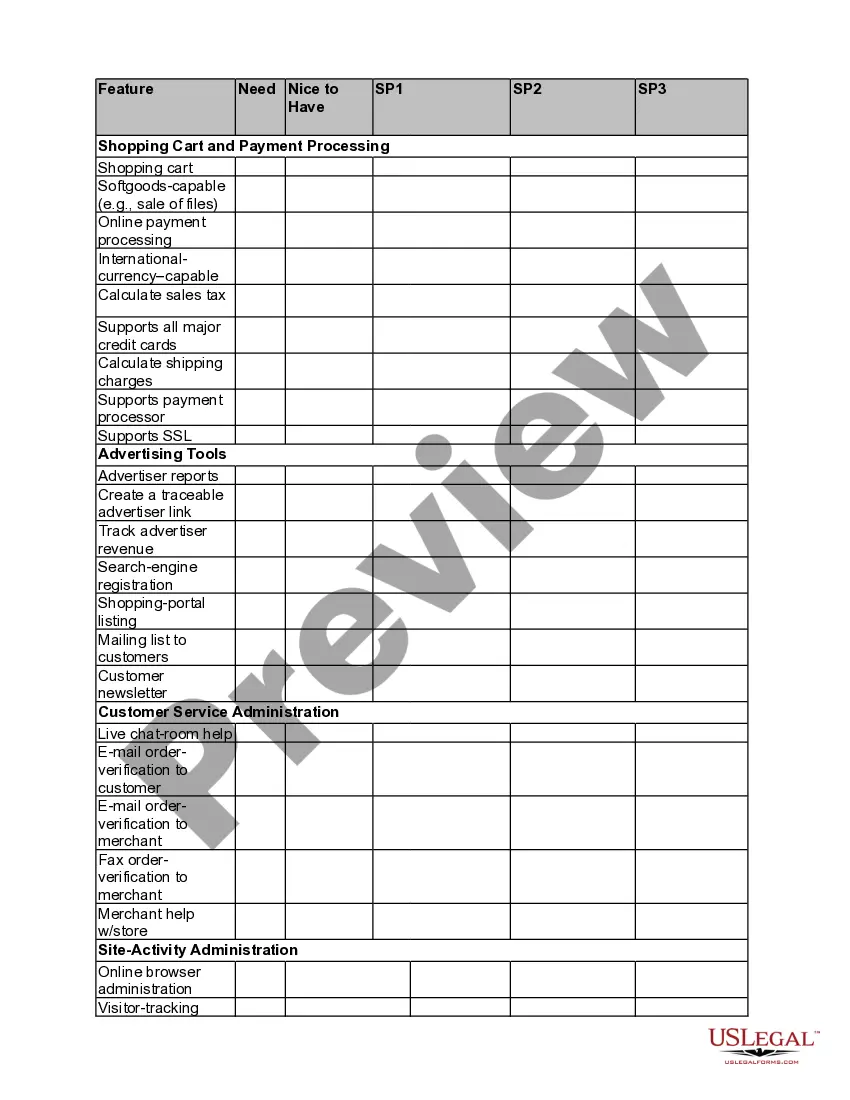

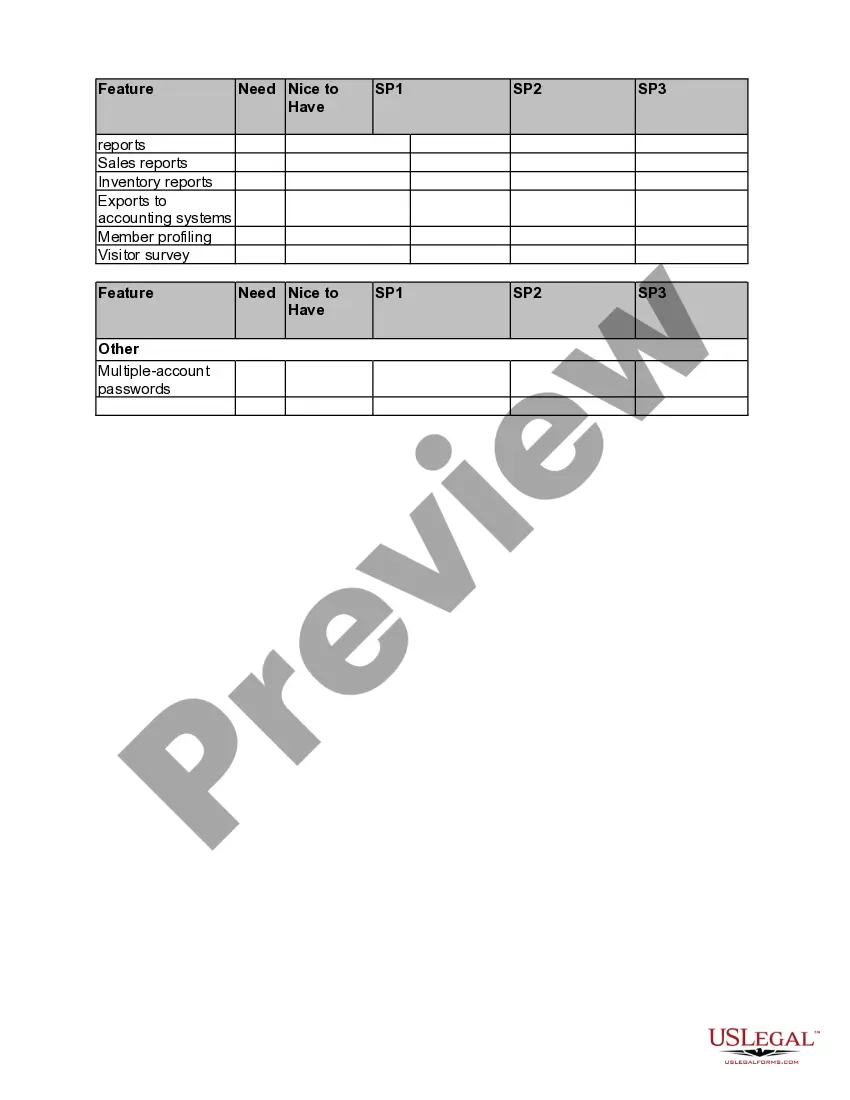

South Dakota E-commerce Product-Comparison Matrix

Description

How to fill out E-commerce Product-Comparison Matrix?

Selecting the appropriate legal document template might be a challenge.

It goes without saying that there are numerous designs accessible online, but how can you acquire the legal document you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple guidelines you should follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Preview option and read the form description to confirm it is the appropriate one for you. If the form does not meet your requirements, use the Search field to find the right form. Once you are confident that the form is suitable, click the Get now button to obtain the form. Choose the pricing plan you prefer and input the necessary information. Create your account and place an order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained South Dakota E-commerce Product-Comparison Matrix.

- The service provides a vast array of templates, including the South Dakota E-commerce Product-Comparison Matrix, suitable for both business and personal needs.

- All forms are evaluated by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Acquire button to obtain the South Dakota E-commerce Product-Comparison Matrix.

- Use your account to browse through the legal documents you may have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

Form popularity

FAQ

On June 21, 2018, The United States Supreme Court ruled 5-4 in South Dakota v. Wayfair that states can mandate that businesses without a physical presence in a state with more than 200 transactions or $100,000 in-state sales collect and remit sales taxes on transactions in the state.

Calculating Sales Tax(Cost of the Item) (Sales Tax Rate) = Total Sales Tax.50 Cost of the Item .101 Sales Tax Rate = $5.05 Total Sales Tax(Cost of the Item) (1 + Sales Tax Rate) = Total Transaction Cost.50 Cost of the Item 1.101 1 + Sales Tax Rate = $55.05 Total Transaction CostMore items...?

The basic rule for collecting sales tax from online sales is:If your business has a physical presence, or nexus, in a state, you must collect applicable sales taxes from online customers in that state.If you do not have a physical presence, you generally do not have to collect sales tax for online sales.

South Dakota v. Wayfair was a 2018 U.S. Supreme Court decision eliminating the requirement that a seller have physical presence in the taxing state to be able to collect and remit sales taxes to that state. It expanded states' abilities to collect sales taxes from e-commerce and other remote transactions.

Wayfair, Inc. On June 21, 2018, the United States Supreme Court ruled in a 5-4 decision in South Dakota v. Wayfair, Inc., et al, that states can generally require an out-of-state seller to collect and remit sales tax on sales to in-state consumers even if the seller has no physical presence in the consumer's state.

The Impact of the Wayfair Decision on Nexus The Wayfair ruling indicates that physical presence is no longer required for a state to impose sales and use tax on a remote seller. This decision impacts nexus, and therefore impacts tax compliance for any organization operating across state borders.

Generally speaking, if an online retailer maintains a physical presence in a state that charges a sales tax on most purchases, then that online retailer must charge sales tax on any items that are sold to customers within the home state.