South Dakota Appraisal System Evaluation Form

Description

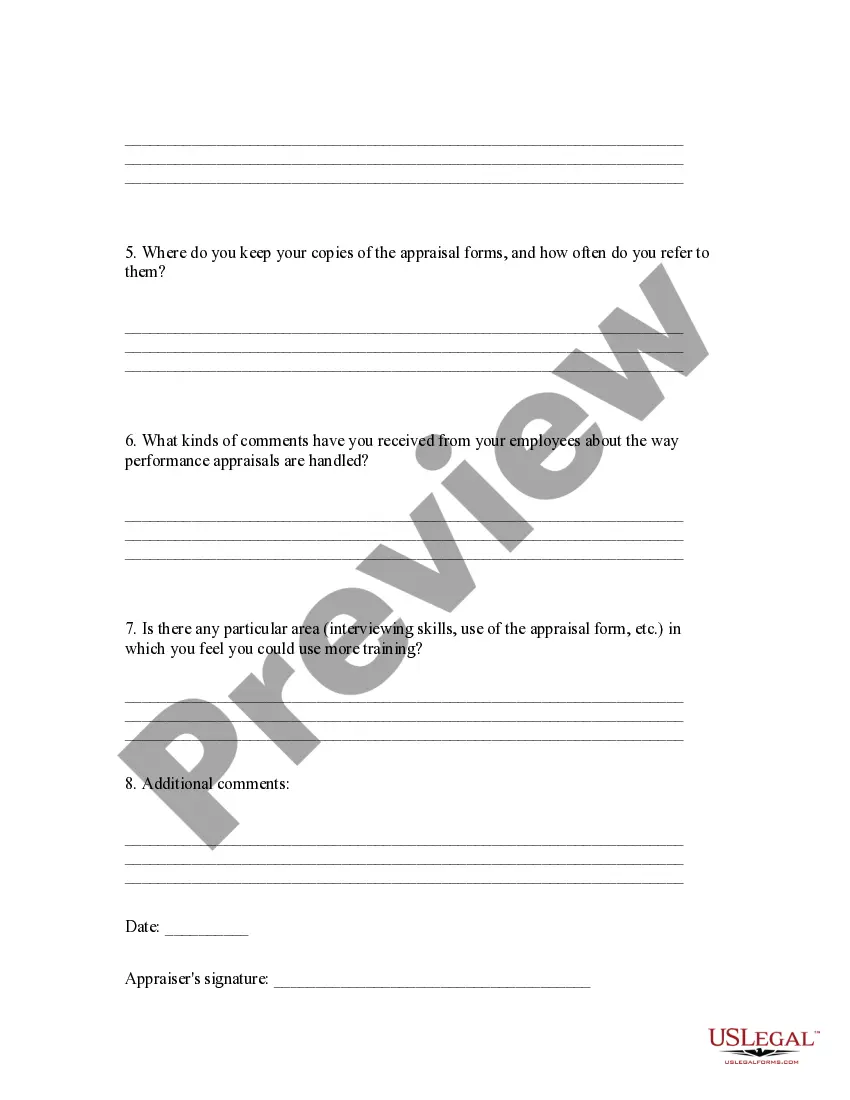

How to fill out Appraisal System Evaluation Form?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a variety of legal form templates available for download or printing.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the South Dakota Appraisal System Evaluation Form in just a few seconds.

Read through the form summary to confirm you have chosen the right document.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already have a membership, Log In to retrieve the South Dakota Appraisal System Evaluation Form from the US Legal Forms collection.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms from the My documents tab of your account.

- If this is your first time using US Legal Forms, below are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form’s details.

Form popularity

FAQ

An appraisal is an opinion or estimate regarding the value of a particular property as of a specific date. Appraisal reports are used by businesses, government agencies, individuals, investors, and mortgage companies when making decisions regarding real estate transactions.

Is that appraisal is a judgment or assessment of the value of something, especially a formal one while evaluation is an assessment, such as an annual personnel performance review used as the basis for a salary increase or bonus, or a summary of a particular situation.

Must be at least 66 years old on or before January 1 of the current year OR disabled (as defined by the Social Security Act). Must have been a South Dakota resident the entire previous year. Must meet the annual income requirements.

The Uniform Standards of Professional Appraisal Practice set forth the requirements for appraisal reports, which may be presented in one of three written formats: self-contained reports, summary reports, and restricted-use reports.

On average, homeowners pay 1.25% of their home value every year in property taxes or $12.50 for every $1,000 in home value. South Dakota property taxes are based on your home's assessed value as determined by the County Director of Equalization.

WHEN ARE MY TAXES DUE? Taxes in South Dakota are due and payable the first of January. However, the first half of the property tax payments are accepted until April 30th without penalty. The second half of taxes will be accepted until October 31st without penalty.

An evaluation should include sufficient information to identify the property, address the property's actual physical condition, and detail the analysis, assumptions, and conclusions that support the market value conclusion. The level of detail documented in the evaluation should reflect the risk in the transaction.

Annual Value (AV) x Property Tax Rate = Property Tax Payable For example, if the AV of your property is $30,000 and your tax rate is 10%, you would pay $30,000 x 10% = $3,000. You may also consider using the IRAS property tax calculator.

Real Estate Appraisal Report Contentdate of letter and salutation.street address of the property and a brief description of the property.identification of the subject property ownership interest.statement that a property inspection and other necessary investigations and analyses were made by the appraiser.More items...

The Interagency Appraisal and Evaluation Guidelines (IGs) defines an evaluation as a valuation permitted by the Agencies' appraisal regulation for transactions that qualify for the appraisal threshold exemption, business loan exemption, or subsequent transaction exemption.