South Dakota Blocked Account Agreement

Description

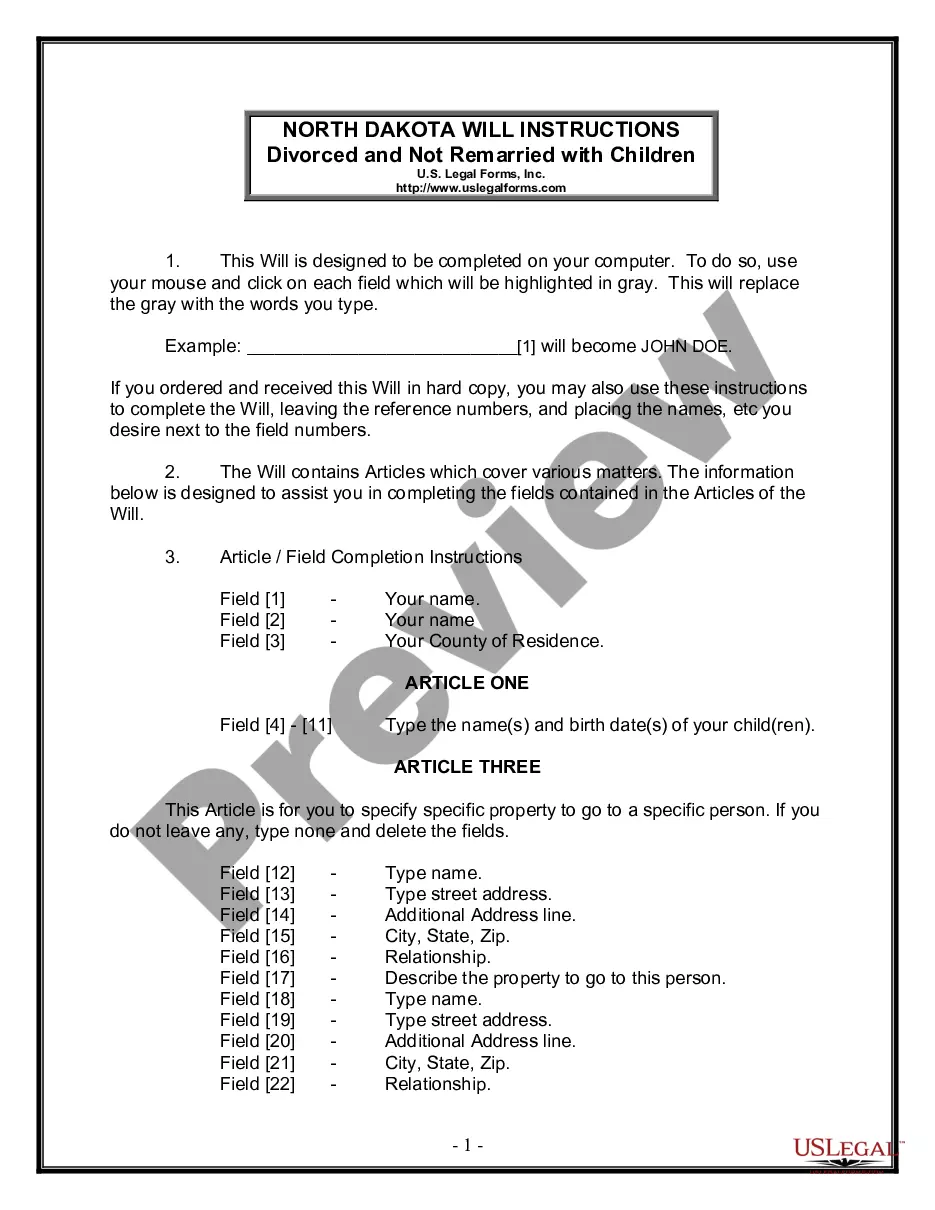

How to fill out Blocked Account Agreement?

Discovering the right lawful document format could be a have a problem. Needless to say, there are plenty of layouts available on the Internet, but how would you find the lawful type you need? Utilize the US Legal Forms internet site. The assistance offers 1000s of layouts, including the South Dakota Blocked Account Agreement, which can be used for enterprise and private requires. All of the types are checked by experts and satisfy state and federal requirements.

If you are already authorized, log in for your accounts and click on the Down load switch to find the South Dakota Blocked Account Agreement. Make use of accounts to check from the lawful types you may have ordered in the past. Go to the My Forms tab of your respective accounts and have yet another copy from the document you need.

If you are a new consumer of US Legal Forms, listed here are simple directions so that you can stick to:

- Initial, make sure you have selected the appropriate type for your area/county. You may look through the form utilizing the Preview switch and read the form outline to make certain it will be the best for you.

- In the event the type is not going to satisfy your preferences, take advantage of the Seach field to find the correct type.

- When you are certain that the form is suitable, go through the Acquire now switch to find the type.

- Opt for the costs program you would like and enter in the essential information. Make your accounts and pay money for an order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit format and obtain the lawful document format for your system.

- Total, modify and print and indication the attained South Dakota Blocked Account Agreement.

US Legal Forms will be the greatest library of lawful types in which you can find different document layouts. Utilize the service to obtain professionally-made files that stick to status requirements.

Form popularity

FAQ

The deposit account control agreement enables the secured party to obtain control over the deposit account, and so enables its security interest in the deposit account to be perfected. It is an example of a collateral document entered into by a debtor to secure obligations under a loan agreement.

Deposit Account Control Agreement (DACA) ? A tri-party agreement among a customer (debtor), a secured party (lender) and a bank that allows the lender to perfect a security interest in the customer's funds by taking control of the deposit account (UCC § 9-104).

BACA means the Blocked Account Control Agreement- the Blocked Account Control Agreement dated July 31, 2023, between Borrower and Bank and executed in ance with Section 6.11 hereof pursuant to which xx has granted ?control?, in ance with Articles 8 and 9 of the UCC, of the Account Collateral to Bank, ...

Blocked Account Agreement means an agreement among the Borrower, the Agent and a Clearing Bank, in form and substance reasonably satisfactory to the Agent, concerning the collection of payments which represent the proceeds of Accounts or of any other Collateral.

If the borrower defaults on the loan, the lender can assume control over the account and instruct the bank to revoke the borrower's ability to make transactions using funds in the account. Active DACAs, or blocked account control agreements (BACA): Only the lender, not the borrower, can make transactions. Deposit Account Control Agreements (DACAs) - Modern Treasury moderntreasury.com ? learn ? what-is-a-dep... moderntreasury.com ? learn ? what-is-a-dep...

Blocked accounts restrict account owners from unlimited and unrestricted use of their funds in that account. Accounts may be blocked or limited for a variety of reasons, including internal bank policies, external regulations, or via a court order or legal decision.

A depository institution that enters into a DACA is incurring significant obligations to both the secured party and its depositor customer. Failure by a depository institution to fulfill its obligations can diminish the value of the lender's deposit account collateral.

A ?blocked? control agreement provides that the borrower will have no access to the funds in the deposit account(s) and that the lender will have complete control over the funds. Instruments of Finance ? The Deposit Account Control Agreement martinllp.net ? instruments-of-finance-the-deposit-... martinllp.net ? instruments-of-finance-the-deposit-...

The deposit account control agreement enables the secured party to obtain control over the deposit account, and so enables its security interest in the deposit account to be perfected. It is an example of a collateral document entered into by a debtor to secure obligations under a loan agreement.