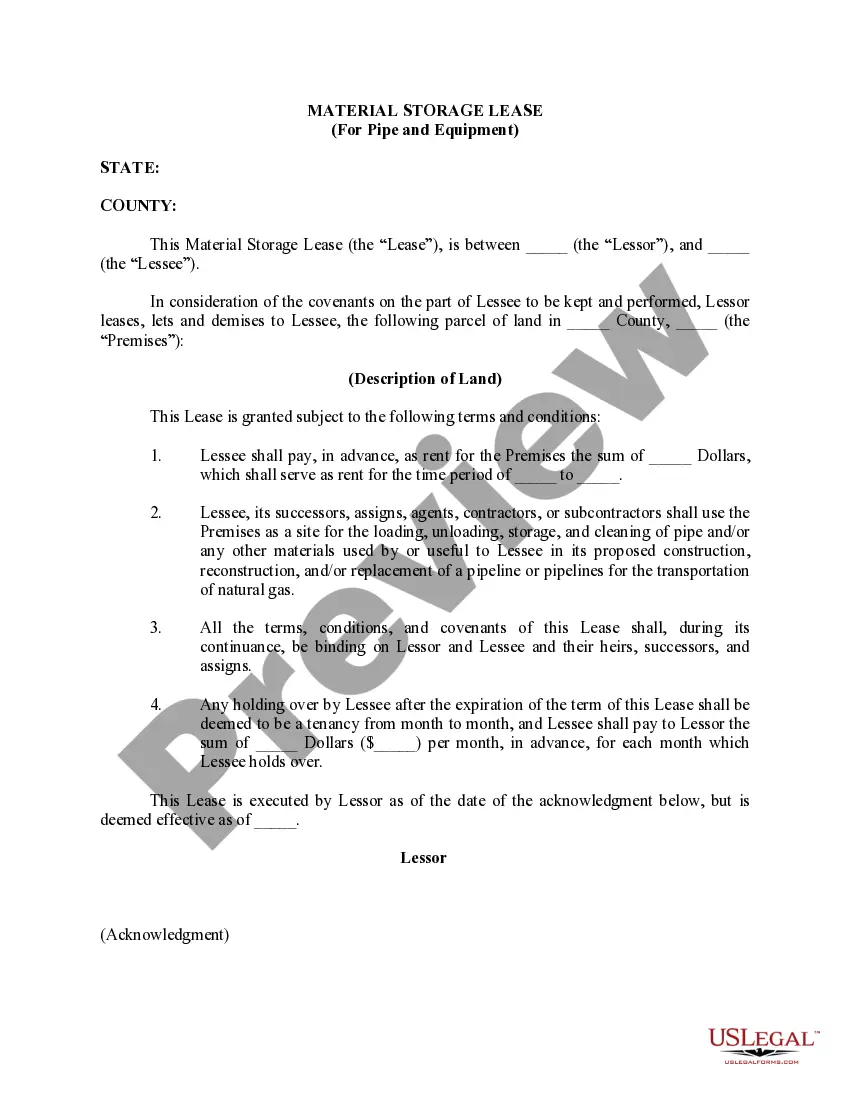

South Dakota Material Storage Lease (For Pipe and Equipment)

Description

How to fill out Material Storage Lease (For Pipe And Equipment)?

If you need to comprehensive, obtain, or printing legal document themes, use US Legal Forms, the biggest variety of legal types, that can be found on-line. Utilize the site`s simple and easy convenient search to get the papers you need. A variety of themes for business and personal purposes are sorted by groups and says, or search phrases. Use US Legal Forms to get the South Dakota Material Storage Lease (For Pipe and Equipment) in a couple of click throughs.

Should you be currently a US Legal Forms consumer, log in in your accounts and click the Down load switch to find the South Dakota Material Storage Lease (For Pipe and Equipment). Also you can accessibility types you formerly saved in the My Forms tab of your own accounts.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for your correct town/land.

- Step 2. Utilize the Review choice to check out the form`s content. Don`t forget about to read the information.

- Step 3. Should you be unsatisfied with all the form, make use of the Search discipline at the top of the monitor to get other versions of your legal form design.

- Step 4. Once you have located the form you need, click the Get now switch. Opt for the rates program you choose and include your references to sign up for the accounts.

- Step 5. Method the deal. You may use your credit card or PayPal accounts to complete the deal.

- Step 6. Choose the file format of your legal form and obtain it on your system.

- Step 7. Full, modify and printing or indicator the South Dakota Material Storage Lease (For Pipe and Equipment).

Each and every legal document design you purchase is your own for a long time. You have acces to each and every form you saved within your acccount. Click the My Forms area and pick a form to printing or obtain once more.

Contend and obtain, and printing the South Dakota Material Storage Lease (For Pipe and Equipment) with US Legal Forms. There are many specialist and status-distinct types you may use to your business or personal needs.

Form popularity

FAQ

The contractor reports $150,000 as gross receipts subject to the contractors' excise tax. collected than is actually due, the additional tax must be remitted to the Department or refunded to the customer. A bid factor of 2.041% may be used to calculate excise tax due when preparing a bid or bill.

If you are a supplier located in South Dakota and your buyer is located in South Dakota, then there is no problem. If, however your buyer is from a non-reciprocating state outside South Dakota, you would not be able to accept their out of state resale certificate.

You may purchase motor vehicles to lease or rent without paying sales tax. Dealers are required to collect the state sales tax and any applicable municipal sales tax, motor vehicle gross receipts tax, and tourism tax on any vehicle, product, or service they sell that is subject to sales tax in South Dakota.

Some customers are exempt from paying sales tax under South Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. South Dakota Sales & Use Tax Guide - Avalara avalara.com ? taxrates ? state-rates ? south-d... avalara.com ? taxrates ? state-rates ? south-d...

The lease or rental of real property is exempt from sales tax. However, leased or rented tangible personal property installed into real property may be subject to contractor?s excise tax. Lease and Rental - South Dakota Department of Revenue sd.gov ? media ? 2016-06-lease-and-rental sd.gov ? media ? 2016-06-lease-and-rental

South Dakota charges a 4% excise sales tax rate on the purchase of all vehicles. In addition, for a car purchased in South Dakota, there are other applicable fees, including registration, title, and plate fees. How Much Is Excise Tax On A Car In South Dakota? DakotaPost ? blog ? how-much-is-sal... DakotaPost ? blog ? how-much-is-sal...

North Dakota motor vehicle excise tax law requires payment of 5 percent motor vehicle excise tax on the purchase price by a leasing company or licensed motor vehicle dealer titling motor vehicles intended for rental service or for lease having a term of less than one year. Lease or Rental of Motor Vehicles Guideline nd.gov ? guidelines ? business ? sales-use nd.gov ? guidelines ? business ? sales-use

The excise tax imposed on the gross receipts for construction projects is at a rate of 2%.