South Dakota Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you currently in a situation where you require documents for either business or personal use nearly every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of template forms, including the South Dakota Qualified Written RESPA Request to Dispute or Validate Debt, which are designed to comply with federal and state regulations.

If you find the correct template, simply click Buy now.

Select the pricing option you wish, complete the necessary information to create your account, and purchase your order using your PayPal or Visa or MasterCard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Qualified Written RESPA Request to Dispute or Validate Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

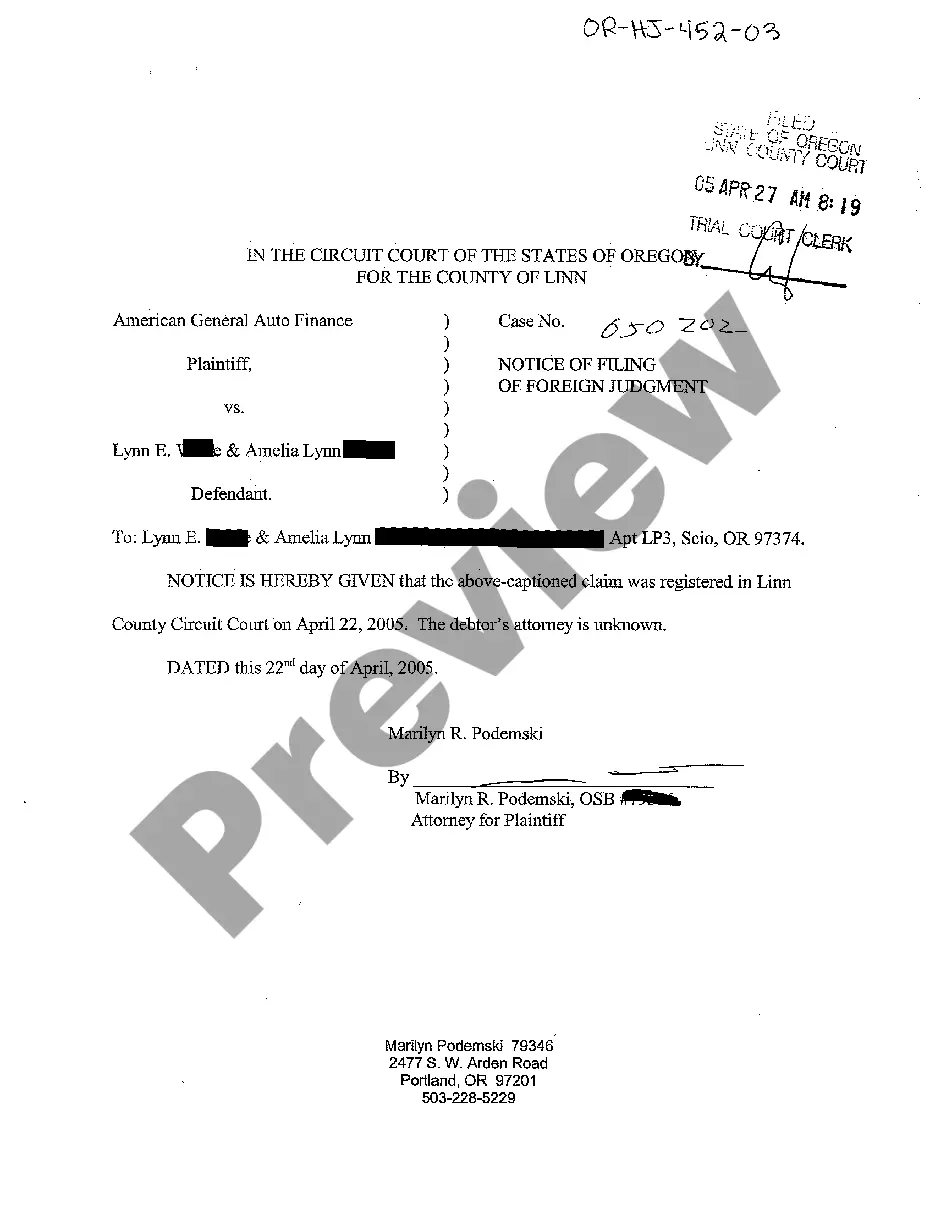

- Use the Review button to examine the form.

- Read the description to ensure you've selected the appropriate form.

- If the form does not meet your needs, utilize the Search field to find the template that fits you and your requirements.

Form popularity

FAQ

A debt collector is required to provide a written validation notice within five days of their initial communication with you. This notice should include important details about the debt, including the amount owed and your rights. Utilizing a South Dakota Qualified Written RESPA Request to Dispute or Validate Debt helps ensure you receive this validation notice, giving you the necessary information to address your debt appropriately.

To write a South Dakota Qualified Written RESPA Request to Dispute or Validate Debt, start by clearly stating your name, contact information, and the mortgage account details. Include a specific request for the information you seek, such as a detailed account history or documentation supporting the debt. Ensure you send this request via certified mail, retaining proof of delivery, as this strengthens your position in any future disputes.

In South Dakota, the statute of limitations generally makes a debt uncollectible after six years. Knowing this timeframe can help you understand your rights regarding any debt collection efforts you face. If you are disputing a debt, combining this knowledge with a South Dakota Qualified Written RESPA Request to Dispute or Validate Debt can provide you with a solid foundation for your case. It's crucial to be aware of these timelines to safeguard your financial health.

When writing a letter disputing a debt, focus on clarity and professionalism. Include necessary references to the South Dakota Qualified Written RESPA Request to Dispute or Validate Debt. Start with your personal information, then explain why you believe the debt is inaccurate or invalid. Support your claim with documentation if available, as this will bolster your dispute.

The best sample for a debt validation letter should be concise, clear, and formally structured. It should incorporate the elements of a South Dakota Qualified Written RESPA Request to Dispute or Validate Debt, ensuring that you outline your dispute clearly. Make sure it includes your account information, details of the debt, and a request for validation. This template can guide you in crafting an effective letter.

Writing a letter to dispute the validity of a debt involves stating your intent clearly and providing relevant details. Begin by referencing the South Dakota Qualified Written RESPA Request to Dispute or Validate Debt as a framework for your letter. Include your account number, the nature of your dispute, and any evidence that supports your claim. This structured approach enhances your chances for a successful dispute.

Responding to a debt validation letter requires you to review the information provided by the creditor carefully. If you believe the debt is not valid or if there are inaccuracies, use the South Dakota Qualified Written RESPA Request to Dispute or Validate Debt to send your response. Clearly outline your concerns and provide any supporting evidence. This helps in asserting your position and ensuring due diligence from the creditor.

Filing a debt validation claim involves sending a formal request to your creditor to verify the details of the debt. Utilize the South Dakota Qualified Written RESPA Request to Dispute or Validate Debt to initiate this process. Include essential information such as your account number and any discrepancies you have identified. This formal approach sets the stage for a clear resolution regarding the debt.

Yes, you can dispute a valid debt, especially if you believe it has errors or inaccuracies. The South Dakota Qualified Written RESPA Request to Dispute or Validate Debt allows you to formally question the legitimacy of the debt. This process ensures that you have an opportunity to clarify your financial standing. It’s important to act promptly and gather any documentation that supports your claim.