South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

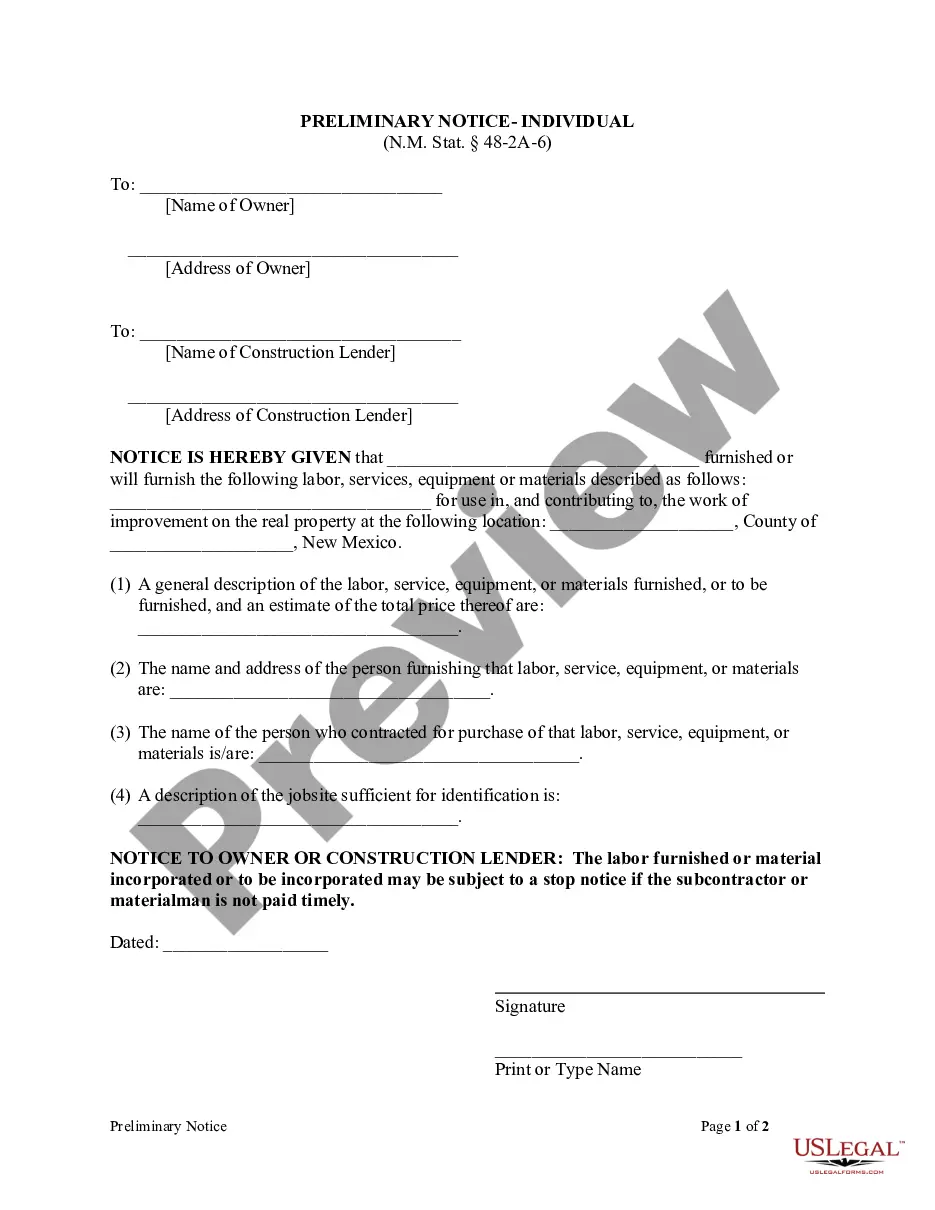

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

You might spend hours online attempting to find the legal document template that meets the state and federal criteria you need.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

It is easy to download or print the South Dakota Self-Employed X-Ray Technician Independent Contractor from your services.

If available, utilize the Preview button to browse the document template as well. If you want to find an additional variation of the form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you want, click Acquire now to continue. Choose the pricing plan you prefer, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the South Dakota Self-Employed X-Ray Technician Independent Contractor. Obtain and print thousands of document layouts using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you may Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the South Dakota Self-Employed X-Ray Technician Independent Contractor.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Read the form description to ensure you have chosen the correct form.

Form popularity

FAQ

Yes, independent contractors file taxes as self-employed individuals. As a South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractor, you will report your income and expenses on your tax return, ensuring you fulfill all tax obligations. Utilizing platforms like uslegalforms can simplify the filing process and help you stay compliant.

To prove you are an independent contractor, compile documents such as contracts, invoices, and payment records. As a South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractor, these materials illustrate your client relationships and work scope. Maintaining clear records will strengthen your status and can be useful for tax purposes.

Independent contractors, including South Dakota Self-Employed X-Ray Technicians, need to file a Schedule C to report their income. Additionally, you'll use a Schedule SE to calculate self-employment taxes. Keeping organized records of all your expenses can also help reduce your taxable income.

Yes, independent contractors are considered self-employed. As a South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractor, you take on projects without a traditional employer-employee relationship. This structure provides both autonomy and the responsibility of managing your own business affairs.

The self-employment tax in South Dakota is 15.3%, which covers Social Security and Medicare taxes. As a South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractor, you need to budget for this tax when calculating your net income. Understanding your tax obligations can help you manage your finances effectively.

Indeed, being an independent contractor means you are self-employed. As a South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractor, you operate your own business and manage your own taxes. This distinction allows you greater flexibility but also requires diligence in record-keeping and tax reporting.

Yes, if you receive a 1099 form for your work, you are generally considered self-employed. This classification applies to those working as South Dakota Self-Employed X-Ray Technicians or any independent contractor. The 1099 form indicates that your client did not withhold taxes, which is a key feature of self-employment.

To show income as a South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractor, you can use 1099 forms received from clients. Keep detailed records of all payments and invoices, as this documentation supports your income claims. Additionally, maintaining a separate business bank account can help track your earnings more clearly.

As a self-employed independent contractor, you operate your own business and provide services directly to clients. If you set your own hours, manage your own finances, and take responsibility for your work, you fit this category. South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractors must also handle their taxes and business expenses. To ensure you meet all legal requirements, consider using USLegalForms to access resources and documents tailored for independent contractors.

The average salary for X-ray technicians in South Dakota varies based on experience, location, and workplace. Generally, South Dakota Self-Employed X-Ray Technician Self-Employed Independent Contractors can expect to earn competitive rates that reflect their skills. As a self-employed technician, your income may also depend on the number of clients you serve and the services you offer. For precise figures, consider researching local job postings or salary surveys in your area.