Pennsylvania Revocable Trust Agreement when Settlors Are Husband and Wife

Description

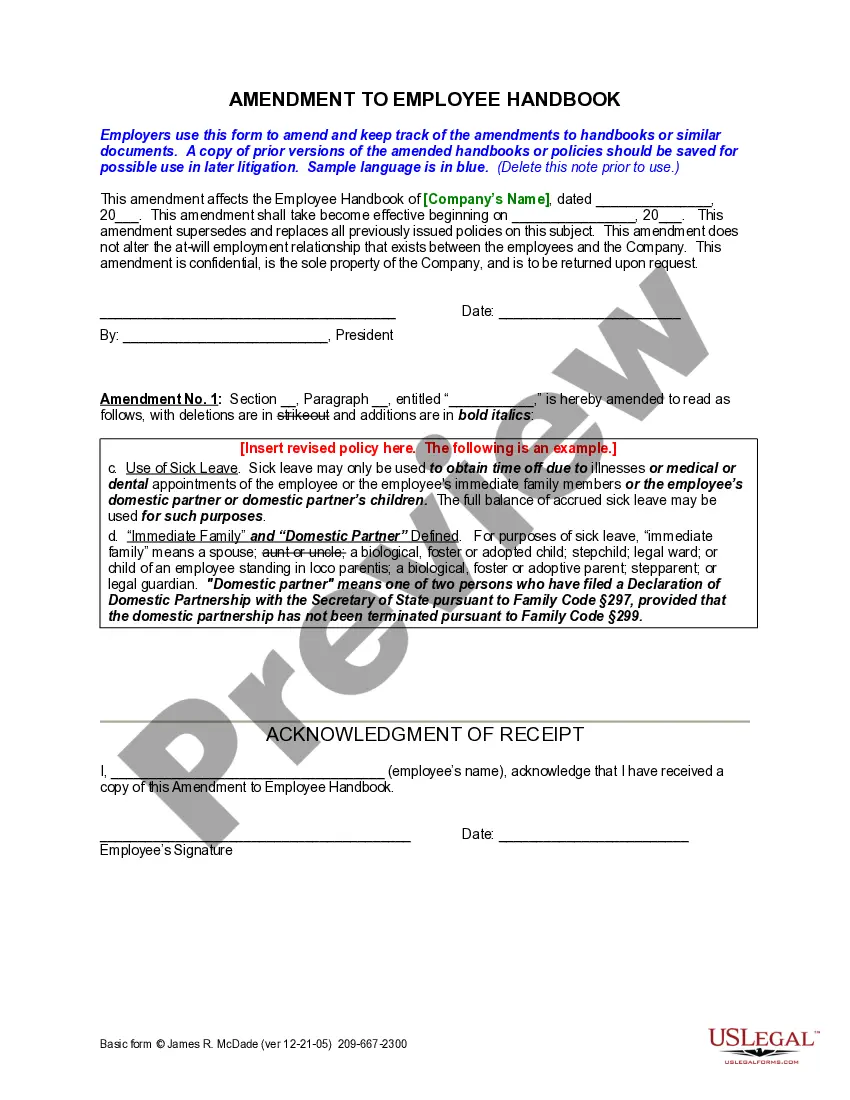

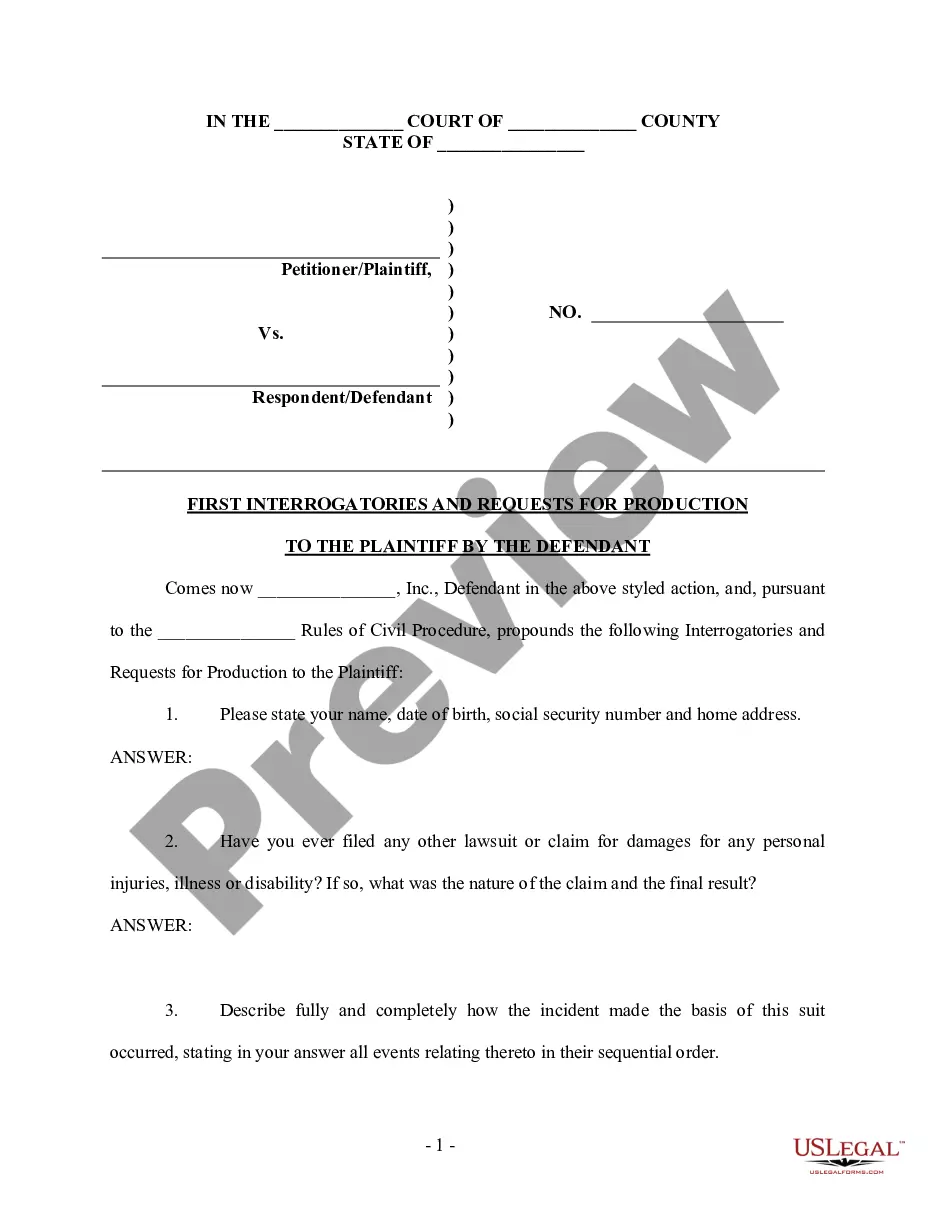

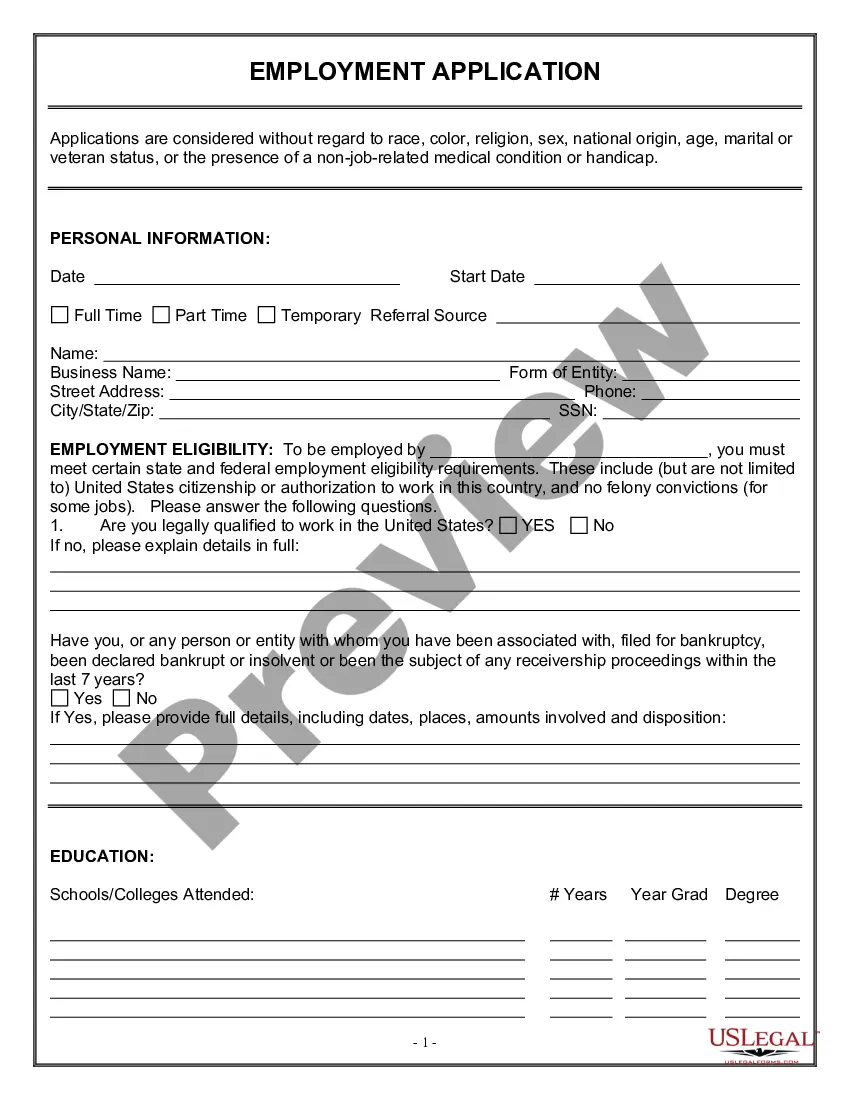

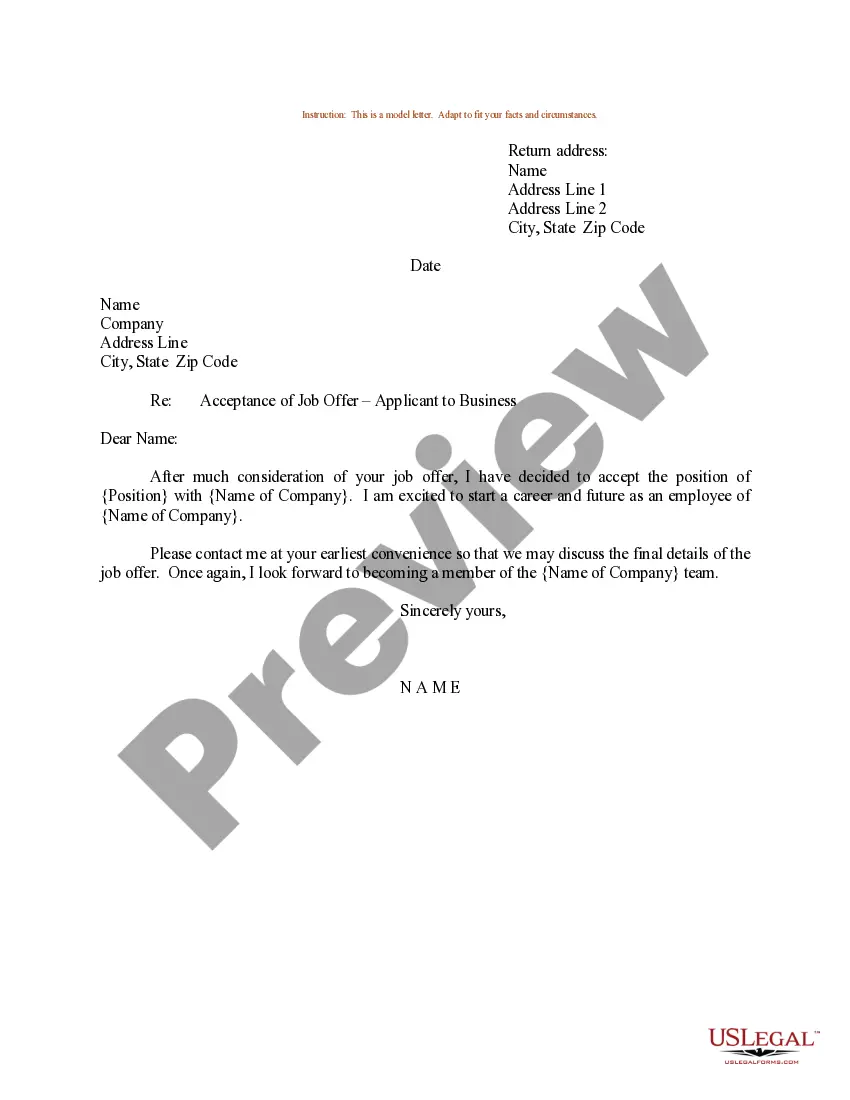

How to fill out Revocable Trust Agreement When Settlors Are Husband And Wife?

Finding the right lawful record web template might be a battle. Of course, there are a variety of web templates available online, but how will you get the lawful form you will need? Take advantage of the US Legal Forms site. The service provides a large number of web templates, such as the Pennsylvania Revocable Trust Agreement when Settlors Are Husband and Wife, which you can use for organization and personal needs. All the types are checked out by professionals and meet federal and state specifications.

Should you be presently authorized, log in to your profile and click on the Acquire option to have the Pennsylvania Revocable Trust Agreement when Settlors Are Husband and Wife. Use your profile to look throughout the lawful types you may have acquired earlier. Go to the My Forms tab of the profile and acquire another version of the record you will need.

Should you be a fresh customer of US Legal Forms, listed below are basic directions for you to stick to:

- First, be sure you have chosen the right form for your personal town/county. You are able to examine the form utilizing the Review option and read the form outline to make certain this is basically the right one for you.

- When the form does not meet your preferences, make use of the Seach discipline to discover the appropriate form.

- Once you are certain that the form is proper, go through the Buy now option to have the form.

- Pick the costs program you desire and type in the needed info. Design your profile and pay for an order making use of your PayPal profile or Visa or Mastercard.

- Opt for the file structure and obtain the lawful record web template to your gadget.

- Comprehensive, modify and produce and indicator the received Pennsylvania Revocable Trust Agreement when Settlors Are Husband and Wife.

US Legal Forms may be the greatest collection of lawful types where you can discover various record web templates. Take advantage of the company to obtain expertly-produced files that stick to express specifications.

Form popularity

FAQ

Whereas a spousal trust is established for the benefit of a settlor's spouse, a JP trust is settled for the benefit of a settlor and the settlor's spouse or common-law partner.

Simple Living Trusts for Married Couples Simple living trusts are often considered the easiest kinds of trusts to set up and keep. In a simple living trust, a couple can share the control and benefits of the trust while they are living.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Two of the most common estate planning vehicles are wills and trusts. Wills and trusts go hand-in-hand as the starting point for any good plan. Writing a will is something that we believe that everyone should do.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

A trust set up in one spouse's name can be considered separate property regardless of whether it is set up before or after marriage.

Each spouse is required to manage their own trust, but they can name the other spouse as co-trustee so they both can control all assets.