South Dakota Approval of savings plan for employees

Description

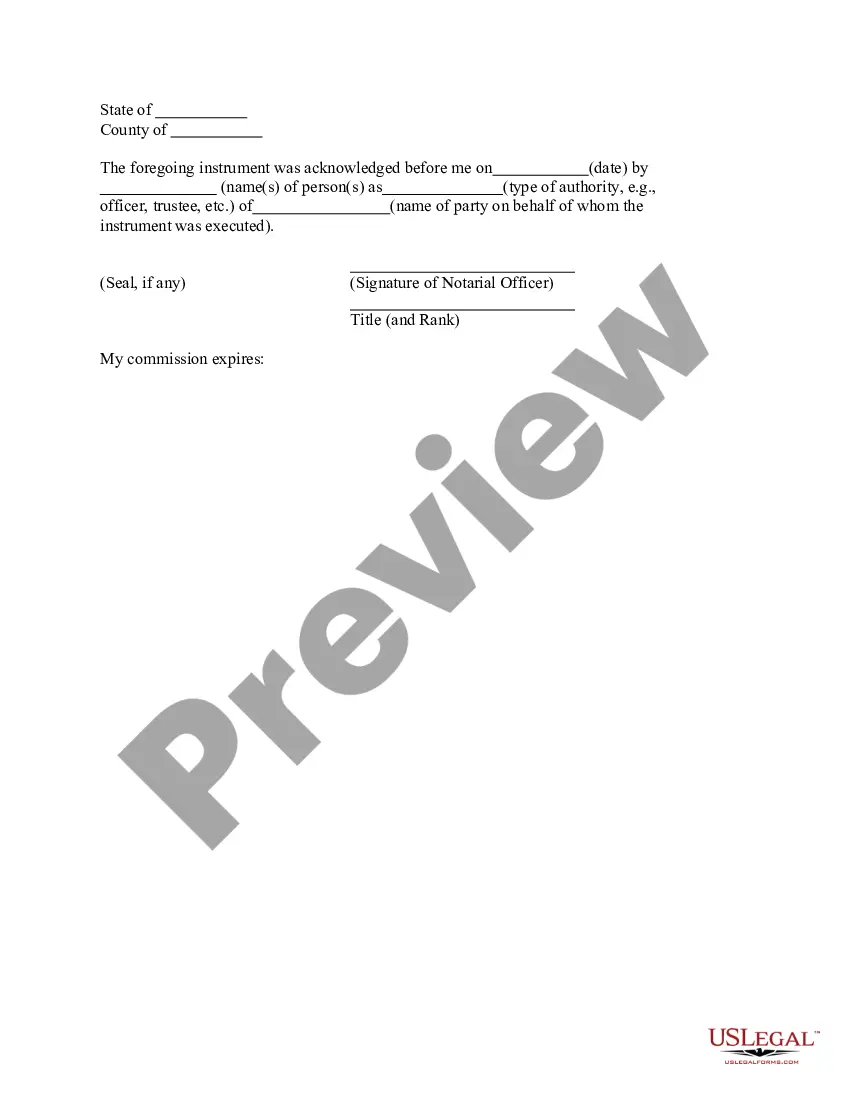

How to fill out Approval Of Savings Plan For Employees?

You are able to invest time on-line looking for the legitimate record template which fits the federal and state demands you require. US Legal Forms provides a large number of legitimate types that are reviewed by specialists. It is simple to acquire or produce the South Dakota Approval of savings plan for employees from your assistance.

If you have a US Legal Forms account, you can log in and then click the Obtain option. Following that, you can total, change, produce, or indication the South Dakota Approval of savings plan for employees. Every single legitimate record template you purchase is yours permanently. To acquire an additional version for any acquired type, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms internet site the very first time, keep to the simple instructions under:

- Very first, be sure that you have chosen the best record template for your county/town that you pick. See the type information to ensure you have picked the proper type. If readily available, make use of the Preview option to check from the record template too.

- If you wish to locate an additional variation in the type, make use of the Look for industry to discover the template that meets your needs and demands.

- After you have found the template you need, click Purchase now to move forward.

- Find the pricing strategy you need, key in your qualifications, and register for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal account to fund the legitimate type.

- Find the formatting in the record and acquire it in your device.

- Make modifications in your record if needed. You are able to total, change and indication and produce South Dakota Approval of savings plan for employees.

Obtain and produce a large number of record web templates making use of the US Legal Forms Internet site, that offers the biggest selection of legitimate types. Use specialist and express-particular web templates to tackle your company or person demands.

Form popularity

FAQ

Q: What does the state law require for rest/meal periods? A: South Dakota does not have a law that requires an employer to provide rest breaks or meal periods. This is a matter of employer policy. The Fair Labor Standards Act (federal) also does not require breaks.

One cannot be terminated because of his or her color, race, religious beliefs or ancestry. Employers also cannot terminate those who have existing contracts, those who refuse to commit crimes on the employer's behalf or those who are engaging in actions such as seeking worker's compensation from the employer.

Payment of accrued, unused vacation on termination is also not addressed by state statutes. Because South Dakota's Legislature and its courts have not provided any information about vacation leave, employers are free to create their own policies regarding vacation leave and PTO payout at termination.

Under California law, unless otherwise stipulated by a collective bargaining agreement, whenever the employment relationship ends, for any reason whatsoever, and the employee has not used all of his or her earned and accrued vacation, the employer must pay the employee at his or her final rate of pay for all of his or ...

Three U.S. states (California, Colorado, and Montana) prohibit use-it-or-lose-it policies for vacation time, which means that unused vacation time must carry over from year to year. Or, employers can choose to cash out unused vacation pay at the end of the year.

Paid time off, once earned or awarded, is considered wages upon separation from employment. If the paid time off is available for use at the time of separation from employment, the employer must pay the employee for that time at the regular rate of pay earned by the employee prior to separation.

Employment relationships in South Dakota may be 'terminated at will,' which means an employer does not need a specific reason to fire an employee. This is the same concept as an employee not needing a specific reason to quit a job. Generally, the only exceptions to this rule are when: A contract for employment exists.

Nonexempt Status - The Fair Labor Standards Act requires that all employees that are not exempt be entitled to overtime pay (compensatory time off - public employers) of at least one-and-one-half times (1 ½) his/her regular rate for hours worked in excess of 40 in any workweek.