South Dakota Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140

Description

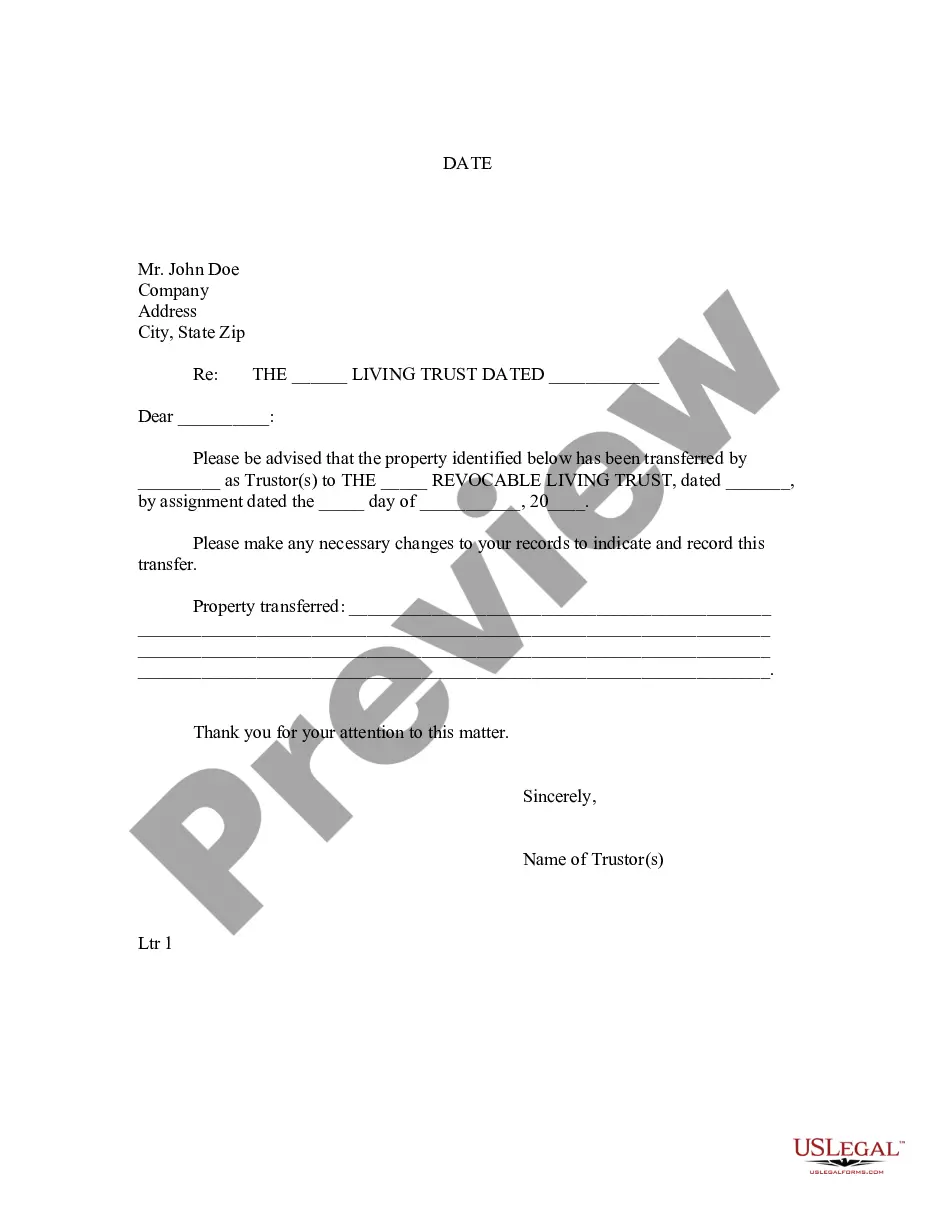

How to fill out Trust Indenture And Agreement Between John Nuveen And Co., Inc. And Chase Manhattan Bank Regarding Terms And Conditions For Nuveen Tax Free Unit Trust, Series 1140?

US Legal Forms - one of the largest libraries of legal varieties in the USA - provides a wide array of legal record web templates you may obtain or print out. Using the internet site, you can get a huge number of varieties for company and individual purposes, sorted by groups, claims, or key phrases.You can get the newest types of varieties like the South Dakota Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 in seconds.

If you currently have a subscription, log in and obtain South Dakota Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 in the US Legal Forms collection. The Acquire option will show up on every kind you perspective. You have accessibility to all in the past delivered electronically varieties inside the My Forms tab of your account.

If you would like use US Legal Forms the first time, here are easy instructions to help you get started:

- Ensure you have chosen the right kind to your metropolis/county. Go through the Review option to analyze the form`s content. See the kind explanation to actually have chosen the right kind.

- When the kind doesn`t suit your needs, make use of the Search discipline at the top of the screen to find the one which does.

- If you are content with the shape, validate your selection by simply clicking the Purchase now option. Then, pick the costs strategy you favor and give your credentials to register on an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to finish the transaction.

- Find the formatting and obtain the shape on your gadget.

- Make changes. Complete, change and print out and indicator the delivered electronically South Dakota Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140.

Each and every design you added to your money lacks an expiration particular date and is yours for a long time. So, if you would like obtain or print out an additional version, just visit the My Forms segment and then click about the kind you want.

Obtain access to the South Dakota Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 with US Legal Forms, the most substantial collection of legal record web templates. Use a huge number of expert and condition-certain web templates that satisfy your small business or individual needs and needs.