South Dakota Self-Employed Independent Contractor Consideration For Hire Form

Description

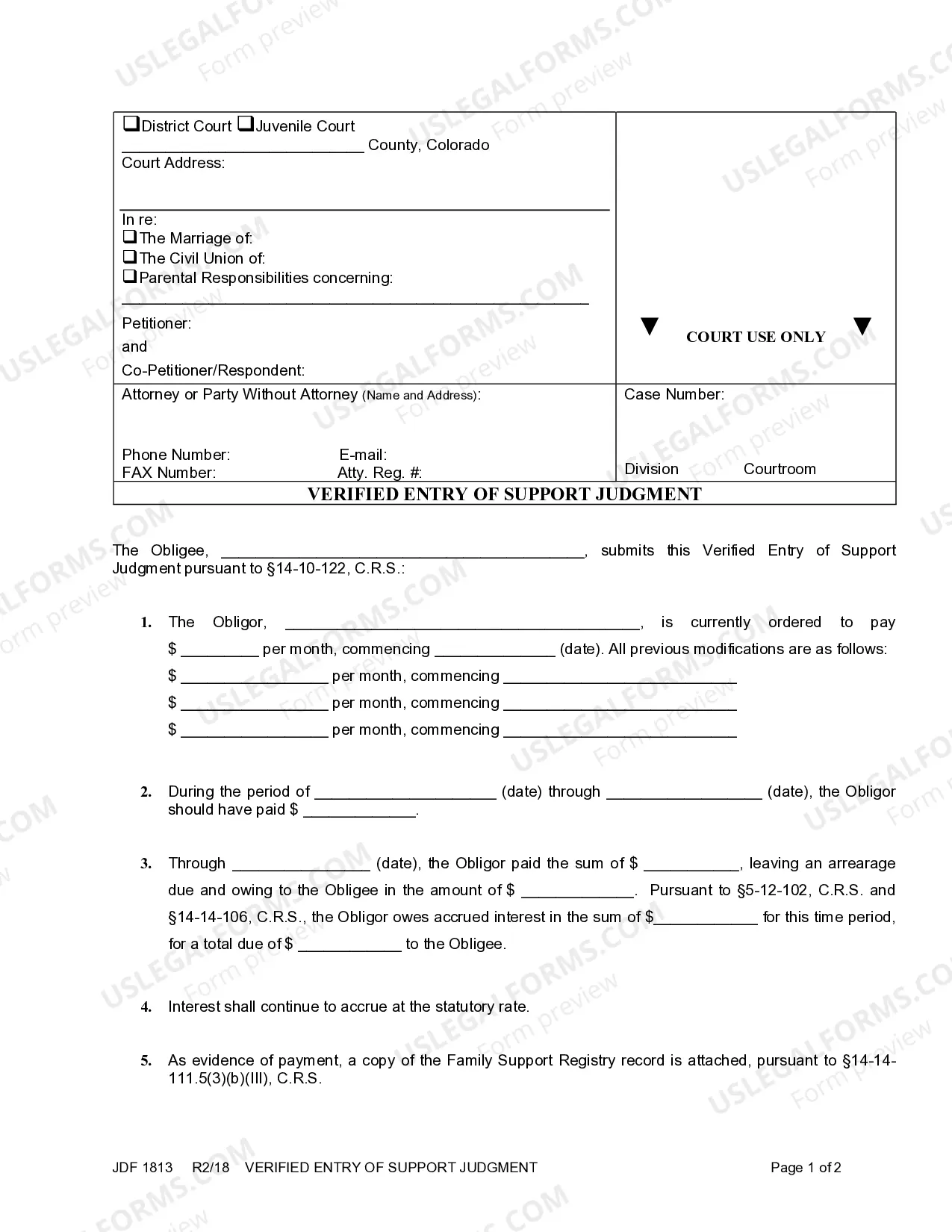

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

You might allocate time online attempting to discover the legal document format that satisfies the state and federal standards you will require.

US Legal Forms provides an extensive collection of legal templates that are evaluated by experts.

You can indeed download or print the South Dakota Self-Employed Independent Contractor Consideration For Hire Form from my services.

If available, utilize the Review button to inspect the document format as well. If you wish to find another version of the form, use the Lookup section to locate the format that meets your needs and requirements. Once you have identified the format you desire, simply click Buy now to proceed. Choose the pricing plan you prefer, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can utilize your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make changes to your document if possible. You may complete, modify, sign, and print the South Dakota Self-Employed Independent Contractor Consideration For Hire Form. Download and print numerous document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the South Dakota Self-Employed Independent Contractor Consideration For Hire Form.

- Every legal document format you acquire is yours for a prolonged period.

- To obtain another copy of any purchased form, navigate to the My documents tab and select the relevant button.

- If you're using the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- First, ensure you have selected the correct document format for the state/city of your preference.

- Review the form description to confirm you have chosen the appropriate template.

Form popularity

FAQ

A person is typically classified as an independent contractor based on several key factors, including their ability to control how they perform their work. Independence in making decisions, providing tools, and determining work hours are significant indicators. Additionally, the nature of the relationship with the hiring party plays a role. Familiarizing yourself with the South Dakota Self-Employed Independent Contractor Consideration For Hire Form will provide valuable insights into this classification.

To complete a declaration of independent contractor status form, start by providing your personal details, such as name, address, and contact information. Next, describe the services offered and indicate your engagement terms, including payment details. Be sure to emphasize your independence in performing the work. The South Dakota Self-Employed Independent Contractor Consideration For Hire Form can serve as an excellent template for this purpose.

Multiple criteria determine a person's status as either an employee or an independent contractor. Key considerations include the level of control by the employer, the nature of the worker's relationship with the employer, and whether the worker provides their own tools. Each aspect contributes to the overall evaluation of the relationship. The South Dakota Self-Employed Independent Contractor Consideration For Hire Form helps clarify this determination.

The most crucial factor in determining worker classification for agency law is the degree of control exerted by the employer over the worker's tasks and methods. If the employer has significant say over how the work is done, this typically indicates an employee relationship. Conversely, if the worker operates independently and decides how to complete their tasks, it leans towards independent contractor status. Reference the South Dakota Self-Employed Independent Contractor Consideration For Hire Form to ensure accurate classification.

Filling out an independent contractor agreement requires clear identification of both parties involved, including their names and addresses. Next, include the scope of work, payment terms, and timelines for deliverables. Always specify the terms of termination and any necessary confidentiality clauses. For a comprehensive agreement, reference the South Dakota Self-Employed Independent Contractor Consideration For Hire Form for guidance.

Hiring an independent contractor requires a few key documents. Primarily, you’ll need a signed contract, a W-9 for tax purposes, and the South Dakota Self-Employed Independent Contractor Consideration For Hire Form. This documentation assists in maintaining clear communication and expectations throughout the work arrangement.

The primary consideration is the level of control your business has over the hired person's work. Factors include how much direction you give and whether the person can work for others. To clearly establish this relationship, ensure they complete the South Dakota Self-Employed Independent Contractor Consideration For Hire Form to outline the terms.

As a sole proprietor, you can hire independent contractors by first identifying the specific services you need. Next, collect necessary forms such as the W-9 and the South Dakota Self-Employed Independent Contractor Consideration For Hire Form to document your arrangement. This process helps in maintaining compliance with tax regulations and outlining the work relationship.

To hire an independent contractor, you will typically need a signed contract outlining your agreement, a W-9 form, and the South Dakota Self-Employed Independent Contractor Consideration For Hire Form. This paperwork ensures that both you and the contractor have a clear understanding of job expectations and payment structures.

Before hiring an independent contractor, confirm their credentials and past work experience. You should also have them complete the South Dakota Self-Employed Independent Contractor Consideration For Hire Form. This form not only protects both parties but also sets the groundwork for a successful working relationship.