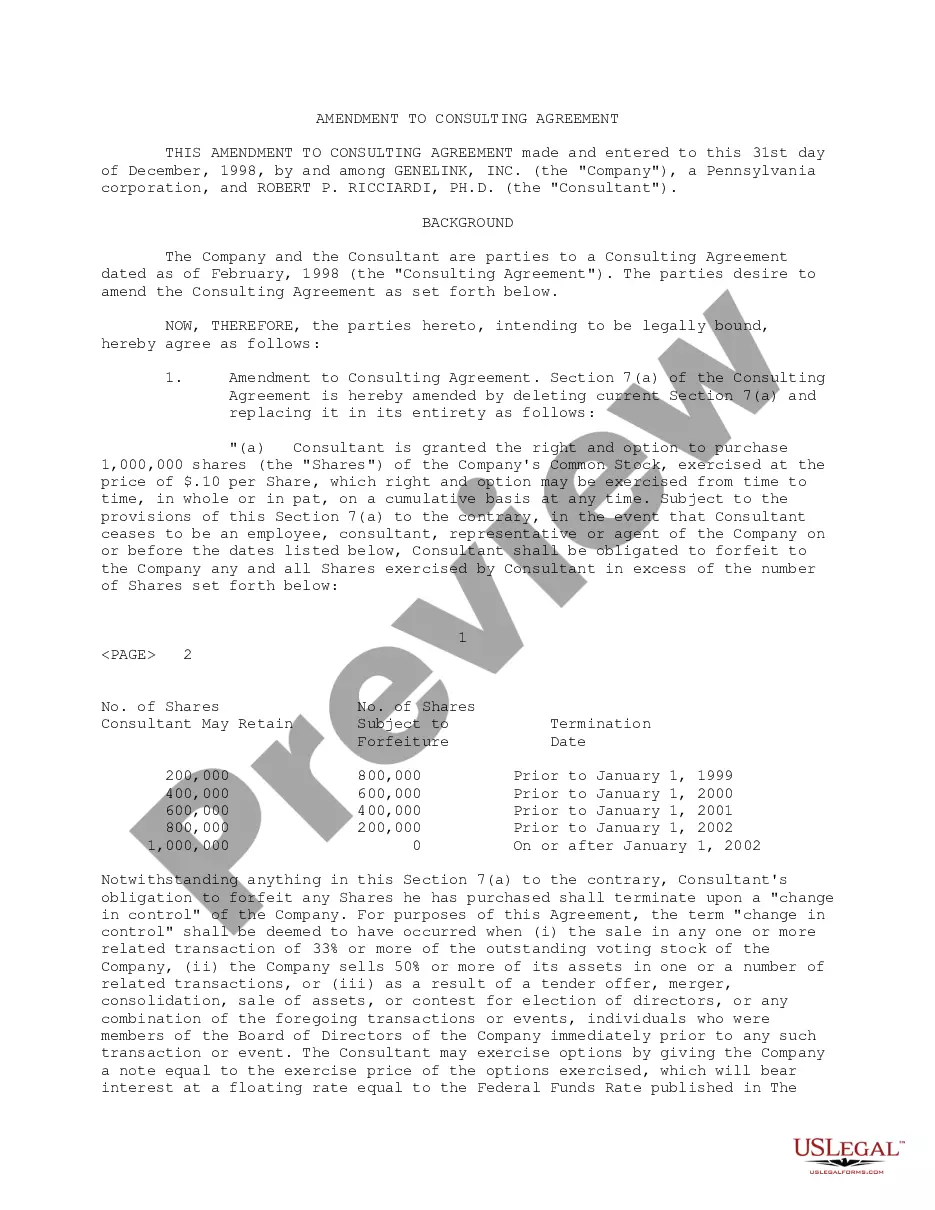

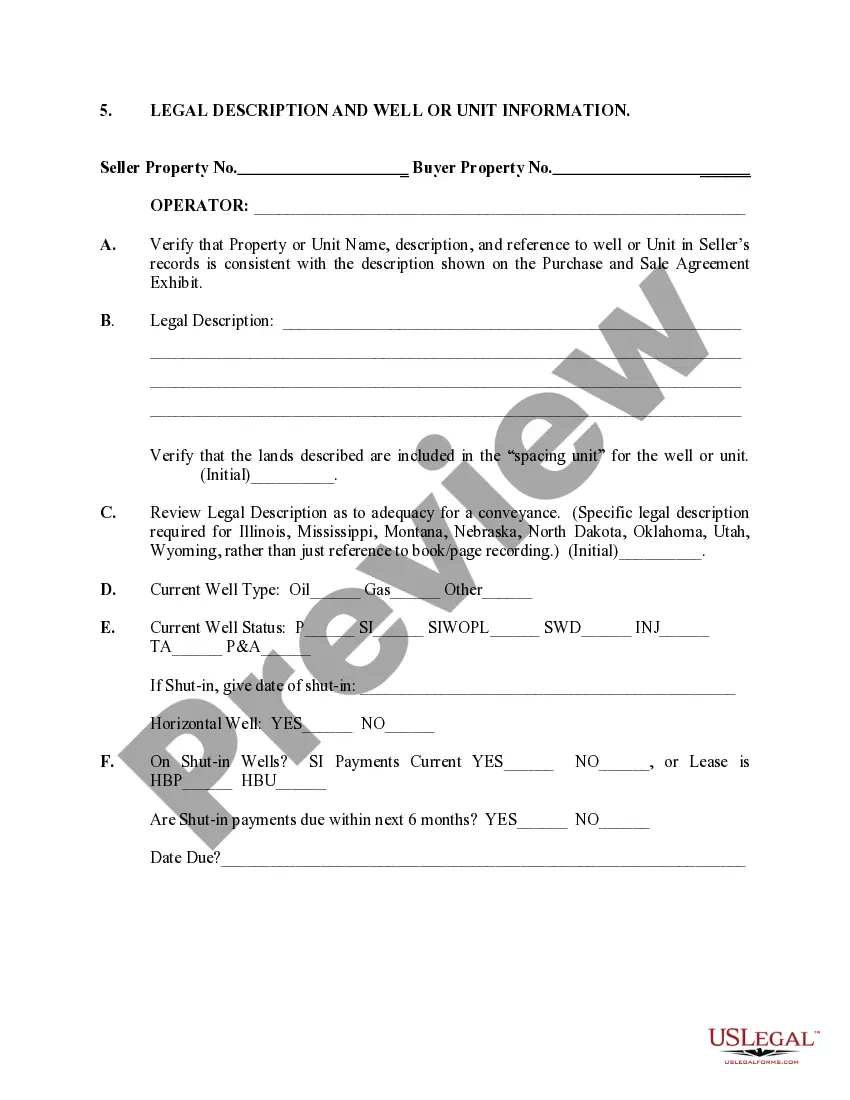

South Dakota Legal Description and Well or Unit Information

Description

How to fill out Legal Description And Well Or Unit Information?

If you need to total, down load, or print lawful papers layouts, use US Legal Forms, the largest variety of lawful types, that can be found on the Internet. Make use of the site`s simple and easy practical look for to find the papers you require. A variety of layouts for organization and person reasons are categorized by categories and states, or search phrases. Use US Legal Forms to find the South Dakota Legal Description and Well or Unit Information in a few click throughs.

If you are previously a US Legal Forms consumer, log in to your bank account and click the Download option to have the South Dakota Legal Description and Well or Unit Information. You can even entry types you formerly saved within the My Forms tab of the bank account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for that proper city/country.

- Step 2. Utilize the Preview choice to examine the form`s information. Don`t forget about to read through the description.

- Step 3. If you are unhappy using the develop, use the Look for field at the top of the screen to locate other versions from the lawful develop format.

- Step 4. Upon having identified the shape you require, go through the Buy now option. Select the prices plan you prefer and put your references to register to have an bank account.

- Step 5. Method the deal. You may use your charge card or PayPal bank account to perform the deal.

- Step 6. Pick the file format from the lawful develop and down load it on your system.

- Step 7. Comprehensive, modify and print or indicator the South Dakota Legal Description and Well or Unit Information.

Each and every lawful papers format you get is your own for a long time. You possess acces to each and every develop you saved within your acccount. Go through the My Forms segment and select a develop to print or down load once more.

Compete and down load, and print the South Dakota Legal Description and Well or Unit Information with US Legal Forms. There are millions of expert and express-particular types you can use for your personal organization or person demands.

Form popularity

FAQ

Taxes in South Dakota are due and payable the first of January, however the first half of property tax payments are accepted until April 30 without penalty. The second half of property tax payments will be accepted until October 31 without penalty.

South Dakota Property Tax Exemption for Disabled Veterans: South Dakota offers a partial property tax exemption up to $150,000 for disabled Veterans and their Surviving Spouse. This exemption applies to the house, garage and the lot up to one acre.

The only requirements to become a resident of South Dakota: You'll need a South Dakota address and the ability to receive mail sent to that address. You must complete PS Form 1583 to show your "permanent change of address" with USPS. You must be physically present to apply for a South Dakota Driver's License.

What Property Is Protected by the South Dakota Homestead Exemption? In South Dakota, homeowners can exempt an unlimited dollar amount of equity in real property, including a home or condominium.

The law requires that the maker of the will be at least 18 years old and of sound mind. The will must be written, signed, and witnessed by two or more individuals. No witnesses are necessary if the will is dated and if the signature and material portions of the will are in the handwriting of the person making the will.

You must be 65 years of age or older OR disabled (as defined by the Social Security Act). You must own the home or retain a life estate in the property. Un-remarried widow/widowers of persons previously qualified may still qualify in some circumstances. Income and property value limits apply.

South Dakota ? The Land of No Taxation: No state income or capital gains tax. One of the lowest state insurance premium taxes. No intangibles tax. No dividends & interest tax. No state LLC tax. No state LLP tax. No state ad valorem tax. No city or local tax.

Signing Requirements for South Dakota Deeds. A South Dakota deed must include the current owner's original signature. The owner's signature should be dated. A deed transferring real estate owned by two or more owners must include all co-owners' signatures?unless only one owner is transferring an interest.