South Dakota Reclassification of Class B common stock into Class A common stock

Description

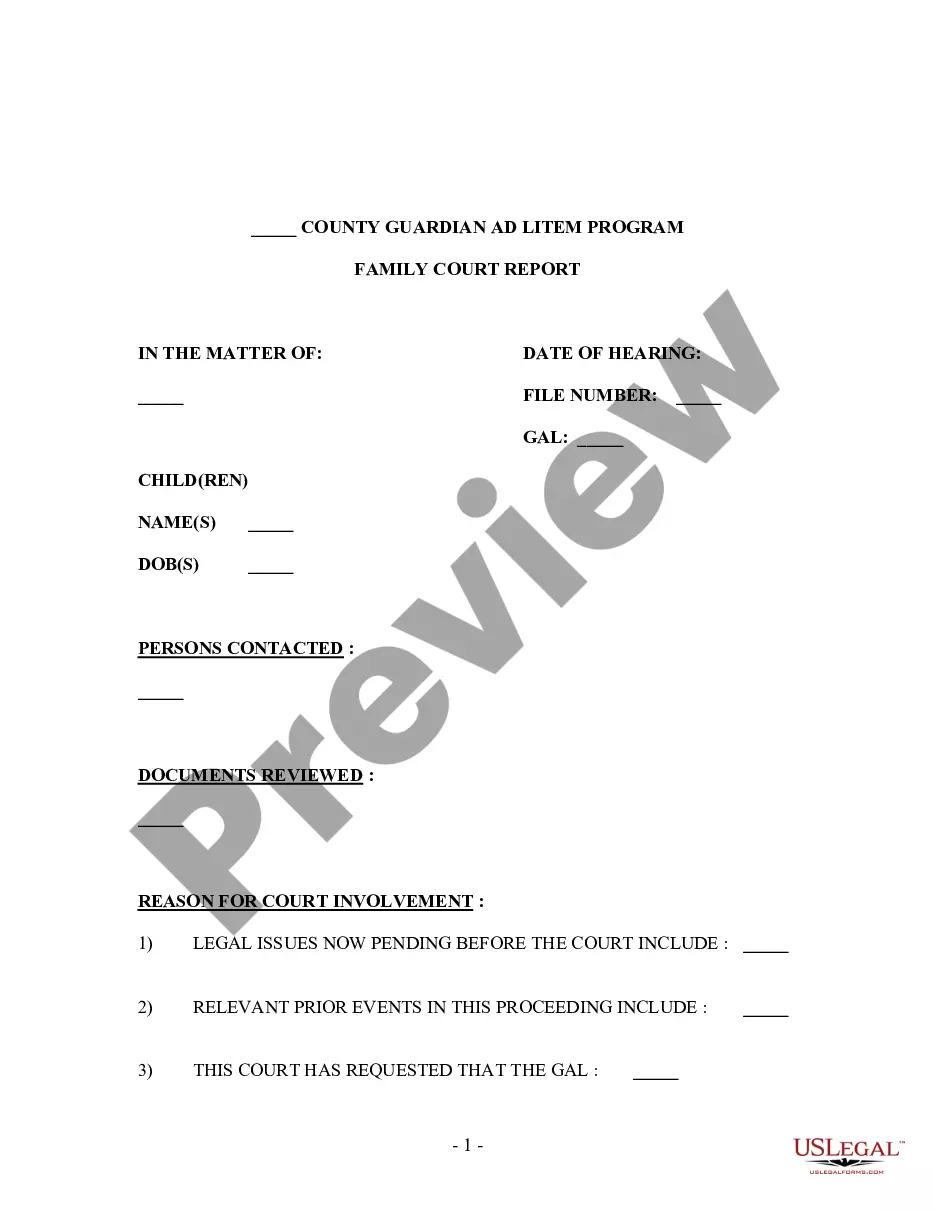

How to fill out Reclassification Of Class B Common Stock Into Class A Common Stock?

You can devote hrs online looking for the legitimate papers format that suits the federal and state demands you will need. US Legal Forms gives a large number of legitimate forms that are analyzed by experts. It is possible to download or print out the South Dakota Reclassification of Class B common stock into Class A common stock from my support.

If you already have a US Legal Forms accounts, you can log in and click the Acquire button. Next, you can full, edit, print out, or sign the South Dakota Reclassification of Class B common stock into Class A common stock. Each and every legitimate papers format you acquire is the one you have for a long time. To acquire yet another version of any purchased type, proceed to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms site the first time, stick to the simple directions beneath:

- Initial, ensure that you have selected the proper papers format for the area/metropolis of your choice. Look at the type information to make sure you have selected the correct type. If readily available, take advantage of the Review button to appear throughout the papers format too.

- If you wish to discover yet another model of your type, take advantage of the Search discipline to obtain the format that meets your requirements and demands.

- After you have identified the format you need, simply click Buy now to proceed.

- Pick the costs program you need, enter your references, and register for your account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal accounts to purchase the legitimate type.

- Pick the file format of your papers and download it in your device.

- Make alterations in your papers if needed. You can full, edit and sign and print out South Dakota Reclassification of Class B common stock into Class A common stock.

Acquire and print out a large number of papers templates making use of the US Legal Forms site, which offers the greatest collection of legitimate forms. Use expert and state-specific templates to handle your organization or personal requires.

Form popularity

FAQ

A series A round (also known as series A financing or series A investment) is the name typically given to a company's first significant round of venture capital financing. The name refers to the class of preferred stock sold to investors in exchange for their investment.

What Is a Class of Shares? A class of shares is a type of listed company stock that is differentiated by the level of voting rights shareholders receive. For example, a listed company might have two share classes, or classes of stock, designated as Class A and Class B.

A series is a subset of a class of shares. If provided for in its articles, a corporation can issue a class of shares in one or more series. The articles may also authorize the directors to create and designate a class of shares in one or more series.

A series is a subset of a class of shares. If provided for in its articles, a corporation can issue a class of shares in one or more series. The articles may also authorize the directors to create and designate a class of shares in one or more series.

Within corporate share structure there are two classes of shares. The first class of shares is a common share. The corporation may issue common shares as voting shares or non-voting shares. The second class of share is a preferred share.

Series 1 Shares means the cumulative rate reset preference shares, series 1 issued by the Company "Series 3 Shares" means the cumulative rate reset preference shares, series 3 issued by the Company "Series 5 Shares" means the cumulative rate reset preference shares, series 5 issued by the Company.