South Dakota Sales Representative Evaluation Checklist

Description

How to fill out Sales Representative Evaluation Checklist?

Have you ever been in a situation where you need documentation for both business or personal reasons almost every day? There are numerous legal document templates available online, but finding ones you can trust isn’t straightforward.

US Legal Forms provides thousands of form templates, such as the South Dakota Sales Representative Evaluation Checklist, designed to comply with state and federal regulations.

If you're already familiar with the US Legal Forms website and have an account, simply Log In. Then you can download the South Dakota Sales Representative Evaluation Checklist template.

- Obtain the form you need and ensure it is for the correct state/region.

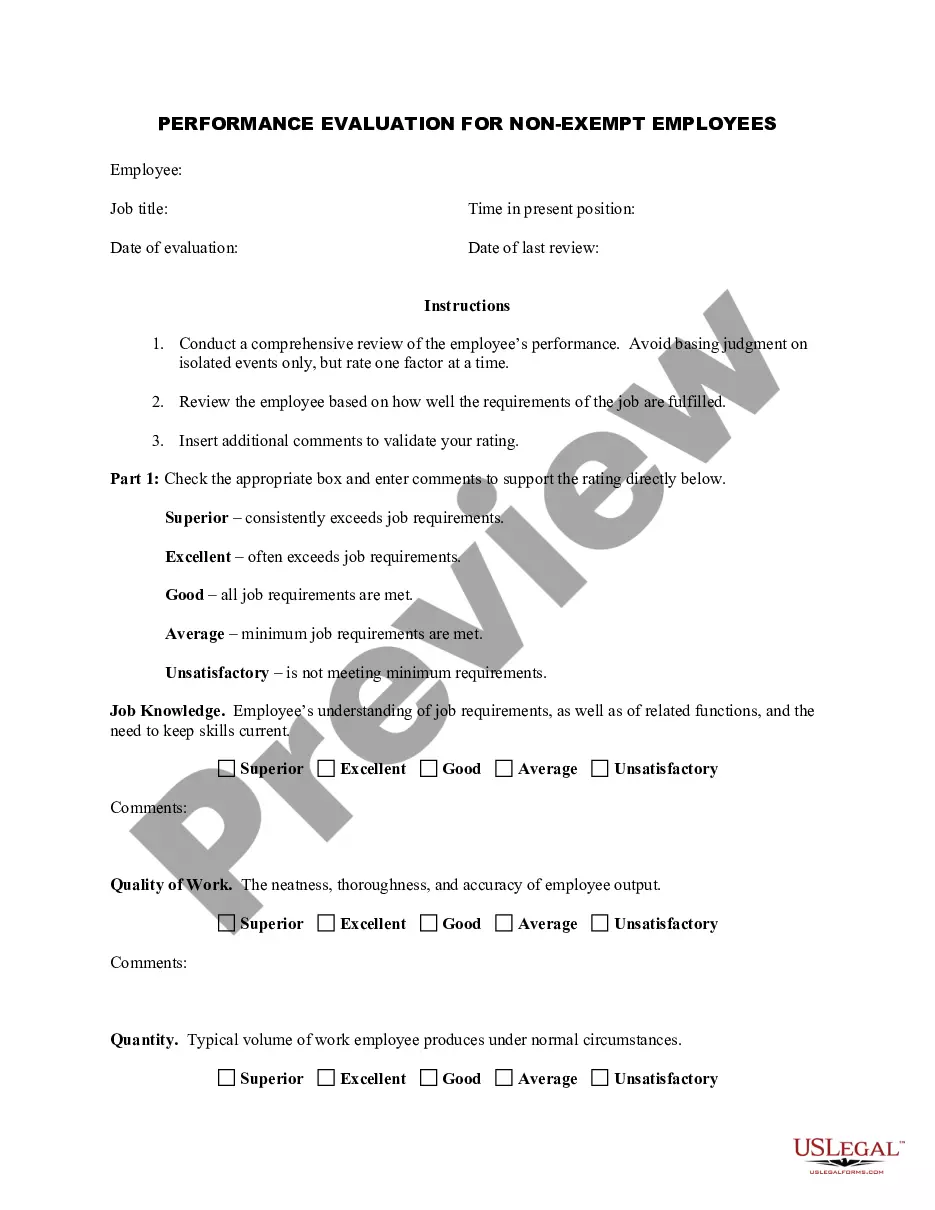

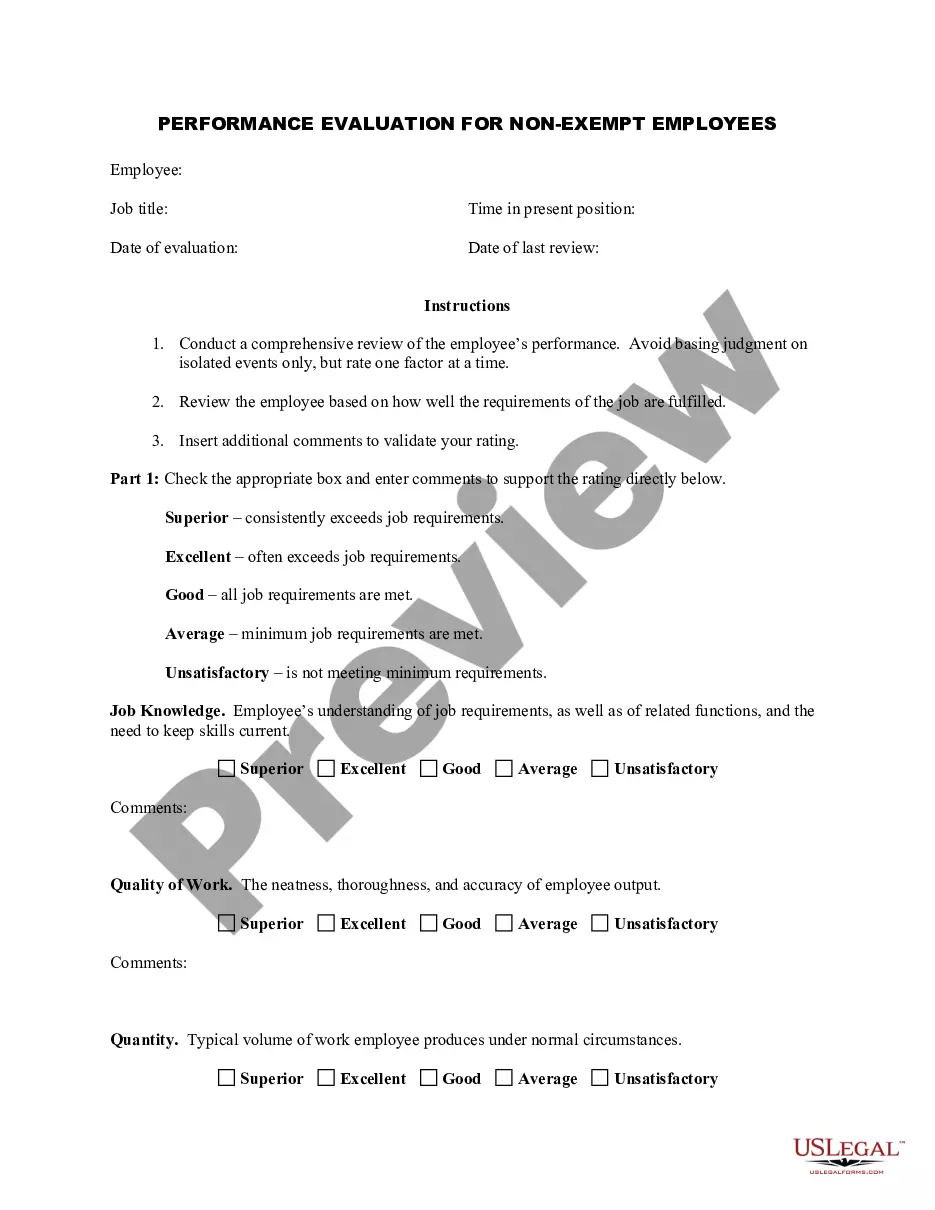

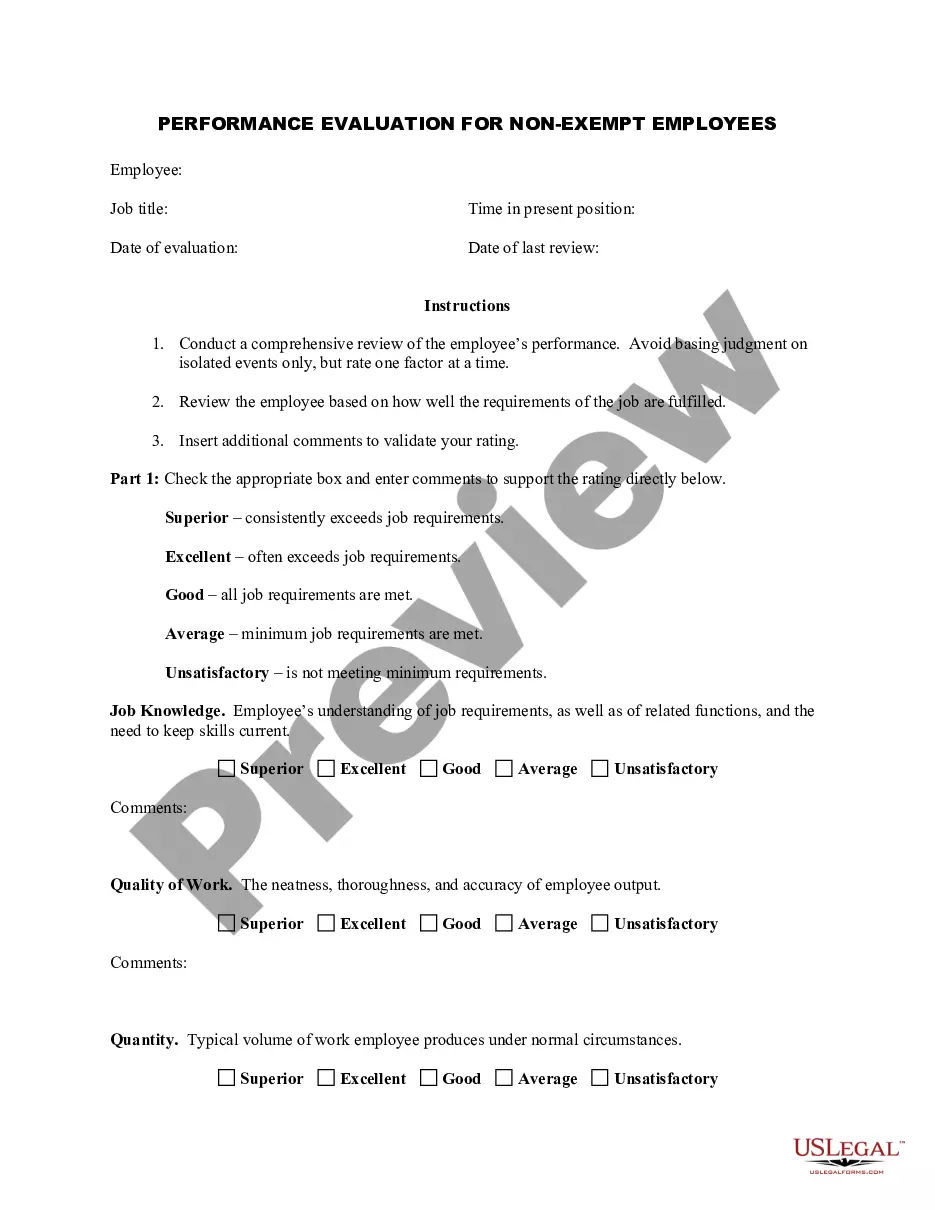

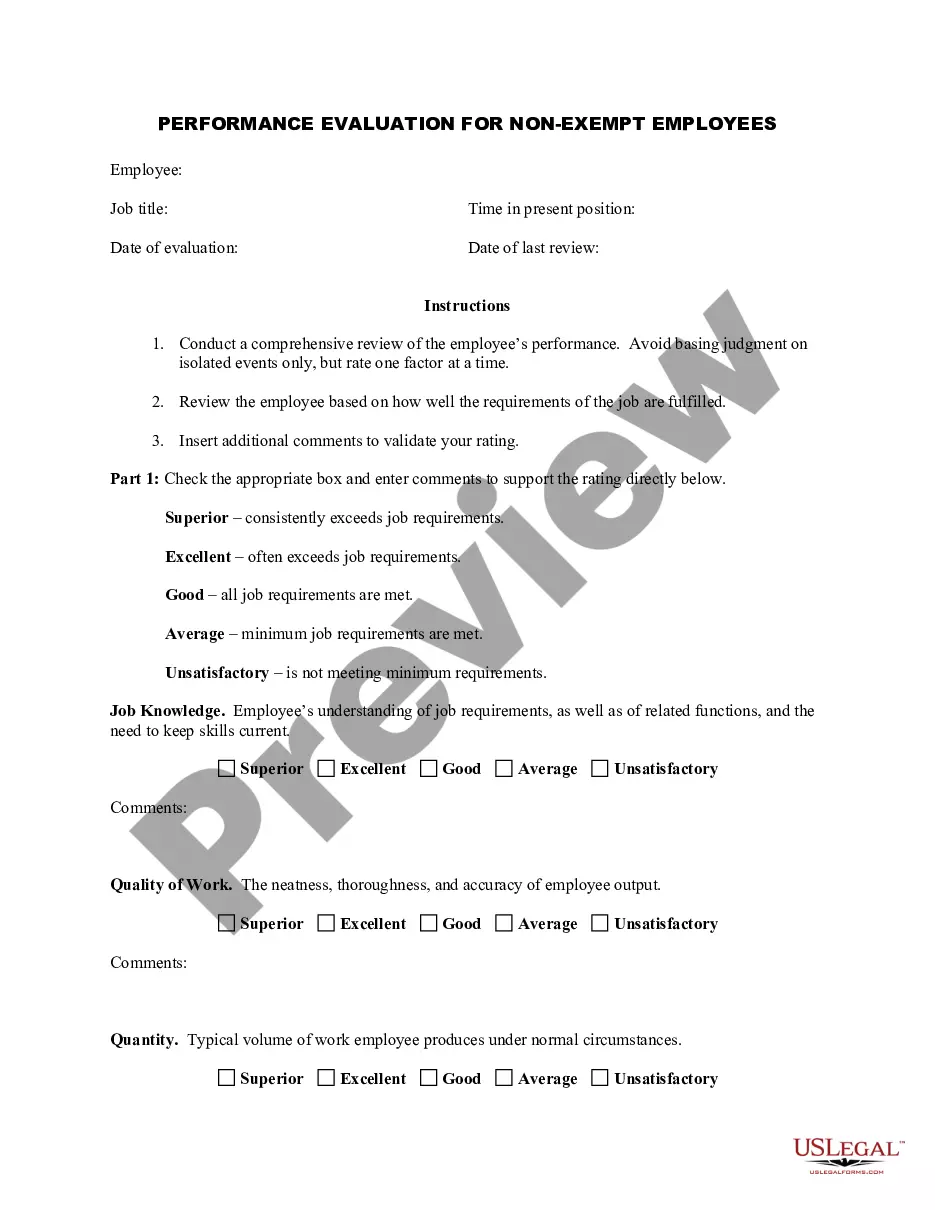

- Use the Review button to examine the form.

- Check the description to confirm that you've selected the right form.

- If the form isn’t what you require, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, simply click Get now.

- Choose the pricing plan you prefer, enter the necessary details to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

In South Dakota, certain items are exempt from sales tax, including specific food items, prescription drugs, and certain agricultural products. Understanding what is not taxed helps you make informed purchasing decisions and reduces unnecessary expenses. The South Dakota Sales Representative Evaluation Checklist provides detailed insights into taxable and non-taxable items, making it easier for you to manage your business or personal finances. Stay informed to take advantage of these exemptions.

To obtain a sales tax exemption in South Dakota, you need to complete the appropriate application form and provide necessary documentation to support your request. Certain organizations, such as non-profits, and specific purchases may qualify for exemptions. The South Dakota Sales Representative Evaluation Checklist can guide you through the exemption process, ensuring you understand what qualifies for tax-exempt status. With clear steps, you can secure the exemption you need.

In South Dakota, any business selling tangible goods or certain services must obtain a sales tax license. This includes retail sellers, manufacturers, and wholesalers. The South Dakota Sales Representative Evaluation Checklist can help you determine if you need to register your business for sales tax. With the right guidance, you can navigate the requirements effectively.

To obtain a tax ID number in South Dakota, you should apply online through the IRS website. This identification number is essential for reporting taxes and can be acquired quickly. When preparing your application, consider utilizing a South Dakota Sales Representative Evaluation Checklist to confirm that you have all the required information at your fingertips.

Getting a South Dakota sales tax permit involves registering your business with the state's Department of Revenue. The application can typically be completed online, and make sure you have your business name and details ready. A South Dakota Sales Representative Evaluation Checklist can be a valuable tool to help ensure you do not miss any critical steps in the application process.

To obtain a sales tax license in South Dakota, you must register online through the state’s Department of Revenue website. Make sure to have your business information and details handy. Following a South Dakota Sales Representative Evaluation Checklist will help you ensure that you have all the necessary documents for a successful application.

No, a sales tax permit and an Employer Identification Number (EIN) are not the same. A sales tax permit allows you to collect sales tax from customers, while an EIN is a unique identifier issued by the IRS for tax purposes. Understanding these differences is crucial, especially when using a South Dakota Sales Representative Evaluation Checklist to ensure compliance with state laws.

South Dakota does have reciprocity agreements with certain states regarding real estate licenses. This means that if you hold a valid real estate license in one of those states, you may be able to obtain a South Dakota license without retaking the entire exam. Utilizing a South Dakota Sales Representative Evaluation Checklist can guide you through the necessary steps and documentation needed for a smooth transition.

In South Dakota, most services are exempt from sales tax, with a few notable exceptions such as the sale of tangible personal property or specific real estate services. This exemption supports both residents and businesses financially. For a complete understanding of what is taxable, you can rely on the guidance provided by the South Dakota Sales Representative Evaluation Checklist.

South Dakota has no state income tax as a policy aimed at attracting businesses and individuals to the state. This allows residents to keep more of their earnings, potentially fostering economic growth. Understanding how state policies impact you can be facilitated by the South Dakota Sales Representative Evaluation Checklist.