South Dakota Contractor Agreement

Description

How to fill out Contractor Agreement?

You have the capability to spend hours online seeking the legal document template that complies with the state and federal requirements you desire.

US Legal Forms offers thousands of legal documents that have been reviewed by experts.

You can obtain or create the South Dakota Contractor Agreement through my services.

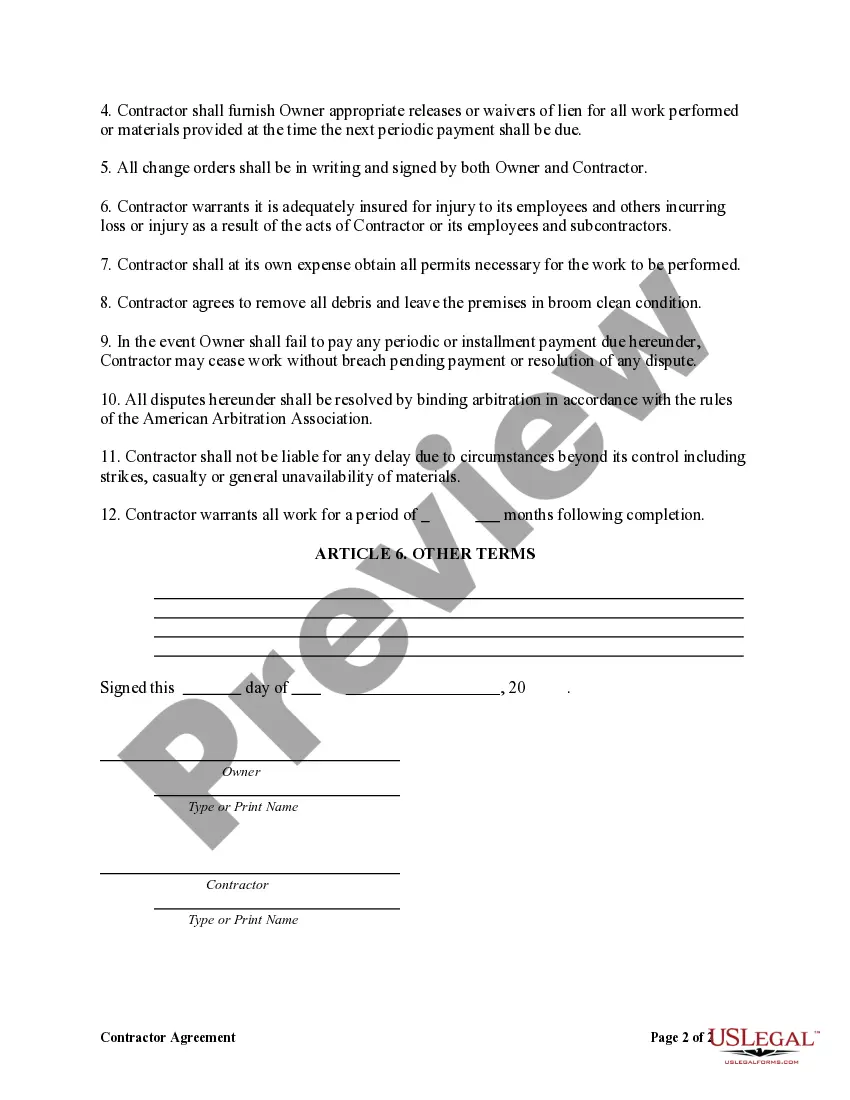

If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Download button.

- Afterward, you can complete, edit, create, or sign the South Dakota Contractor Agreement.

- Every legal document template you purchase is yours permanently.

- To get another version of any purchased form, navigate to the My documents section and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the locality you choose.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

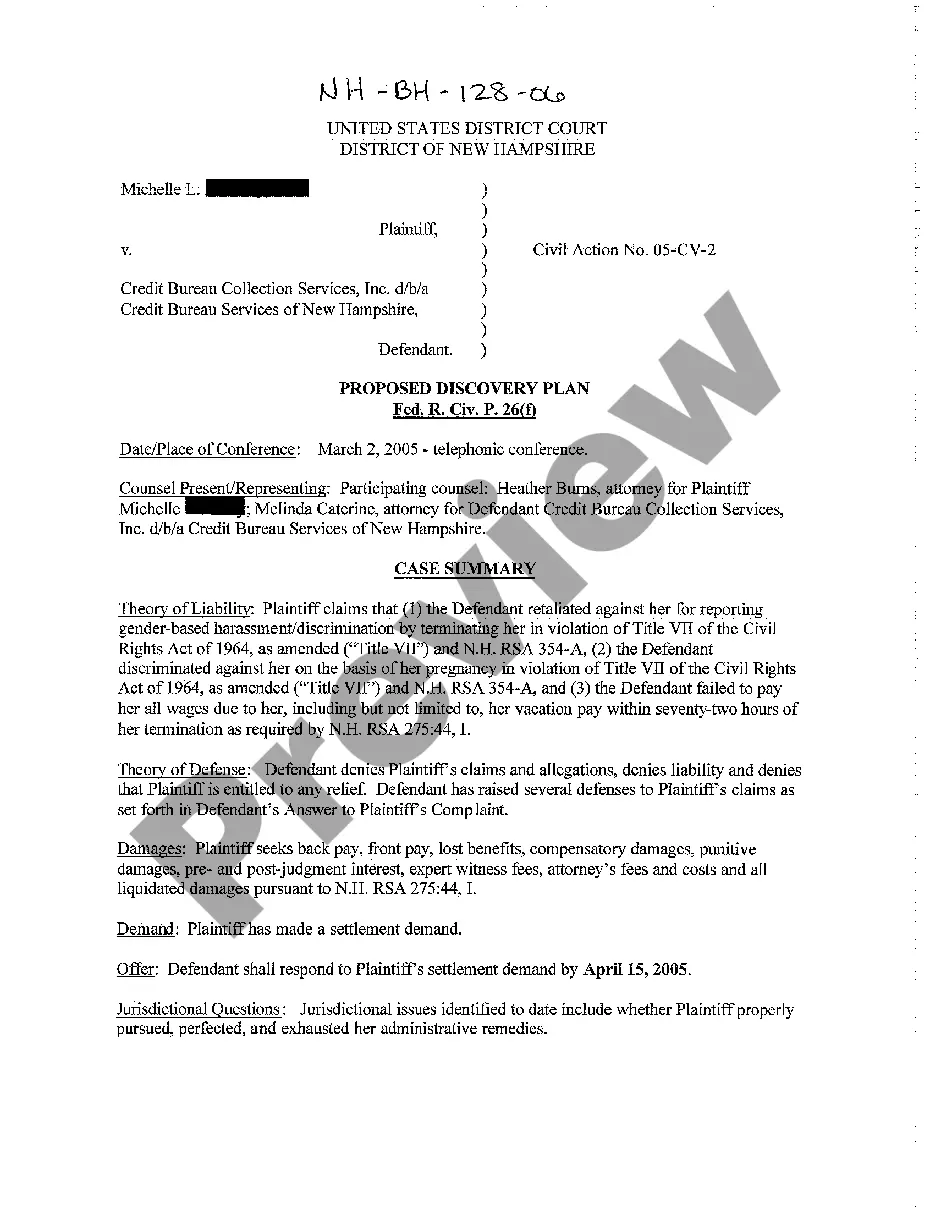

To file as an independent contractor in South Dakota, begin by organizing your income and expenses throughout the year. You will need to report your earnings using Schedule C of your federal tax return. It’s also vital to complete and submit a self-employment tax form. A solid South Dakota Contractor Agreement can provide guidelines on income reporting and help streamline your filing process.

The contractor tax in South Dakota refers to the taxes applicable to individuals and businesses engaged in contracting work. These taxes include self-employment taxes, income taxes, and any applicable local taxes. It is crucial to track all earnings and expenses accurately to ensure compliance. A well-prepared South Dakota Contractor Agreement can assist in clarifying tax obligations for all parties involved.

Independent contractors in South Dakota are responsible for paying self-employment tax on their net income. This tax covers Social Security and Medicare contributions. Additionally, they must report their income on their personal tax returns and may be subject to state income tax. Utilizing a clear South Dakota Contractor Agreement can help ensure you understand your responsibilities and manage your finances.

In South Dakota, an LLC is typically treated as a pass-through entity for tax purposes. This means that the income earned by the LLC is reported on the owners’ personal tax returns, avoiding double taxation. However, if an LLC opts to be taxed as a corporation, it may face corporate taxes. To simplify your management of taxes, consider drafting a South Dakota Contractor Agreement that outlines your financial responsibilities.

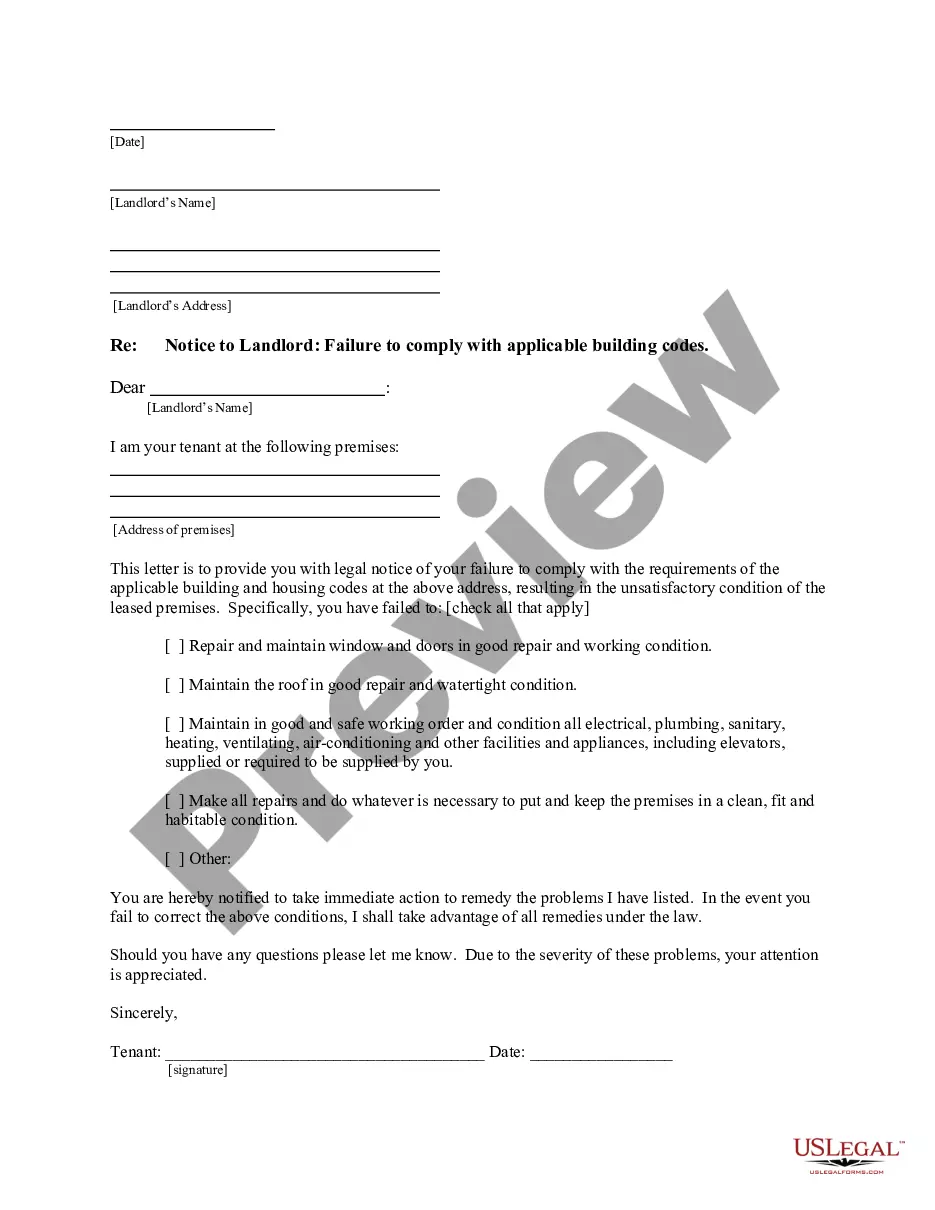

To set up an independent contractor agreement, begin by outlining the roles and responsibilities for each party. Incorporate key elements such as payment details, deadlines, and confidentiality clauses. A reliable source for a South Dakota Contractor Agreement template can ease this process and ensure your agreement meets state requirements. Always encourage both parties to review the final document before signing.

Creating your own contract agreement involves several steps, including defining the scope of work, payment terms, and project timelines. Start by researching a South Dakota Contractor Agreement template to ensure you include essential elements. Make sure to tailor the agreement to meet your specific project requirements. Don't forget to leave space for signatures from both parties, as this formalizes your understanding.

Setting up an LLC can offer benefits for independent contractors, including personal liability protection and potential tax advantages. It is advisable to evaluate your business needs, as a South Dakota Contractor Agreement can also define your business structure. An LLC can provide a professional image, which may attract more clients. Consider speaking with a financial advisor to discuss your specific situation.

Typically, the hiring party creates the independent contractor agreement. However, both parties should review the document to ensure mutual understanding and agreement on the terms. Utilizing a South Dakota Contractor Agreement template can simplify the process, ensuring compliance with local laws. Always consult with a legal expert if you have concerns or questions regarding specific clauses.

You can use an out-of-state contractor in South Dakota, but ensure they meet state licensing requirements. This process helps protect your project and interests. To streamline your potential agreements, consider a South Dakota Contractor Agreement that addresses out-of-state contractor terms.

Yes, South Dakota generally requires a contractor license for specific trades. These licenses help ensure that contractors meet safety and quality standards. When you draft your South Dakota Contractor Agreement, make sure to incorporate any necessary licensing information relevant to your work.