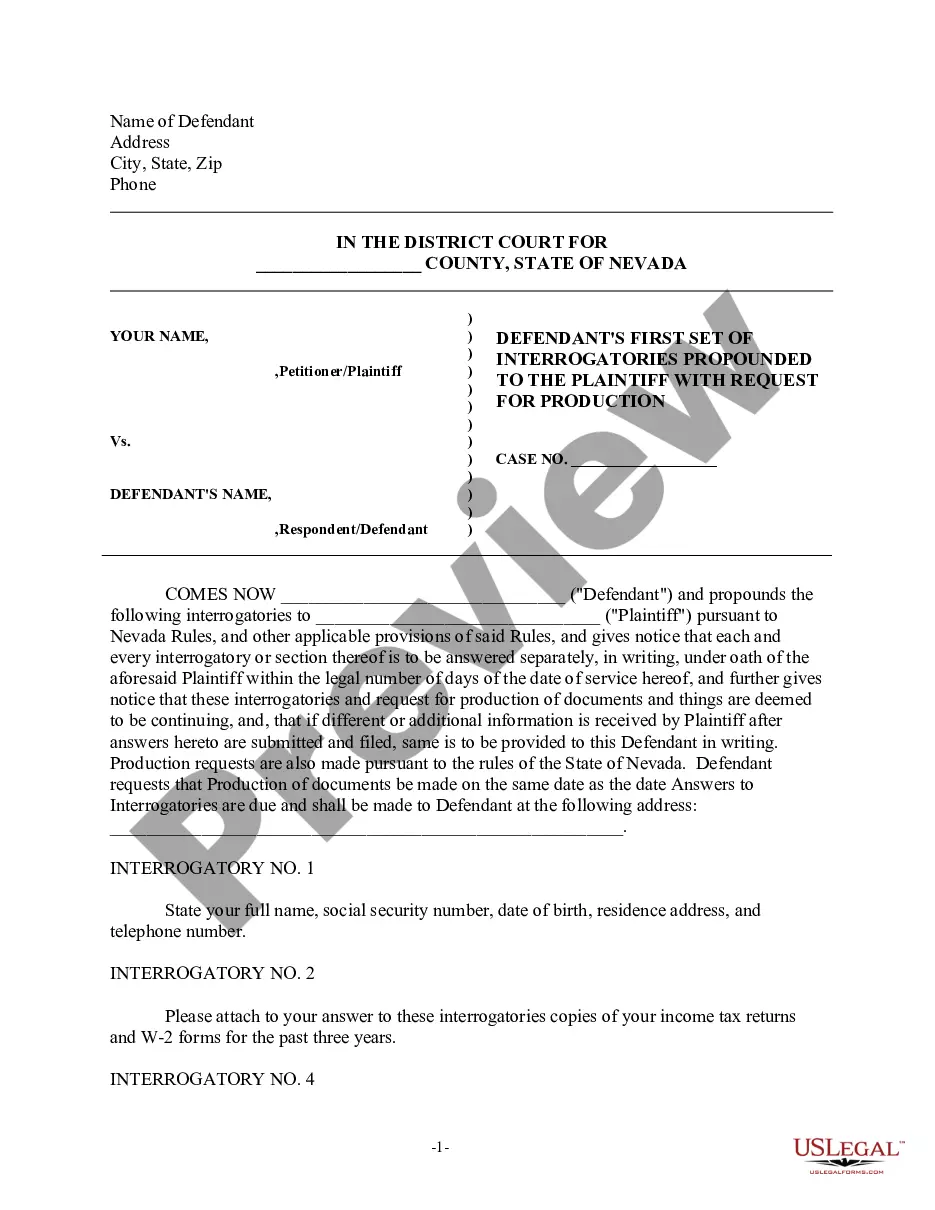

South Dakota Savings Plan for Employees

Description

How to fill out Savings Plan For Employees?

Choosing the right lawful file template might be a have a problem. Of course, there are a variety of templates available on the net, but how do you obtain the lawful form you require? Take advantage of the US Legal Forms internet site. The assistance delivers a huge number of templates, for example the South Dakota Savings Plan for Employees, that you can use for organization and personal requirements. Each of the kinds are checked by pros and meet federal and state requirements.

If you are already signed up, log in to your accounts and click on the Acquire option to get the South Dakota Savings Plan for Employees. Utilize your accounts to search with the lawful kinds you might have acquired in the past. Proceed to the My Forms tab of your own accounts and have another version in the file you require.

If you are a fresh consumer of US Legal Forms, listed below are easy directions that you should stick to:

- Initial, ensure you have selected the appropriate form for the area/region. It is possible to examine the form while using Preview option and study the form outline to ensure this is the right one for you.

- When the form is not going to meet your expectations, make use of the Seach discipline to find the appropriate form.

- When you are certain that the form is proper, select the Acquire now option to get the form.

- Pick the pricing program you want and enter the needed details. Build your accounts and pay for your order making use of your PayPal accounts or charge card.

- Pick the document format and down load the lawful file template to your device.

- Comprehensive, revise and produce and indicator the received South Dakota Savings Plan for Employees.

US Legal Forms is the most significant library of lawful kinds that you can discover numerous file templates. Take advantage of the company to down load appropriately-manufactured documents that stick to state requirements.

Form popularity

FAQ

The rule of 85 says that workers can retire with full pension benefits if their age and years of service add up to 85 or more. So if you're 60 years old and you've been working at the same company for 25 years then technically, you could be eligible for full pension benefits if you choose to retire early.

Normal retirement age is 65 with three years of service. Early retirement age is 55 with three years of service with unreduced benefits upon attaining Rule of 85 (age plus service equals or exceeds 85). Early retirement reduction with less than 20 years of service is 3% per year.

South Dakota is a fairly tax-friendly state for retirees. It is one of the most tax-friendly states for seniors. There are no state income taxes. This means that your Social Security retirement income, pension income, and even 401(k) and IRA withdrawals are tax-free.

If a work-related injury causes death, compensation is payable to the employee's spouse at the rate of 66.67% of the employee's average weekly wage (with overtime included at the straight rate) and is subject to the state minimum and maximums amounts from SDCL 62-4-3.

The COLA for 2023 was 2.10%, compared to 8.75% inflation; the 2022 COLA was the full 3.5%, while inflation was 5.92%. By comparison, SDRS in prior years paid COLAs that were relatively close to inflation, either slightly above or below.

A pension that will not be reduced in the event of early retirement. 65 is considered the 'normal' retirement age for PSPP. You can start receiving your pension as early as age 55 and still receive an unreduced pension if your age at retirement plus your years of service equals 85 points. This is called the 85 factor.

How Do You Calculate the Rule of 85? As mentioned previously, the Rule of 85 is a very simple formula. Just add up your age and your years of service to your employer, and if the total is at least 85, then you can retire early with full benefits.

The SDRS Special Pay Plan (SDRS-SPP) is an additional retirement plan funded by an eligible employee's special pay (termination pay) which is compensation other than regular salary or wages accumulated by an employee and converted to a lump-sum amount at termination of employment.