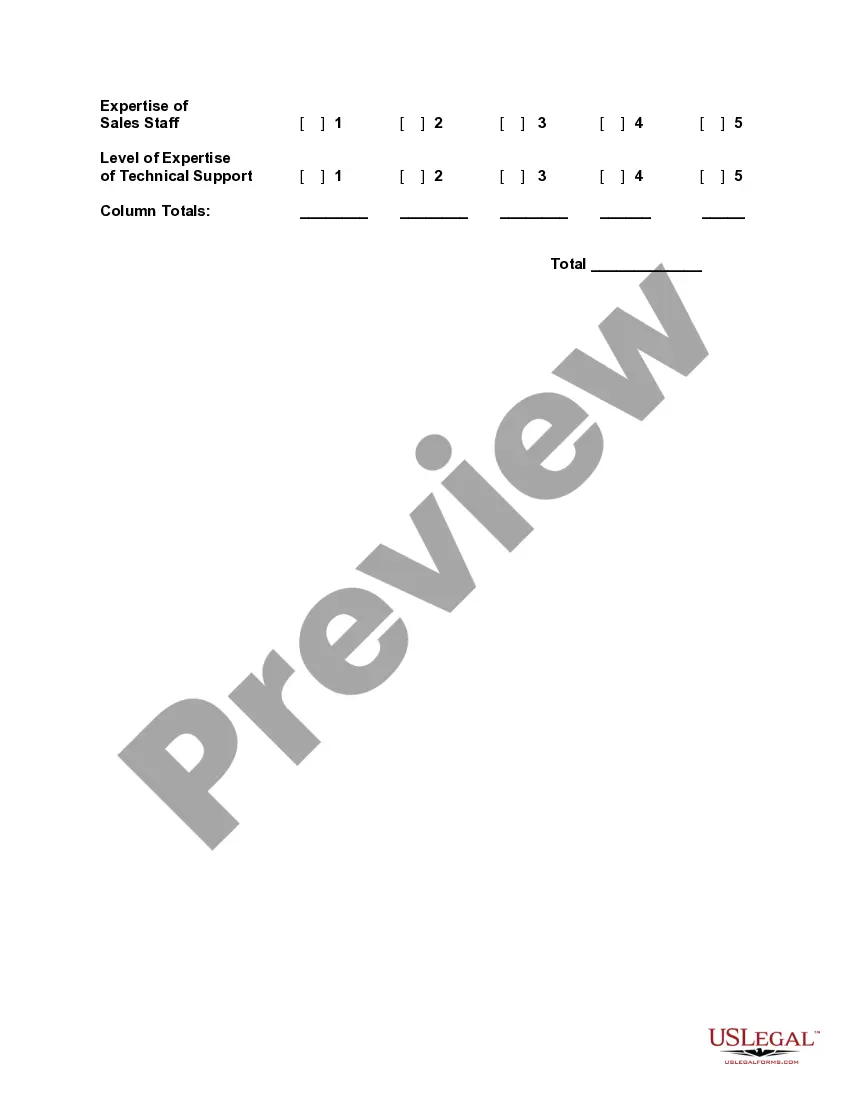

South Dakota Vendor Evaluation

Description

How to fill out Vendor Evaluation?

If you want to finalize, acquire, or output authentic document templates, utilize US Legal Forms, the premier collection of authentic forms that can be located online.

Utilize the site’s straightforward and efficient search to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Choose the payment plan you prefer and submit your information to register for an account.

Step 5. Process the transaction. You can use your Visa, MasterCard, or PayPal account to complete the purchase.

- Employ US Legal Forms to obtain the South Dakota Vendor Evaluation with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to find the South Dakota Vendor Evaluation.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Preview option to view the form’s details. Don't forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find additional models of the legal form format.

Form popularity

FAQ

Yes, South Dakota requires certain businesses to obtain a business license. The requirements vary based on the type of business and location. It’s essential to check with local authorities to comply with these regulations. This knowledge can significantly influence your South Dakota Vendor Evaluation, underscoring your commitment to following legal guidelines.

If you're conducting business activities or wish to open a business bank account, you likely need to register your business in South Dakota. Registration not only ensures legal compliance but also enhances your professional image. This step is crucial for performing a thorough South Dakota Vendor Evaluation and establishing beneficial relationships in the business ecosystem.

To look up an LLC in South Dakota, you can utilize the Secretary of State's website. They provide an online search tool where you can enter the business name and access detailed information. This resource is invaluable for anyone conducting a South Dakota Vendor Evaluation, as it helps you understand your competition and confirm the legitimacy of potential vendors.

Yes, registering your business is often required to file taxes properly. Without registration, it can be complicated to claim deductions or apply for business tax benefits. This registration also aids in maintaining clear financial records. Therefore, when you perform a South Dakota Vendor Evaluation, having a registered business simplifies your accounting processes.

You do not need to register your business in every state unless you operate there. However, if you plan to conduct business activities in multiple states, it is generally wise to register. This ensures compliance with local laws and helps in building a solid reputation. For instance, when conducting a South Dakota Vendor Evaluation, your inclination to register your business will bolster your standing.

Registering a business in South Dakota offers several advantages. It provides legal protection for your business name, making it exclusive to you. Additionally, a registered business can gain credibility with customers and suppliers. This step often leads to better opportunities for funding and partnerships, making your South Dakota Vendor Evaluation more favorable.

Filing sales tax in South Dakota requires businesses to collect the appropriate tax from customers and report it to the South Dakota Department of Revenue. You can file online or via paper forms, depending on your preference. To streamline this process, consider using the US Legal Forms platform, which can assist you during your South Dakota Vendor Evaluation.

South Dakota has chosen to forgo a state income tax in favor of other revenue sources, such as sales tax and tourism. This tax structure can create a more favorable environment for both businesses and individuals. As you assess your business model, consider how a South Dakota Vendor Evaluation can help you leverage this unique tax situation.

In South Dakota, you do not need to file a state income tax return, as there is no state income tax. However, you'll still be responsible for federal taxes. A complete South Dakota Vendor Evaluation ensures you understand your federal obligations while recognizing the absence of state income tax.

To obtain a tax ID number in South Dakota, you will need to apply through the South Dakota Department of Revenue. The application process is straightforward and involves providing your business details. If you are using the US Legal Forms platform, you can find all forms and guidance necessary for a successful South Dakota Vendor Evaluation.