South Dakota Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

It is feasible to utilize the Internet looking for the legal document template that fulfills the state and federal criteria you need.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

You can obtain or print the South Dakota Agreement to Form Partnership in Future to Conduct Business through our service.

If you are visiting the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the state/city of your choice.

- If you possess a US Legal Forms account, you can Log In and then select the Obtain option.

- After that, you can fill out, modify, print, or sign the South Dakota Agreement to Form Partnership in Future to Conduct Business.

- Every legal document template you purchase is yours permanently.

- To get an additional copy of an acquired form, go to the My documents tab and click the corresponding option.

Form popularity

FAQ

South Dakota does not have a state income tax for partnerships, which simplifies the tax structure for businesses. This absence of state income tax can be a significant benefit in your South Dakota Agreement to Form Partnership in Future to Conduct Business. Always consult with a tax professional for personalized advice.

Yes, partnerships must file a separate tax return, as they are considered pass-through entities for tax purposes. The partners report their share of income or loss on their personal tax returns. Be sure to reflect this in your South Dakota Agreement to Form Partnership in Future to Conduct Business to ensure clarity.

To set up a business partnership agreement, start by drafting a document that outlines each partner's roles, contributions, and profit-sharing arrangements. Clearly define the terms to avoid future disputes. Tools like the uslegalforms platform can help you create a comprehensive South Dakota Agreement to Form Partnership in Future to Conduct Business.

No, South Dakota does not impose a business income tax. This can be advantageous for businesses looking to maximize profits. However, be sure to address any other applicable taxes and considerations in your South Dakota Agreement to Form Partnership in Future to Conduct Business.

The four main types of partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type offers unique structures and responsibilities. When creating a South Dakota Agreement to Form Partnership in Future to Conduct Business, identify which partnership type suits your business goals.

Yes, South Dakota does require partnerships to file a partnership tax return. This involves reporting the income, deductions, and credits of the partnership. Understanding the partnership tax return process is crucial when drafting your South Dakota Agreement to Form Partnership in Future to Conduct Business.

Yes, South Dakota recognizes domestic partnerships. These partnerships can provide important legal benefits, similar to marriages. If you are considering a South Dakota Agreement to Form Partnership in Future to Conduct Business, be aware of how domestic partnership laws may impact your arrangement.

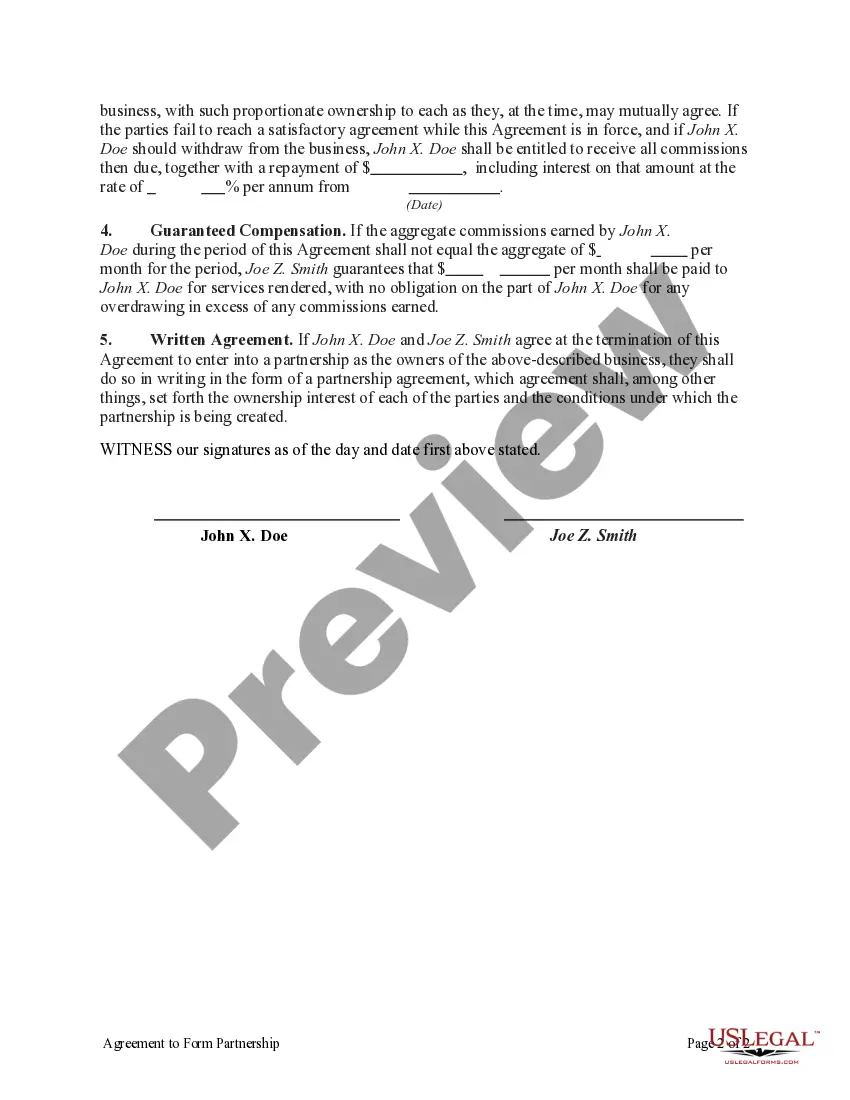

Filling out a partnership form involves providing details about each partner, including their roles and contributions. Ensure that you clearly articulate the purpose of the partnership and how decisions will be made. Referring to a South Dakota Agreement to Form Partnership in Future to Conduct Business can provide clarity on how each section should be completed.

A partnership agreement should include partner identities, business objectives, capital contributions, and distribution of profits and losses. Additional sections could cover dispute resolution mechanisms and exit procedures for partners. A solid South Dakota Agreement to Form Partnership in Future to Conduct Business will typically encompass all these vital components.

Filling out a partnership agreement requires entering pertinent details about the partners and the business structure. Clearly define roles, clarify financial contributions, and outline the procedures for resolving conflicts. By following a South Dakota Agreement to Form Partnership in Future to Conduct Business format, you can ensure that all essential aspects are covered.