South Dakota Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

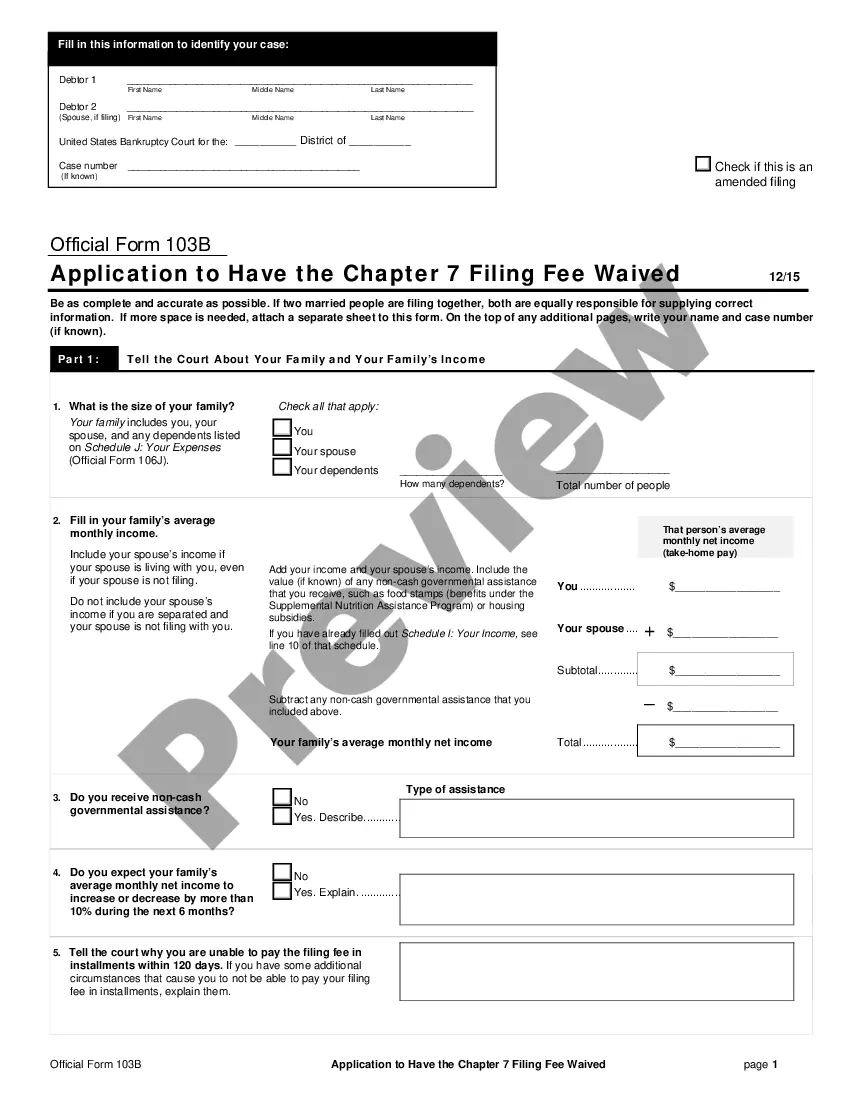

How to fill out Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

You might spend numerous hours on the web trying to locate the legal document template that satisfies the national and local stipulations you require.

US Legal Forms provides thousands of legal documents that have been evaluated by experts.

It is easy to acquire or print the South Dakota Agreement to Dissolve and Wind up Partnership with Division of Assets among Partners from the service.

First, ensure you have selected the correct document template for the county/area of your preference. Review the document description to confirm you have chosen the right form. If available, use the Preview button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and press the Acquire button.

- After that, you can fill out, modify, print, or sign the South Dakota Agreement to Dissolve and Wind up Partnership with Division of Assets among Partners.

- Every legal document template you buy is yours indefinitely.

- To obtain an additional copy of a purchased form, go to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

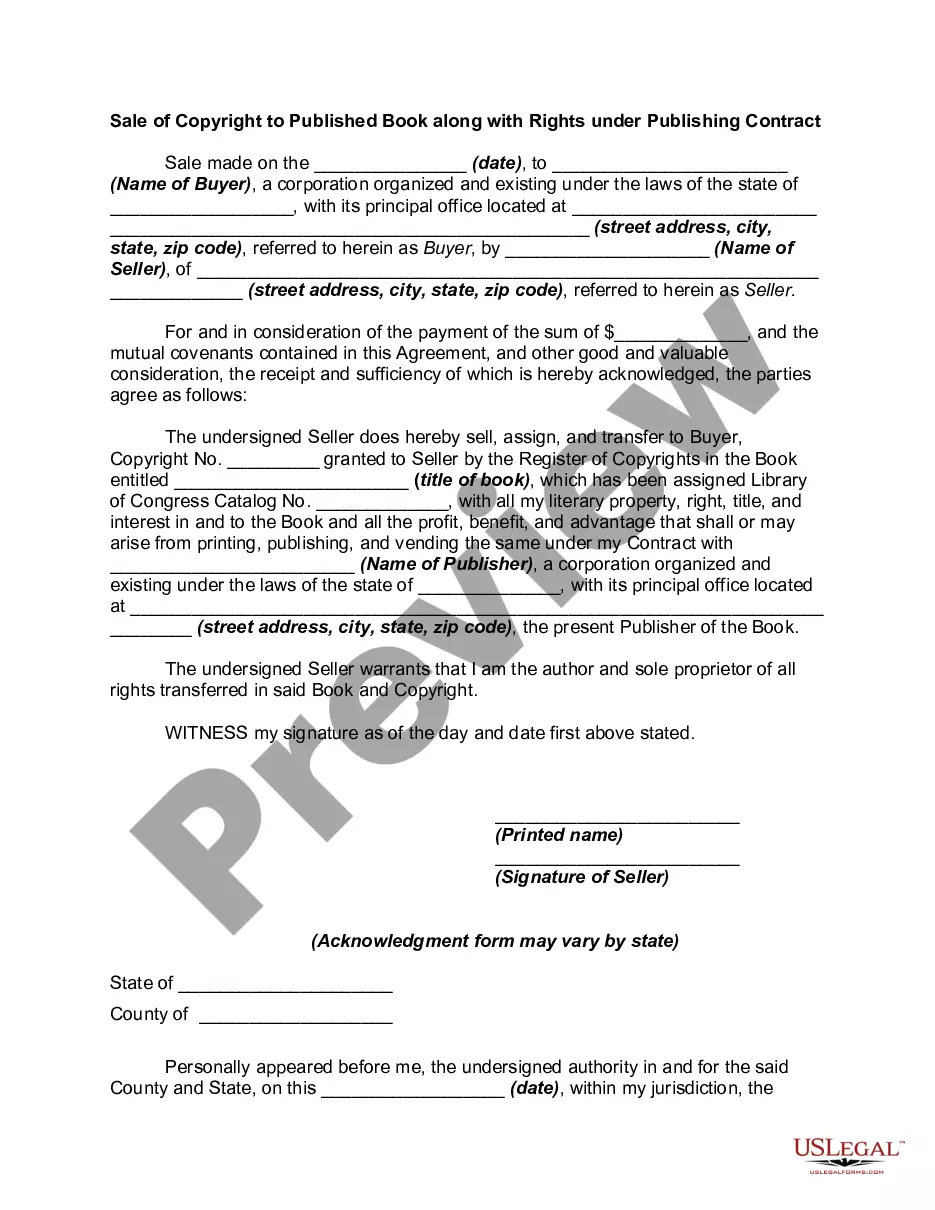

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

On the dissolution of a partnership every partner is entitled, as against the other partners in the firm, and all persons claiming through them in respect of their interests as partners, to have the property of the partnership applied in payment of the debts and liabilities of the firm, and to have the surplus assets

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.