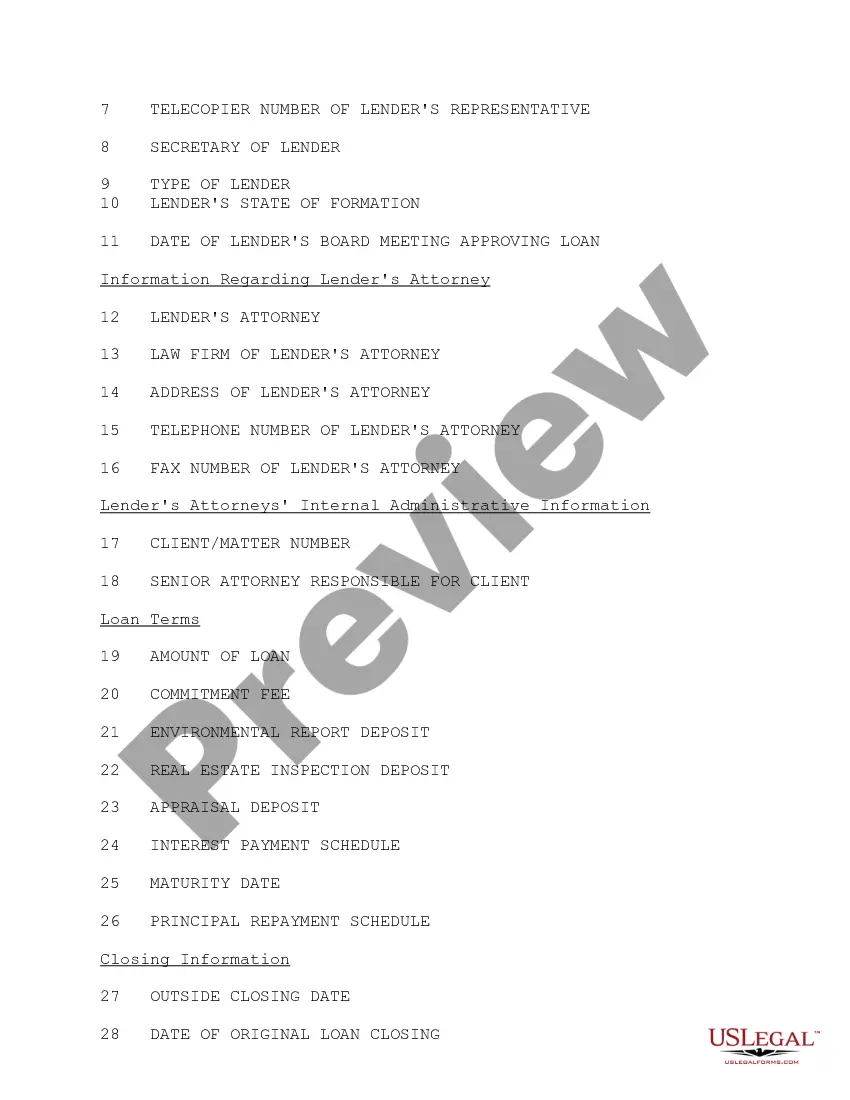

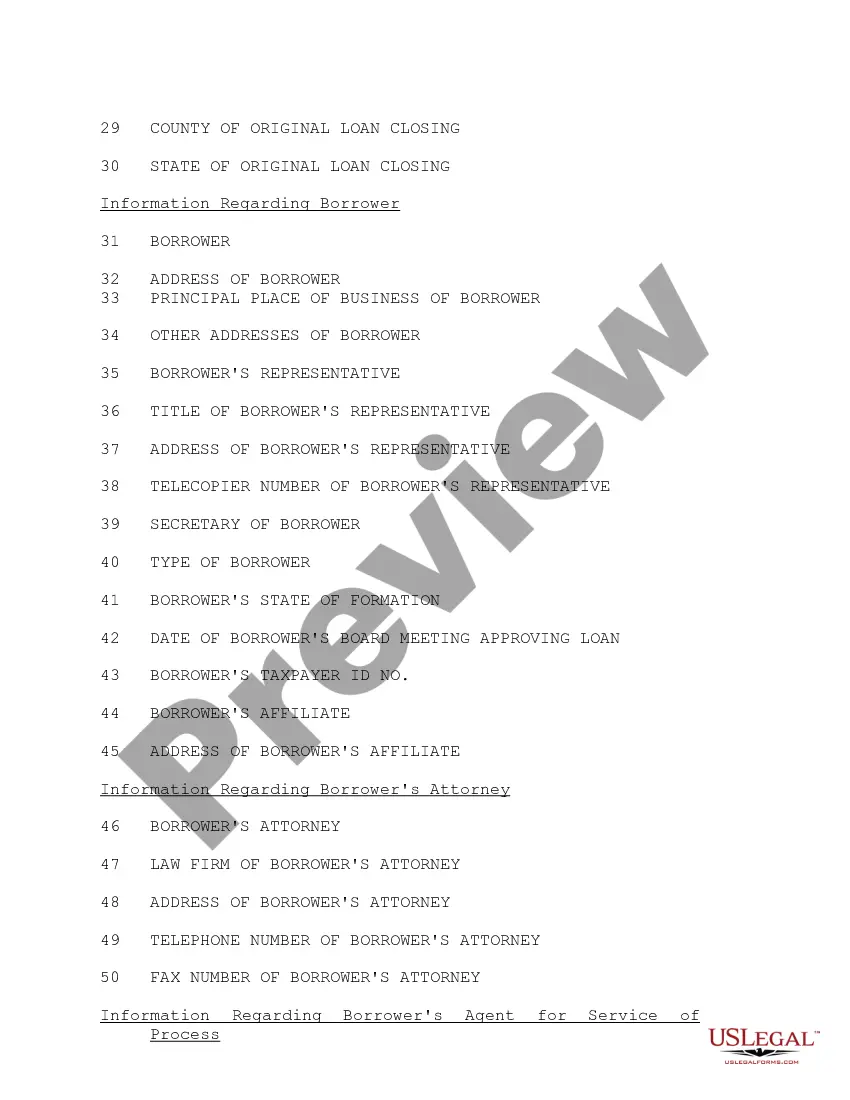

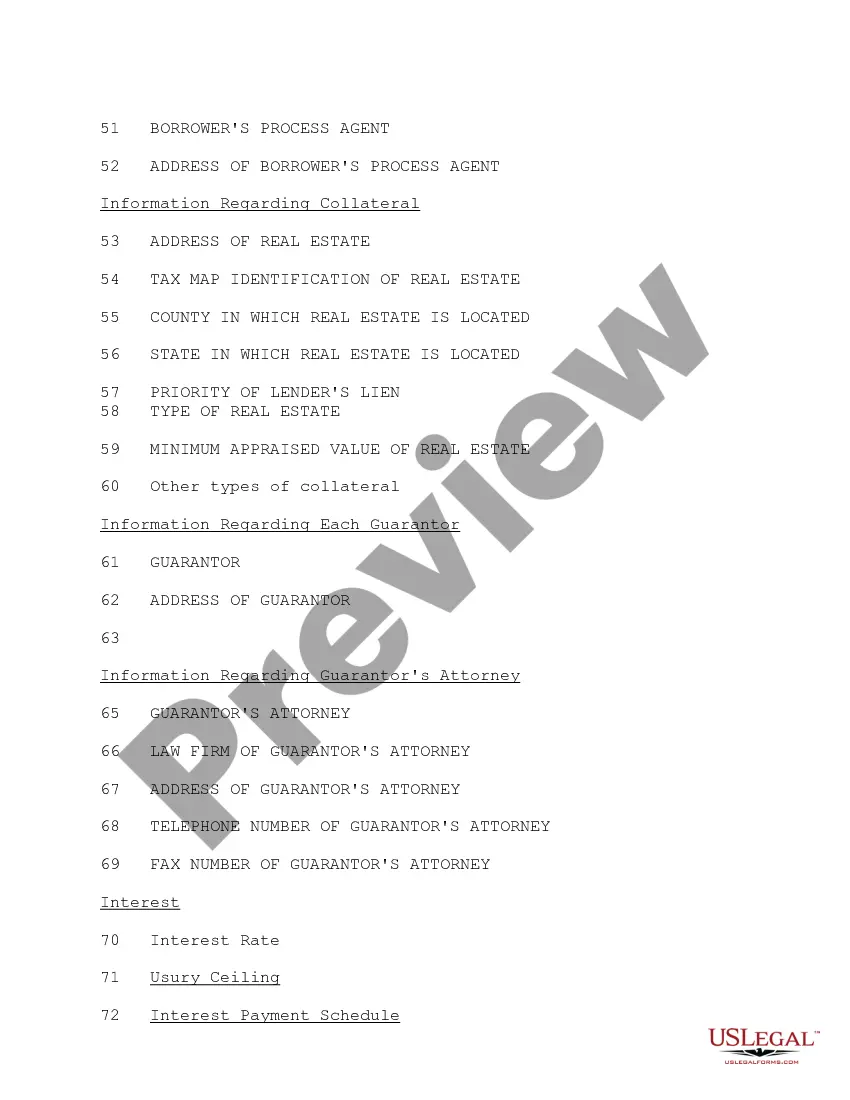

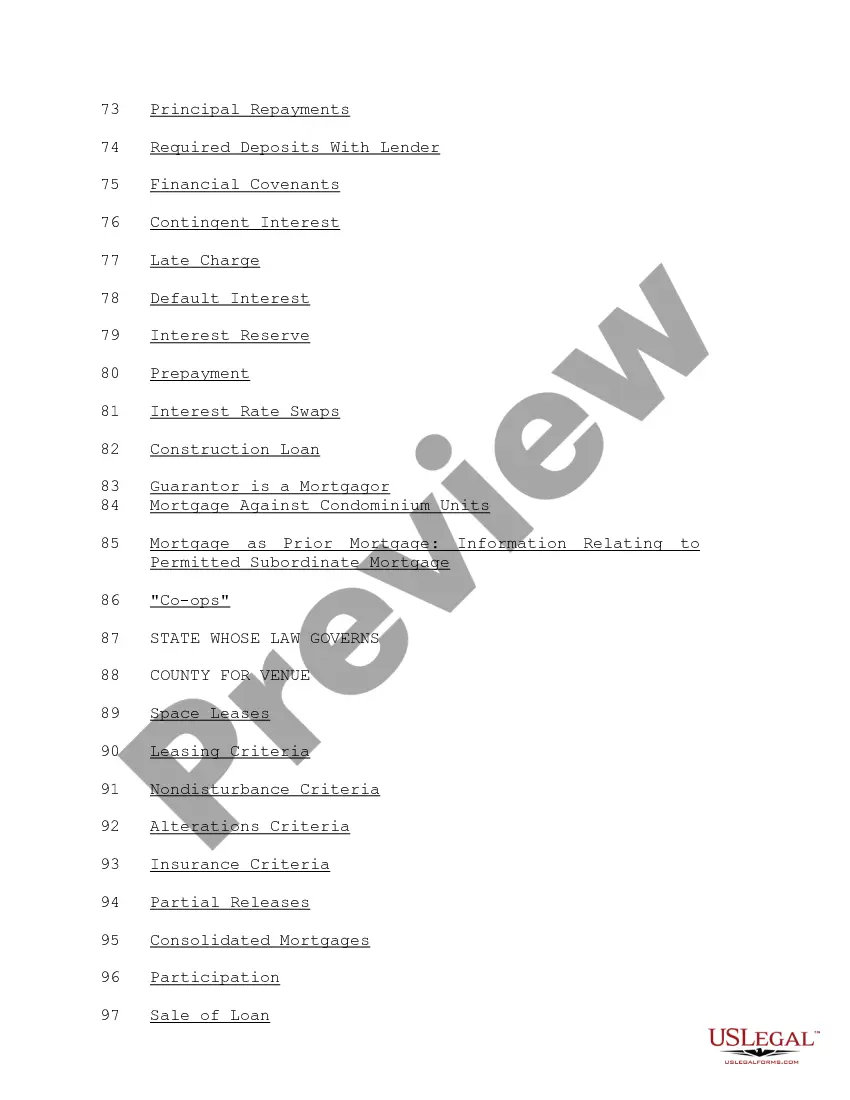

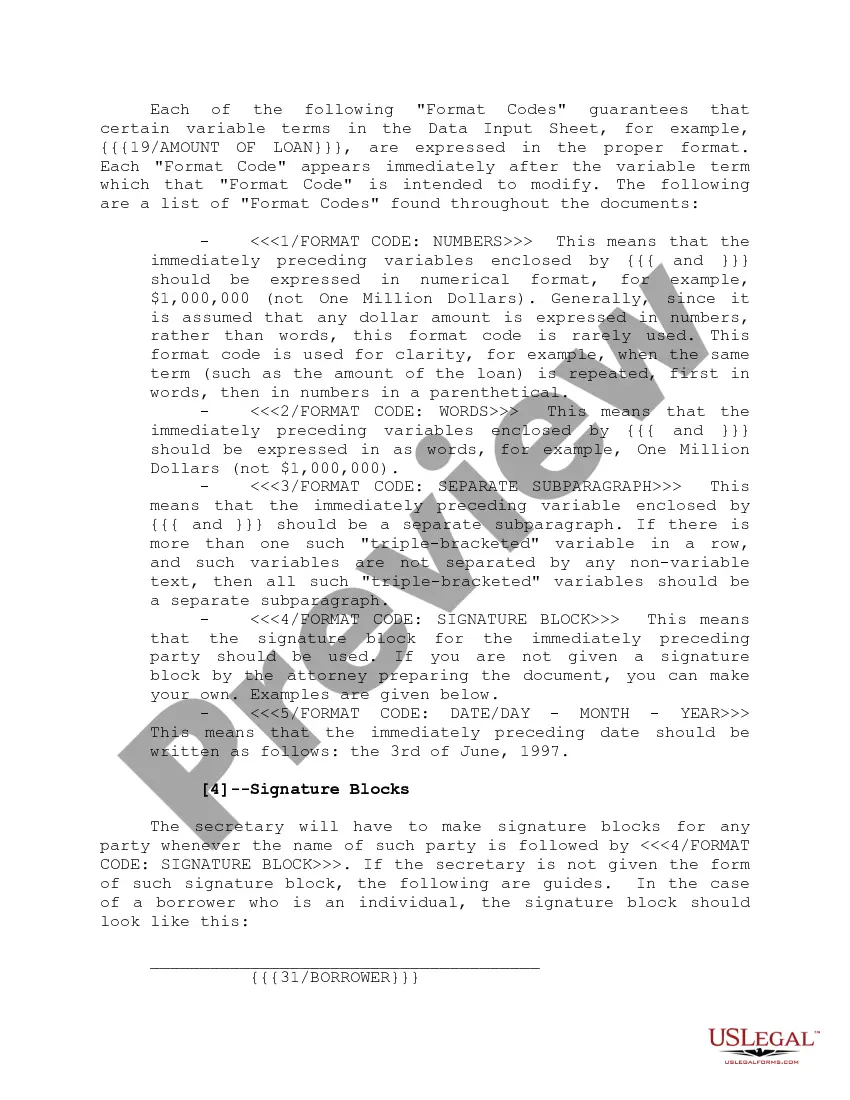

"Data Input Sheet" is a American Lawyer Media form. This is a form is an instructional form on how to fill out the different real estate forms.

South Dakota Data Input Sheet

Description

How to fill out Data Input Sheet?

If you want to total, down load, or print lawful document layouts, use US Legal Forms, the most important selection of lawful varieties, which can be found on-line. Make use of the site`s simple and handy lookup to obtain the files you require. Different layouts for enterprise and personal purposes are categorized by groups and says, or keywords and phrases. Use US Legal Forms to obtain the South Dakota Data Input Sheet within a few click throughs.

In case you are previously a US Legal Forms consumer, log in to your bank account and click the Down load key to get the South Dakota Data Input Sheet. You can even gain access to varieties you formerly saved in the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for your right area/nation.

- Step 2. Utilize the Review method to examine the form`s content material. Do not overlook to read the outline.

- Step 3. In case you are not happy using the type, use the Search area near the top of the display screen to find other variations of your lawful type web template.

- Step 4. Upon having found the form you require, go through the Get now key. Choose the rates plan you like and add your references to sign up on an bank account.

- Step 5. Approach the purchase. You may use your charge card or PayPal bank account to perform the purchase.

- Step 6. Choose the format of your lawful type and down load it on your own device.

- Step 7. Total, revise and print or sign the South Dakota Data Input Sheet.

Every single lawful document web template you buy is yours eternally. You possess acces to every single type you saved within your acccount. Go through the My Forms portion and choose a type to print or down load yet again.

Compete and down load, and print the South Dakota Data Input Sheet with US Legal Forms. There are millions of skilled and status-specific varieties you can utilize for the enterprise or personal demands.

Form popularity

FAQ

Penalty of 10% (. 10) of the tax liability (minimum $10.00 penalty, even if no tax is due) is assessed if a return is not received within 30 days following the month the return is due in. 911 Emergency Surcharge returns and payments must be filed and paid timely by electronic means to receive the administrative fee.

Sales and/or services made on or after July 1, 2023, are subject to 4.2% state tax plus applicable municipal tax. It does not matter when the actual payment for the sale is received. Cash Basis: The tax rate in effect at the time payment is received applies to that payment.

South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent. South Dakota's tax system ranks 2nd overall on our 2023 State Business Tax Climate Index.

The CRA is limited in how far back they can look at someone's returns ? in most cases. Normally, a CRA waudit the two or three most recent tax years. If the CRA finds significant discrepancies in their tax audits they have the authority to go further back and audit previous years.

A seller's permit may be printed by the seller using the online Vehicle Registration & Plates portal or may also be obtained at a county treasurer's office. The seller's permit is valid for 45 days.

South Dakota Codified Laws 10-59-16 defines the statute of limitations for sales tax assessment as 3 years from the return filing date.

In South Dakota, all misdemeanors carry a lengthy seven-year statute of limitations. Most felonies also have a seven-year statute of limitations. Class A, B, and C felonies do not have any statute of limitations.