South Dakota Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship

Description

How to fill out Sample Letter For Initiate Probate Proceedings Regarding Estate - Renunciation Of Executorship?

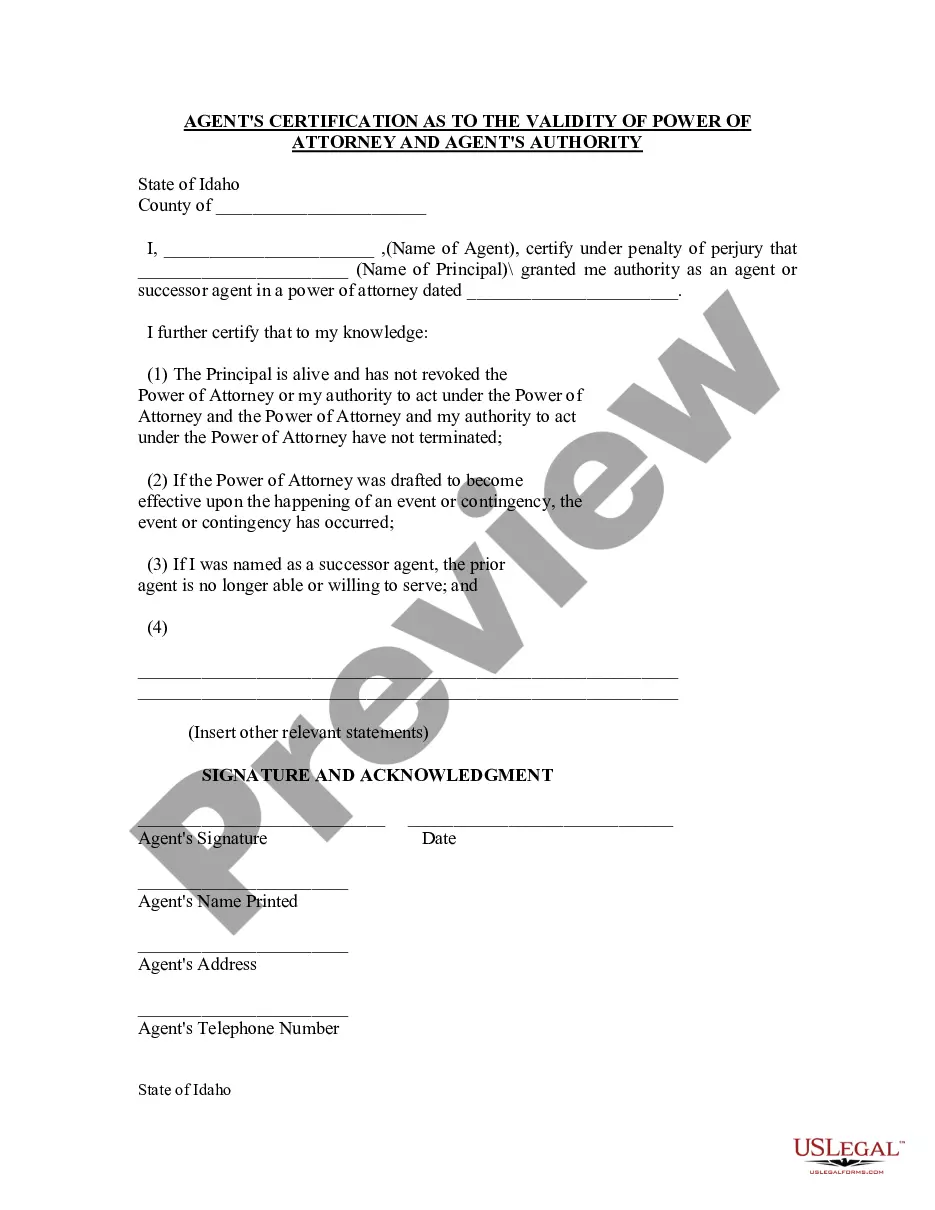

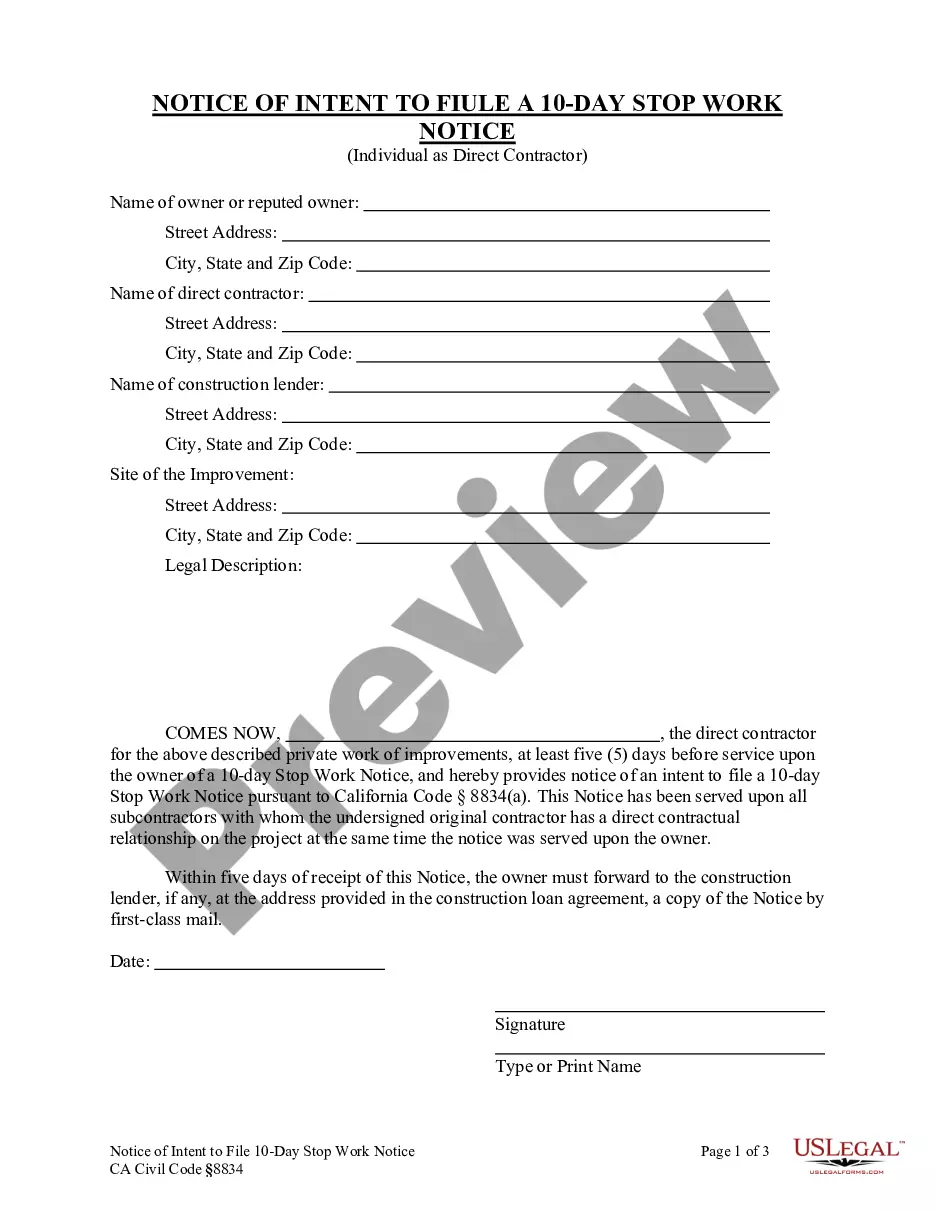

Finding the right lawful file template could be a have difficulties. Obviously, there are plenty of themes available on the Internet, but how would you get the lawful type you want? Make use of the US Legal Forms internet site. The assistance provides a large number of themes, for example the South Dakota Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship, that you can use for enterprise and private requirements. All the kinds are inspected by specialists and meet federal and state requirements.

Should you be currently registered, log in to your bank account and then click the Down load button to obtain the South Dakota Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship. Make use of bank account to search with the lawful kinds you have bought previously. Check out the My Forms tab of your bank account and get yet another version of your file you want.

Should you be a new end user of US Legal Forms, listed below are basic instructions for you to follow:

- Very first, make certain you have chosen the proper type for your personal metropolis/region. You are able to look over the form using the Review button and browse the form information to make certain it will be the best for you.

- In the event the type will not meet your expectations, make use of the Seach field to obtain the appropriate type.

- Once you are positive that the form would work, go through the Buy now button to obtain the type.

- Opt for the costs prepare you would like and type in the necessary details. Build your bank account and pay for an order using your PayPal bank account or credit card.

- Choose the file file format and obtain the lawful file template to your product.

- Total, revise and print out and sign the acquired South Dakota Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship.

US Legal Forms is definitely the greatest collection of lawful kinds for which you can discover different file themes. Make use of the company to obtain skillfully-manufactured files that follow state requirements.

Form popularity

FAQ

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

The court will appoint a personal representative to administer the estate and distribute the property. This person is often a surviving spouse or another beneficiary. Because there is no will, state law will be used to distribute property. Property will usually go to surviving spouses and other heirs.

The court will appoint a personal representative to administer the estate and distribute the property. This person is often a surviving spouse or another beneficiary. Because there is no will, state law will be used to distribute property. Property will usually go to surviving spouses and other heirs.

No. In South Dakota, not all your property may have to go through probate. The assets that do go through probate make up your probate estate. These are usually assets that are titled solely in your name and come under the control of your personal representative (formerly known as an executor).

The surviving spouse who is a devisee of the decedent has the highest priority for consideration as the personal representative in informal probate proceedings.

(a) An informal probate proceeding is an informal proceeding for probate of a decedent's will with or without an application for informal appointment. An informal appointment proceeding is an informal proceeding for appointment of a personal representative in testate or intestate estates.

If a person creates a will before passing away in South Dakota, the will must go through the legal probate process after that person's death. This allows the deceased person's assets to be distributed as instructed in the will, but complications can occur that require an attorney's assistance.

However, it is possible to skip probate in South Dakota if the entire value of an estate is less than $50,000. In that case, the estate would pass through what's called a simplified probate process.