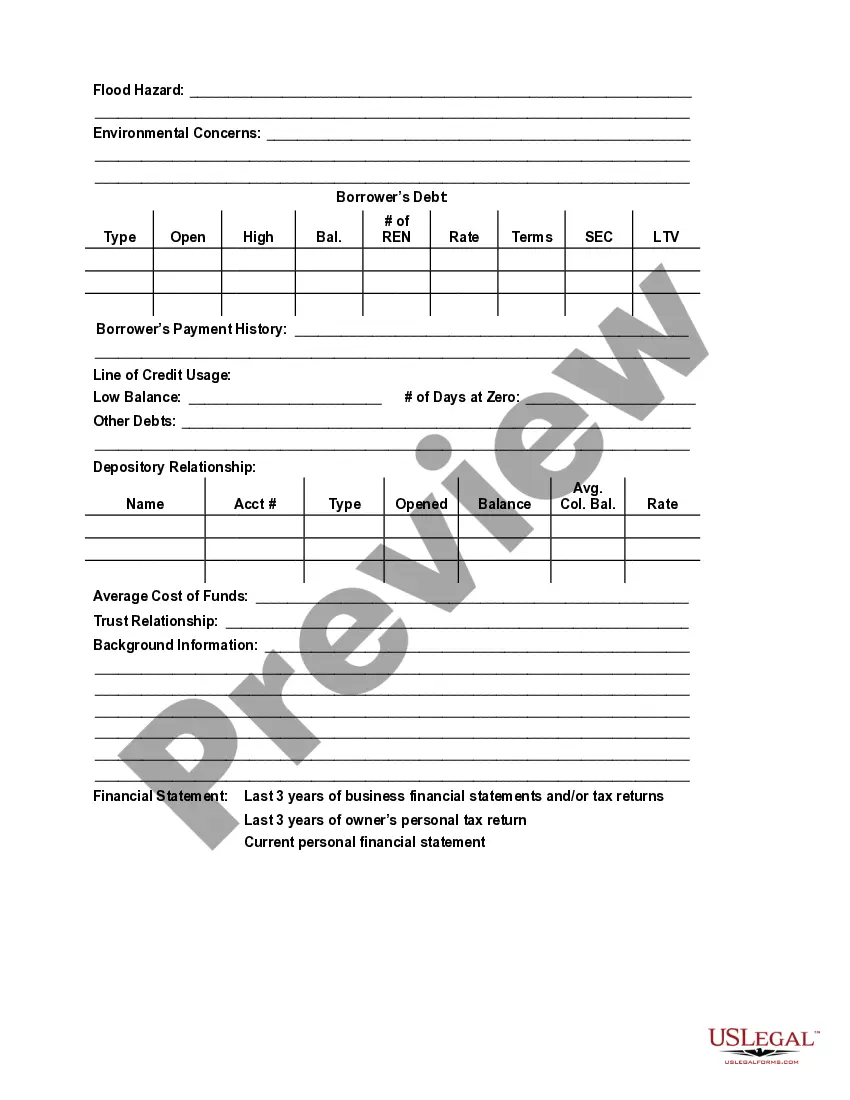

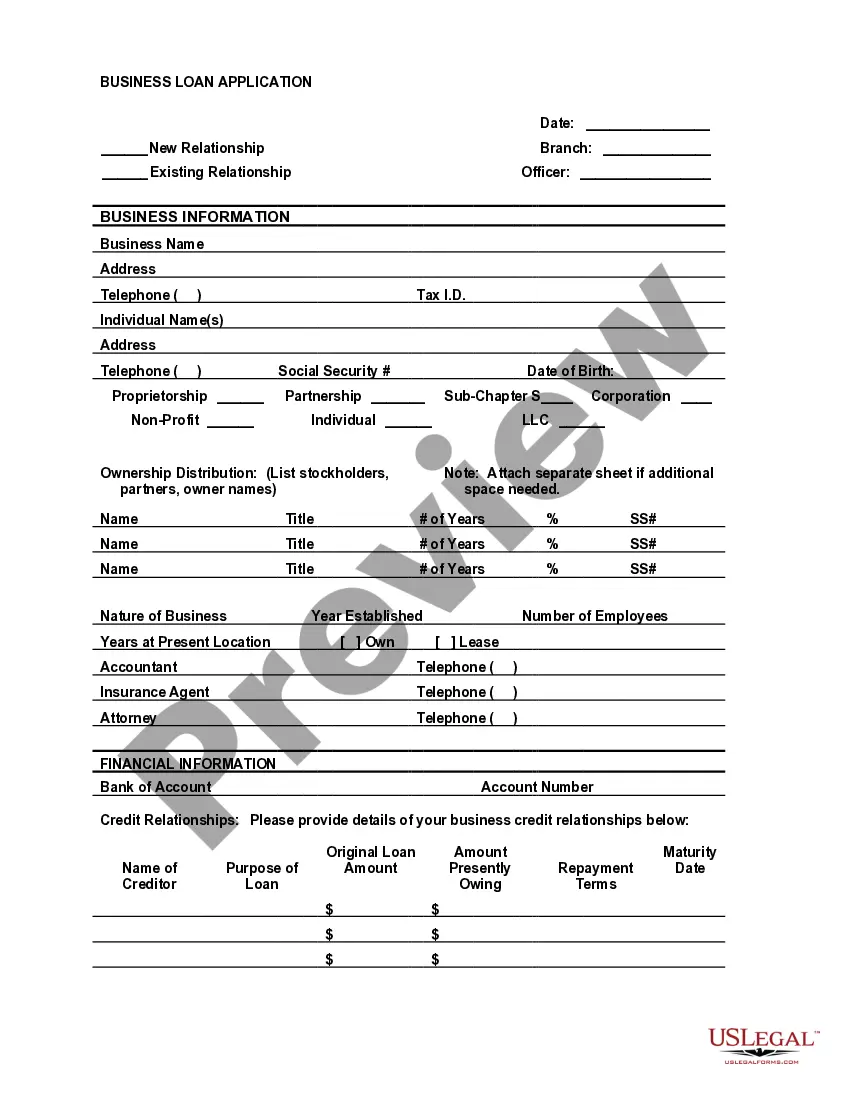

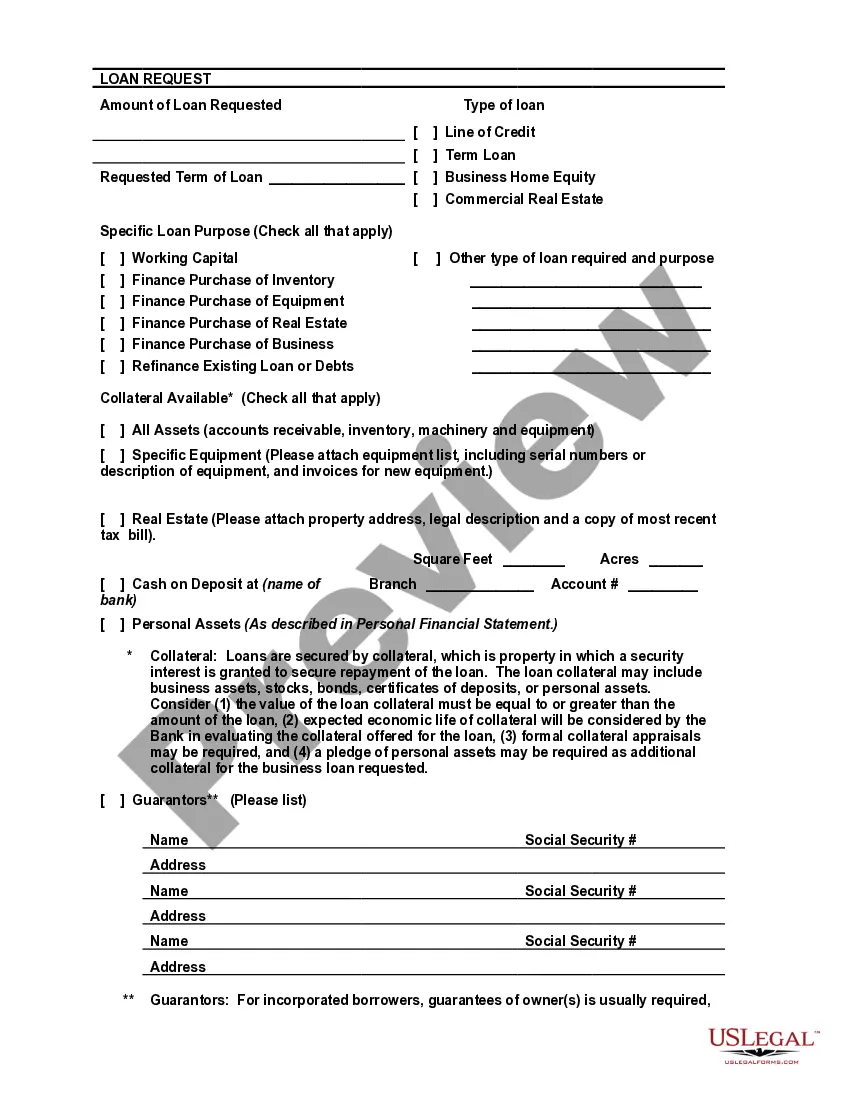

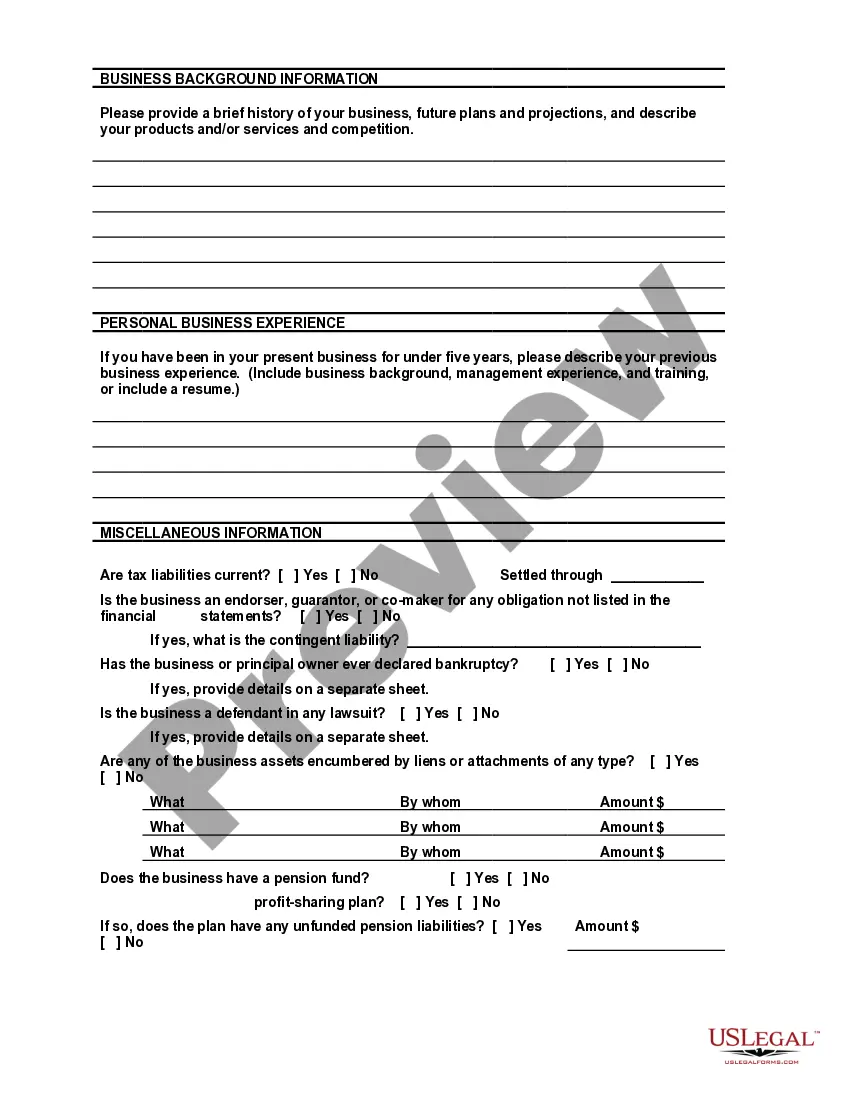

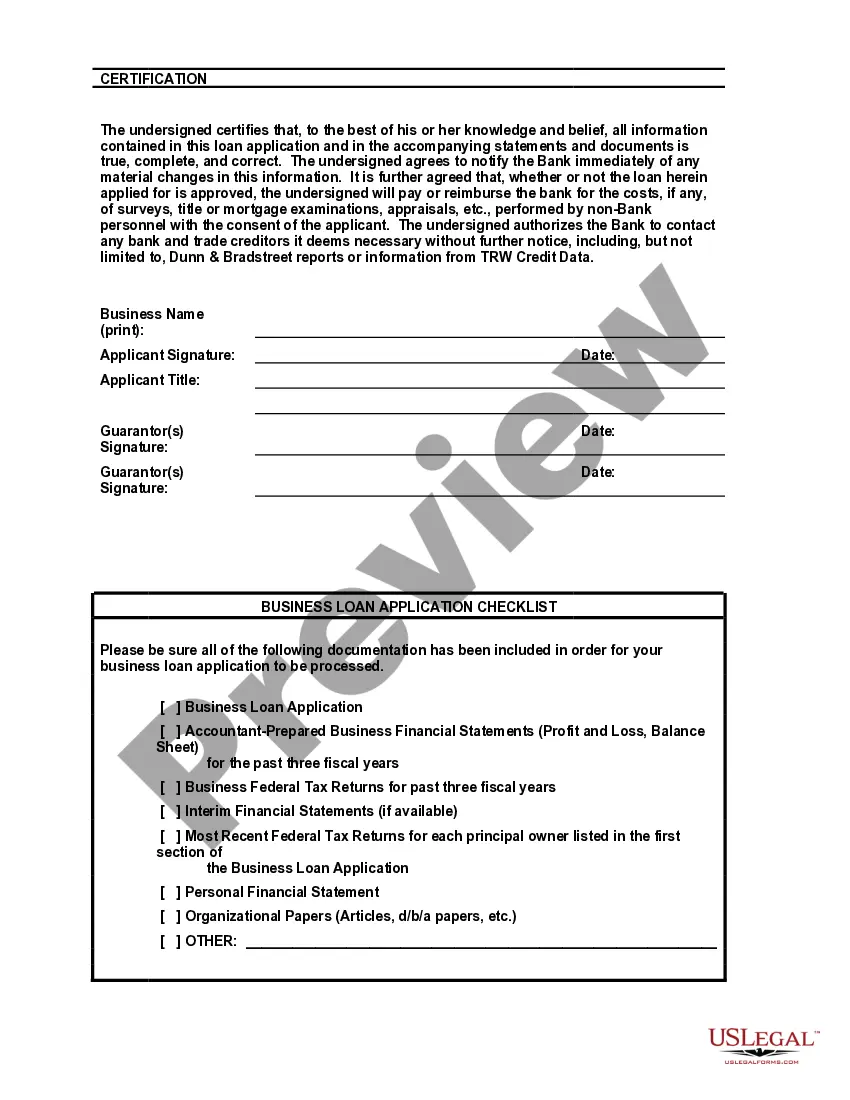

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

South Dakota Bank Loan Application Form and Checklist - Business Loan

Description

How to fill out Bank Loan Application Form And Checklist - Business Loan?

If you have to complete, down load, or produce legal record web templates, use US Legal Forms, the biggest assortment of legal kinds, which can be found on the Internet. Utilize the site`s simple and handy research to obtain the paperwork you want. Various web templates for company and person reasons are sorted by groups and suggests, or key phrases. Use US Legal Forms to obtain the South Dakota Bank Loan Application Form and Checklist - Business Loan within a few mouse clicks.

If you are currently a US Legal Forms customer, log in for your account and click the Obtain button to get the South Dakota Bank Loan Application Form and Checklist - Business Loan. You can also access kinds you earlier saved in the My Forms tab of your respective account.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape to the correct town/land.

- Step 2. Take advantage of the Review solution to look through the form`s articles. Never forget about to read the explanation.

- Step 3. If you are not happy using the kind, take advantage of the Look for field near the top of the display screen to locate other types of your legal kind template.

- Step 4. When you have discovered the shape you want, go through the Buy now button. Opt for the rates strategy you prefer and put your credentials to sign up for an account.

- Step 5. Process the purchase. You should use your bank card or PayPal account to perform the purchase.

- Step 6. Find the format of your legal kind and down load it in your device.

- Step 7. Full, revise and produce or sign the South Dakota Bank Loan Application Form and Checklist - Business Loan.

Each legal record template you buy is your own forever. You may have acces to each and every kind you saved with your acccount. Click the My Forms segment and pick a kind to produce or down load once more.

Be competitive and down load, and produce the South Dakota Bank Loan Application Form and Checklist - Business Loan with US Legal Forms. There are thousands of specialist and status-distinct kinds you can utilize for your company or person requirements.

Form popularity

FAQ

Govt Schemes: The government has come out with many schemes for small business loans, especially after the COVID-19 pandemic. These come in the form of loan or credit guarantee, under which the government will pay back the lender in case of a default by the borrower.

Financial documents Up to one year of business bank account statements. Personal and business tax returns from the most recent three years. Most recent and projected balance sheets. Income statement and cash flow statement.

Traditional lenders, like banks and credit unions, tend to offer the lowest interest rates on business loans. The average interest rates on business bank loans range from 5.75% to 11.91%, ing to the most recent data from the Federal Reserve.

Determine how much funding you'll need. Fund your business yourself with self-funding. Get venture capital from investors. Use crowdfunding to fund your business. Get a small business loan. Use Lender Match to find lenders who offer SBA-guaranteed loans. SBA investment programs.

Term loans: Best for funding established businesses. ... SBA loans: Best for covering large expenses. ... Business lines of credit: Best for accessing flexible funding. ... Equipment loans: Best for purchasing equipment. ... Commercial real estate loans: Best for business owners who want to own property.

Types of Business Loans 10 Best Options for You Working Capital Loan. ... Loan against Property for SME. ... Invoice Financing. ... Equipment Financing. ... Business Loan for Women. ... Overdraft. ... Merchant Cash Advance. ... Business Credit Card.

How to apply for a business loan in 7 steps Prepare documentation. ... Review your credit score. ... Gather financial documents. ... Create a business plan. ... Consider your collateral. ... Consider which loan to apply for. ... Assemble and submit your application.

Here are the typical items required for any small business loan application: Loan Application Form. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.