South Dakota Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

If you need to acquire, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search to find the documents you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find alternative legal form templates.

Step 4. Once you have found the form you need, click the Buy Now button. Choose the payment plan you prefer and input your details to register for an account.

- Use US Legal Forms to obtain the South Dakota Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Wife's Death in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to find the South Dakota Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Wife's Death.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

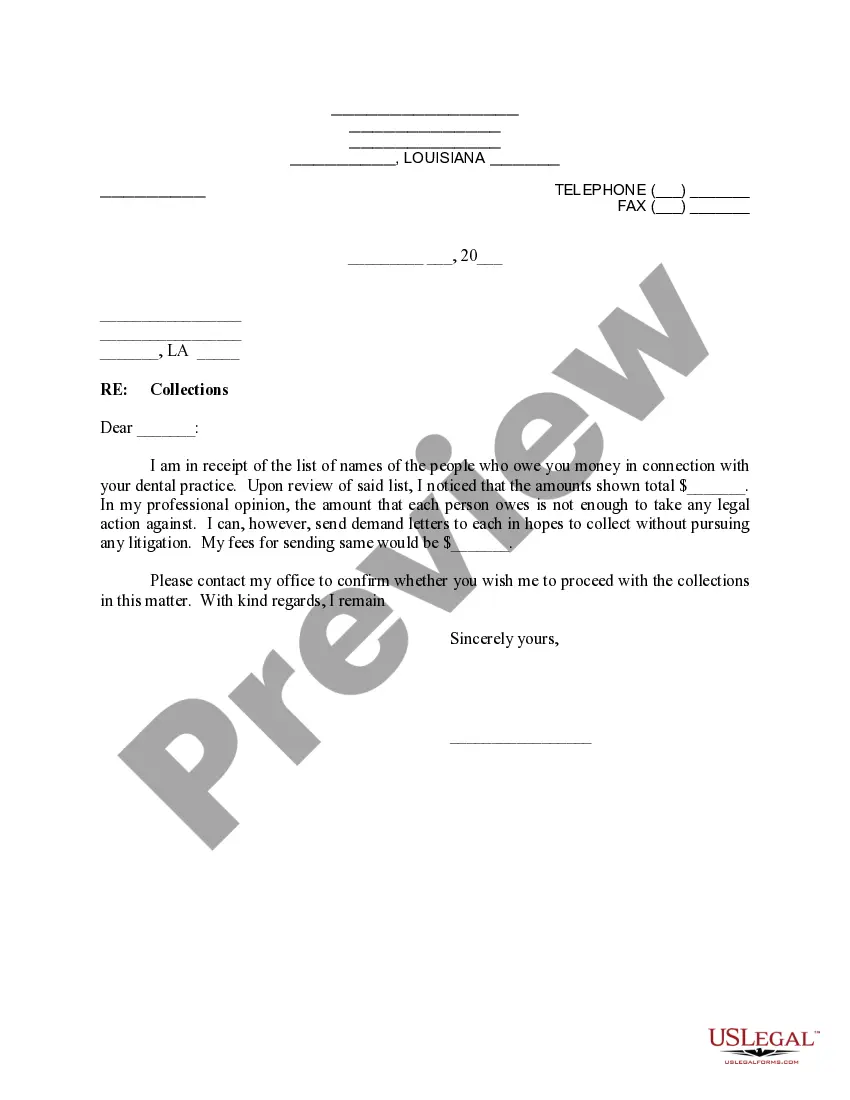

- Step 2. Use the Review option to browse the form’s content. Make sure to read the description.

Form popularity

FAQ

Taxation of Testamentary Trusts Once a testamentary trust has been created, it becomes a taxable entity in its own right and is thus subject to income taxes. If it has $600 or more in annual income, it must file a U.S. Income Tax Return for Estates and Trusts (Form 1041) for that year.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouseunder some arrangements, the surviving spouse can also receive principal payments.

The standard rules apply to these four tax brackets. So, for example, if a trust earns $10,000 in income during 2022 it would pay the following taxes: 10% of $2,750 (all earnings between $0 $2,750) = $275. 24% of $7,099 (all earnings between $2,751 $9,850) = $1,703.76.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year. The trustee must issue you a Schedule K-1 for the income distributed to you, which you must submit with your tax return.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

Generally, trusts are considered the separate property of the beneficiary spouse and the assets in a trust are not subject to equitable distribution unless they contain marital property.

How does Testamentary Trust Taxation Work? Testamentary Trusts are taxed as a whole, though beneficiaries will not be forced to pay taxes on distributions from the Trust. Note that you could be responsible for the capital gains tax, depending on your state.