South Dakota Flood Insurance Authorization

Description

How to fill out Flood Insurance Authorization?

Discovering the right authorized file design can be a battle. Naturally, there are plenty of web templates available on the Internet, but how would you discover the authorized develop you want? Use the US Legal Forms internet site. The support gives a huge number of web templates, for example the South Dakota Flood Insurance Authorization, that you can use for company and private requirements. All the kinds are inspected by pros and fulfill federal and state demands.

If you are previously listed, log in for your accounts and click the Download option to obtain the South Dakota Flood Insurance Authorization. Make use of your accounts to search from the authorized kinds you might have purchased previously. Go to the My Forms tab of the accounts and get yet another duplicate from the file you want.

If you are a new user of US Legal Forms, allow me to share straightforward guidelines that you should stick to:

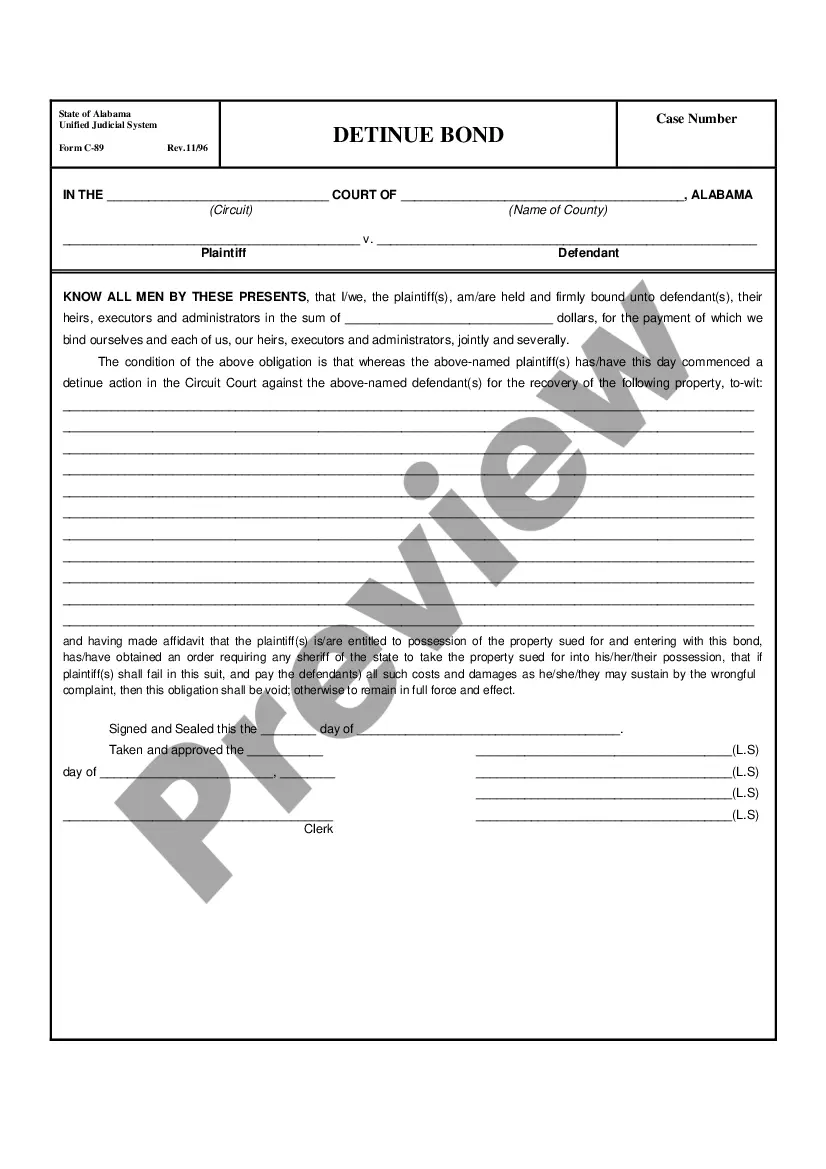

- Initially, make certain you have chosen the right develop to your area/county. You may look over the form while using Review option and read the form outline to guarantee this is basically the best for you.

- In the event the develop will not fulfill your requirements, use the Seach industry to get the appropriate develop.

- When you are sure that the form would work, click the Get now option to obtain the develop.

- Select the rates program you would like and enter in the essential information. Create your accounts and pay money for your order utilizing your PayPal accounts or charge card.

- Pick the data file formatting and down load the authorized file design for your system.

- Complete, edit and printing and indicator the attained South Dakota Flood Insurance Authorization.

US Legal Forms may be the largest catalogue of authorized kinds in which you will find various file web templates. Use the company to down load expertly-produced files that stick to express demands.

Form popularity

FAQ

When a community participates in the NFIP, it participates in one of two phases: the Emergency Program or the Regular Program. Emergency Program: Entry-level participation phase. Regular Program: Most participating communities are in this phase.

Federally-regulated lending institutions complete this form when making, increasing, extending, renewing or purchasing each loan for the purpose is of determining whether flood insurance is required and available.

All federally regulated and insured lenders must require flood insurance before extending a loan to a home in a high-risk flood zone. Mortgage lenders base their flood insurance requirements on Federal Emergency Management Agency (FEMA) flood maps.

Declarations page which includes the policy number and certain information about the insurance company or agent.

The Standard Flood Insurance Policy (SFIP) consists of three coverage forms: The Dwelling Form. The General Property Form, and. The Residential Condominium Building Association Policy (RCBAP) Form.

Fannie Mae does not require evidence of a master flood insurance policy, provided the unit owner maintains an individual flood dwelling policy that meets the coverage requirements of this Guide for the following loans or project types: high LTV refinance loans, units in a two- to four-unit project, and.

The Standard Flood Hazard Determination Form is required for all federally backed loans and is used by lenders to determine the flood risk for their building loans. The form is authorized by the National Flood Insurance Reform Act of 1994 and is imposed on lenders by their regulatory entities, not by FEMA.

The average cost per policy in South Dakota through the NFIP is $961.60. Depending on where you live, this average could vary substantially! Premiums can change depending on your deductibles, the cost of your home and contents inside your home.