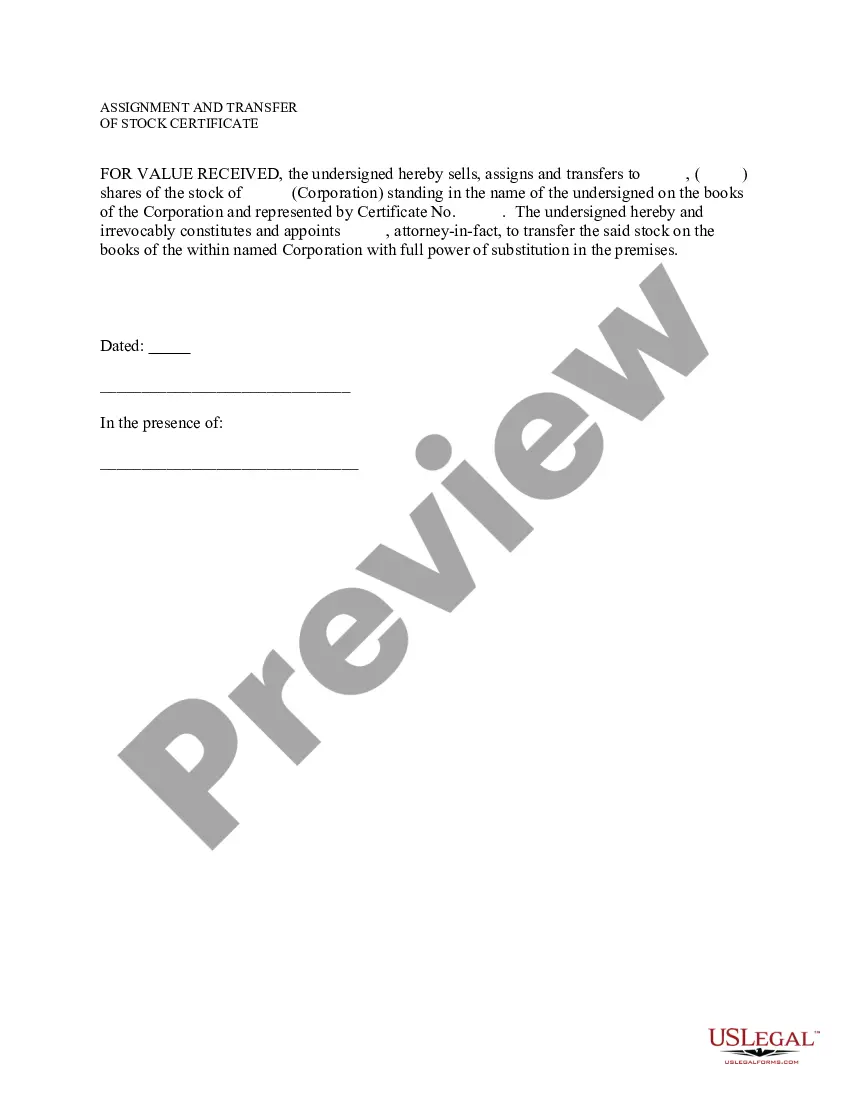

South Dakota Sample Letter for Assignment and Transfer of Stock Certificate

Description

How to fill out Sample Letter For Assignment And Transfer Of Stock Certificate?

US Legal Forms - among the greatest libraries of lawful types in the United States - offers a variety of lawful record templates it is possible to download or print out. Utilizing the site, you can get 1000s of types for enterprise and person uses, sorted by types, states, or search phrases.You will discover the most up-to-date variations of types such as the South Dakota Sample Letter for Assignment and Transfer of Stock Certificate within minutes.

If you already possess a registration, log in and download South Dakota Sample Letter for Assignment and Transfer of Stock Certificate from your US Legal Forms catalogue. The Acquire option can look on every form you view. You have accessibility to all in the past downloaded types in the My Forms tab of your accounts.

In order to use US Legal Forms the first time, allow me to share simple directions to help you get started out:

- Make sure you have picked out the right form to your town/region. Go through the Preview option to review the form`s content. See the form explanation to ensure that you have chosen the right form.

- In the event the form doesn`t suit your requirements, make use of the Lookup industry at the top of the display to get the one that does.

- In case you are satisfied with the form, confirm your choice by simply clicking the Get now option. Then, opt for the prices strategy you prefer and provide your credentials to sign up on an accounts.

- Procedure the purchase. Make use of bank card or PayPal accounts to perform the purchase.

- Select the formatting and download the form on your own device.

- Make modifications. Fill out, modify and print out and indicator the downloaded South Dakota Sample Letter for Assignment and Transfer of Stock Certificate.

Each web template you put into your bank account lacks an expiration day which is your own eternally. So, if you wish to download or print out another backup, just visit the My Forms section and click on the form you want.

Gain access to the South Dakota Sample Letter for Assignment and Transfer of Stock Certificate with US Legal Forms, by far the most comprehensive catalogue of lawful record templates. Use 1000s of specialist and state-distinct templates that meet up with your company or person requirements and requirements.

Form popularity

FAQ

Transfer of Ownership If you hold securities in physical certificate form and want to transfer or sell them, you will need to sign the certificates or securities powers. You will probably need to get your signature "guaranteed" before a transfer agent will accept the transaction.

A formal signed instruction letter detailing the transfer by including the name of the transferee(s) with addresses and social security or tax identification numbers and the number of shares to be transferred to each. A Substitute IRS Form W-9 (Certification of Taxpayer Identification) completed for each transferee.

Documents Required For Transfer of Shares Original Share Certificate of share to be transferred. Certificate of Stamp duty payment (Franking) on issue of share certificate. Valuation and the share transfer agreement. Share transfer form duly signed by the parties. ID and address proof of the transferor and transferee.

Requirements The Articles of Association of the company must not restrict the transfer of shares. Duly executing share transfer deed in form SH-4. Submission of SH-4, original share certificates, and other relevant documents with the Company. KYC documents of the transferor and the transferee.

A Demat instruction slip (DIS), a share transfer deed, as well as necessary Know Your Customer (KYC) paperwork are frequently needed documentation for share transfers.

Don't use correction fluid or stick labels on the form. 1 Consideration money. ... 2 Full name of Undertaking. ... 3 Full description of Security. ... 4 Number or amount of Shares, Stock or other security. ... 5 Name(s) and address of registered holder(s) ... 6 Signature(s) ... 7 Name(s) and address of person(s) receiving the shares.

Documents Required for Transfer of Shares The Articles of Incorporation of the corporation. The Bylaws or shareholder agreement of the corporation. The ID and address proof of the transferor and transferee. Written resolution taken by the company regarding the share transfer.

The process of changing stock ownership The broker will simply make the transfer on its own internal books. If you transfer shares outside your broker, you'll need a broker-to-broker transfer form, and your current broker will need instructions on how to make the transfer to the receiving broker.