South Dakota Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

You can spend time online looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can obtain or print the South Dakota Drafting Agreement - Self-Employed Independent Contractor from my service.

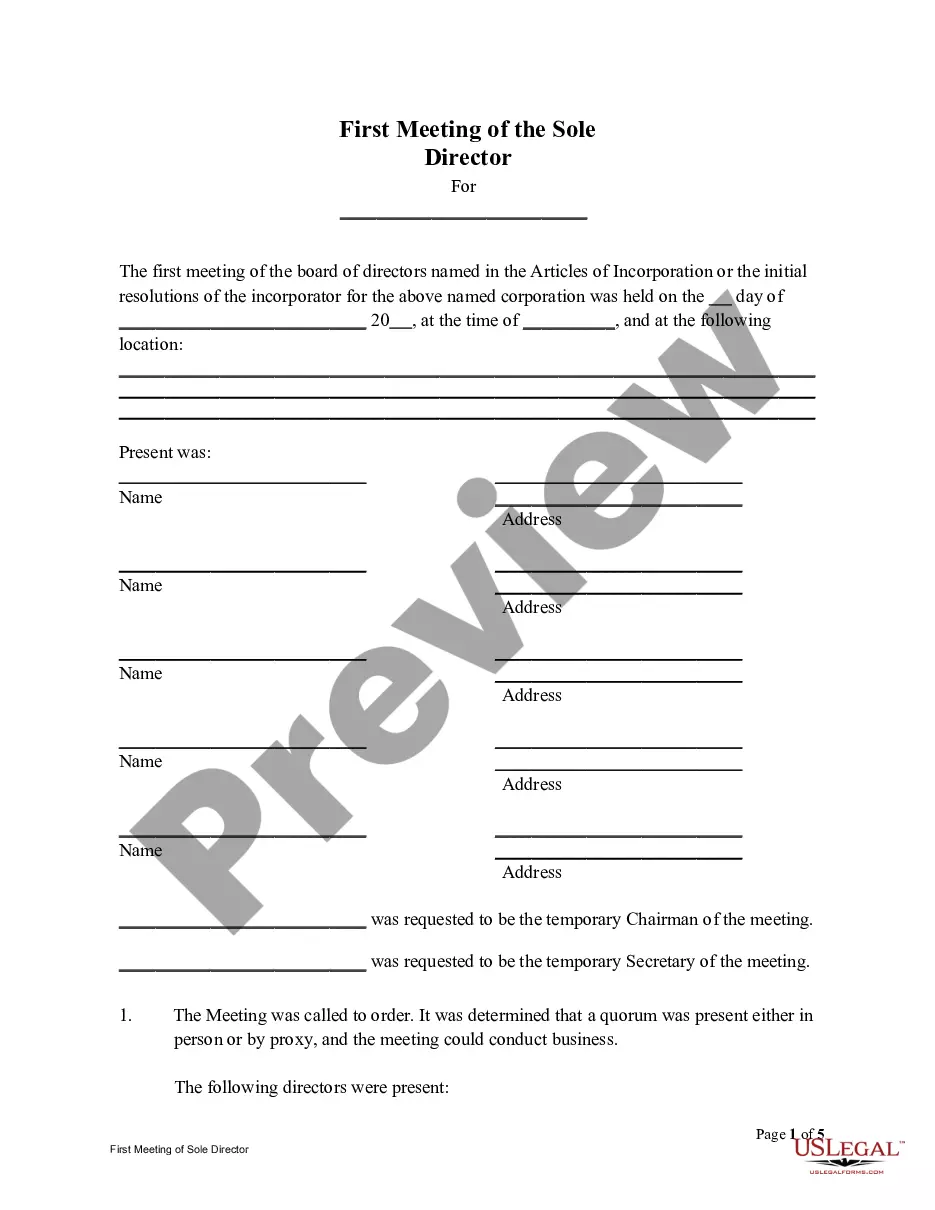

If available, use the Preview button to examine the document template as well. If you wish to find another version of the form, use the Search field to locate the template that fits your needs and requirements. Once you have identified the template you want, click Get now to continue. Select the pricing plan you require, enter your information, and sign up for an account on US Legal Forms. Complete the payment. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Retrieve the format of the document and download it to your device. Make edits to your document if necessary. You can complete, modify, and print the South Dakota Drafting Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the South Dakota Drafting Agreement - Self-Employed Independent Contractor.

- Every legal document template you receive is yours permanently.

- To get another copy of a purchased form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/city of choice.

- Review the form details to confirm you have chosen the appropriate template.

Form popularity

FAQ

Yes, you can write your own legally binding contract as long as it meets the necessary legal standards. It's important to include essential components such as the parties involved, terms of agreement, and signatures. For those who prefer a guided approach, using US Legal Forms can help you craft a South Dakota Drafting Agreement - Self-Employed Independent Contractor that fulfills legal obligations and protects your interests.

Creating an independent contractor agreement involves specifying key elements such as the scope of work, payment terms, and confidentiality clauses. To simplify this process, you can utilize services like US Legal Forms that offer ready-to-use templates for a South Dakota Drafting Agreement - Self-Employed Independent Contractor. This ensures that all legal requirements are met while saving you time and reducing the risk of mistakes.

The independent contractor agreement can be written by various parties involved. Often, it is prepared by the business hiring the independent contractor. However, contractors can also draft their own agreements or seek assistance from platforms like US Legal Forms, specifically tailored for South Dakota Drafting Agreement - Self-Employed Independent Contractor needs. This allows both parties to ensure that their terms and expectations are clearly outlined.

As an independent contractor, you typically need to fill out an independent contractor agreement, tax forms like the W-9, and a declaration of independent contractor status. These documents outline your relationship with clients and clarify your tax obligations. Using a platform like USLegalForms can simplify the process by providing templates for these essential documents, ensuring you meet the requirements for the South Dakota Drafting Agreement - Self-Employed Independent Contractor.

Filling out a declaration of independent contractor status form involves providing your basic personal information and details about the scope of your work. Ensure you accurately state your job title, the services you provide, and any agreements with the hiring party. It's crucial to include your business name and address, as well as the date you began working. Finally, reviewing the South Dakota Drafting Agreement - Self-Employed Independent Contractor can help you ensure your form complies with state regulations.

Writing an independent contractor agreement involves several key components. Start with an introduction that identifies the contractor and the client, followed by a detailed description of services to be rendered. It's important to address payment terms, project timelines, and termination conditions as well. You can simplify the process by leveraging the US Legal platform, where you can find templates specifically designed for a South Dakota Drafting Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, start by clearly stating the names of both parties involved. Outline the scope of work, payment structure, and deadlines to provide clarity. Don't forget to include dispute resolution terms and confidentiality clauses. Utilizing resources like the US Legal site can help you craft a comprehensive South Dakota Drafting Agreement - Self-Employed Independent Contractor that protects both you and the client.

Filling out an independent contractor form requires careful attention to detail. Begin by entering your personal information, including your name, address, and contact details. Next, specify the services you will provide and include the agreed payment terms. For a more streamlined process, consider using the US Legal platform to access professionally drafted templates, ensuring your South Dakota Drafting Agreement - Self-Employed Independent Contractor meets legal standards.