South Dakota Agreement to Reimburse for Insurance Premium

Description

How to fill out Agreement To Reimburse For Insurance Premium?

Selecting the optimal legal document template can be a challenge.

Indeed, there are numerous designs accessible online, but how do you determine the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the South Dakota Agreement to Reimburse for Insurance Premium, suitable for both business and personal purposes.

You can preview the form using the Preview option and review the form details to confirm it is suitable for your needs.

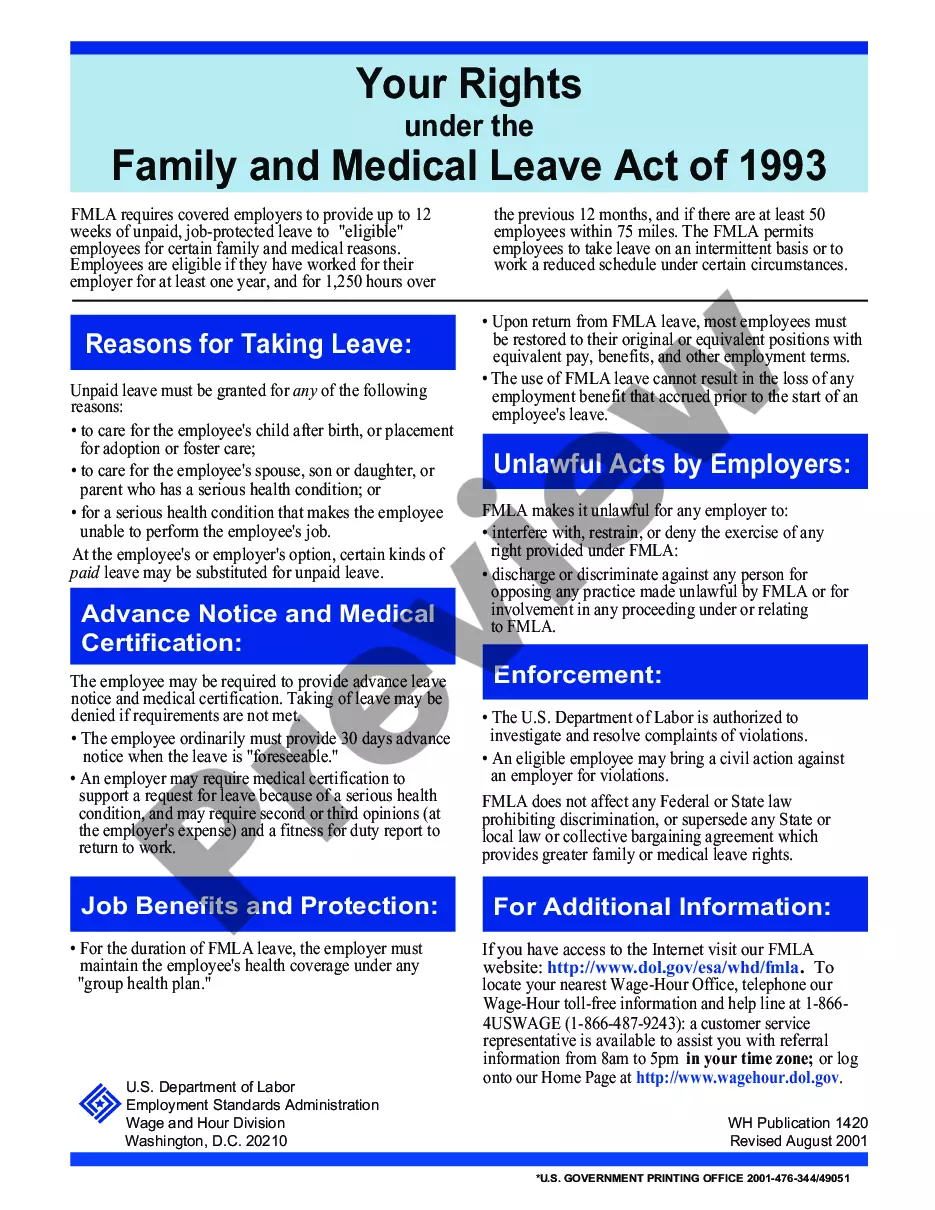

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download option to access the South Dakota Agreement to Reimburse for Insurance Premium.

- Use your account to browse the legal documents you have previously purchased.

- Navigate to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your area/county.

Form popularity

FAQ

What is on-exchange health insurance? As the name implies, if you buy your health insurance through the health insurance exchange in your state or HealthCare.gov then it's considered an on-exchange plan.

A premium is the amount of money charged by your insurance company for the plan you've chosen. It is usually paid on a monthly basis, but can be billed a number of ways. You must pay your premium to keep your coverage active, regardless of whether you use it or not.

Is South Dakota a no fault state? South Dakota is considered an at-fault state, which means drivers must take responsibility and pay for any crash they might cause. After an accident, the insurance of the driver who caused the accident must pay the other driver's costs for damage caused by the collision.

South Dakota law requires that any person who licenses and/or operates a motor vehicle must show proof of financial responsibility. Most people comply with this requirement by purchasing automobile insurance.

No, personal injury protection insurance is not required in South Dakota it's optional. South Dakota drivers who opt for PIP can get a minimum of $2,000 in medical coverage, with a death benefit of $10,000 and $60 per week in disability coverage.

Montana is a fault-based insurance state. If the at-fault driver has no liability insurance, you can make a claim with your own insurance provider under the uninsured motorist provision.

In exchange for healthcare coverage, the insurer charges you a monthly premium. According to eHealth's recent study of ACA plans, in 2020 the national average health insurance premium for an ACA plan is $456 for an individual and $1,152 for a family.

Homeowners Insurance. Medicaid - SD Department of Social Services. Medicare. Medicare Supplement Policies. Partners in Education Tax Credit Program.

The 12 states that have no-fault insurance laws are: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah.