South Dakota Gust Series Seed Term Sheet

Description

developed by Gust, the platform powering over 90% of the organized angel investment groups in the United States.

The goal was to standardize on a single investment structure, eliminate confusion and significantly reduce the costs of negotiating, documenting and closing an early stage seed investment.

For those familiar with early stage angel transactions, this middle-of-the-road approach is founder-friendly and investor-rational, intended to strike a balance between the Series A Model Documents developed by the National

Venture Capital Association that have traditionally been used by most American angel groups (which include a 17 page term sheet and 120 pages of supporting documentation covering many low-probability edge cases), and the one page Series Seed 2.0 Term Sheet developed in 2010 by Ted Wang of Fenwick & West as a contribution to the early stage community (which deferred most investor protections and deal specifics until future financing rounds.)

The Gust Series Seed Term Sheet does meet Section 2.2 of the Founder Friendly Standard. The term sheet providesfor "reverse vesting"so the company can repurchase unvested stock if a Founder leaves before four years.

How to fill out Gust Series Seed Term Sheet?

If you have to comprehensive, down load, or print legitimate document web templates, use US Legal Forms, the largest selection of legitimate types, which can be found online. Use the site`s basic and practical research to find the files you require. Different web templates for company and personal uses are categorized by classes and suggests, or key phrases. Use US Legal Forms to find the South Dakota Gust Series Seed Term Sheet in just a few mouse clicks.

If you are already a US Legal Forms buyer, log in to the accounts and click the Download option to get the South Dakota Gust Series Seed Term Sheet. You can even accessibility types you in the past delivered electronically from the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for that appropriate town/country.

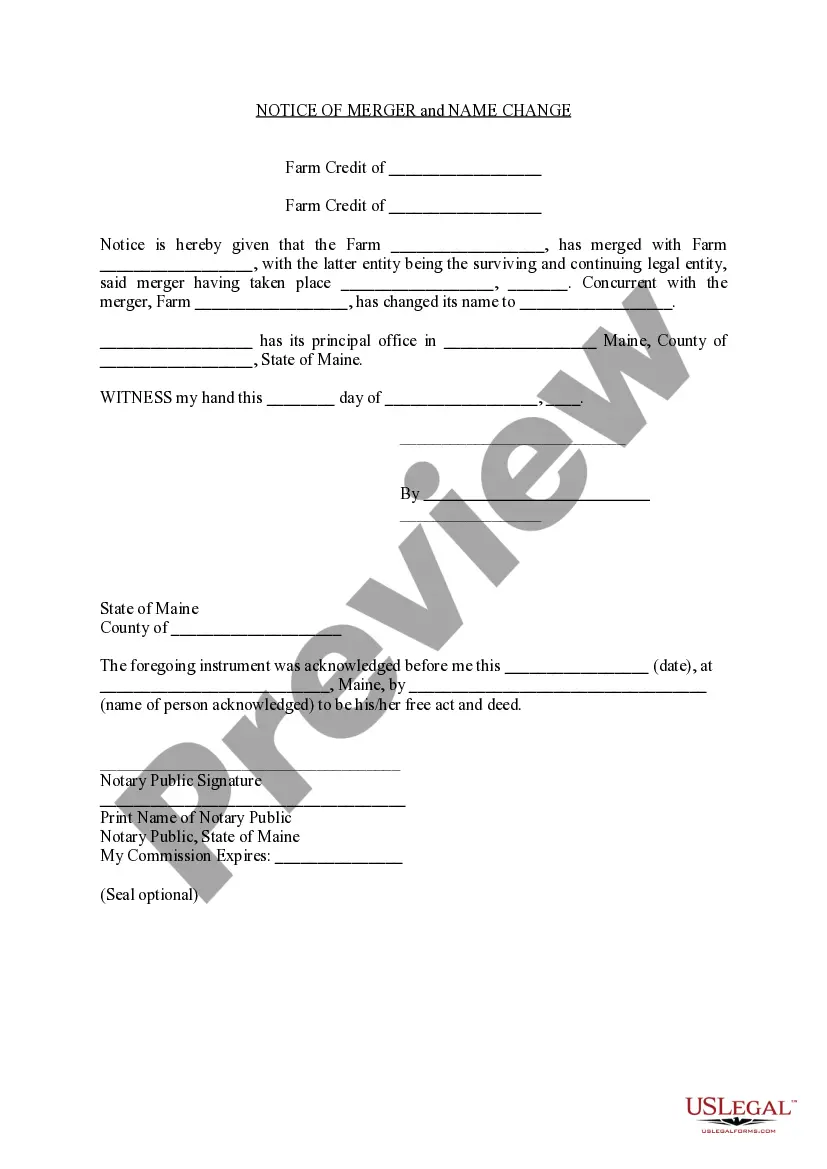

- Step 2. Make use of the Preview solution to check out the form`s articles. Never neglect to see the outline.

- Step 3. If you are unhappy with all the kind, use the Search discipline near the top of the display screen to discover other types from the legitimate kind template.

- Step 4. After you have located the shape you require, click the Purchase now option. Choose the prices plan you like and include your credentials to sign up to have an accounts.

- Step 5. Process the financial transaction. You can use your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Pick the structure from the legitimate kind and down load it on your own system.

- Step 7. Complete, edit and print or indicator the South Dakota Gust Series Seed Term Sheet.

Each and every legitimate document template you buy is your own for a long time. You possess acces to every single kind you delivered electronically with your acccount. Click the My Forms area and decide on a kind to print or down load once again.

Remain competitive and down load, and print the South Dakota Gust Series Seed Term Sheet with US Legal Forms. There are millions of specialist and condition-specific types you can use to your company or personal needs.