South Dakota Loan Term Sheet

Description

How to fill out Loan Term Sheet?

Finding the right legal papers design can be quite a battle. Needless to say, there are plenty of themes available on the net, but how would you discover the legal type you want? Utilize the US Legal Forms website. The support gives thousands of themes, like the South Dakota Loan Term Sheet, which can be used for company and private demands. All the varieties are checked by pros and satisfy federal and state needs.

In case you are currently authorized, log in to your accounts and click on the Acquire key to obtain the South Dakota Loan Term Sheet. Utilize your accounts to look with the legal varieties you might have bought in the past. Visit the My Forms tab of your accounts and acquire another duplicate of your papers you want.

In case you are a new user of US Legal Forms, allow me to share basic instructions for you to follow:

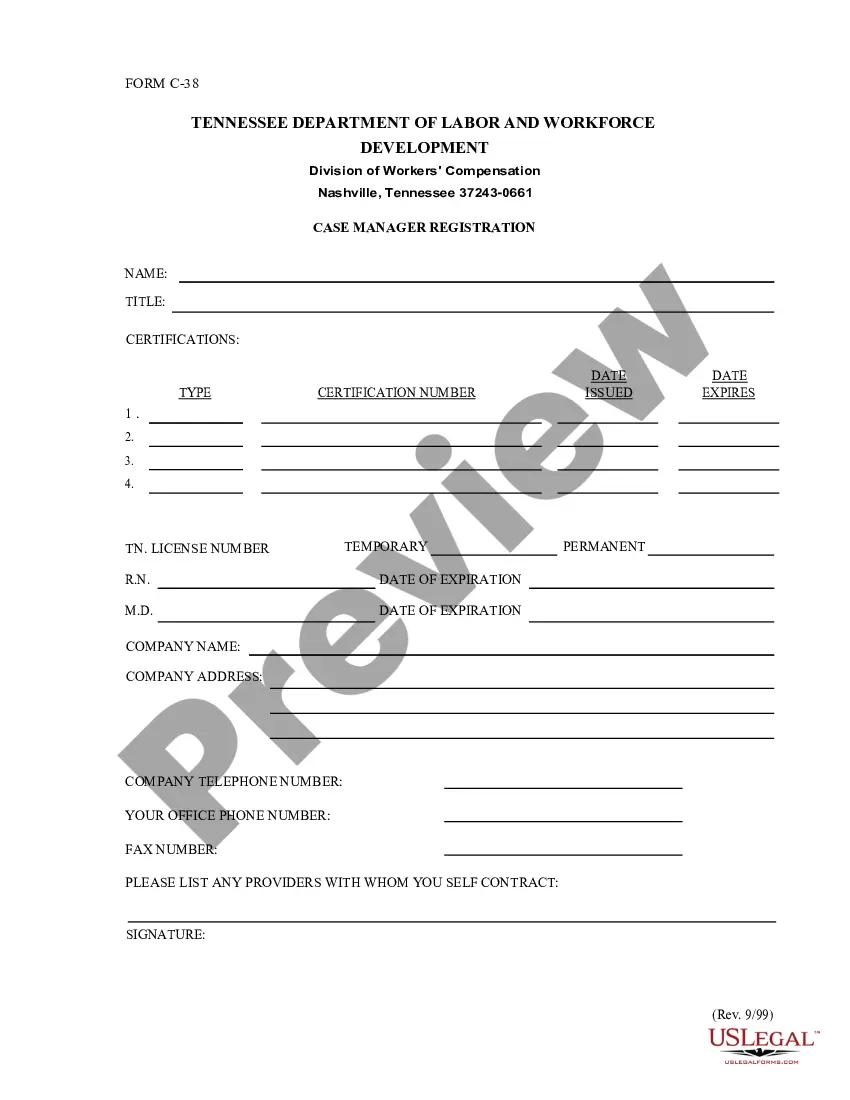

- First, ensure you have chosen the right type for the town/county. You can examine the form while using Review key and look at the form outline to ensure it is the best for you.

- In the event the type is not going to satisfy your needs, take advantage of the Seach field to discover the proper type.

- When you are certain the form would work, click on the Acquire now key to obtain the type.

- Opt for the rates strategy you need and enter in the essential info. Make your accounts and pay for the order with your PayPal accounts or Visa or Mastercard.

- Opt for the document structure and acquire the legal papers design to your device.

- Comprehensive, change and printing and indicator the attained South Dakota Loan Term Sheet.

US Legal Forms is the largest collection of legal varieties in which you can discover various papers themes. Utilize the service to acquire skillfully-manufactured papers that follow status needs.

Form popularity

FAQ

Loan Documentation refers broadly to the documents needed to legally enforce the loan agreement and properly analyze the borrower's financial capacity. Common loan documents are: promissory notes. note guarantees, financial statements. collateral agreements, and.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

Take the following steps to write a business loan application letter: Include a header. ... Add a subject line. ... Start with a greeting. ... Give a summary of the request. ... Provide necessary business information. ... Explain the purpose of the business loan. ... Describe the plan to repay the loan. ... Close the letter.

The repayment tenure of term loans ranges between 12 months to 60 months. Personal loans, business loans, auto loans, education loans, gold loans, and home loans are some examples of term loans.

A loan term is defined as the length of the loan, or the length of time it takes for a loan to be paid off completely when the borrower is making regularly scheduled payments. These loans can either be short-term or long-term, and the time it takes to pay off debt from the loan can be referred to as that loan's term.

Term loans are normally meant for established small businesses with sound financial statements. In exchange for a specified amount of cash, the borrower agrees to a certain repayment schedule with a fixed or floating interest rate.

A Loan Agreement, also known as a term loan, demand loan, or a loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the amount of the loan, any interest charges, the repayment plan, and payment dates.