South Dakota Internet Business Services Agreement

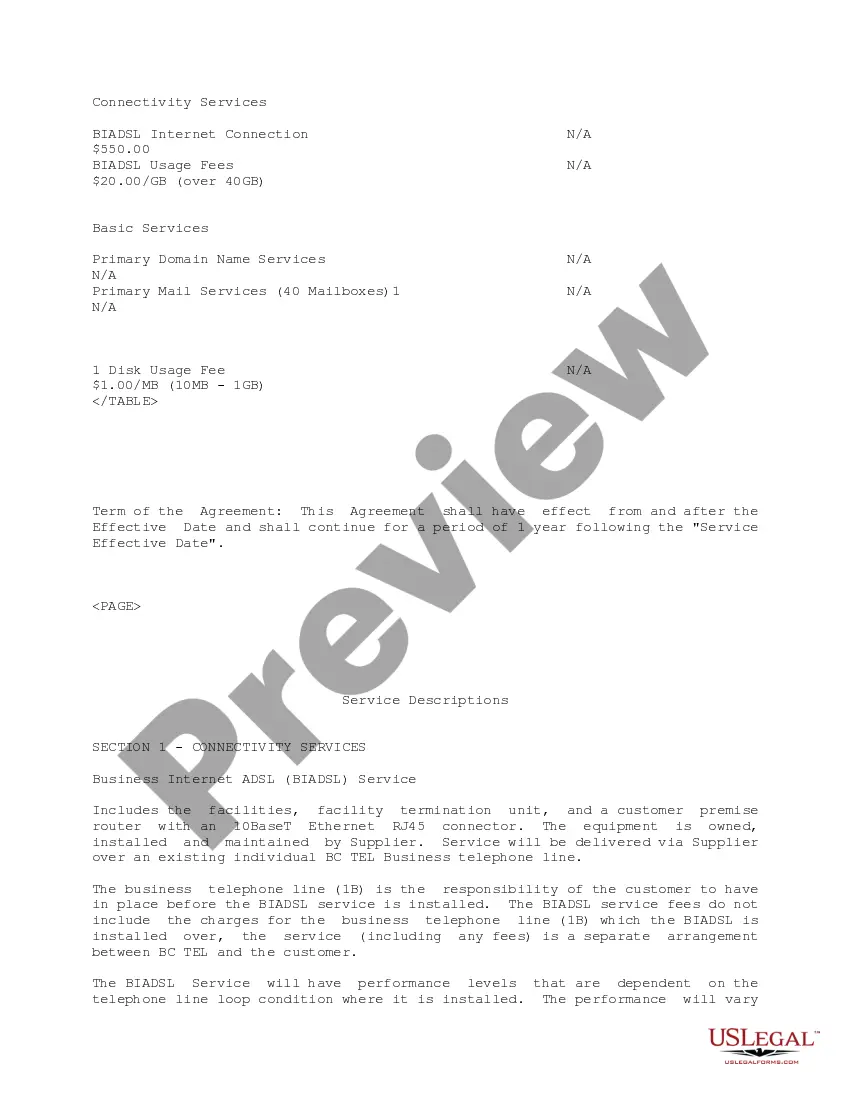

Description

How to fill out Internet Business Services Agreement?

If you wish to comprehensive, download, or produce lawful record templates, use US Legal Forms, the largest variety of lawful varieties, which can be found online. Utilize the site`s simple and hassle-free research to get the papers you want. Different templates for organization and person reasons are sorted by classes and states, or key phrases. Use US Legal Forms to get the South Dakota Internet Business Services Agreement within a handful of click throughs.

When you are already a US Legal Forms buyer, log in to your bank account and click on the Acquire button to obtain the South Dakota Internet Business Services Agreement. You can even access varieties you previously saved within the My Forms tab of the bank account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for the right area/land.

- Step 2. Utilize the Preview method to examine the form`s information. Never neglect to see the explanation.

- Step 3. When you are unsatisfied with the type, take advantage of the Lookup discipline on top of the monitor to locate other variations of the lawful type format.

- Step 4. Upon having discovered the form you want, click on the Get now button. Choose the pricing plan you prefer and add your credentials to sign up to have an bank account.

- Step 5. Approach the transaction. You can utilize your bank card or PayPal bank account to accomplish the transaction.

- Step 6. Choose the file format of the lawful type and download it on your own gadget.

- Step 7. Full, revise and produce or signal the South Dakota Internet Business Services Agreement.

Every lawful record format you acquire is yours forever. You have acces to each and every type you saved inside your acccount. Select the My Forms portion and decide on a type to produce or download yet again.

Remain competitive and download, and produce the South Dakota Internet Business Services Agreement with US Legal Forms. There are thousands of expert and state-certain varieties you may use for your organization or person needs.

Form popularity

FAQ

The economic nexus threshold will now be gross revenue of $100,000 in the previous or current calendar year, effective July 1, 2023. This is potentially good news for smaller remote sellers making sales into South Dakota whose sales don't exceed $100,000 in a calendar year but whose transaction count exceeds 200.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

Some goods are exempt from sales tax under South Dakota law. Examples include gasoline, purchases made with food stamps, and prescription drugs.

Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered electronically) into South Dakota.

If you are conducting business in South Dakota you need a license even if you do not have a physical location. If you have nexus then all your sales in South Dakota are taxable (including online and catalog sales) and you must be licensed with the Department of Revenue.

With few exceptions, the sale of products and services in South Dakota are subject to sales tax or use tax. Services such as auto repair, maintenance, body repair, oil changes, and customizing are subject to state and municipal sales tax.

Optional maintenance contracts provide prepaid coverage for scheduled oil changes, tire rotation, etc. Optional maintenance contracts are taxable if they include any taxable items, unless the cost of those items is insignificant. The sales tax is due when the contract is sold, not when the maintenance is performed.