South Dakota Request for Proof of Debt

Description

How to fill out Request For Proof Of Debt?

Are you presently within a circumstance that you will require paperwork for both business or personal purposes almost every day? There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the South Dakota Request for Proof of Debt, which are designed to satisfy federal and state requirements.

If you are already familiar with the US Legal Forms site and possess an account, just Log In. Then, you can download the South Dakota Request for Proof of Debt template.

Choose a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the South Dakota Request for Proof of Debt anytime, if needed. Just select the necessary form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

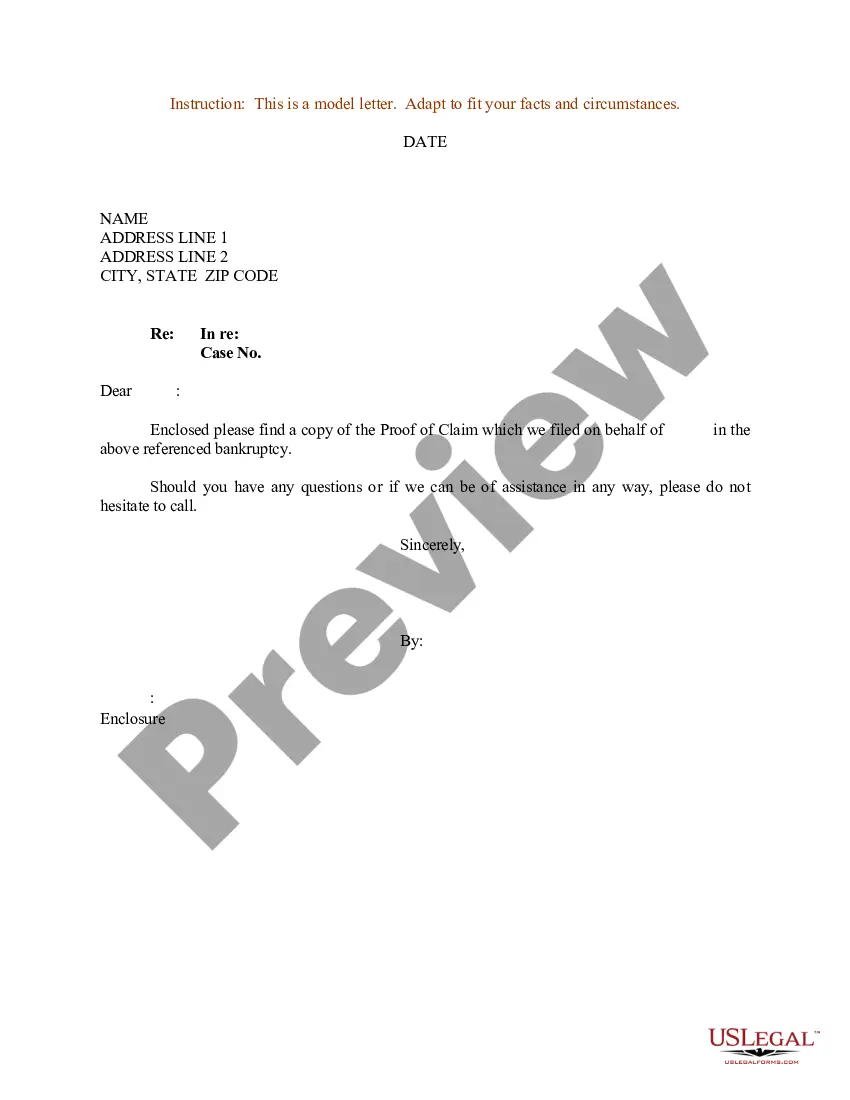

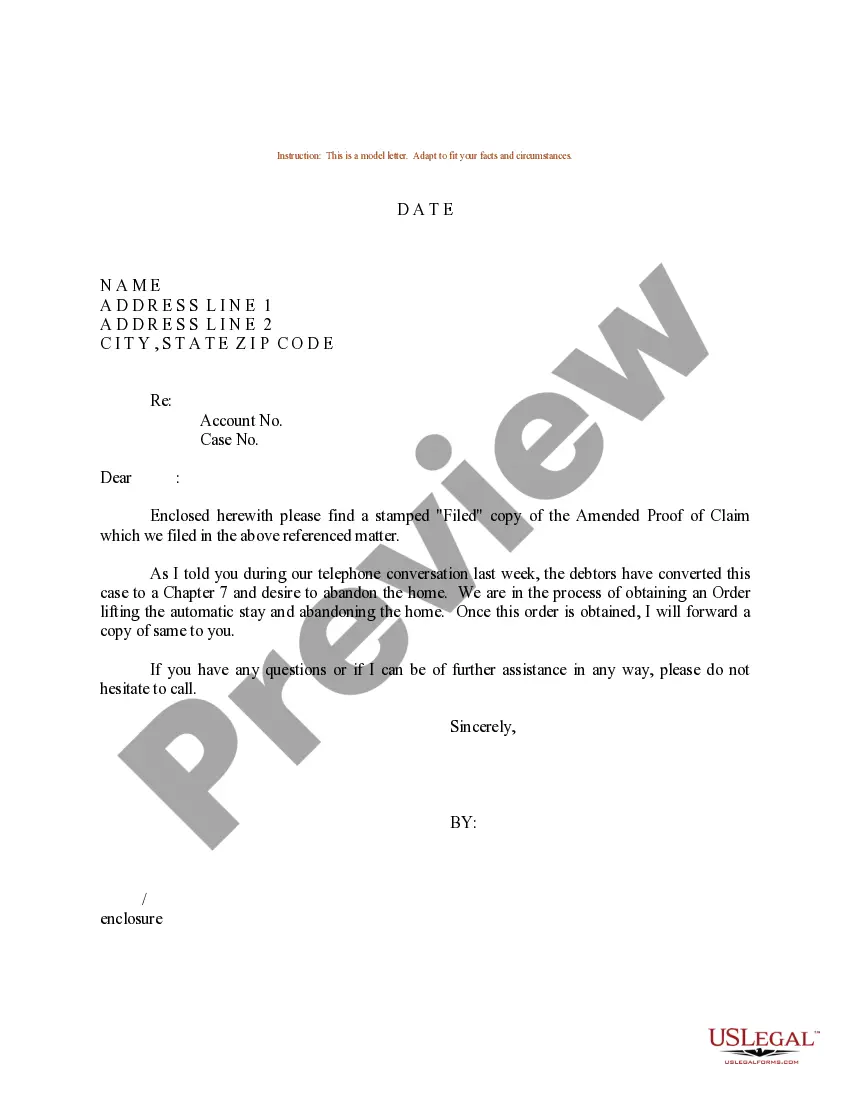

- Utilize the Review button to evaluate the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are searching for, use the Lookup field to find the form that meets your needs and requirements.

- When you find the appropriate form, click on Get now.

- Select the pricing plan you prefer, complete the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Yes, you can send a debt verification letter via email, but ensure you include all necessary details for proper identification. Clearly state your request for proof of debt and provide relevant information such as your account number and personal details. Keep in mind that email may not provide the same level of documentation as a mailed letter. For a more official approach, consider using US Legal Forms to create a formal South Dakota Request for Proof of Debt.

To write a letter requesting proof of debt, start by clearly stating your request at the top. Include your name, address, and account number to help the creditor identify your account. Be sure to mention the specific debt in question and request documentation that verifies its validity. Utilizing a service like US Legal Forms can help you access templates and guidance for crafting an effective South Dakota Request for Proof of Debt.

Yes, you can ask for proof of debt at any time. It is your right to understand the debts attributed to your name, and asking for proof ensures transparency. By utilizing the South Dakota Request for Proof of Debt, you can formalize your inquiry and receive the documentation you need. Consider using USLegalForms to access helpful resources for making your request.

Requesting proof of debt involves writing to your creditor and including specific details about your account. In your request, be clear about the type of documentation you need and why it is important to you. Following the South Dakota Request for Proof of Debt guidelines can help you craft an effective request. Platforms like USLegalForms provide templates that can simplify this task.

To obtain proof of debt, reach out to your creditor and formally request the necessary documentation. You may also want to check your credit report, as it often contains details about outstanding debts. Utilizing the South Dakota Request for Proof of Debt can enhance your chances of receiving accurate information. USLegalForms offers resources to help you navigate this process effectively.

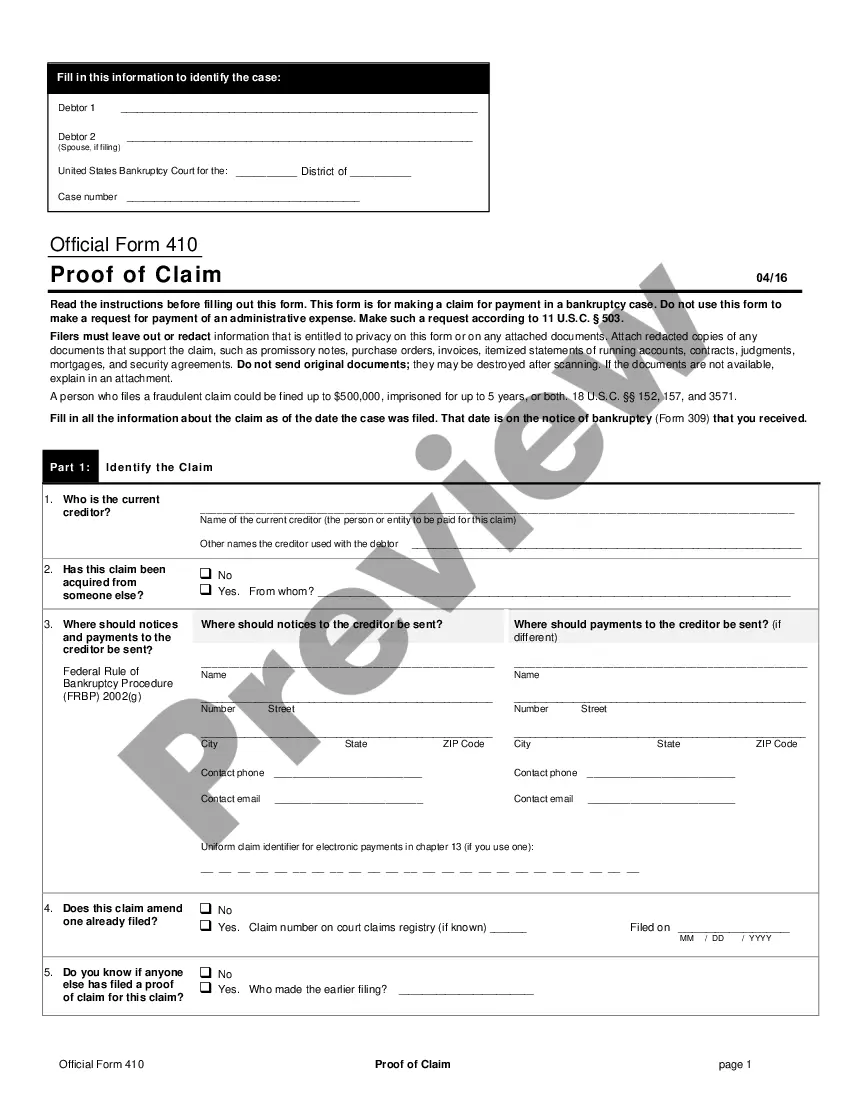

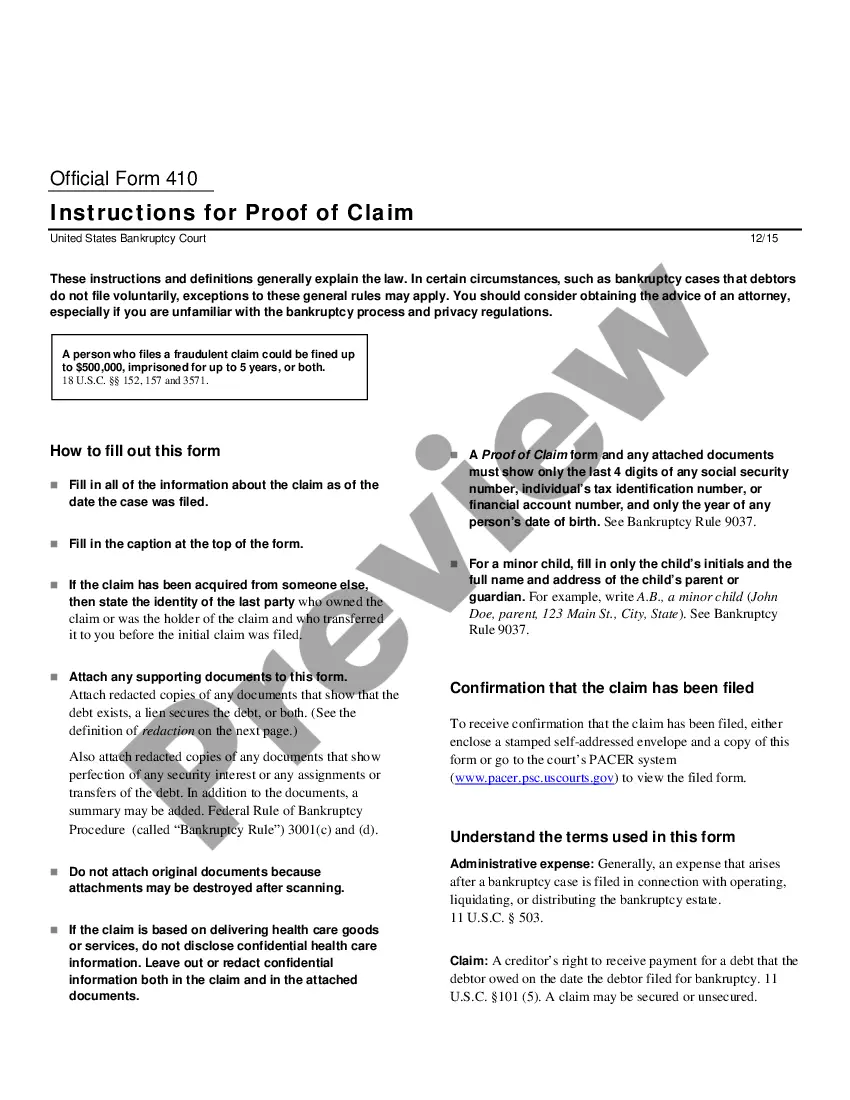

Proof of debt generally includes documents such as account statements, contracts, or written agreements between you and the creditor. This documentation should clearly outline the amount owed and the terms of repayment. Understanding what qualifies as proof of debt can help you make a more informed South Dakota Request for Proof of Debt. Always ensure you have the necessary documents to support your claim.

You can obtain a copy of your debt by contacting your creditor directly and requesting the details. It is helpful to provide your account number and any other relevant information to expedite the process. Additionally, using the South Dakota Request for Proof of Debt can provide you with a structured method for making this request. Consider using platforms like USLegalForms for templates and guidance.

To ask a creditor for proof of debt, you can start by writing a formal letter. In your letter, clearly state your request for documentation that verifies the debt. Be sure to include your account details and any relevant information that can assist them in identifying your account. Using the South Dakota Request for Proof of Debt process can help streamline this communication.

To ask for proof of debt, begin by identifying the creditor and their contact information. You can reach out via phone or write a letter, clearly stating your request for proof of debt. Mention the South Dakota Request for Proof of Debt to ensure clarity. If you prefer, platforms like uslegalforms can provide templates and guidance to simplify the process for you.

In South Dakota, the statute of limitations for most debts is six years. This means that if a creditor does not take legal action within this timeframe, the debt becomes uncollectible. Understanding this timeline can help you make informed decisions about your financial situation. Always consider making a South Dakota Request for Proof of Debt to verify your obligations.